Last updated on October 18th, 2025 at 11:23 am

Whenever, you think about growing your money then the first thing that comes to the mind is stocks. However, does the scope of investment analysis stop at just the analysis of the asset? Let me take you through the practical and broader challenges of how this actually works in the real world.

Estimated reading time: 8 minutes

Scope of Investment Analysis

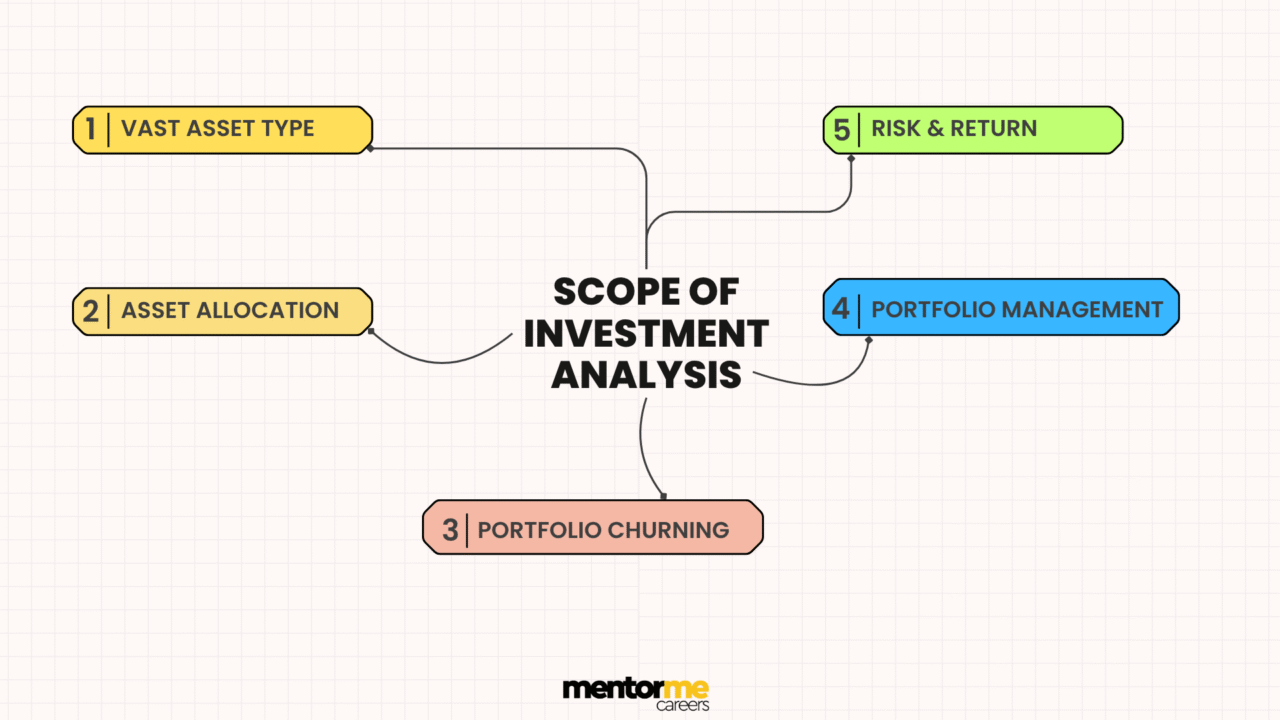

Now let me pen down the various scope of investment analysis as per the current industry;

Vast Asset Type

- First in terms of the sheer target assets, there are so many types of investment avenues. For example; you have real estate, bonds- short term and long term, stocks- mid,large, small cap, precious metal, paintings and the list can keep increase.

- Each of these asset type or financial assets have different characteristics. For example; Stocks analysis depends primarily on the business fundamentals. But the same doesn’t hold true for paintings.

Risk & Return

Another subject which makes investment analysis further complicated, is the analysis of risk and return. Where I am stressing on the risk part. As a popular saying for investors ,”Return is unknown but risk is always known”. So the questions is, do you manage the known or the unknown. Well, it turns out, its better to manage the risk, so that the unknown can survive.

Asset Allocation

Now, it might sound very simple and straightforward to invest is the highest return generating asset, and with the lowest risk. But such ideal situations don’t really exist. In fact, in the real world you need a mix of financial instruments or asset classes to achieve diversification.

Portfolio Management

Now understand, that asset allocation is not portfolio management and neither is investment strategy. Because whatever the pool of capital you have is getting invested hopefully for a reason. For example the reasons can be ;

- Retirement Funding

- Meeting expenses of charity

- College foundation

so, any of the the above objectives can vary differently basis the most important attribute which is time. For example an investment portfolio which is focused on achievement retirement funding and which has started during the mid 30’s has time on its side. Which also implicates more investment options.

Portfolio Churning

There are various statistical observations which I can quote here but let me instead give you some very easy situations to understand this concept.

- For example; usually you can conclude that the good large cap companies keep performing better irrespective of when you invest in it.

- However you returns can get affective if you redistribute the gains made in the better performing stocks to be invested in the low performing stocks.

So, you can understand that the buy and sell decisions are much more complicated than what it appears.

Nature of Investment Management

So, more or less I think I had already discussed this in the previous sections. However, let me give you a brief summary of the nature of investment management;

- Deciding the objective

All investment decisions should ideally be guided by objectives. Although you would rarely come across individuals who have this way of thinking. Rather mostly this process is more pronounced in institutional portfolio management.

- Setting The Risk Threshold

I am pretty sure that when a beginner thinks about returns, then they forget the risk. However, in the practical world the nature of investment management has a lot to do with risk management.

- Regulations

There are various regulations which can affect a specific client. For example an investor investing in mutual funds in india, might very different disclosure requirements compared to an investor in the United States.

- Liquidity Needs

So in professional management, you do not sell stocks to cover your expenses but plan theses events ahead. Which means, you need to evaluate your investment options based on the requirement for cash. Hence the need of fixed income security arises.

- Taxation

Let me illustrate this point to you. Let’s say you have one investment option that gives you a gross return of 20% but is taxable at 30%. Whereas you have another which is expected to give 15% return but it doesn’t attract any tax. So, the decision is not purely based on the gross returns but after tax returns. In the former case you would end up making only 14%.

Skills Used & Required

Now, let me generalise this section into a definitive structure. Firstly, you can get swayed by unlimited options of courses and skills. However, you don’t need everything at every level. For instance; a fresher analyst will hardly ever get a chance to write a research report, so why should you learn report writing?

Priority List

Now, ill list down first the priority of the skills and knowledge;

- Financial statement analysis

The only skill which doesn’t get talked about much often, yet in the field of investment management this is the most important skill. You need to spend some time learning basic accounting, linkages of financial statements. While also actually go through real financial statements of companies.

- Asset Classes

You also should spend some quality time understanding the structure of various assets. For example; Equity, debt, derivatives. At the same time also understand the investment banking operations.

- Market Trends

I always suggest new freshers aspiring to enter investment management to pick up a niche. For example; if you understand or incline towards the banking industry, then build your expertise around it. That doesn’t mean that you will get the same sector. But the quality of your answers will encourage the recruiter to have an understanding if your potential.

- Valuation & Related Skills

Usually a lot of beginners tend to learn this skill first, however in reality this is the most easy one. In fact, nothing really changes in valuation techniques once you learn it. However, once you understand the above priority skills, then you move in here.

Also do not approach valuation in a subjective way but understand first broadly how a valuation of company actually gets affected.

This will help you in ascertaining, the assumptions and going deeper on the analysis of the business itself.

Salary & Jobs in In Investment Management

So, the discussion would be incomplete if I don’t discuss the salary and job prospects in this field. So firstly let me categorise the kind of major roles in investment management;

- Research

Research is the most prominent job role that you will find under investment management. Also the reason for this is that research can be on different fronts. From primary research to secondary research, which includes competitive analysis, product research etc.

Generally the research designations include; research associate, research analyst etc.

The average salary for equity research based entry level jobs start at around 5-6 Lacs INR in India.

- Wealth Management

You would be surprised to know that the investment management industry has more wealth managers than analysts. The simple reason for this, is that wealth management is personal. You need personal connect and usually there is no one size fits all.

The starting salary including commissions on wealth management can go upto 8-9 Lacs.

A place big hiring and lot of work force. This is because, with millions of trades and transactions worldwide, there has to be a process. For example; Trade initiation, confirmation ,reconciliation etc.

There are sone big companies in this field including BNY Mellon, Deutsche bank, Eclerx, State street who offer this services to clients.

- Compliance

The world after 2007 crisis and before it are very different. Pre- 2007 the rules of customer engagement, onboarding, risk management laws, reporting was not as stringent as today. Hence compliance is another vertical which opened up in the scope of investment management. The popular roles include AML kyc analyst, client support etc.

Final Word

Investment management is a huge and wide field, so when someone asks me that they wants to enter investment management. Then my next questions, is “Where?”. And that’s when mutual realisation comes on the lack of awareness of the field. Also there is no real reason to know everything before hand but a broader picture needs to be clear.

Whether you are the kind of person whose personality is more tilted towards people or more of analysis. Once this basis clarity is there then you can of course discover a niche for yourself.

FAQ

Which are different types of investment analysis?

- Fundamental

- Technical

- Bottom-up

- Top-down

What are three steps of investment analysis?

Step 1: Identify evaluate opportunities

Step 2: Conduct in-depth analysis

Step 3: Apply and monitor

What is investment analysis?

Investment analysis is where an investment is analyzed by an investor for making a good return percent opportunity seen in the investment.