Last updated on June 22nd, 2024 at 04:20 pm

This article will simplify, solidify and clarify all your questions related to CFA level 1 syllabus that might be confusing you or may be scaring you too. So lets get started right away. I am going to divide this discussion in the following sections, you may skip to the part that is more suitable for you.

Syllabus for CFA level 1 2022

The syallbus of CFA level 1 is divided across 10 subjects or topics, and the number of topics don’t change between level 1 and level 2. However the weightage and depth of the cotnent will change. The ten topics are given below and I have covered in basic what it covers , the difficulty level and its importance for the CFA level 1 exam

| Topics | Weightage Level I | What it Covers | Difficulty | Importance |

| Ethics and Professional standards | 15-20% | Investment conflicts as a manager | Easy but Needs consistent reading | High |

| Quantitative Methods | 8-12% | Financial mathematics and statstics | Hypothesis testing can be difficult for newbees in stats | High |

| Corporate Issuers | 8-12% | Capital budgeting concepts | Easy | High |

| Economics | 8-12% | Macro and micro | Lengthy and boring | Moderate |

| Financial statements analysis | 13-17% | Basic accounting and analysis | Easy but very vast | High |

| Fixed Income | 10-12% | Bonds types and valuation | Moderate | Moderate |

| Equity Valuation | 10-12% | Equity markets and valuation | Easy | Moderate |

| Derivatives | 5-8% | Derivative types, uses and pricing | Charts can be difficult | Low |

| Alternative Instruments | 5-8% | Overview and uses | Easy | Low |

| Portfolio Management | 5-8% | Overview and theory | Moderate | Low |

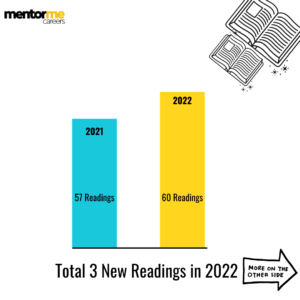

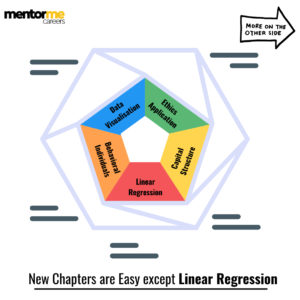

Changes in CFA level 1 Syllabus 2022 from 2021

| Topics | Weightage | Deletion | New Readings |

| Ethics and Professional standards | 15-20% | GIPS Chapter is gone | Ethics application |

| Quantitative Methods | 8-12% | Statistical concepts is gone | Linear regression /Data visualisation |

| Corporate Issuers | 8-12% | A lot of LOS are re arranged | Capital structure |

| Economics | 8-12% | Minor Updation | |

| Financial statements analysis | 13-17% | Minor Updation | |

| Fixed Income | 10-12% | Minor Updation | |

| Equity Valuation | 10-12% | Minor Updation | |

| Derivatives | 5-8% | ||

| Alternative Instruments | 5-8% | Minor Updation | |

| Portfolio Management | 5-8% | Minor Updation | Behavioral Biases of Individuals |

Importance of Ethics and Professional Standards

Ethics and Professional Standards hold significant weight in the CFA Level 1 syllabus, emphasizing the role of ethical behavior and professional conduct in the investment industry. Financial analysts must adhere to a strict code of ethics, which ensures trust and integrity in financial markets. The 2022 updates have placed more focus on the application of ethics, reflecting real-world scenarios where investment professionals might face ethical dilemmas. Understanding these standards not only prepares candidates for the exam but also for ethical decision-making in their careers.

Is CFA level 1 Difficult?

The answer is no, CFA program is more comprehensive and demands your time and dedication. Give it its worth of 300 hrs preperation and your will clear it

How much time does it take to study for the CFA level1 syllabus?

Calculated in months, you should start your preperation atleast 4 months prior to the exam day.

How is the CFA level 1 exam graded?

The right and wrong correction focourse is now automated but the minimum passing score is decide by charterholders basis how much an average candidate could score on the entire exam. You can check a more detailed preperation strategy on this article

Tips for studying CFA level 1 to pass in one attempt

- Start Early: Don’t delay your preperation just because the exam look far.CFA Exam is like training for a marathon, you can’t run marathons in one day preperation

- Focus on Learning outcomes: Don’t just look at topic headings but the exact expectation of the learning outcomes, will save you a lot of time and energy and will also keep you focussed.

- Practice from CFA portal: CFA institute provides its own learning portal and the questions are good. As soon as you are done with the reading, focus on consistent practice.

- Practice completed topics: Once you are done with a subject make sure you are practicing atleast 10-15 questions everyday. This will things fresh and you wont forget concepts.

- Dont Assume:Dont assume you know the subject or topic, CFA institute is known to get dirty with little things which you might assume you already know. Infact I have seen a lot of CPA’s , CA’s and MBA’s failing the exam because of overconfidence.

- Refere the Original CFA Curriculum:The original curricul is deep and gives you a lot of perspective. Yes it can be lenghty but do you want to learn CFA and then embarass yourself in the interviews? Added to that it gies a lot of peace that you are reffering the best content.

- Don’t Over focus on calculation and calcualtor: Its much easy to answer a calculative question than a conceptual question with no calculation at all. Thats exactly what CFA exam will feel like.For eg any student can calculate standard deviation but only a few can answer its relevance and problems.

- Calm Down: Dont obsess on the result, tis a journey. Life doesnt change after CFA, and it takes time to become expereinced in this industry. So focus on learning.

Concluding Remarks

In summary, the CFA Level 1 syllabus demands consistency and effort, but with a solid game plan, it is not overly difficult. The updates for 2022 include important changes that reflect current trends in the investment industry, making it crucial to stay updated. By following the tips provided and focusing on comprehensive preparation, candidates can successfully pass the CFA Level 1 exam and advance in their financial careers. Best of luck, and feel free to reach out for any questions or suggestions regarding this post.