Last updated on February 9th, 2024 at 02:49 pm

Credit control has many facets; in economics, it means controlling the flow of debt in a country. On the other hand, the same word means very different when I talk about business credit. Hence, I would try to explain the objectives of credit control by adding some flavour of context.

Credit Control in Economics

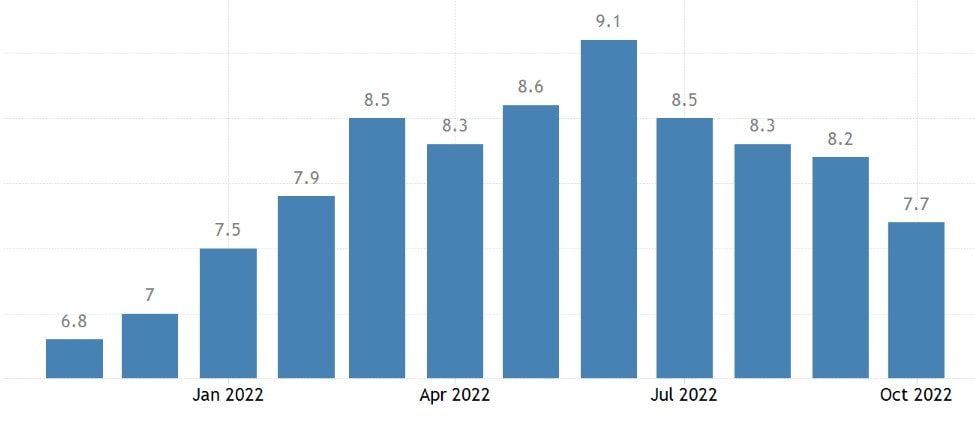

Credit control in economics means controlling the supply and demand of money. For example, the recent U.S inflation crisis led the federal bank to raise interest rates, which led to a reduction in inflation.

Notice how the inflation peaked between January 2022 and July 2022, which led the markets to tank significantly.

So, observe now how the interest rates, when increased, leading to the reduction of credit and finally led to the decrease in inflation.

Credit Control in Business

Now, with a little economics lesson, let’s look at what credit control means in a business context. At a business level, credit control implies the following.

- Offering credit purchases to eligible customers

- Companies can either be aggressive or moderate in this.

- The strategies used include; discounts, credit standards and collection policy.

So, in general, what I am saying is to delay the payment and make the offer more attractive for the customer to enter.

What is a Credit Control Policy?

A credit control policy is a written document that guides how the business acts and reacts to credit sales. For example, a customer wants an iPhone but needs 12 instalments. The question here is whether the company has a credit policy which will accept such a request.

4 Factors Effective Credit Control

Let’s now discuss, what are the signs of an effective credit control policy.

- Roles are defined

Firstly, an effective credit control policy will define the exact roles, responsibilities and authority of various people in the organisation.

- Credit Check Process

Secondly, there should be an effective, simplified process of analysing a person’s or organisations credit worthiness. Also, in India, the simple tool used for credit checks is CIBIL.

- Terms & Conditions

Thirdly, a detailed outline of what is acceptable and what does not must be jotted down. So, for instance, is a CIBIL score of 699 good or not?

- Limits

Fourthly, what is the amount of credit that cannot be exceeded? For example, in the case of a housing loan in India, banks mandate the maximum credit limit to be eighty per cent of the property mortgaged.

Five objectives of Credit Control

Now, you don’t do so much work without a goal in mind. If I was running a business, the objectives of credit control is two-sided. First, to increase sales and profitability and second, to ensure safe collection.

Increase Sales

Now, that’s pretty obvious, but at the same time, not so obvious. So, let me illustrate this a little more.

Let’s suppose I start a business of online courses, just like ours, Mentor Me Careers. I would first want to understand whether a credit is needed or not. Now, the question is, how will I even understand this? Well, for starters, you and I need to look at the data of similar businesses.

- So, do they require credit?

- Is the price too high?

- How many customers ask for credit?

- Finally, do our competitors extend credit?

Control Risk

So, with credit comes risk wrapped in a beautiful gift cover. While it does increase your sales significantly but at the same time, it increases the internal work. So it would be best if you decided on the following objectives

- Firstly, should we extend internal credit? or tie up with a financial institution?

- Secondly, which one of the above is more cost-effective?

- Thirdly, who bears the brunt of non-payment? You or customers?

Lower Receivables

So, if you have figured out your risk parameters, then credit control with an excellent tool. An effective policy can benefit a company.

Now, how does that happen? First, it ensures cash collection(provided you tie up with a financing company). So, the bank or finance institution sends you the cash instantly, and the collection responsibility shifts to the bank.

Tax Benefit

Now, extending credit does come with some costs that you as a business have to bear. However, that cost is justified if it benefits by reducing some taxes.

Reputation

So, just like a customer benefits from taking a loan and improving his/her credit score. Good, non-default customers can also spike your credibility in the financing industry.

Credit Control Policies That Harm

So, credit control policies initially seen from the perspective of benefits can also harm if they fall under the following heads.

- Not Segregating Clients

Not all customers are defaulters, and having the same terms for everyone can damage your reputation.

- Confusing Payment Terms

You have to think about credit from the customer's angle. If you willfully make it confusing to benefit you, then the whole idea of credit is defeated.

- Lack of customer support

So, mistakes happen from both you as well as the customers. However, you are going to provide the support when needed is the deciding factor.

- Unnecessary Threats and Penalty

A good credit control policy will refrain from making unnecessary threats and charging extreme penalties.