Last updated on February 10th, 2023 at 03:22 pm

When you think of financial statements, different categories of people might give different versions of their perspectives on the objectives of financial statements. For eg; Let’s say if I am a supplier. may say that the priority is to know, if I get paid, and you the company owner might say to understand his tax liability or an investor might say to know the worth of the company.

Introduction to objectives of Financial Statements

Knowing how to work with the numbers in a company’s financial statements is an essential skill for analysts as well as investors. The interpretation and analysis of the balance sheets, income statements, and cash flow statements are the basis for smart investment choices. Let us look at what these financial statements are and their importance.

What are financial statements?

Financial statements are the records of all the financial activities and positions of a business, company, or other entity. They convey the financial performance of the company. Financial statements are usually audited by agencies, accountants, auditors, etc to ensure the authenticity and accuracy of the financial statements. A company’s annual report consists of all the financial statements that are required to assess the performance of the company and is an important step in the accounting process.[1] [2]

Objectives of Financial Statements as per Accounting Standards

Now, let me discuss the various objectives of financial statements as per different perspectives. Also, the reason I say so is that the perspective can be very different when we are dealing from the angle of an accountant versus an analyst.

IFRS -Conceputal Framework- Objectives of Financial statements

The objective of general-purpose financial reporting is to:

- To, provide financial information about the reporting entity that is useful to exist and potential investors, lenders, and other creditors in making decisions relating to providing resources to the entity.

- Those economic decisions involve decisions by doing financial analysis about:

- a) buying, selling or holding equity and debt instruments;(b) providing or settling loans and other forms of credit;

- or (c) exercising rights to vote on, or otherwise influence, management’s actions that affect the use of the entity’s economic resources.

Hence, majorly this definition talks about the usefulness of financial statements to make decisions.

Also, if you read a little more detailed explanation given by IFRS, you find that the focus is on providing the party with no access to inside information of the health of the company. Hence, that would enable the supplier or the investor with sufficient information.

Suppliers’ Perspective : objectives of financial statements

So, as a vendor, your concern would be at maximum.

However, this is where the usefulness of the financial statements differs vastly, between a vendor and an investor. For eg; Let’s suppose you were planning on giving your office space on rent to a publicly listed company.

- Liquidity situation of the company and cash flow

- Ensuring you get your rent on time

- What is the average payable days for the creditors

However, the investor’s needs of information, are more towards the intent of each decision that the company is or is planning to take. This, information by the way is almost impossible to incorporate in the financial reporting framework.

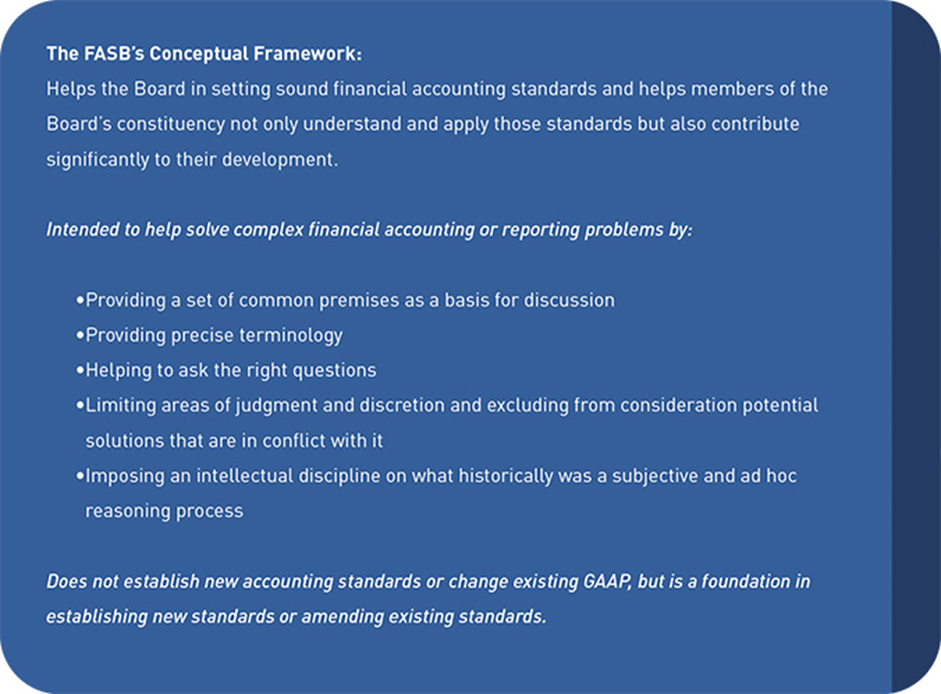

US GAAP: FASB objectives of financial statements

So, in other words the real objective of financial statements, for U.S GAAP is to solve complex financial accounting or reporting problems by providing access;

- Firstly, Common premises for discussion

- Secondly, Precise terminology

- Thirdly, Limiting the areas of judgement

- Finally, Imposing a discipline in reporting

Objectives of financial statements – Analysts & Investors’ Perspective

Financial analysts and investors use the financial data from these financial statements to analyze the performance of a certain company and also to make predictions about its future performance and growth. apart from this there also used to evaluate the company’s financial health and earning potential. Financial statements are important because they provide a huge amount of information about the company’s revenue, expenses, profitability, debt, and ability to meet short-term and long-term obligations [3]. Some other advantages of financial statements shows are listed below [4]:

- To determine the ability of a business to generate cash

- To derive financial ratios from the statements

- To track and review the inventory of a company and see whether the goods are in demand, fast-moving, or slow-moving.

Types of Financial Statements

The three types of financial statements are prepared for achieving the various objectives of financial statements to the investors, suppliers etc including;

Income Statement

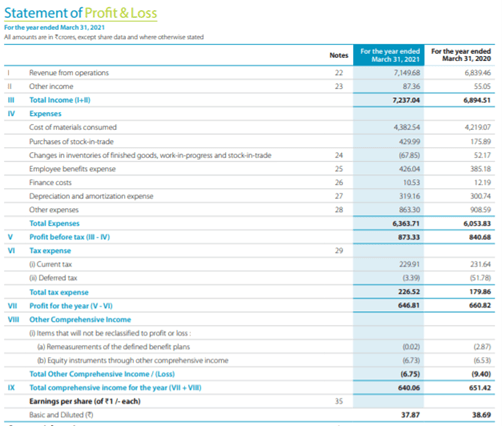

An income statement of a company is a financial record that shows you the company’s incomes and expenditures for a certain period (quarterly or yearly). The income statement is also referred to as the P&L statement, statement of operations, profit and loss statement, and statement of earnings. The income statement reports information on the revenue of the company, the expenses incurred to generate the revenues, tax and depreciation, and the earnings per share number. To have a better understanding let’s look at the income statement of Amaraja Batteries [5].

As you can see that the total income is ₹7,237.04 Cr. Now, the expenses include the cost of materials, purchase of stock in trade, change in inventories, employee benefits, finance costs, depreciation and amortization, expense, and other expenses. Hence, the total expense comes to ₹6363.71 Cr. The tax is ₹226.52 Cr. Finally, After deducting the tax, the profit for the year 2020-2021 is ₹646.81 Cr. The earnings per share are ₹37.87.

Balance Sheet

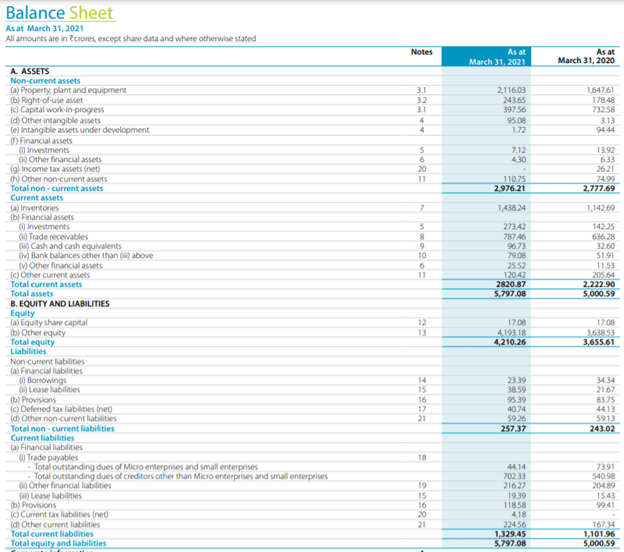

The balance sheet refers to the financial record of the company’s assets, liabilities, and shareholder’s equity. Also, the balance sheet is very important when it comes to financial modelling and accounting. Finally, the balance sheet is prepared on a flow basis, meaning, it has financial information about the company right from the time it was incorporated. The balance sheet tells us how the company has evolved financially over the years. The assets and liabilities are both separated into two categories: current and non-current.

To have a better understanding let’s look at the balance sheet of Amaraja Batteries [5].

In any typical balance sheet, the company’s total assets should be equal to the company’s total liabilities. Hence,

ASSETS = LIABILITIES

The above equation is also called the balance sheet equation. Owners Capital is the difference between Assets and Liabilities and it is also known as Shareholders Equity

Shareholder’s equity = Assets – Liabilities

Cash Flow Statement

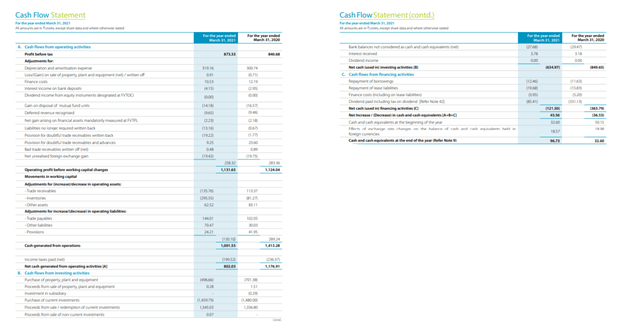

A cash flow statement is a financial report that provides data regarding all the cash inflows a company receives from its ongoing operations and external investment sources. It also includes all the cash outflows that pay for business activities and investments during a given period. Cash flow statements help in short-term planning, details where the money is spent, track of excess cash, long term planning, optimum level of cash balance, and analyzing the working capital. Let’s look at the cash flow statement of Amaraja Batteries [5].

Cash flows are divided into 3 categories viz. Cash flows from operations, cash flows from investing, and cash flows from financing.

Conclusion on Objectives of Financial statements

The P&L statement discusses how much the company earned as revenues versus how much the company expanded in terms of expenses. The Balance Sheet provides information regarding the company’s assets and liabilities. The cash flow statement provides information of the financial statements about the company’s ability to generate cash and cash equivalents. All these three financial statements are one of the most crucial aspects when it comes to financial statement analysis. Many financial ratios are dependent on the values represented in these statements. The bottom line is that no one indicator can adequately assess any company’s financial position and potential growth.