So banks have upgraded evolved from the days where visiting the bank branch was inevitable. However, in today’s banking industry, a visit to the branch is a sin. Of course, there are still PSU Banks which prefer to be very social. In this article I will show you the various ways on, how to get a job in bank after graduation.

Now, I will take you through this topic in incremental discussion. Firstly I will touch upon the various types of job roles, then the various routes for it. And finally giving you some tips in the end.

The Banking Industry & Roles- How to get a job In Bank after graduation?

So, firstly let me take you through the various roles in the banking industry. Which is the first question to answer in the,”How to get a job in bank after graduation, question.

Types of Banking

So, you need to understand that banking is not just the retail bank branch activity. Firstly, you can simply classify banking activities in two fronts;

- Retail Banking: Savings account, loan, credit card etc will fall under this head

- Corporate Banking: Current accounts, project funding, Bond distribution, credit analysis, investment banking etc on the other hand will fall here.

- Wealth Management: Financial advisory on high net worth individuals, portfolio management etc will fall in this category

Types of Roles as per category

Now let me briefly touch upon the various roles in the above three very different category of jobs in banking. Which, will set the tone for the question ” How to get a job in banking after graduation”.

Retail Banking

So, retail banking is all about common customers like you and me. And what are our needs? Simple! We need an operational savings bank account with a certain interest rate. Then we need all the means of payment. Finally, we need access to borrowed capital. Hence the roles in retail banking are;

- Deposit Side Operations in Banking

So, this basically means opening of accounts, providing cash as a teller etc.

- Loan Side Operations

Whereas, the loan side operations is related to providing overdrafts, home loans, personal loans. Or even providing locker facilities in a bank.

- Bank Sales

On the other hand, if you are more towards customer acquisition then you are going towards branch management.

How to get a job in Retail Bank After Graduation?

So, this depends on whether you are targeting a private bank job after graduation. Or public sector bank( SBI, IOB, Bank of Baroda etc).

- Firstly, for private banking there are no exams or qualifications that you require.

As you can see above in retail banking roles, there is hardly any specific educational requirements. However, that being said its important to have strong knowledge of the following;

- Banking rules like AML, KYC

- Secondly, Bank process’s

- Lastly, various rules of bank transfer limit, swift payment codes etc.

How to get a job in Government Retail Bank after Graduation?

Now, on the other hand getting a job in a government bank is slightly different. Because it’s a government job and hence the process is through the Bank Probationary officer exam. Once you clear the Bank PO exam, and get selected then the career will progress as follows;

- Middle Manager – Middle Management Grade Scale 2

- Senior Manager – Middle Management Grade Scale 3

- Chief Manager – Senior Management Grade Scale 4

- Assistant General Manager – Senior Management Grade Scale 5

- Deputy General Manager – Top Management Grade Scale 6

- General Manager – Top Management Grade Scale 7

- Executive Director

- Chairman and Managing Director

Corporate Banking

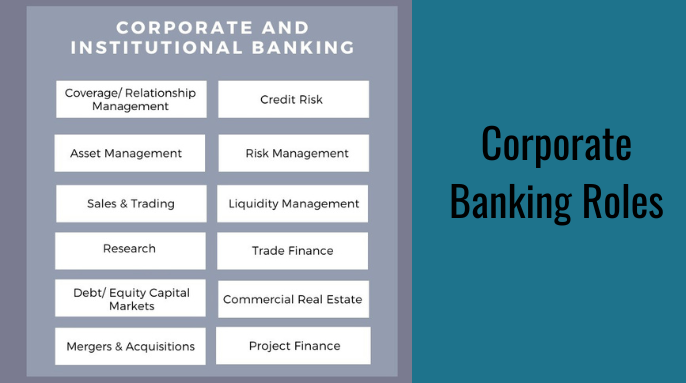

As compared to retail banking, corporate banking is a different ball game. Where, the clients are no more retail clients but institutional clients. For eg; Mutual funds, insurance companies, family officers, companies and corporate entities.

As you can see above corporate banking is much more complex that retail banking. And it really depends on which of the above areas do you really specialise in your education. For eg;

- Let’s say that you are very inclined towards investments and research, then you can get into the investment banking side of corporate banking. In which you work is towards, deal making, research, project finance etc.

- On the other hand if you are more inclined towards the quantitative side of things, then you can get into liquidity management. Or Risk management etc.

Education & Skills for Corporate Banking

So, no matter which role you choose the entry level requirements of education are as follows for corporate banking;

- Firstly, some form of formal education in finance like MBA Finance, CFA, CA etc

- Secondly, since most of these roles are related to decision making you need to learn Financial modeling

- Finally, if you are targeting very specifically into risk management then qualifications like FRM is more suitable.

Wealth Management

Now, wealth management would also ideally fall under the same category but here there is difference. Instead of actually being the fund manager, you are an intermediary. Which is, that you are between the mutual fund cum asset manager and the client. Hence, here the knowledge of the products is very important, not very much on how to manage it.

So let me give you one example; let’s say there is a client, which is an insurance company. Which wants to invest their money for capital appreciation with medium risk target. Hence, here we are clear that it’s medium risk category and capital appreciation. Both which needs stocks to invest, but not small cap stocks. Hence, your target would be to find the appropriate fund which can full fill this need.

Education & Skills for Wealth Management

Now, here also you need to have the following;

- Firstly, you need some form formal education in portfolio management like CFP or CFA

- Secondly, excellent knowledge on investment products, taxation etc.

- Finally, skills like Financial modeling etc can be add on advantage.

However, do note that initially your experience is going to be entirely customer acquisition. And later on as you grow with experience you get to also do the more technical stuffs.

Final Tips on How to get a job in bank after Graduation

So, I have covered in detail on the various roles, paths and ways by which you can get a job in bank after graduation. However, you must remember the following tips;

- Firstly, initial job roles are tedious and monotonous. but interesting work gets assigned after 3-4 years of experience.

- Secondly, every successful banker is usually good in sales. Rarely will you see a banker being successful behind a laptop or a desktop whole day.

- Finally, banking is evolving at a very high speed, so upgrading your skills and knowledge continuously is very important.