Last updated on October 23rd, 2024 at 03:57 pm

If you are confused about whether to do financial Modeling or CFA? Or maybe you are confused if MBA is going to be enough. Then I am going to put these confusions to rest today in this article and explain you exactly how to become a financial analyst in India.

A strong piece of advice is to read the entire article since half knowledge about this can be even more dangerous.

Who is a Financial Analyst?

So, let me be honest with you that I can’t answer that. Lol! Now, the reason why I say that is because the term financial analyst is like saying who a manager is.

Hence, the obvious question that anyone would ask after a person says that I am a manager. Similarly, with financial analysts, the question to ask is, “What do you analyse in Finance”.

- Budget- Do you analyze the budgets of companies?

- Valuation- Do you analyze the financial statements of companies?

- Operations- Do you analyze financial operational regulation?

- Risk- Do you analyze the financial risk status of a company?

So, to conclude, a financial analyst is a generic designation given to a person with different functions related to finance. However, they are responsible for evaluating, recommending, or researching data.

How to become a financial analyst in India?

Let me continue with the same thought,” What do you analyse?”

So, based on your interest, you can have the following career paths and thats the first step on how to become a financial analyst in India. Following are the roles that you can get into.

- Financial Planning & Analysis Analyst: I call this the investment banker of corporate finance. Also, the analysis doesn’t take place in investment banks but even in the company themselves. A typical job role of an FP&A analyst is to;

- Set budgets for various projects

- Set metrics to measure the performance

- Monitor and report performance

- Financial Analyst- Equity Research: So, if you start your career in a stock broking firm researching various stocks, then you would be called an Equity research analyst.

- Financial Analyst- Reconciliation( IB Operations): The analysis is not on stocks but on the process. A typical investment banking firm has to reconcile various trades taken by the company, ensuring that the trade was taken as per plan.

- Financial Analyst- Accounting: Yes, a financial analyst can be present in accounting too. For eg, an analyst who analyses and creates reporting sheets in compliance with LCR, LCD etc

Financial Analyst Qualifications: To become a financial analyst in India

So, what exactly do these jobs require in terms of qualifications? Firstly, I need to point out that qualifications matter and don’t matter simultaneously.

Now, let me explain that! So, where does qualification help

- Firstly, in shortlisting resumes because recruiters use it as a probable filter

- Secondly, it can make life easier when understanding.

However, let me also point out how qualifications don’t help

- Firstly, after shortlisting qualifications, leverage drops, and what you can do matters more.

- Secondly, too many qualifications are a two-edged sword. Unnecessary qualifications and certifications can implicate that you are unsure about yourself.

Given the above points in mind, now let me segregate the qualifications as per the roles.

Qualifications by Job category:

- FP&A :

- Advantage: CA/CPA/CFA would be ideal for entering this field

- Minimum: Qualification no bar

- Financial Analyst- Equity Research

- Advantage: CFA or MBA tier 1

- Minimum: Qualification no bar

- Financial Analyst- Reconciliation(IB Operations

- Advantage: Any commerce qualification

- Financial Analyst- Accounting:

- Advantage: ACCA/CPA/CA

- Minimum: Commerce

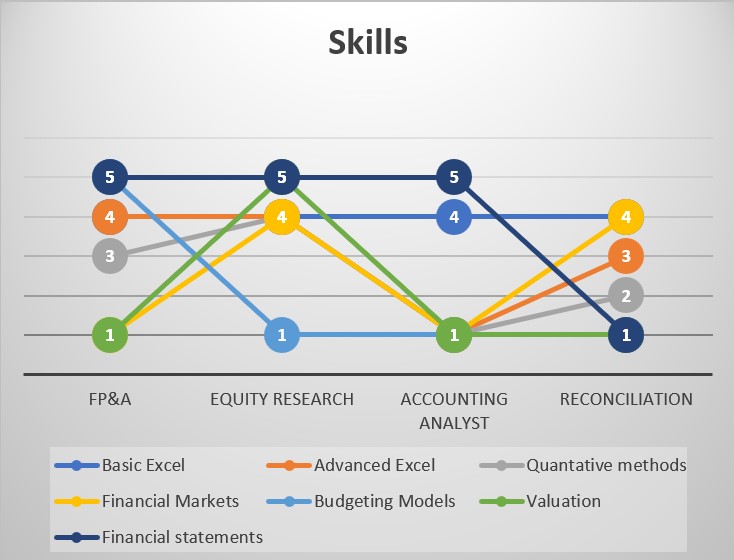

Skills required for becoming a financial analyst in India

Now, unlike qualifications, skills are non-negotiable in these jobs. This is why you can get by having a sub-standard degree, but you can’t get away from proving your skills. Any financial analyst jobs after the initial shortlisting will include a written or case-based test. So, if you have a relevant qualification but can’t crack the case, then it’s curtains down.

Having said that, let me know, and list the skills which are recommended.

So, in summary, the most common excel that most of the roles are going to require master’s is

- Excel

- Financial statements

- Quantitative finance calculations

However, with exceptions to accounting analysis and reconciliation, which requires less advanced skills.

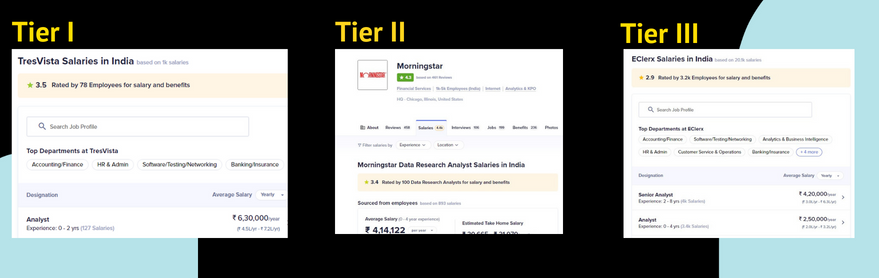

Financial analyst salary in India for freshers

You might want to target a cloud nine salary, just like everyone. However, we must be realistically based on your prior experience and skill level. So, let’s consider the salary in three aspects.

Firstly, let me explain what I mean by these tiers.

- Tier 1 means companies that pay salaries more significant than 6 Lacs P.A for freshers

- Similarly, Tier 2 means companies that pay in the range of 4.5 but less than 6 LPA.

- Finally, Tier 3 companies are low paymasters ranging between 2.4 LPA to 3.5 LPA

Now let me show this to you with proof, which will put this question to rest.

As you can see, companies like Tres vista have premium clients with premium needs and hence pay higher entry-level salaries. Mostly, the reason is, for obvious reasons, higher quality applicants.

On the other hand, eclerx can be a good start for a student who is improving his skill sets and employability but not the final destination.

Another point to note is that even Tier III companies may pay higher salaries for mid-level executives, exactly opposite to the trend at fresher levels.

Financial Analyst Jobs In India

Now, I’ll take you through the financial analyst jobs in India. Also, I’ll bifurcate according to the career paths, which are, FP&A, Equity Research, Accounting & Operations -Investment banking.

Equity Research:

Company: Sutherland

Job Description

Sutherland is seeking a passionate and self-motivated person to join us as a Professional – Equity Research. We are a group of driven and hard-working individuals. If you are looking to build a fulfilling career and are confident you have the skills and experience to help us succeed, we want to work with you! Professionals in this role get to: Be the Expert: join dedicated client teams providing valuable ideas, penetrating insights, and sector-focused analysis. Build, value and update the company’s financial models using both absolute (Discounting Cash Flow) and relative models. Analyze financial information to produce forecasts of business, industry, and economic conditions for use in making investment decisions. Formulate the research framework to analyze industries and companies in consultation with clients and project managers. Impact the Bottom Line: Carry out industry/company research and prepare reports outlining the investment recommendation. Write in detail Initiating.

Qualifications

Analyze financial information to produce forecasts of business, industry, and economic conditions for investment decisions. Formulate the research framework to analyze industries and companies in consultation with clients and project managers. Impact the Bottom Line: Carry out industry/company research and prepare reports outlining the investment recommendation. Write in detail Initiating.

JP Morgan Global Commodities Research

Analyst

J.P. Morgan’s Global Research Center (GRC) was set up in Mumbai in August 2003 as an extension of the firm’s global equity research teams worldwide. GRC has grown steadily, and the team of analysts has expanded to provide coverage for the key sectors globally. Besides working with J.P. Morgan’s equity research teams, GRC Analysts are now engaged with other areas of public side research, including fixed-income research, strategy, derivatives, commodities, quant and indices.

To support the continuing growth of the Global Research Center, we are seeking to hire a Junior Commodity Analyst. This Analyst will be aligned with J.P Morgan’s Global Commodity Research Team and will work with colleagues in the UK and USA, on markets including agriculture, biofuels and carbon but with opportunities to expand into other areas of commodity coverage.

The Junior Analyst’s Main Responsibilities Will Include

- Gathering and analysing data from various sources, including Bloomberg, government and company reports, the internet, online databases, market consultancies, weather bureaus and J.P. Morgan proprietary content. Summarizing conclusions from data analysis for research colleagues will be critical to this role.

- Building, maintaining and analysing models of commodity markets; generating regular and one-off reports, graphs and datasets from these models using a standard JPMorgan model format.

- Updating text, tables, and charts in presentations, as well as writing research for reports covering market developments and prospects.

- Maintaining regular contact with colleagues in the global research team, taking part in conference calls and responding to project requests (often client-generated). Establishing a collaborative, team-focused approach is critical to the role’s success.

Essential Skills

- Keen interest in agricultural, commodity and financial markets

- Strong quantitative, statistical and coding/VBA skills

- Analytical aptitude and ability to learn commodity and financial market concepts

- Good knowledge of Excel, use of the internet and standard Office suite

- Good communication and team skills in a multi-location set-up

- Close attention to detail and ability to work to very high standards

- A strong motivation to learn and manage projects independently

- Passion for and interest in commodity market analysis

Research Analyst- Equity Research- Mumbai – Indian Market (1-3 years)

A Research Analyst / Senior Research Analyst is responsible for executing research of a designated sector/geography for a leading sell-side research firm

- Build and update the company and industry models

- Create and maintain databases using data from different sources

- Work on regular research publications – earnings previews, reviews, event updates, flash notes etc.

- Contribute meaningful research ideas for thematic publications

- Carry out sector analysis and come up with investment themes /ideas

- Keep track of the latest developments in the companies under coverage and the sector and incorporate these into the research publications etc.

- Conduct independent company-specific, economic, or trend analysis

- Publish written articles and research reports that summarize analysis & findings

- Develop and publish own industry forecasts, subject to review by senior team member

- Write and publish analytical articles with minimal supervision and requiring little editing or input from senior team members

- Respond to client inquiries concerning designated coverage areas

- Deepen research skills to prepare investment thesis and generated differentiated research ideas

- Get an opportunity to travel onsite and work closely with the onshore team and understand/experience the investment decision-making process

What we are looking for?

- MBA (Finance) or Chartered Accountant with one to five years of prior experience

- Pursuing or clearing the CFA certification

- Prior experience in Equity Research is preferred but not mandatory

Financial Planning & Analysis Jobs in India

Job description-Qualification CA

- Coordinating variance analysis with BU finance controller.

- Margin variation analysis for BU-wise, customer-wise, and product-wise.

- Quarterly presentation to auditors for any variations.

- Reporting Monthly, Quarterly, and Annual Financial results and analysis, including preparing Flash reports and Variance commentary based on General Ledger Analysis.

- Adherence to Group Accounting policies and updating and maintaining SOP

- Automation and process improvement of legacy reports using BI

- Analyzing monthly, quarterly, and yearly SG&A expenses and comparing them with Plan, forecast, and PY.

- Responsibilities included but were not limited to detailed data collection, analyzing and modelling. Identifying key value drivers and deal breakers. Calculation of normalized EBIDTA, Working capital and cash flows. Revenue analysis, Contract reviews, and quality of earning accounting.

- Computing & reporting the Currency impact on Revenue & EBIDTA

Executive – Financial Planning and Analysis – IT

This role is for a leading MNC IT organization for their office in Bangalore.

Key Responsibilities

- Support plan and estimate processes for different teams covering financial modelling, revenue projections, reporting, engagement tracking and cost estimates and preparation of related presentations

- Evaluating engagement pricing and its implications on financials.

- Keeping track of estimated engagement position for large projects to avoid surprises on any overruns/premium adjustment

- Supporting the monthly Management Reporting to the leadership team and various other related analyses

- Providing business finance support in the areas of decision support, analysis, planning and reporting

Experience

- CA (1st or 2nd attempt) or MBA Finance (top colleges only)

- 1-2 years of relevant work experience in financial analysis, budgeting and planning

- Strong analytical skills, with an ability to navigate details

- Ability to operate effectively in a virtual team

Investment Banking Operations Job

Associate Investment Banking- Accenture

Roles And Responsibilities: Accenture Post Trade Processing (APTP)

In this role, you must solve routine problems, mainly through precedent and referral to general guidelines. Your expected interactions are within your team and direct supervisor. You will be provided detailed to a moderate level of instruction on daily work tasks and detailed instruction on new assignments and the decisions that you make that would impact your work. You will need to be well versed with basic statistics and terms involved in the day-to-day business and use them while discussing with stakeholders. You will be required to help in the overall team’s workload by managing your deliverables and assisting the team when needed. You will be an individual contributor as a part of a team with a predetermined focused scope of work. Please note this role may require you to work in rotational shifts.

Financial analyst course to become a financial analyst

So, now that you know all about becoming a financial analyst in India, which course can you take?

You can, of course, use multiple options, given your situation, for example.

- If You are fresher or have experience up to 2 years, then join our financial analyst course in Pune

- If you are already well versed in finance, then you can check our placement services course.

Conclusion:

So, with all that information, its time to summarize. Firstly, becoming a financial analyst is not difficult if you know the absolute truth behind preparation. Secondly, qualifications are not necessary. So stop that serial certificate hunter; it ain’t working. Finally, you need to find your interest and seal it consistently in the industry.