Last updated on February 12th, 2024 at 12:38 pm

Well if you landed in this article, then chances are that you might be appearing for a job interview, which demanded that you knew some real estate?

After all, there are so many KPOs today in India and elsewhere offering real estate advisory to clients in the U.S, Hongkong, Singapore etc.

In fact, India is almost set to capture 70 per cent of the global KPO market share, which by no means is small.

Anyways, you and I now are going to nail this topic and be ready to take on any interviews on real estate.

The Basic Logic of Real Estate Valuation

I want to set the context here before digging deep into this asset class!

Real estate like any other asset, follows the same process of identifying value and finally selling at a higher rate.

So at the fundamental level, you are still trying to make money eh?

The only difference between stocks and real estate is the unique terminologies and valuation perspective.

For instance,

- Any income generated from stocks divided by the price is called a dividend yield.

- However, the same income to price metric in real estate is called a cap rate.

Another important differentiation of this asset class is how we buy it.

Banks wouldn’t really fund your stocks purchase up to 80% of the capital needed.

On the other hand, banks would happily lend you 85% of your real estate purchase.

I don’t really want to get into the specifics as of now, but in a nutshell, that’s what makes real estate modeling interesting.

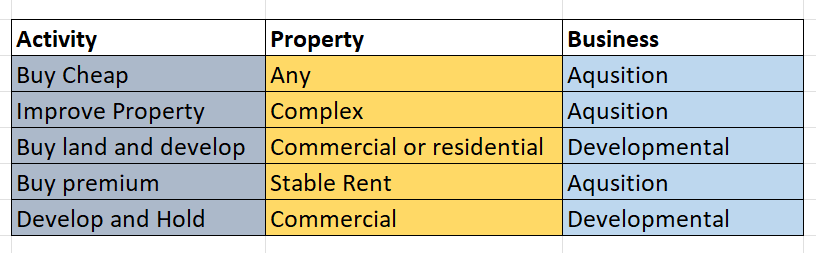

Types of Real Estate Business

Notice that I didn’t say types of real estate investment but business.

Can you take an educated guess, why?

Well simply because the type of real estate is not what matters but our intent.

You see unlike stocks, where a lot of emphases is on the type of company.

While in real estate the focus is on what we would want to do with the real estate in the first place. So this is how we categorize it.

So then why is this important? For a simple reason of calculation.

That is to say, wherever we acquire and sell, mostly the effect is property appreciation. However when we are dealing with developmental strategies, then the calculation and approach change to full-fledged business.

Valuation Multiples for Real Estate

I am going to discuss only the really important metrics, which you require to get the ideas flowing.

The specifics, you will discover anyways once you start working in this field or exploring it.

So first things first

Cap Rate

This is by any means the most spoken about metric in real estate valuation, so it deserves our attention. However, believe it or not doesn’t require many brains!

For example; Allen is working for a real estate advisory company and it has identified a property which generates a Gross rental income of $ 100,000. The asking price quoted by the seller is $750,000. What is the Cap Rate?

Solution: Just like dividend yield, divide the rental income by the purchase price. The Cap rate comes up to be:13.3%

Uses: Now the obvious question that you should be asking me is, where do we use it?

- Firstly it is used as a metric to compare other properties to check whether its expensive or not

- Second, we can use it for finding the possible exit price.

I will illustrate the second point, also known as the exit cap rate.

Exit Cap Rate

Let’s say we bought the property at $750,000, but you are trying to forecast the future sale price.

Now the only possible way of estimating this with research is to estimate the annual rent growth.

So, let’s say the rent growth is 5% every year, and we want to sell it after 5 years. Then what will be our sale price?

- The rent after 5 years will be $127628

- The cap rate shouldn’t change much, because the rent to value should more or less remain stable.

- So $127628 divided by a 13.3% cap rate will give us the estimated value of the sale, which is $959610.

Acquisition Cap Rate

What if we are told, that there is a property, which is selling for $55000 and the acquisition cap rate is 6%. What would be the rental income?

Just rearrange the equation, that is cap rate x property value= rental income

So, the answer is $3300!

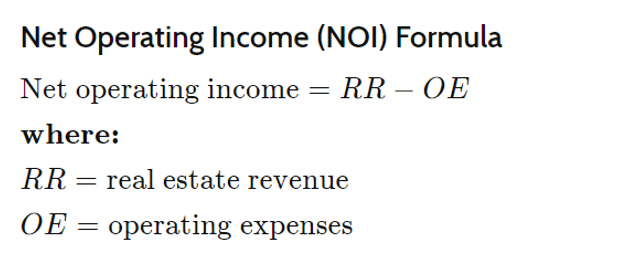

Net Operating Income(NOI)

I wouldn’t really call this a metric, but a financial statement calculation. So unlike, a normal company with operating profit as the calculation.

In real estate valuation, Rent minus all the expenses to run the set up= Net Operating Income

Vacancy Lost

When dealing with any real estate investments, there is a factor of occupancy. Rarely would a real estate asset be occupied 365 days a year, hence analysts assume a certain vacancy rate.

So, what do you do with it?

Well simply reduce the total rents with the vacancy rate to get Gross rental income.

Just to nail this in your head, let’s take an example;

ABC acquires a multi-family residential property with rent per unit of $12,000 per year. The complex consists of 15 units. The vacancy rate is 15%. What is the gross rental income?

Solution: So we multiply $120000 x 15 units x (1-15%)= $153000

Real Estate Valuation Model

Nothing is quite complete unless we practice it with a real case. So I have covered this in a video tutorial, you may download this template below and solve it with the video.

Real Estate Valuation Template

Frequent Interview Questions

I am going to list down some very common questions, expected in real estate valuation interviews.

These questions are general finance concepts, not necessarily real estate but since these are used sparsely in stocks you may find them new.

- Our client is a real estate private equity company that focuses on multifamily acquisitions. A property we are looking at has a net operating income (NOI) of $567,678. The asking price is $10,650,567. What is the cap rate?

- The same client was told by a broker that one of his listings is selling for roughly $55,000,000 at a 6% cap rate. What is the NOI?

- The property acquisition price is $45,500,000. The bank is lending the acquirer $25,000,000. What is the LTV?

- Describe what a promote structure is (also known as a waterfall) for sponsors and investors in real estate?

- Please describe the relationship between debt and equity in real estate.

- What is the difference between levered and unlevered cash flows?

- What are the two main types of “capital events” or “exits” in real estate?

- Which cap rate is better? (5% or 8%)

- What is cash on cash return?

- What is DSCR?

- Difference between NOI and cash flow

- Loan interest Vs Amortisation.