Certificate in Investment Banking Operations Course With Placement (CIBO)

Certificate in Investment Banking course by mentor me is the highest rated course to kick start your career in IB Operations.

- 100% Job support

- Investment Banking Placements

- 200 Hrs of Training

- NSE Certification

- Life Time validity

Investment Banking Course Recruiters with Mentor Me Careers

Course Highlights

Unlimited Interviews

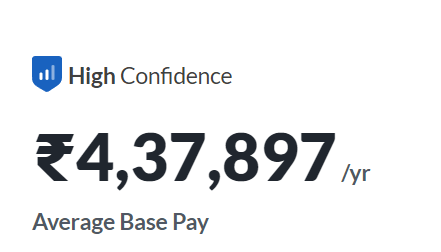

Avg CTC 4.5

LPA

Life Time Validity

Certificate in Investment Banking Course Summary

- You get 200 Hrs of placement focussed training in a live virtual environment with industry professionals.

- 100% Job guaranteed interviews.

- Get to learn about investment banking from scratch, no background is required

- Get prepared for the interview

*Guaranteed interviews are subject to student fulfilling the basic course requirements

- Get 100% job support and unlimited interviews until you get palced

- Sit for investment banking interviews like Goldman Sachs, Jp morgan, HSBC, Axa Business service

- Location: All Tier 1 Metros

- Introduction to finance, market structure, Corporate actions, Trade life cycle, reconciliation, Trade support, Risk management, Regulations

- Lifetime me access to the learning portal

- Unlimited batch access, pay only once, no batch transfer charges

- 200 Hrs of live training for live version students

- Self-paced students get 50 Hrs of video and doubt solving sessions

Give the optional NSE Certification on IB

Certificate in Investment Banking Description

The certitificate in Investment banking operations training course is designed for candidates who are targeting a career in the thriving financial services industry in India. The investment banking course with job gurantee, has assured interviews on completion of the course.

India holds a significant share in the the financial services outsourcing industry globally. The CIBO course aligns your skills for what the operations roles require.

If you fall under any of the below categories then this online course is for you to make your career in the investment banking industry.

- MBA Finance graduate

- B.com Graduate

- CA inter

- Enginner graduate willing to shift to banking career.

- Basic Mathematics

- Interest in finance

- English Language- Spoken and written

CIBOP Course Fees

Instructor Led Live Options

Live Online - Basic- Weekends

Live Online Classes *

Personal Mentorship*

Lifetime Content Access

Course Certification

Fees – ₹16499 (+ GST)

Live Online - Plus+ Weekday / Weekend

- Guaranteed Interviews*

AML KYC Content

+30 Hrs Interview Prep

Risk Management

Recommended for Freshers

- Fees – ₹32999 (+ GST)

Self Learning Options

Self Paced - Basic

Pre-recorded Videos

- Forum Support

1 Year Content Access

Course Certification

Fees – ₹5499 (+ GST)

Self Paced - Plus+

Personal Mentorship*

Lifelong Content Access*

Course Certification

Community Access

Fees – ₹10999 (+ GST)

Detaild Curriculum

- Investment Banking Foundation: Trading termilogies,Various methods of exchange,Recording details of a trade witb case study,Actual trade order case study,structure of investment banks, functions and roles

- Equity & Markets Strucuture I:Classification of markets,tyoes of securities,financial intermediaries,long and short positions,leverage ratio,execution and clearing instructions, security market indices

- Equity & Market Structure II:Index construction method, types of index, rebalancing and reconstitution, Types of fixed income indices, Indices for alternative investments, financial markets.

- Derivatives Instruments I:Concept of arbitrage, forward and future contracts, forward rate agreement, swap contracts,, value of options(in the money, out of money)

- Derivatives Instruments II:Exchange-traded versus over the counter instruments,forward claims and contingent claims,value at expiration calculation,purpose of derivate markets

- Fixed Income Securities I:Classfication of global fixed income markets,interbank rates,primary versus secondary markets for bonds,types of bonds- sovereign, corporate. Short term funding for banks

Fixed Income Securities II:Features of a bond- coupon, rate, yield curve,bond covenants,regulatory, legal and tax considerations for bonds, fixed income cash flow structures,contingency provisions

Asset Management:Portfolio approach to investing,steps in portfolio management process, types of investors,defined contribution and defined benefit plans,aspects of asset management, mutual fund industry

Corporate Governance:Stakeholder groups and their interests,conflicts in stakeholder management, board of directors and functions, risks of poor governance,ESG Considerations

- Trade Execution:Order placement, types of investors, different types of orders, trade capture front office

- Trade Agreement:Trade confirmation and agreement template, transmission methods, settlement instructions,Risk in settlement

- Custodian:Roles of the custodian, types of the custodian, custodian selection, unmatched instructions, Updating STO books and records

- Settlement Failure:Causes of settlement failure, preventing settlement failure, enforcing trade settlement,trade settlement methods,netting

- SWIFT:Identifiers,benefits of SWIFT,Development of SWIFT and swift codes

- Internal Reflection:Pre-settlement trade order, Post settlement trade record, Updating failure,Unsettling a trade internally

- Securities Lending & Borrowing:Principles of lending and borrowing,Updating internal records for lending and borrowing, Calculation

- Safe Custody:Safe custody legal agreements,external custodians, taxation of external accounts, valuing clients securities, advanced safe custody services

- Corporate Actions:Concept of corporate actions, Types of corporate actions, Announced benefits, unannounced benefits, dividends timeline, Bonus shares,stock splits,take overs

- Reconciliation:Reconciliation terminologies, types of reconciliation, methods of reconciliation, manual versus automated reconciliation, independence of the function and benefits

- Risk Management:Risk management process, risk management types, financial risk management, operational risk management, and mitigating risk

- Anti Money Laundering:Sources of money laundering, stages of money laundering, popular methods used, AML Regulations U.S,KYC program,KYC process, customer due diligence

- Basic Excel:Cell referencing, data table, pivot table, look up, H look up, charts, Logical operator functions, Excel dashboards, slicer and timeline

- Interview Preperation:Domain mocks, pre-interview mocks, written tests for practice, extra classes for weak students

Average Packages after CIBO

Certificate in Investment Banking- Certification

Upon completion of the all the modules and clearing the certification exams, you will receive the CIBO Certification.

At the same time, modular certificates are issued automatically in your learning management system. These certificates can be shared with prospective employers at any time.

Placement Process

Goal Setting

Baselining

Profile Building

Job Applications

Mock Interviews

Success

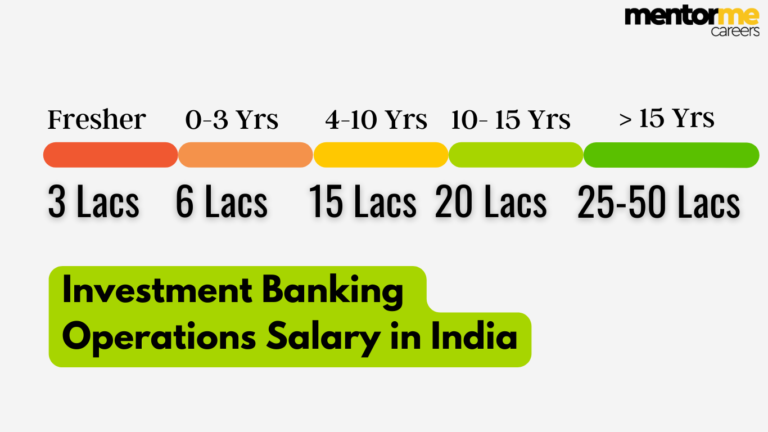

CIBO Salary in India

The average salary of a CIBO trained student in the industry ranges between INR 3.5 Lacs P.A to 6 Lacs P.A.

Industry Trainers

Highest Rated Institute

Jatin2024-03-31I opted for the financial modeling course, and my overall experience till now has been pretty good. The faculties and administrative staff are really amazing.

Jatin2024-03-31I opted for the financial modeling course, and my overall experience till now has been pretty good. The faculties and administrative staff are really amazing. Babita Shah2024-03-31I have enrolled in Investment Banking Operations with Mentorme Career and it's been almost 3 months They provide learning from scratch. Highly recommend if you want to make your career in finance.

Babita Shah2024-03-31I have enrolled in Investment Banking Operations with Mentorme Career and it's been almost 3 months They provide learning from scratch. Highly recommend if you want to make your career in finance. Vismay Mishra2024-03-30I enrolled for Investment banking course and I would say their assistance to grow our financial knowledge is quite outstanding, with the regular classes to doubt solving everything is phenomenal, I'm quite pleased with the way they teach, and would definitely recommend this platform to many others.

Vismay Mishra2024-03-30I enrolled for Investment banking course and I would say their assistance to grow our financial knowledge is quite outstanding, with the regular classes to doubt solving everything is phenomenal, I'm quite pleased with the way they teach, and would definitely recommend this platform to many others. Navnath Rathod2024-03-30I have purchased the investment banking operation and they teaching and organising the hole course is phenomenal, I would recommend this course to all the finance aspirants who want to begin their career in finance 👍

Navnath Rathod2024-03-30I have purchased the investment banking operation and they teaching and organising the hole course is phenomenal, I would recommend this course to all the finance aspirants who want to begin their career in finance 👍 ashish pandey2024-03-27It been months since I joined mantormee class. I know confidently tell that I can now face the problem related to financial modelling and attempt to solve them. Overall it's a nice experience

ashish pandey2024-03-27It been months since I joined mantormee class. I know confidently tell that I can now face the problem related to financial modelling and attempt to solve them. Overall it's a nice experience Abhishek Bhosale2024-03-21I am currently learning from Mentor me careers for Investment banking course, for now I found the course is structured in detail. Currently, I look forward that I will get placed in the right organization through Mentor Me Career.

Abhishek Bhosale2024-03-21I am currently learning from Mentor me careers for Investment banking course, for now I found the course is structured in detail. Currently, I look forward that I will get placed in the right organization through Mentor Me Career. Sohail Shaikh2024-03-19I opted course of financial modelling.all mentors are good and supportive. Good platform for upskilling in core finance domain. ⭐️

Sohail Shaikh2024-03-19I opted course of financial modelling.all mentors are good and supportive. Good platform for upskilling in core finance domain. ⭐️ Sumit Kapse2024-03-19Learning experience with Mentor Me has been excellent. I’ve enrolled for financial modeling course and I must say it’s the best place for finance courses.

Sumit Kapse2024-03-19Learning experience with Mentor Me has been excellent. I’ve enrolled for financial modeling course and I must say it’s the best place for finance courses. Satvik Chavan2024-03-19Having chosen the investment banking operations batch, I am finding that Mentor Me offers a highly interactive interface in addition to really helpful professors. Overall, I am really enjoying my time with Mentor Me. The fact that courses start from scratch and are therefore incredibly helpful for beginners is something I find appealing about them.Google rating score: 4.9 of 5, based on 534 reviews

Satvik Chavan2024-03-19Having chosen the investment banking operations batch, I am finding that Mentor Me offers a highly interactive interface in addition to really helpful professors. Overall, I am really enjoying my time with Mentor Me. The fact that courses start from scratch and are therefore incredibly helpful for beginners is something I find appealing about them.Google rating score: 4.9 of 5, based on 534 reviews

FAQ's

Since mentor me stands for learning, each mentor listed on mentor me can run as many courses as they want but can only take 20 mentees( students) in batch to maintain delivery and at a time mentor 20 students overall.

Mentor Me Careers has the most comprehensive curriculum and is the most value for money course on IB operations course. The placement services are personalised and the entire placement team works on individual profile of students

At mentor me we are serious on the quality of content you read, use and learn with.

We have high quality pre – recorded videos, recorded by experts

We have reading slides as summary

Class Recordings for staying updated (Applicable for Online Instructor Led)

Cheat Sheets- Get small pocket mind maps to remember formulas and logic

Excel Templates- Get high quality templates to learn financial modeling

Interview question bank- we have compiled over the years question banks for interviews for top 50 companies in India. You will get to practice these from day 1.

- More so, the mock interviews which are conducted are also included which are aimed at personality development of an individual for cracking the interviews

If you are in the Live online plus variant then you can attend multiple batches for a year.

Those who are live online basic- need to pay 2000 Batch transfer fee to enroll for the next batch

Content will be available for all variants for life time

It all depends on your learning curve and previous background. Below is the summary of recommendations’

Self Paced Basic- Suitable for Finance professionals

Self Paced Plus- Suitable for candidates who are well versed with fundamentals and are self-learners

Live Online Basic- Suitable if you are not looking for a placement and are just upskilling

Live Online Plus- anyone looking for a job.

The trainer or mentor will provide you with all the support required during this course, and you can access him/ her directly on whatsaap.

A valid internet connection that can handle online meetings , a laptop with a working Microsoft Excel account

Learning is global and accessible to all. We provide services to all

Yes if you enroll with more than 2 students as a group then we provide 10% Waiver for all.

College training with a large of more than 20 students can contact at [email protected]

We teach exactly what is required in placement interviews and we understand the finance space well. With our updated material, high quality content we are pretty sure, with the students effort that one should not have any problems getting success.

However we do not offer placement guarantee. Check the placement report here. Another fact is that all our students who have been placed with previous expereince have got minimum 20% growth rate in their packages.

We have multiple easy payment methods available.

EMI On Credit Card

Debit Card

Early Salary

UPI

Net banking

PayPAL

PayTM

And Many others. You can choose the method which is most convenient for you.