Last updated on August 9th, 2024 at 10:47 pm

The Indian capital market is much younger compared to peers across the world. Although the first start of trading happened in the eighteenth century, during the East Indian Company. Also, your guesses might be correct; Mumbai and Kolkata were the centres for it. Since then, India has grown many folds with the boom of business listings and the creation of two major exchanges. Let me discuss the entire structure of Indian capital Markets in this article.

History of Indian Capital Markets

So, its important to know how it all started in everything and capital markets is no different. Now, a market for capital is created as long there is a need for capital. Hence, that need ofcourse started during the british era in India, where even Indian railways used to raise capital in the london exchanges.

Now, fast forward that 100’s of years and the first exchagne was started in surat and mumbai almost at the same time. Which we know today as the bombay stock exchange and dalal street. This actually began below the banyan tree.

Participants in the Indian Capital Markets

Now having discussed a brief trailer of the birth of BSE, let me quickly show you the various participants of the Indian capital market.

Exchanges

So, exchange as the word itself suggests is a place where things exchange. In our case of course it relates to the exchange of securities. So the exchange is a platform which is run mutually by market participants, to enable a quick and efficient way of exchanging securities. Where the exchange acts as a guarantor of the transaction.

Popular exchanges include; NSE, BSE, MCX etc

Brokers

Brokers are the members of the same exchange created by them, howoever in today’s regulation world also ensure that they do not enforce rules for the exchanges. However, a broker is the member throught which retail investors like you and me can buy and exchange securities,

Regulators

In Indian capital and elsewhere, there is a regulator who ensures that the market is fair and free from bias. In India, this role is done by SEBI( Securities Exchange Board of India). SEBI ensures that investors interest is protected at all costs, and also it regulates how companies get access to capital and the various parameteres it has to meet.

Asset Management Companies

Unlike big investors, most of the retail investors can’t affor a private fund manager. Hence, in India such capital is pooled in a trust and then an asset management company is appointed to manage and generate returns on the capital. These asset management companies are also regulated by SEBI.

Capital of India and Its Influence

New Delhi, the capital of India, situated along the banks of the Yamuna River, plays a crucial role in the nation’s financial landscape. The city not only hosts key government institutions but also influences economic policies that shape the capital markets. The proximity to the Yamuna River underscores its historical significance and strategic importance as a hub for financial activities and regulatory frameworks governing India’s economic growth.

Structure of Indian Capital Markets

Size

The Indian capital markets, against the general perception, are not all about stocks but bonds, derivatives, cash etc. Equities form a tiny proportion of the total market size of the entire capital market.

So, you can see bonds are double the size of equity markets, followed by equity, double the value of derivatives.

Structure

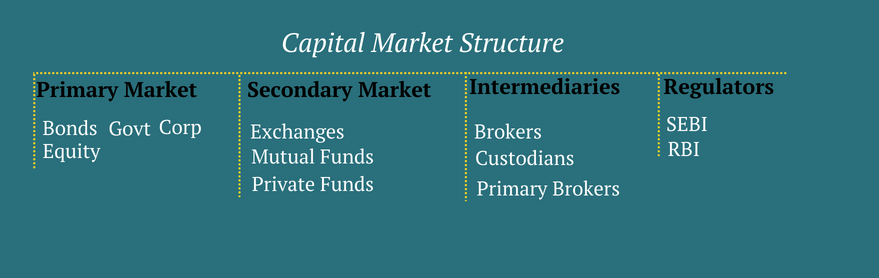

Now, let’s focus on the structure after I have established the size perception.

There are multiple ways I could look at the capital markets, but I feel this is the most easiest way.

- Primary Market

So, the primary market is the place where the real action begins. For example, zomato getting funded by info edge during the start-up phase is an example of the primary market. However, at the same time, the IPO listing of zomato initially is also immediate.

Similarly, you buy government bonds also from the primary market. ICICI is one of the direct brokers to purchase government bonds.

- Secondary Market

This is where zomato, once bought by you in the IPO, will keep changing hands. Suppose you purchased Zomator stock in IPO and then sold it to me. The critical distinction is no new security is created in the process.

Also, this is facilitated by exchanges like the National stock exchange or the Bombay stock exchange. If you are not investing directly, you gain exposure through asset management companies like mutual funds.

- Intermediaries

So, someone has to specialise in helping a customer purchase stocks or bonds from the exchanges. In the process, also adds the value of research done by the brokers. On the other hand, custodians offer the service of holding your securities in digital form like CDSL.

- Regulators

This complex movement of securities, purchasing and listing can lead to disputes. So, it would be best if you had a watchman to guard the interest of all the parties. Which is done by the regulator. The Securities Exchange Board of India mainly regulates capital markets in stocks, derivatives, mutual funds etc.

On the other hand, RBI deals with bonds and currencies.

Essential Facts about the Indian Capital Market

Now, let me discuss some important facts about the Indian capital markets which any person should be aware of.

- BSE Stock exchange is the largest stock exchange in the world, with about 5500 companies listed.

- BSE stock exchange is the oldest stock exchange in Asia, founded by a business named Premchand Roychand.

- Only 2.5% of the Indian population invests, and the growth potential is excellent. This means only around 8 Cr people in India invest in the markets.

- NIFTY, which is an index of NSE, has given 11.2% returns since its inception in 1995.

- Mumbai city has the highest number of dematerialised account holders.

- The market capitalisation of Tata consultancy services is greater than the total market cap of the Pakistan stock exchange.

- Believe it or not India has a total of 23 stock exchanges apart from NSE & BSE

- The first stock listed in India was D.S.Prabhudas & Company, a joint venture with Merill Lynch.

- The Harshad Mehta scam in 1992 was worth 4500 Cr, equivalent to 35000 Cr today. That’s close $5 Billion dollars in today’s terms.

Conclusion

The Indian capital markets have a long way to go, imaging that only 2.5% of people have exposure to the markets today. In the U.S, the retail participation is close to 25%, close to 10 times the Indian share.