In the past, when a B school graduate would be asked what you want to do? The answer was either, an Investment banker or get into strategic consulting. However, those days were marked with non linear information availability and lack of work force. In this letter, I would like to address the scope of investment banking, while keeping in mind its past and what is in store for you in the future.

Scope of Investment Banking

So, when generally a student comes for education counselling at mentor me careers, and asks me this question. What is generally referring to is the salary. Now, if you only are interested in the salary, then this article will disappoint you. Also, the reason I say that is because, salary is such a broad and cloudy data, with hundreds of dimensions attached to it. For eg; your age, your experience, your location, the department in investment banking etc. So, this article should give you a clear road map, of how this industry has been shaping up since ages and which will give us some hints on what lies ahead.

Reminiscing The Past- Scope of Investment Banking

The Dutch East India Company

So, a quick walk across some memory lanes. Trading overall began during the dutch east india company times. While the dutch used to send across ships to the asian side, to trade and get back treasures. Also, the success of the voyage depended on the ship successfully making it back to Dutch. At the same time, the investment was done on these ships, which on successful returns meant returns.

So, this simple example should give you hints on the how the scope of investment banking emerged.

The Coffe House in U.K

So, then came the trading of shares in Coffe houses in London. The Coffe uses to be a place where brokers and investors used to trade shares and securities. However, there was a catch! And the catch was that in case you wanted to sell the security, you had to physically search for the investor on the roads of London.

Now, these same trading firms who initially traded spices, silk and silver, later started trading bonds and started to be called as merchant banks. Also, they started underwriting and selling government bonds.

Emergence of Americas

Now, you might be amazed to know that the biggest investment bank names that you aspire to enter today, are a result of the American civil war. That’s right! During this period, several banks emerged who were expected to fund the federal government on capital requirements to fight the civil war. The names like JP Morgan and Goldman Sachs are born out of this event.

Again, investment banking emerged as a result of financial service to the federal government.

Decoding the Present State of Investment Banking

So, in todays world the services of investment banking has widened. The investment bank just doesn’t do trading, research, funding, underwriting but it does all. In fact compared to the past, investment banks are heavily involved in private equity investments as well.

Institutional Broking:

So, investment banks are also institutional brokers and hence their services include providing the client with good research. So, this used to be a big place where a lot of smarty pants used to aspire to work. In fact, this was a place where any investment banker was born. However over time, institutional broking research itself is outsource to cut costs. Now, the reason is multifold

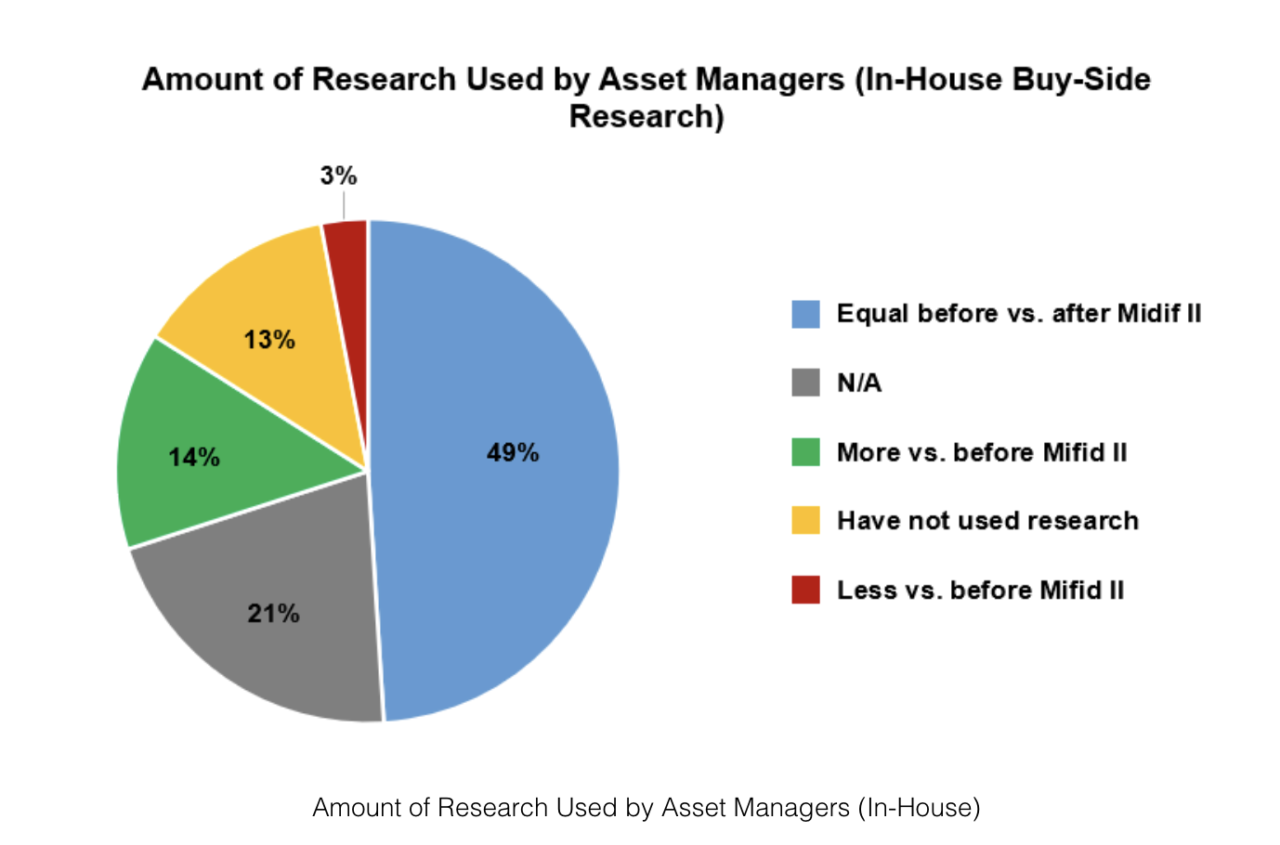

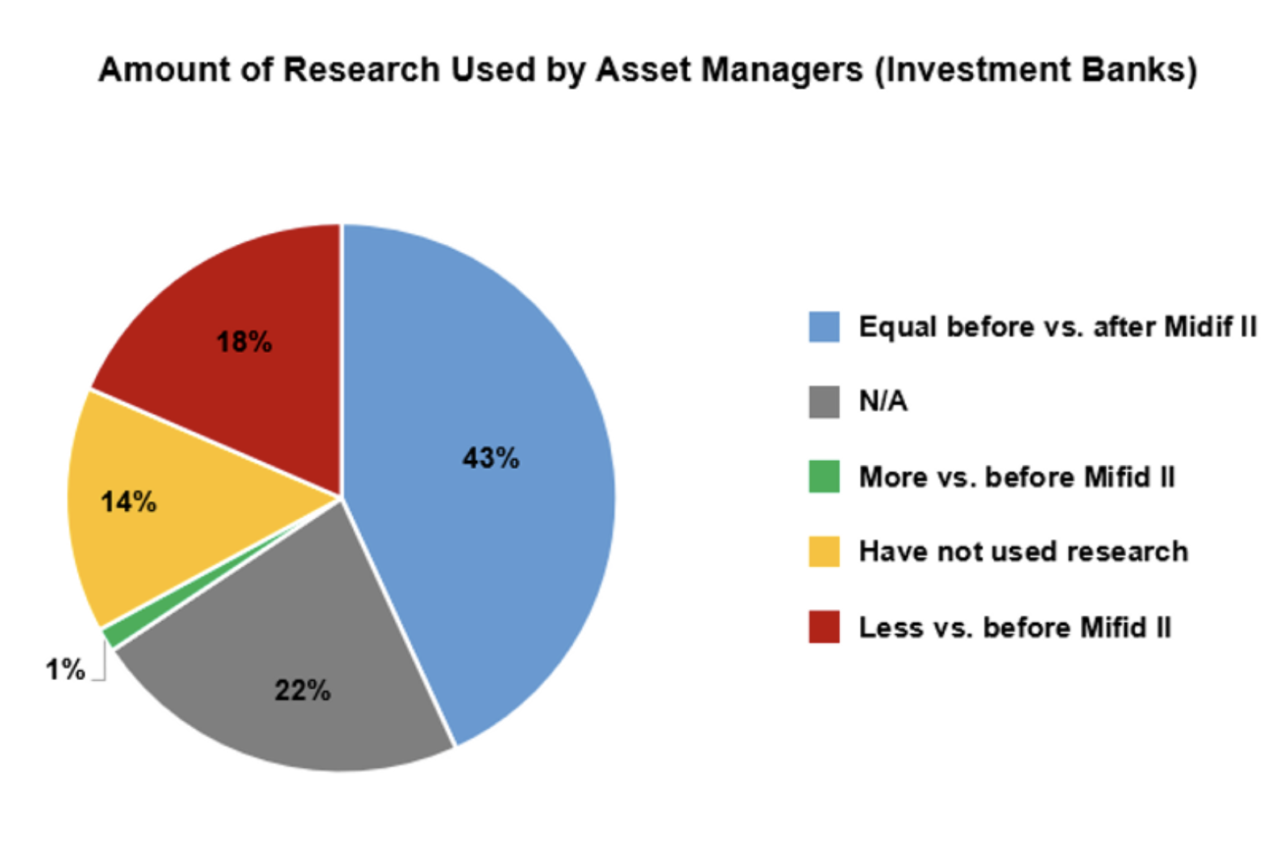

- First the European MIFID 2 Regulations, which mandates the asset management companies de-bundle the fees paid for broking and research separately. Now, this mean that an investor in the asset management company, would have the ability to question the research itself and its use.

- Second, the emergence of newer ways of getting relevant research like platforms or data aggregators. So, the hours spent by an analyst on research on a stock, gets compiled into a single platform which then gets disseminated on averages of other analysts as well.

- Thirdly, in the figure below it should be clear that asset managers are clearly allocating research expenses to buy side rather than sell side.

- In conclusion, what this means is that as a candidate you will get more opportunities in buy side rather than sell side.

Mergers & Acquisitions

So, when two companies decide to work together or one bigger company eats up the smaller one is what this section is about. As you might have noticed, that investment banks are basically the same firms like BCG or mckensy. The only difference is that they are wrapped in the name of Investment Bank.So, even in mergers or acquisitions, the investment banks has the work of finding a potential buyer and a potential seller. In between they end up making a commission if the deal goes through. Also, in order to make the deal happen, the investment banks will take up multiple activities like;

- Firstly, Creating financial models

- Secondly, Researching on the business

- Thirdly, offering due diligence services

- Fourthly, negotiating on both sides

Do, remember that an investment bank only gains when the deal actually happens.

Project Finance & Debt Syndication

So, the world needs roads, ports, airports and power. All, these kinds of infrastructure is done on a PPP model. Which, is public private partnership. Where, the government offers a tender to build a road for example , and bids are invited to bid on the price at which you would able to complete the project.

Even in this activity, given that your firm does have the capability to build a road for instance. Still, the project needs to funded with a lot of debt, while that debt is actually with a bank. And the bank needs a financial model, presentations and negotiations. Enters, an investment bank which helps you syndicate many times of banks to fund one project. Again in return for a fee.

Wealth Management

So, if you have the capability to do research, create great presentations and even have a voice in the market. Then why not also offer some wealth management services to the rich. Investment banks also offer personal wealth management services to HNI’s and UHNI’s.

The Future

Now, I am not an astrologer to exactly predict the future of investment banking. However there are certain patters that definitely emerge.

- Firstly, the roles of research will consolidate further. With lesser need for equity research and more demand for platform based services. This also means, that the customer will expect more from transaction services.Which also means that research is not going to be a very high paying Job in the future

- Secondly, comprehensive wealth management is going to of much bigger importance in the overall scheme of trends. Since more and more capital is going to get invested in non traditional investments like equity and mutual funds, which will increase the need of wealth managers.

- Thirdly, deal makes and sales skill is going to be critical to survive in this industry. As long as your people skills are in place then survive can turn into thriving.

- Also, note that even though sell side research will eventually take a hit, the investment in buy side research increases. However, there is a catch here that it’s not necessary that all the buy side work gets done in house in asset management companies. But gets outsourced to KPO’s specialising in buy side research.