Last updated on June 23rd, 2024 at 02:26 pm

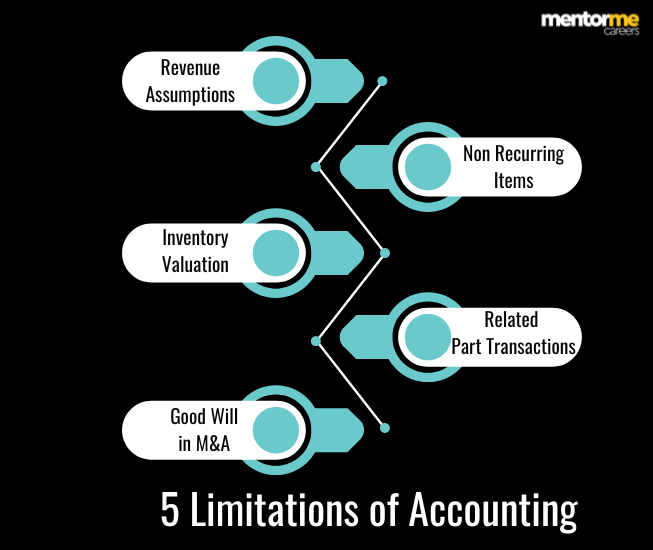

In this article we discuss the comprehensive coverage of the limitations of accounting.

So, you start reading the annual reports of a company and tabulating the numbers. While you punch in those numbers and believe this is a great company?

But what if I told you that you might feel great because the accountant wants you to feel that way? So, just like as an analyst, you seek to be right in understanding a company. Similarly, an accountant’s job is to make you feel good about the numbers. An accountant is not even remotely interested in whether your business is good, bad or ugly.

Accounting audits ensure the following of accounting principles, not investing principles.

Limitations of Accounting Key Takeaways

- Revenue Manipulation is first and big limitations of accounting.

- Exceptional items should be non recurring and limited amount

- Over and under valuing inventory to manipulate profitability

- Laundering income as expenses through internal related party transactions

- Unwanted acquisitions. For eg cox and kings case where huge debt was taken to buy out and launder banks company.

The Rozy Pictures in Accounting

When you invite someone to your home to sell the house, what do you do? Do you go and show him every problem you faced in that house? Also, maybe you also tell him how obnoxious your neighbour’s dogs are, as they constantly bark at night?

Now, you don’t do that, and I don’t think no one in this world will do that. However, ask yourself why? Because it hurts sales.

Then, how do you expect a company, no matter how good they are, can you expect them to give you an accurate picture?

Let me give you some statistics here.

Financial statement fraud is the most costly form of occupational fraud, causing a median loss of $1,000,000;

Gettry Marcus’ Certified Fraud Examiners

Now, there you go; it’s the most common fraud that can be done because it’s so easy.

Limitation Number 1- Revenue Manipulation

The number one place and the most frequent place to manipulate financial statements is revenue. Let me show you how a company and its accountants can do that.

- Booking Revenue Ahead

So, how does this work? E.g., You run a company, and the customer pays you for a monthly subscription, but you show an invoice for an annual plan. According to the principle, there is nothing wrong in this, but it bloats the revenue more than it should.

“They (Byju’s) have had to move parts of their revenue for it to be approved as per Indian Accounting Standard (Ind-AS) 115 rules… For example, revenue projected in one financial year for a multi-year fee can’t be used as that year’s revenue alone,” said an industry executive who spoke to ET recently.

Economic Times Article

In the above case, Byju was overbooking the revenue as per the information provided by Deloitte, its auditing firm.

- Other Income

You might be fooled into believing that a company has a fantastic profit after tax, but the devil is in the details. The company might have bought and sold private companies, showing huge gains.

Limitation Number 2- Exceptional Items

An easy and often overlooked place, exceptional items are not so exceptional these days with companies. So, the crux is, put; nothing doesn’t have an explanation for extraordinary items. However, these entries can be red flags if they are often too often.

Limitation Number 3- Inventory Valuation Gimmicks

There are a lot of scopes to manipulate the costs if you can’t manipulate the revenue. Moreover, giving the impression that the margins are increasing. For example;

Company ABC is the in the business of manufacturing sugar, and it buys sugar cane in advance. In the market, sugar cane costs are rising, leading to lower margins in the profit and loss statement. The CFO came up with the idea that we could stop buying new sugar cane and use the FIFO inventory valuation method.

So, the result is that in the income statement, older inventories are cheaper, leading to higher margins in the books. However, in reality, nothing has changed.

Limitation Number 4: Employee Kickbacks

There is no way to identify if all the transactions done with employees and senior managers are legitimate. There might be many such kickbacks in the form of marketing, travelling expenses or even consulting income. Which is nothing but the management of costs.

Also, in the same category, I would like to point out another method where accounting can be used very creatively.

Suppose you have an interest expense, which could lower your profitability in the books. So a simple method to manipulate that is to create a capitalised asset in the balance sheet and depreciate it after a couple of years.

Limitation Number 5: Mergers and Acquisitions

Amid all the seriousness of a merger and acquisition activity, I could also charge ” Merger Expenses”. In other words, although I might acquire another company for, let’s say, X, but I pay in the books X+ 20%. However, you will never know who got that X+20%, and it can also be paid in the form of stock issued to the other party.A Brief look at Accounting Standards

Loop Holes in Accounting Standards

One of the reasons why there exists limitations in accounting, is for the trade off that happens with flexibility. On one side business’s want flexibility to fit in their complex business assumptions, but at the cost of accuracy.

A brief Look at International Financial Reporting Standards

The sole objecting of IFRS is to ensure uniformity, not transparency. It’s not possible to have uniformity with accuracy at the same time. Think about it for a second. Let us assume the research and development expenses and the accounting standard in IFRS for it.

So let’s look at what the IAS 38 Standard says.

Under IAS 38, an intangible asset arising from development must be capitalised if an entity can demonstrate all of the following criteria:

- the technical feasibility of completing the intangible asset (so that it will be available for use or sale)

- intention to complete and use or sell the asset

- ability to use or sell the asset

- existence of a market or, if to be used internally, the usefulness of the asset

- availability of adequate technical, financial, and other resources to complete the asset

- the cost of the asset can be measured reliably.

So there are 6 ways of capitalising development expenses and this leads to a lot of mis use of getting the fancy and creating accounting to seep in.

Addressing Limitations through Operational Efficiency

One way to mitigate these limitations of accounting is by focusing on operational efficiency. By improving how a business operates, you can get a clearer picture of its financial health. Look beyond the financial statements and assess the popularity and reliability of its products, customer feedback, and market presence.

Enhancing Financial Transparency

Ensuring transparent financial transactions and accurate cash flow statements are crucial for reliable financial analysis. Using comprehensive study material and rigorous preparation of financial statements can help identify discrepancies early. Maintaining thorough accounting records and understanding various branches of accounting can provide a more accurate view of a company’s financial health.

Conclusion

Always trust no one when analysing companies. The reality of a business’s financials is reflected in the popularity of its products and happy customers. More insights are generated by looking at companies, customer feedback and reliability. Hence move out of the financial statements and also correlate whether the same feedback is received in the product’s market, as is shown in the financial statements. The key benefit of reporting and the flexibility itself is the biggest limitation of accounting.

Frequently Asked Questions

- What are the limitations of Financial Statements?

There are 8 limitations of financial statements

- Historical Costs – Records assets at their original purchase prices, which may not reflect current market values.

- Inflation Adjustments – Often fails to adjust for inflation, potentially misrepresenting the true value of assets and liabilities.

- No Discussion on Non-Financial Issues – Does not account for qualitative factors like employee satisfaction, company culture, or brand reputation, which can significantly impact performance.

- Bias – Can be influenced by the subjective judgments and estimates of accountants and managers.

- Fraudulent Practices – Risk of being manipulated to mislead stakeholders.

- Specific Time Period Reports – Provides a snapshot of financial performance at a specific time, potentially overlooking longer-term trends and events.

- Intangible Assets – Difficult to quantify items such as intellectual property, brand value, and goodwill may be underrepresented.

- Comparability – Differences in accounting methods and standards can make it difficult to compare financial statements across different companies.

- What are the limitations of Income statement?

Limitations of the Income Statement

1. Historical Costs: This head of the income statement is such that it records transactions based on historical costs, transactions which might not at times be reflective of the current market conditions and therefore serve to misrepresent financial performance.

2. Non-Financial Factors: It fails to take into account non-financial factors such as employees’ morale, customer satisfaction, and market conditions, which are likely to weigh a lot in the performance of the company.

3. Estimates and Assumptions: Income statements depend on estimates and assumptions for items such as depreciation and bad debt; this feature can introduce bias and inaccuracy.

4. One-Off Items: One-off or non-recurring items may cause the result to be distorted, and hard to read concerning the company’s ongoing operational performance.

5. Accounting Policies: Different accounting methods and policies can create incomparability among firms, which makes it very difficult to evaluate financial performance consistently for different organizations.

- What is the limitations of accounting standards like U.S GAAP & IFRS?

Limitations of IFRS

1. Complexity and cost, which require significant modifications and training.

2. Subjectivity of judgment, thus leading to discrepancies.

3. Frequent measurements at fair value cause much volatility.

4. Extensive disclosure leading to information overload.

Limitations of U.S. GAAP

1. Rules-based approach limiting flexibility and adaptability.

2. Numerous rules increase complexity and chance of errors.

3. Understate assets and incomes as a possibility of the conservative approach.

4. Fair value measurements introduce volatility and subjectivity.