Last updated on February 19th, 2026 at 06:45 pm

All right, so there is no point in just listing you the list of investment banks in Mumbai. However, what you need is investment banks which can be a stepping stone to getting started.

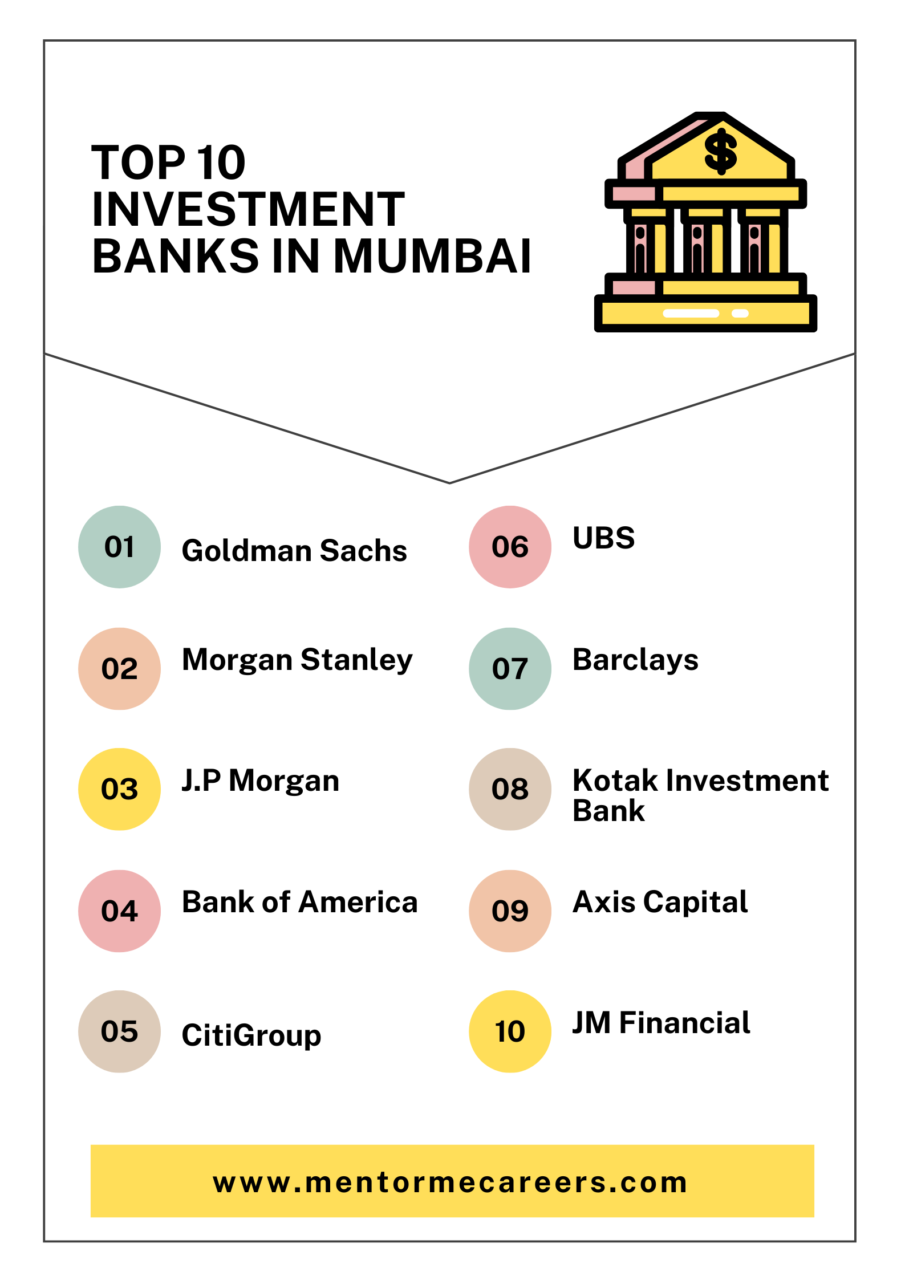

| Rank | Investment Bank | Type | Core Strengths in India | Best Known For |

|---|---|---|---|---|

| 1 | Goldman Sachs | Global (Bulge Bracket) | M&A, ECM, marquee advisory | Top-tier global IB deals |

| 2 | Morgan Stanley | Global (Bulge Bracket) | IPOs, cross-border M&A | High-profile India IPOs |

| 3 | J.P. Morgan | Global (Bulge Bracket) | IB + corporate banking | Large corporate mandates |

| 4 | Bank of America (BofA Securities) | Global (Bulge Bracket) | Capital markets, M&A | ECM/DCM & advisory |

| 5 | Citigroup | Global (Bulge Bracket) | CIB, markets, advisory | Corporate & institutional banking |

| 6 | UBS | Global | Advisory, wealth & IB | Advisory & global exposure |

| 7 | Barclays | Global | Investment banking, markets | Markets & structured finance |

| 8 | Kotak Investment Banking | Indian | M&A, IPOs | Leading domestic IB |

| 9 | Axis Capital | Indian | Equity capital markets | IPOs & ECM deals |

| 10 | JM Financial | Indian | IB, PE advisory | Mid-market M&A |

Importance of Asset Management in Investment Banking

Asset management is a critical function within investment banking that involves the strategic management of client assets to achieve specific investment goals. Investment banks like JP Morgan Chase, Deutsche Bank, and Kotak Mahindra Capital provide comprehensive asset management services to their clients. These services include portfolio management, financial planning, and advisory services that help clients maximize their returns while managing risk effectively. By leveraging their expertise in various financial instruments and market conditions, investment banks play a pivotal role in growing and protecting client wealth.

1.Goldman Sachs

Goldman Sachs is one of the world’s most prestigious investment banks, known for its leadership in investment banking, asset management, and global markets. In Mumbai, Goldman Sachs plays a key role in M&A advisory, equity capital markets, and cross-border transactions involving Indian and global clients. The firm works with large corporations, governments, and institutional investors on complex financial deals. Goldman Sachs is highly selective in hiring and values strong analytical ability, financial modelling skills, and problem-solving mindset. It is especially attractive for professionals seeking top-tier exposure, global deal experience, and accelerated career growth. Working at Goldman Sachs is considered a benchmark achievement in investment banking careers.

What Goldman Sachs Looks For

Goldman Sachs hires candidates who show strong analytical depth, structured thinking, and global exposure mindset. The firm places heavy emphasis on problem-solving ability rather than rote finance knowledge.

Skills Required

- Advanced financial modelling (3-statement, DCF, merger models)

- Deep accounting knowledge (IFRS/Ind AS preferred)

- High proficiency in Excel & PowerPoint

- Ability to analyze complex data under time pressure

- Strong written and verbal communication

Entry Requirements

- Bachelor’s/Master’s in Finance, Economics, Engineering, or MBA

- Prior internship in IB, consulting, PE, or corporate finance

- Financial modelling certification strongly preferred

- Excellent academic consistency

Key Roles & Responsibilities

Investment Banking Analyst

- Build valuation and merger models

- Create pitch books for M&A and capital raises

- Perform industry & company research

- Support senior bankers during deal execution

Associate

- Review analyst models and presentations

- Coordinate with global teams

- Manage timelines and client deliverables

Address: 1. 9th & 10th Floor, Ascent-Worli, Sudam Kalu Ahire Marg, Worli, Mumbai, Maharashtra – 400025. 2. 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai – 400025.

2.JP Morgan chase

Morgan Stanley is a global investment bank renowned for its strength in equity capital markets, IPO advisory, and mergers and acquisitions. Its Mumbai office has been actively involved in several high-profile Indian IPOs and cross-border transactions. Morgan Stanley combines investment banking with wealth management and institutional securities, giving professionals broad exposure to financial markets. The firm values financial modelling, valuation expertise, and strong communication skills, especially for client-facing roles. Morgan Stanley is well known for its structured training programs and emphasis on teamwork, making it a preferred choice for freshers and professionals aiming for long-term careers in global investment banking.

So, JP morgan is a frequent name in investment banks in Mumbai that hires at the entry level investment banking roles.

Address: JPMorgan Chase Bank N.A., Mumbai Branch. Address: J.P. Morgan Tower, Off CST Road, Kalina, Santacruz East, Mumbai, 400098, India Phone: +91 22 6157 3000.

Responsibilities

1.Perform in-depth credit analysis for various potential and existing TCIO investments across the fixed-income spectrum. Engage with senior members of TCIO Credit Risk and the Portfolio Management teams to complete risk analysis, present conclusions and facilitate timely investment approvals on live transactions

2.Participate in portfolio credit impairment projections as part of various Firm wide exercises including the industry-wide annual CCAR (Comprehensive Capital Analysis and Review) process and quarterly CECL (Current Expected Credit Losses) reserving process

3.Work alongside senior team members around product specific deep dives required to support risk discussions, including preparation and delivery of analytical presentations for various senior Risk forums

4.Participate in the development and maintenance of various credit loss models related to CCAR stress testing as well as CECL reserve projections. Liaise with independent Model Review teams to prepare model documentation, pass credible challenge and obtain usage approvals

5.Partner with the Front Office, Finance, Valuation Control Group, Model Review Group, Policy, Finance, Technology and Middle Office for other ongoing projects, thus leading to the continued build-out of the TCIO Credit Risk franchise

Minimum Skills, Experience and Qualifications:

1.Min 1-3 years of relevant work experience in credit risk management or in a credit rating agency

2.Master’s degree in business or professional qualification in Accountancy; excellent academic record

3.Strong analytical background with sound understanding of financial statements, including ratio analysis, cash flow analysis, and fundamental knowledge around key accounting standards

4.Excellent oral and written communication skills, with an ability to deliver effective presentations to senior management

5.The following additional items will be considered but are not required for this role.

6.Candidates having proficiency with Python or other analytical tools such as Alteryx & Tableau will be preferred

7.Knowledge of regulatory requirements as relates to a credit fixed income portfolio, including CCAR stress testing and CECL loss reserving would be ideal

3.Morgan Stanley

J.P. Morgan is a global leader in corporate and investment banking, offering services across M&A, capital markets, and corporate finance. In Mumbai, J.P. Morgan supports both domestic and international clients, especially large corporates and financial institutions. The firm is known for its strong balance sheet, deep industry expertise, and integrated banking model. J.P. Morgan places high importance on finance fundamentals, execution skills, and risk awareness. It offers diverse career opportunities across investment banking, markets, and corporate banking, making it an excellent choice for candidates seeking stability, global exposure, and structured career progression in investment banking.

What Morgan Stanley Values

Morgan Stanley focuses on capital markets expertise, structured thinking, and client communication. It is known for IPOs and large India-related equity deals.

Skills Required

- Equity valuation & IPO modelling

- Financial statement analysis

- Capital markets understanding

- Strong presentation and storytelling skills

Entry Requirements

- Degree in finance, economics, engineering, or MBA

- Excel modelling test is common

- Strong resume with internships or live projects

Key Responsibilities

- IPO execution support

- Equity capital market analysis

- Investor presentations

- Market and sector research

Address: 1. Athena, Bldg. No. 5, Level 1, 6, Malad, Sector 30, Mindspace, Goregaon (W, Mumbai, Maharashtra 400104 2. Altimus, Level, 39 & 40, Worli Pandurang Budhkar Marg, B Wing, BDD Chawls Worli, Worli, Mumbai, Maharashtra 400018. 3. Block-B7, Nirlon Knowledge Park, St Yadav Road Block B2 (Level 3, 4 & 8), Block B4/5 (Level 7 – 9) and Block B7 (Level 1, Maharashtra 400063

4.Bank of America (BofA Securities)

Bank of America, through BofA Securities, is a major global investment bank with strong capabilities in equity and debt capital markets, M&A advisory, and corporate banking. Its Mumbai operations support global transactions and India-focused capital market activities. BofA is known for combining investment banking expertise with a strong corporate banking platform. The firm looks for candidates with solid financial analysis, valuation skills, and global market awareness. Bank of America offers a balanced work environment compared to some peers, along with opportunities to work on large, complex cross-border deals.

Hiring Philosophy

BofA looks for capital markets knowledge, execution skills, and global coordination ability.

Skills Required

- ECM & DCM modelling

- Financial analysis and forecasting

- Excel, PowerPoint, and data interpretation

Entry Requirements

- Degree in finance/economics/MBA

- Internship in capital markets preferred

- Strong quantitative aptitude

Key Responsibilities

- Supporting equity & debt issuances

- Preparing valuation models

- Cross-border transaction support

Address: One BKC, Ground Floor, A Wing, G Block, Bandra Kurla Complex (BKC), Bandra (East), Mumbai – 400051

5.Citigroup

Citigroup is a globally diversified financial institution with a strong presence in corporate and investment banking, markets, and transaction services. In Mumbai, Citi plays a key role in advising large Indian corporates and multinational clients. The bank is known for its institutional client focus, regulatory discipline, and global reach. Citi values candidates who understand both financial analysis and compliance frameworks, given its strong risk management culture. It offers career paths across investment banking, corporate banking, and markets, making it suitable for professionals seeking a mix of finance, strategy, and global exposure.

What Citi Looks For

Citigroup emphasizes institutional banking, corporate finance, and risk awareness.

Skills Required

- Corporate banking & IB knowledge

- Financial modelling

- Understanding of regulatory environment

- Strong documentation skills

Entry Requirements

- Commerce/finance/economics background

- Internship experience preferred

- Case study + technical interviews

Key Responsibilities

- Corporate finance advisory

- Financial analysis & reporting

- Deal documentation

- Client servicing

Address: First International Financial Centre, G-Block, Bandra Kurla Complex, Bandra East, Mumbai – 400051

6.UBS

UBS is a leading global financial services firm with strengths in investment banking, wealth management, and advisory services. In Mumbai, UBS supports advisory and capital market activities, often working on cross-border mandates. The firm emphasizes client relationships, strategic advisory, and high-quality execution. UBS values professionals with strong communication skills, financial analysis capability, and a global mindset. It is particularly attractive for those interested in combining investment banking exposure with wealth and asset management insights. UBS is known for its professional work culture and international career mobility.

Hiring Focus

UBS combines investment banking with advisory and wealth management, valuing candidates with a relationship-oriented mindset.

Skills Required

- Valuation & advisory modelling

- Financial analysis

- Strong communication skills

Entry Requirements

- Finance or MBA background

- Presentation skills highly valued

- Modelling assignments in interviews

Key Responsibilities

- Advisory support for M&A

- Financial research

- Client presentation preparation

Address: Airoli Knowledge Park, Navi Mumbai, MH 400708

7.Barclays

Barclays is a global investment bank with expertise in investment banking, global markets, and structured finance. Its Mumbai presence supports analytical, markets, and deal-related functions for global clients. Barclays is particularly strong in fixed income, currencies, commodities (FICC), and structured products. The firm values candidates with quantitative skills, financial modelling ability, and strong market understanding. Barclays offers good exposure to global financial markets and is well suited for professionals interested in markets-driven and analytics-heavy investment banking roles.

What Barclays Emphasizes

Barclays focuses on markets, structured finance, and analytics-heavy roles.

Skills Required

- Markets & structured products knowledge

- Quantitative and analytical skills

- Excel-based modelling

Entry Requirements

- Finance/economics degree

- Market awareness

- Strong numerical aptitude

Key Responsibilities

- Market analysis

- Financial modelling

- Supporting structured finance deals

Address: Raheja Altimus, Level 32/33, Pandurang Budhkar Marg, Worli, Mumbai – 400018.

8.Kotak Mahindra Capital Investment Banks in Mumbai

Kotak Investment Banking is one of India’s leading domestic investment banks, known for its dominance in M&A advisory, IPOs, and capital market transactions. Headquartered in Mumbai, Kotak works closely with Indian corporates, promoters, and investors. The firm places strong emphasis on practical execution, Indian market knowledge, and hands-on deal experience. Kotak is highly respected for its role in landmark Indian IPOs and M&A deals. It is an excellent choice for professionals aiming to build deep expertise in India-focused investment banking.

Kotak Investment Banking is a leading full-service investment bank in India, offering integrated solutions encompassing high-quality financial advisory services and financing solutions. Our services include Equity and Debt Capital Market issuances, M&A Advisory, Private Equity Advisory and Infrastructure Advisory & Fund Mobilization.

Address: 27BKC, 7th Floor

Plot No. C-27, “G” Block, Bandra Kurla Complex

Bandra (East), Mumbai – 400051

Tel: +91 22 43360754/0701

Key Responsibilities :

1.Preparing financial models and analytical support for merger & acquisitions advisory transactions.

2.Supporting deal origination & execution by taking ownership of creating high quality models and related pitch documents.

3.Developing & building on business / industry for his purpose.

4.Drafting pitch materials, information memoranda, investor presentations and term sheets etc.

5.Performing company, industry, market and competitor research and due diligence.

6.Ensuring quality of client deliverables by having strong attention to detail.

7.Working across sectors and products on deal origination & execution

Skills and Requirements

1.Strong knowledge of financial concepts, especially relating to M&A.

2.Ability to prioritize tasks, work on multiple engagements and manage rapidly changing assignments in a team environment.

3.Ability to quickly evaluate and analyze companies and financial information.

4.Strong working knowledge of Excel, Word and PowerPoint.

5.Excellent analytical and quantitative skills, as well as strong writing and communication skills.

6.High level of attention to detail.

7.Ability to work effectively with senior professionals in an engagement team

9.Axis Capital

Axis Capital is a prominent Indian investment bank and a subsidiary of Axis Bank, specializing in equity capital markets, IPOs, and corporate advisory. Based in Mumbai, Axis Capital has advised on numerous large and mid-sized IPOs in India. The firm values strong valuation skills, IPO execution knowledge, and client communication. Axis Capital is well regarded for its capital markets expertise and offers solid exposure to Indian equity markets, making it a strong platform for finance professionals interested in ECM-focused investment banking careers.

Hiring Style

Axis Capital prefers capital markets specialists, especially IPO-focused analysts.

Skills Required

- Equity capital market modelling

- Valuation & forecasting

- Investor communication skills

Entry Requirements

- Commerce/finance degree

- IPO exposure preferred

Key Responsibilities

- IPO documentation

- Valuation and pricing analysis

- Investor presentations

Address: 1st Floor, Axis House, Pandurang Budhkar Marg, Worli, Mumbai, Maharashtra 400025.

10.JM Financial

JM Financial is a leading Indian financial services group with a strong presence in investment banking, private equity advisory, and capital markets. Based in Mumbai, JM Financial is particularly active in mid-market M&A, private capital raising, and structured finance. The firm values professionals with strong financial modelling, due diligence, and analytical skills. JM Financial offers hands-on exposure to deals and is often considered a good entry point for candidates aiming to build a solid foundation in Indian investment banking and corporate finance.

Mid-Market IB Focus

JM Financial is strong in mid-market M&A and private equity advisory.

Skills Required

- M&A and PE modelling

- Financial due diligence

- Analytical thinking

Entry Requirements

- Finance/commerce background

- Practical modelling skills

Key Responsibilities

- M&A and PE deal support

- Financial analysis

- Pitch book preparation

Address: One International Centre, 22nd Floor, Tower 2, Senapati Bapat Marg, Prabhadevi, Mumbai – 400013

Conclusion

Mumbai stands at the center of India’s investment banking ecosystem, hosting both global bulge-bracket banks and leading domestic investment banking firms. These institutions play a critical role in IPOs, mergers and acquisitions, capital raising, and corporate advisory, making Mumbai the most important city for finance careers in India.

For aspirants, investment banking offers high learning exposure, strong career growth, and competitive salaries, but it also demands solid financial fundamentals, financial modelling skills, and practical deal understanding. Whether you aim to work at a global firm like Goldman Sachs or a domestic leader like Kotak Investment Banking, the right preparation and skill set are essential.

With increasing competition, candidates who combine technical skills, real-world exposure, and structured guidance stand the best chance of breaking into investment banking roles in Mumbai.Want to start your investment banking career in Mumbai?

Build the exact skills investment banks look for financial modelling, valuation, Excel, and deal analysis with structured, job-oriented guidance.

Enroll in Mentor Me Careers’ Financial Modelling & Investment Banking Training

Get expert career guidance and interview preparation

Talk to a mentor and plan your investment banking journey today

FAQ

A finance-related degree (B.Com, BBA, MBA, CA, CFA) is preferred, but non-finance backgrounds can enter investment banking by gaining relevant skills and certifications.

Global banks (like Goldman Sachs, Morgan Stanley) focus on cross-border deals and global markets, while Indian banks (like Kotak, Axis Capital) emphasize domestic M&A and IPOs.

Salary varies by firm, role, and experience. Generally, global bulge-bracket banks (Goldman Sachs, Morgan Stanley) offer higher pay compared to local firms, but individual skills and performance also matter.

Key skills include financial modelling, valuation, analytical thinking, communication, Excel proficiency, and attention to detail.

Yes, many investment banks hire freshers for analyst roles, especially those with strong academics, internships, and practical finance skills.