Last updated on August 28th, 2023 at 06:33 pm

So, let me straight forward give you an example; if you take an education loan for an MBA, the bank gives you one year post your MBA program. Which basically means you’ve got one year to find your job and settle yourself before you start paying the EMI. That is the best example to start with for the topic of Moratorium period meaning.

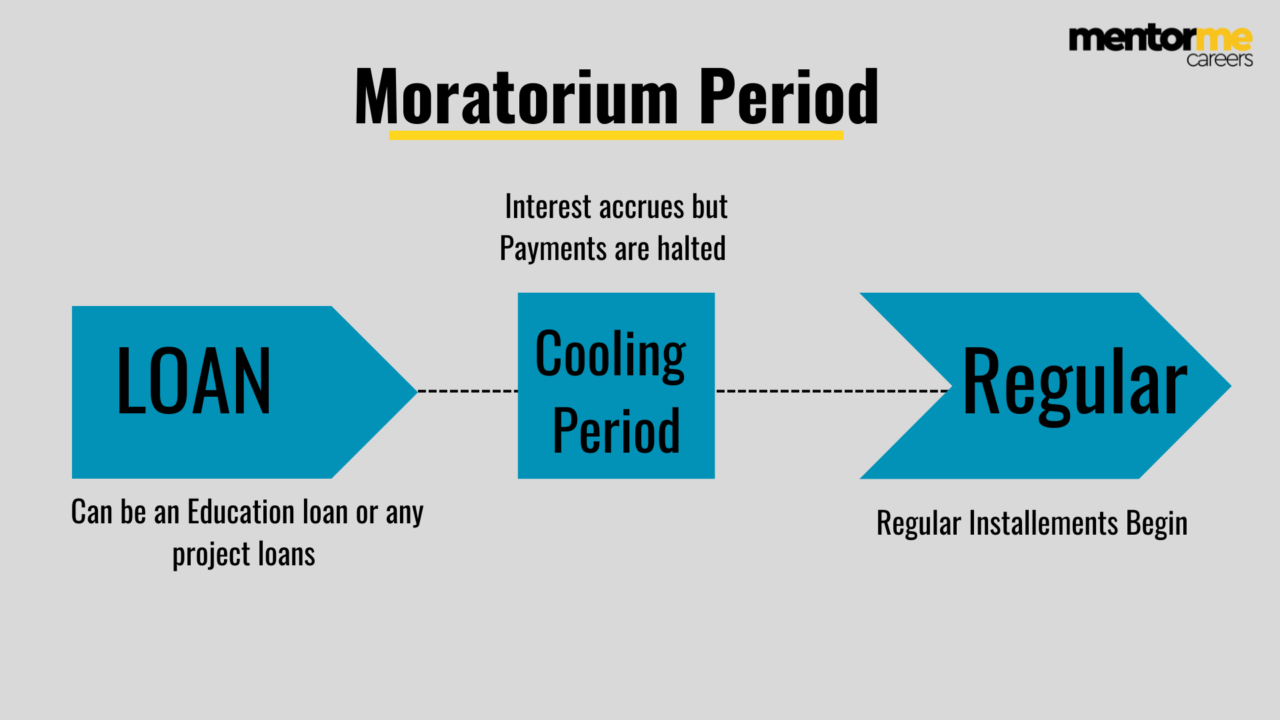

Moratorium Period Meaning

The literal text book definition of the moratorium period meaning is, a period during which the borrower is not obligated to make any payments. In other words, during a moratorium period, you are permitted to halt their payments. Also,the interest rate on a loan during the moratorium period generally accrues.

Which is commonly seen across educational loans & a big picture across project finance loans.

Understanding Moratorium Period Meaning with Examples

Covid Pandemic Moratorium By RBI

During the year 2020 when the covid pandemic affected millions, RBI Mandated all the banks and lending institutions to offer a 3 month moratorium on;

- Credit card dues

- Hosing loans

- Any other term loans.

According to RBI, the deferred payments included principal or interest components, bullet repayments, EMI’s or credit card dues. Thus from this example, the moratorium period meaning should be very clear that it is a deferred payment structure.

Yes Bank Moratorium

Now, this was another instance of moratorium but from the perspective of benefiting the lender. The customers of Yes Bank were capped to withdraw only fifty thousand rupees for a period of 30 days. Hence, the moratorium period meaning in this example would mean a 30 days deferred structure for the benefit of the lender.

Features of Moratorium

The moratorium period typically commences once a loan is granted. It is primarily extended to give the borrower adequate time to sort finances and prepare for the loan repayment. In some cases, the moratorium period can also occur during the mid-life of a loan. It would be the case if the lender allows the borrower to stop making payments over a specified period for a specific reason – for example, due to financial hardship. It should be noted that interest on the loan generally accrues over the moratorium period.

Example ;

John was provided with a $500,000 loan by Money Tree Bank, a fictitious bank, in January 2020 to expand his restaurant business. John agreed to pay fixed monthly payments of $100,000 over six months (total repayment of $600,000) to secure the loan, with the first payment due at the start of February 2020 and subsequent payments at the start of each following month.

However, in mid-March 2020, John’s restaurant business was forced to close due to the coronavirus pandemic. Due to such an unprecedented event, Money Tree Bank decided to grant John a moratorium period from mid-March 2020 to June 2020 for no additional charge. As a result, John is now able to defer his April 2020 payment to July 2020.

Moratorium Period Vs Grace Period

So once we have understood the moratorium period meaning, I would also like to clarify the differences between moratorium period and grace period. So in case of moratorium period, its a deferred payment where the bank doesn’t loose any interest but actually accrues more interest which is payable later. However, when we speak about grace period then it’s a time extended to the borrower to clear the dues before attracting penalisation. Hence, during grace period there is no extra interest that accrues.

Moratorium Period In Project Finance

Moratorium period is a very common feature in project finance. So, a small detour into project finance, project finance is the funding of long term projects like road construction, port development, airport construction or power plants. So, you need to understand first that whenever companies bid to take up any of these projects, they do so using a structure called as SPV or special purpose vehicle. Now, a SPV is temporary structure or a subsidiary which has a limited life until the project completes. Hence this way the company is able to isolate the risk, incase the project fails. This also benefits the banks because the bank fund the project only and does not take additional cash flow risk of the company’s fundamentals.

Moratorium by Design

So, since the SPV doesn’t have any cashflow of its self until the project actually completes, hence there is no question on paying the interest or EMI’s from the start. So, during the development phase of the project, the interest which was due, gets further created into new debt and is calculated as a part of project cost. Moreover, even after the development of the project is completed, the bank gives the project a few years as moratorium period to defer payments. Hence this would be another example for moratorium period meaning.

Conclusion Moratorium Period Meaning

So, in total you need to think of moratorium period as deferred payments, where interest accrues continuously. Against grace period which is no cost time give to the borrower to clear the dues.