Last updated on January 23rd, 2026 at 05:11 pm

If you’re preparing for financial modelling interviews, this guide gives you exactly what students look for: real interview questions, clear explanations, and practical tutorials that help you answer confidently. Whether you are a fresher, CFA candidate, MBA student, or career switcher, recruiters expect you to explain models, assumptions, and outputs not just formulas.

In this article, you’ll find commonly asked financial modelling interview questions, step-by-step answers, and hands-on practice guidance so you can build and explain models the way interviewers want. We also include a downloadable PDF for quick revision and a tutorial-style walkthrough to strengthen your concepts before interviews. If your goal is to crack analyst, investment banking, equity research, or corporate finance interviews, this guide is built exactly for that purpose.

Common financial modelling Interview Questions

1.What do financial statements show, and how do they interlink with each other?

Income statement, Balance sheet and cash flow statement. Performance, status till date, and performance in cash.

Hence the Income statement basically runs on the philosophy of Revenue-Expenses= Profit.

Just as profit links to retained earnings, various other line items also link to the balance sheet. For example, cost of goods sold affects inventory

The cash flow on the other hand is like a reconciliation of Income statement to cash by using the changes in balance sheet items.

For example:

5 items sold worth $10, but the buyer would be you in the future then $50 gets booked in revenue ( basis the accrual system of accounting). However in cash flow statement you need to be convert revenue into cash.

So we take the $50 and find what changed in accounts receivable(credit sales). Hence if the credit sales in the previous year was $10 and in the current year is $60. That means the change is $-50. So the cash revenue =$50(Income statement)- ( $10-$50) change in accounts receivable

Operating, financial u0026 investing activities of the business.

2.How do you calculate FCFF u0026 FCFE with various line items of Income statements and state its use?

Free cash flow means, cash of business which is surplus after taking into consideration all the business activities.

The cash flow have two perspectives generally. Are you a debt investor or an equity investor.

If it’s a debt investor then the cash flow that is relevant is the cash before repayment of principal and interest

If its an equity investor then the cash flow that is relevant is the cash after interest. Those are the basic principles to start with.

FCFF = EBIT * (1 – Tax Rate) + Depreciation u0026 Amortization – Capital Expenditures – Change in Working Capital

FCFE = Net Income + Depreciation u0026 Amortization – Capital Expenditures – Change in Working Capital + Net Borrowing

Bankers won’t let you through unless you’ve paid their interest and principal. The interest is already deducted in net income, if it was accrued it gets adjusted through changes in working capital. What’s left is the cash available to equity investors.

3.What are the various revenue recognition methods and demonstrate its use?

We divide revenue recognition are into regular and special cases.

Special cases include percentage completion method, cost recovery method, and completed contract method.

Methods like these are used in cases like Construction real estate companies. Since usually the acquisition, construction and sale of real estate projects can take multiple years. The revenue is recognized basis the percentage of the completion of the project. This is an aggressive method of revenue recognition.

Completed contract method: In this method no revenue is recognized until all the construction is completed. This is the most conservative method

Cost recovery method- In this method, revenue is recognized up to the costs incurred during the profit. Resulting in zero profit. This method is used usually in case of instalment sales.

4.What are the three types of finance?

Majorly there are three types of finance namely, Investment finance, corporate finance and private finance.

5.Why Finance?

This question is a very common question, and usually the interviewer is seeking to understand your interest. For example; when I was first asked this question, my direct answer was that I was curious about stocks since high school where I used to check scrips going up and down. From there my exploration lead me to study finance.

Excel Financial Modelling Interview Questions

1.Which function can we use, if we want to test the model sensitivity to various given assumptions?

Sensitivity analysis can be done using the data table function in the Data Ribboonu003e What if Analysis u003e Data table Data table is an array function. A Data table can be created by creating 2 x 2 Matrix of the assumptions to be tested. For example in a very basic table, we could test the interest rate u0026 tax rate effect on profitability. Hence in the 2 x 2 Matrix interest rate and tax rate become the rows and col. To the side of the matrix we need to link the original profit calculation, which tells excel that this is the calculation which needs to be replicated by changing the two assumptions. Its important to note, that this won’t work unless your calculation and model is linked and no hard coding is done.

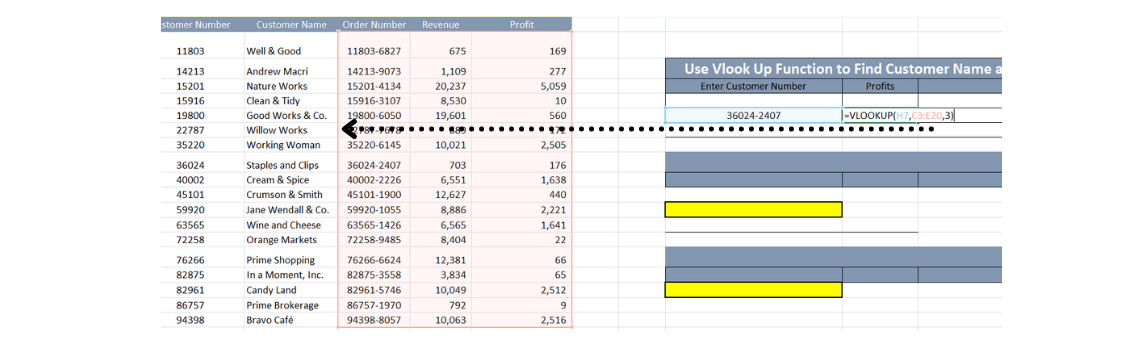

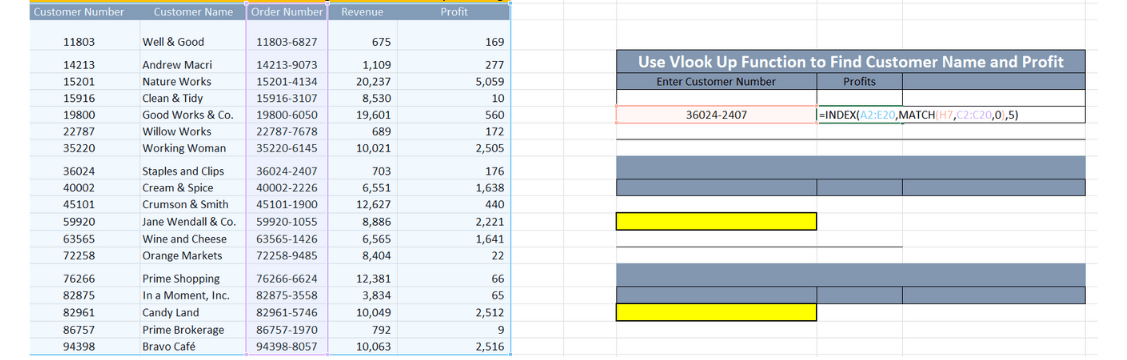

2.Explain how vlook and Index(match) differ u0026 When you would use it?

V look up or vertical look up function u0026 Index match are both used to find the related data, basis some field data point you have.

If you check the above data set, the data firstly flows from top to down i.e vertical. Hence vlook up gets used. Second we take customer number(3604-2407), as the source of finding profit.

So vlook up function asks for three things. Look up value – 3604-2407

Table array- the place where you are looking. Difference between the two functions. Table array needs to be selected to make sure the source data col, is to the left most side of the selection, followed by the numeric index position of the finding data. The third column is where the profit lies.

While with index and match removes this constraint and you don’t have the constraint of left most side selection.

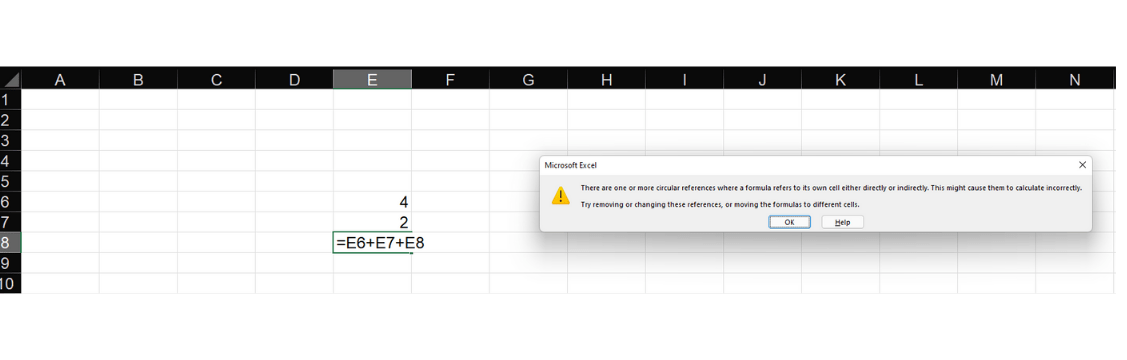

3.What is a circular reference?

A typical question to test, whether you understand how calculations actually work on excel.

Circular reference is basically an error caused when a calculation is performed linking its self.

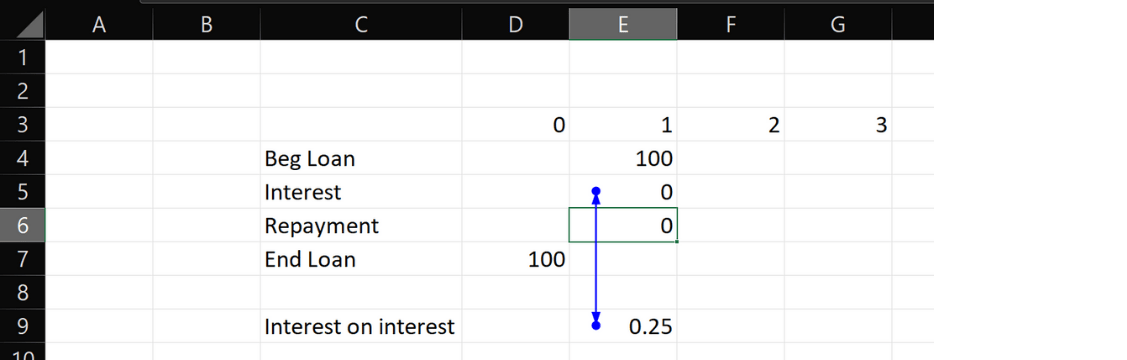

In fact a lot of models would be difficult to calculate if it wasn’t for circular calculation feature of excel. Let me give you an example: Lets say you took a loan $100 with interest rate of 5% compounded annually. However you can’t pay the interest for 3 years. So what would would be the loan accrued until 3 years.

4.What is a Debt Schedule in financial modelling?

A debt schedule is a detailed plan that outlines a company’s debt obligations, including principal repayments, interest payments, and the timing of these payments. It is a critical component in financial models as it impacts the cash flow forecasts and the overall financial health of the company.

Advance Core Financial Modelling Interview Questions

1.What are the various return measures, which are used in financial calculations and their uses?

Even Cash Flow Method: Decision making related to stock market performance or a mutual fund investment, there is a particular entry point and an exit point.

Rate = (FV/PV)^(1/n)-1 (CAGR). Excel: Just type =rate (All the expected details).

Uneven Cash flow method: In regular cases, the returns are not calculated in the same method. In such cases we are more concerned about initial investment to start the business. The Free cashflow generated during lets say 4-5 years of the forecasting. Selling of assets and shutting down the business at the end. In these cases we use “ Internal rate of Return” u0026 “Net present value” Method.

In IRR, we try to estimate the rate of return based on the logic that there must be some rate, which can make NPV zero( Initial Investment- Future cash flows).

You can learn how to calculate this with a model here: Learn

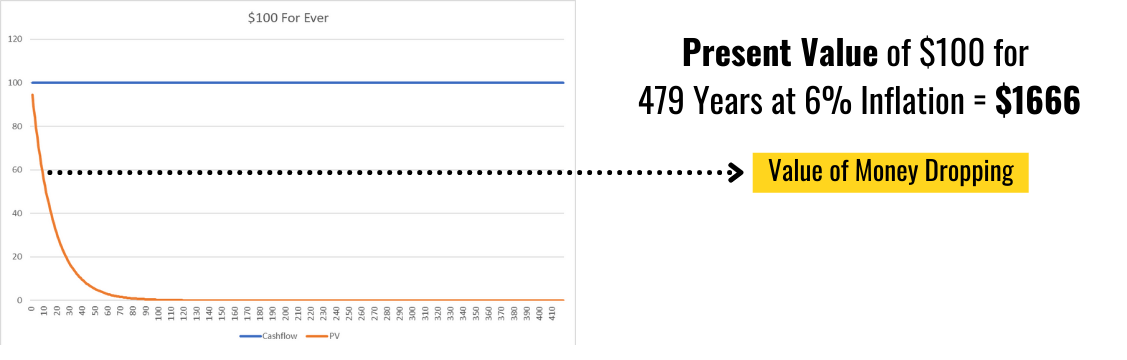

2.If someone is ready to give $1000 Every year forever, in exchange for you paying him $5000 today. Considering that there is a inflation of 6%. Will you accept this? If yes why and if no why?

This question will prove whether you understand time value of money in its intended way or not.

If you are answer is “Yes”, then you are wrong.

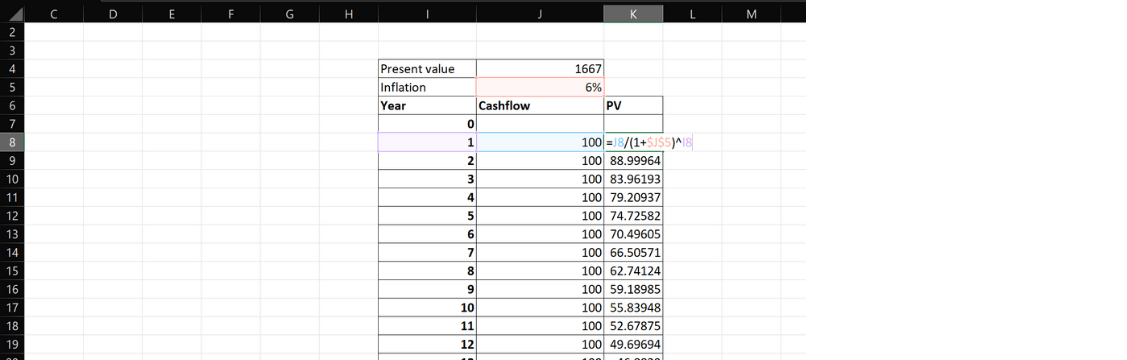

3.Create an excel with $100 And Find the PV like shown below and see for yourself?

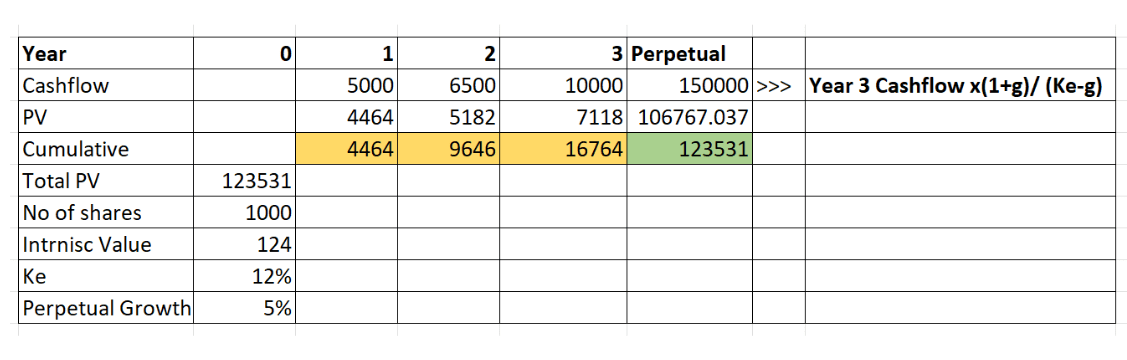

4.How do you value a company based on DCF( Discounted Cash flow)?

Continuation of the financial mathematics, based on the present value concepts.

We can value a company using DCF, by first forecasting the free cash flow of the company

FCFF- To find the enterprise Value

FCFE- To find the equity value

Usually we use FCFF because, it can also be used to find the acquisition value. When you acquire a company you pay the enterprise value.

We then estimate the cost of capital and cost of equity for the company based on the method chosen. If we are using FCFF, then we use WACC (Weighted average cost of capital), else we use Cost of equity (Derived from CAPM)

We discount the cashflow back to zero based on the discounting rate( either WACC or Ke ). Also since we are discounting only the forecasted period, but the business is a going concern hence we use the concept of Gordon growth model (Very similar to the present value of $100 example taken above).

Explicit Forecasted Present value

Perpetual growth

Lets say we are hypothetically valuing Infosys. Its FCFE for 3 years( Forecasted period) is as follows

$5000

$6500

$10000

Ke: 12%

Perpetual Growth rate: 5%

No of shares= 1000

CMP:$10

5.How would you value a company that has negative cash flows?

The interviewer is trying to test, if you have spend enough time spending on practical cases.

You can actually value a company with even negative cashflows but not by DCF. You can do that by using relative valuation. Some companies might be negative because of their growth phase, hence doesn’t really mean that the company has no value.

Do valuation based on P/E, EV/EBITDA etc. on profitable companies and then try to adjust it to estimate the value of the negative cash flow company

You could also do the same with DCF, and try to predict the profitable phase.

You can do asset based valuation, so no cash flow needed.

6.Which ratios will you use while doing financial analysis?

Can you tell what the purpose is?

Lets say he says filtering based on the highest return performance, then

Return on Equity

Return on capital

ROE and ROC are very important ratios for filtration, because any company consistently performing over and above 15% ROC u0026 ROE is likely also to continue to perform better.

7.What is revenue driver? Tell me your approach to finding the revenue driver for a grocery store?

Revenue drivers are important. You can’t really understand a business, if you don’t have the ability to understand the two most important factors behind the revenue

Price X Quantity.

No! The grocery store revenue driver is not Price of inventory X Quantity of inventory.

How can you really predict or forecast the inventory. Also how can you ever judge whether the goods are actually getting sold or not. The simplest way to think about revenue drivers is to think, this way.

What is the similarity between a large super market and small grocery store?

Space!

Larger space, larger revenue. Hence area matters in a super market business. So how about we design the revenue driver as:

Revenue Per sq feet (That’s price) x Space

Now you can forecast the revenue of the grocery store by forecasting space or the revenue per sq feet (premium products staking will leading higher revenue per sq feet).

8.Which are the most common ratios used in projects to ascertain the feasibility of the project?

Project finance is usually funded through debt and the banks want to know whether your business has the capability to repay. Hence practically they want to understand if your cashflows are going to be enough to cover the interest and principal payments

So the ratios we can use is

Debt Service coverage ratio

Interest Coverage Ratio

Pay back period

Discounted pay pack period

Profitability Index

9.Can we increase sales by reducing head count?

In a normal layman’s talk , this is impossible but if you think about the possibilities then it is.

Larger number of employees doesn’t mean good. Higher number of employees can also mean, more costs of maintaining an employee.

It might be possible to increase revenue by incentivizing a smaller number of employees and removing inefficient employees.

Why for example: Lets you had 10 employees and you were paying them $1000 in total. Out of which 5 employees are under performing on a major scale. The rest 5 star performers though feel under paid.

Hence we could pay each one of the 10% higher and saving $500. So you not only saved $500 but also may be increase the motivation of the star performers to perform at 100% capacity.

10.What is break even sales?

Break even sales is the minimum sales you would have to do, in order to cover your fixed costs. Its very important for a business to constantly know, what’s the kind of minimum sales required to not shut down.

Hence here you need to understand what is variable cost and what is fixed costs. Variable costs include- salaries, raw materials etc. Fixed costs include rent, plant and machinery maintenance.

So divide the fixed costs by average revenue to find the break even sales.

11.What is net operating Income?

Net operating income is EBIT in normal sense that’s all. The only difference in real estate is that we generally consider real estate maintenance expenses, tax etc

Valuation & Forecasting Financial Modelling Interview Questions

1.How is the Perpetual Growth Model used in DCF valuation?

Explanation: The Perpetual Growth Model, also known as the Gordon Growth Model, is used in the terminal value calculation of a Discounted Cash Flow (DCF) analysis. It assumes that free cash flows will grow at a constant rate indefinitely. The formula is Terminal Value = (Final Year Free Cash Flow * (1 + g)) / (r – g), where “g” is the perpetual growth rate and “r” is the discount rate.

2.What is Financial Forecasting and why is it important?

Financial forecasting involves predicting future financial performance based on historical data, current trends, and assumptions about future conditions. It is crucial for budgeting, planning, and decision-making, as it helps companies anticipate revenues, expenses, and capital needs.

3.How would you calculate the Discounted Payback Period?

The Discounted Payback Period is the time it takes for an investment to break even in terms of net present value (NPV). Unlike the regular payback period, it accounts for the time value of money by discounting the cash flows. It is calculated by summing the discounted cash flows until they equal the initial investment.

3-Statement Linking Interview Questions

1. What happens if a company issues new equity?

Answer:

- Cash Flow Statement: Cash inflow under financing activities.

- Balance Sheet: Cash increases; share capital increases.

- Income Statement: No immediate impact.

2. What is working capital and how does it affect cash flow?

Answer:

Working capital is Current Assets – Current Liabilities. An increase in working capital uses cash, while a decrease releases cash in the Cash Flow Statement.

3. What happens when interest expense increases?

Answer:

- Income Statement: Net income decreases.

- Cash Flow Statement: Lower operating cash flow (after tax).

- Balance Sheet: Retained earnings decrease.

4. What is the final link that closes the 3-statement model?

Answer:

The ending cash balance from the Cash Flow Statement links to the Cash account on the Balance Sheet, ensuring the model balances.

DCF & Valuation Interview Questions

1. What discount rate is used in a DCF?

Answer:

The Weighted Average Cost of Capital (WACC) is used because it reflects the cost of both debt and equity financing.

2. What happens to a company’s valuation if WACC increases?

Answer:

If WACC increases, the present value of future cash flows decreases, leading to a lower valuation.

3. What happens if revenue growth assumptions are too high?

Answer:

The valuation becomes overstated and unrealistic, which can mislead investment decisions.

4. How do you move from enterprise value to equity value?

Answer:

Equity Value = Enterprise Value – Net Debt (Debt – Cash) ± other adjustments.

5. Why is sensitivity analysis important in DCF?

Answer:

It shows how valuation changes when key assumptions like growth rate or WACC change, helping assess risk.

Financial Modelling Interview Questions Best practices

1.What are the top best practices in financial modeling?

Financial modeling best practices are essential for creating accurate and reliable models. The top best practices include:

• Simplicity: Keep the model as simple as possible while still capturing the necessary details. Avoid overcomplicating with unnecessary calculations.

• Transparency: Make sure all assumptions, inputs, and calculations are clear and well-documented. Use comments or separate sheets for assumptions and sources.

• Consistency: Use consistent formatting, naming conventions, and color-coding throughout the model. This makes it easier to follow and reduces the risk of errors.

• Modularity: Build the model in distinct, easily understandable sections, such as separate tabs for income statements, balance sheets, and cash flow statements.

• Error Checking: Regularly check for errors by auditing formulas, using Excel’s error-checking tools, and conducting scenario analysis.

2.How can you ensure the robustness of your financial model?

Ensuring the robustness of a financial model involves several key steps:

• Stress Testing: Stress testing involves pushing the model’s inputs to their extremes to see how the outputs behave. This helps identify vulnerabilities or areas where the model may fail under different scenarios.

• Scenario Analysis: Conducting scenario analysis allows you to test the model under various conditions, such as best-case, worst-case, and base-case scenarios. This provides insights into how changes in key variables affect the overall outcomes.

• Model Auditing: We should regularly audit the model by reviewing all calculations, cross-checking formulas, and using Excel’s auditing tools. This process helps you identify and correct errors before finalizing the model.

• Version Control: Maintain version control to track changes and if needed revert to previous versions. This helps in keeping the model’s integrity intact, especially when multiple users are involved.

Real estate financial modeling interview questions

1.How would you model the impact of rent escalations and lease renewals in a multi-tenant property?

n a multi-tenant property, rent escalations and lease renewals are crucial factors that affect cash flow projections. To model this, you need to set up schedules for each tenant that account for:

• Base rent increases: These are often tied to inflation (CPI adjustments) or fixed percentage increases.

• Lease renewal options: Include assumptions on renewal probability, potential rent increases, and vacancy periods between leases.

• Step rents: Model the effect of staggered rent increases over the lease term. The overall impact on NOI should reflect these variables over the investment horizon.

2.How do you approach modeling a joint venture (JV) partnership in a real estate development project?

When modeling a JV partnership, it’s essential to reflect the different equity contributions, preferred returns, and profit-sharing arrangements:

• Equity Contribution: Model the capital contributions from each partner according to the agreed structure (e.g., 70/30, 60/40).

• Preferred Return (Hurdle Rate): Calculate the preferred return on equity before profits are distributed.

• Profit Sharing (Waterfall Distribution): Implement the waterfall structure, where profits are distributed according to pre-agreed tiers, such as IRR hurdles or cash-on-cash returns.

• Promote Structure: Include any promote structures where the developer or a specific partner receives a higher share of profits after certain financial milestones are achieved.

3.How would you incorporate the impact of property taxes that change with property reassessment in your model?

Property taxes can change significantly after a reassessment, which usually occurs after a property sale or significant improvement:

• Current Property Tax: Start with the current tax rate applied to the assessed value.

• Reassessment: Model the impact of a new assessment value post-acquisition or after significant capital improvements. This may involve estimating a new tax rate based on comparable property sales or improvements.

• Tax Abatements: Consider any tax abatement programs that might delay or reduce the tax burden for a specified period.

• Future Tax Growth: Incorporate assumptions on how property taxes will escalate annually based on local tax laws and projected appreciation in property value.

4.Explain how you would model debt structuring with a combination of senior debt, mezzanine financing, and equity in a real estate investment.

Debt structuring with multiple layers of financing involves careful modeling of cash flows and repayments:

• Senior Debt: Model the senior debt first, including interest payments, amortization schedules, and covenants. Senior debt usually has the lowest interest rate but the highest claim on cash flows.

• Mezzanine Financing: Include mezzanine financing, which typically comes with a higher interest rate and can include equity participation or warrants. Borrowers make payments on debt after they meet senior debt obligations.

• Equity: Model the equity contribution last, and reflect the residual cash flows after you have satisfied all debt obligations.. The equity holders’ return is based on cash flows remaining after servicing both senior and mezzanine debt.

• Debt Coverage Ratios: Calculate key metrics like Debt Service Coverage Ratio (DSCR) to ensure the project can service its debt at all levels.

5.How do you model a property that requires significant deferred maintenance, which you plan to address through capital expenditures over time?

Modeling a property with deferred maintenance requires detailed capital expenditure planning and its impact on future cash flows:

• Initial Assessment: Identify, estimate the cost of deferred maintenance to be addressed immediately or over first few years.

• CapEx Schedule: Create a schedule for capital expenditures, detailing timeline of work and how much it will cost. Spread these costs over the project timeline.

• Impact on Cash Flow: Reflect the impact of these expenditures on cash flow, both in terms of the outlay for maintenance and potential increases in rental income or property value due to improvements.

• Financing: Whether the Cap Ex will be financed through additional debt or paid by operating cash flow.

• Depreciation and Tax Benefits: Include the effects of depreciation on the capital improvements and any tax benefits that may arise from these expenditures.

Role specific Financial Modelling Questions

Financial Analyst:

1.What is ZBB ? What are your recommendations ?

Zero-base budgeting is a process of budgeting where manager has to build a budget from scratch (From zero) which helps with allocation of resources. With proper training and awareness ZBB can increase efficiency by 5-10%.

2.What are the roles of Financial Analyst ?

`1. Analyzing financial information like ratio analysis profitability, economic trends, potential financial risks to interpret results and make Investments decisions.

2. Illustrate technical reports like annual budget using spreadsheets.

3. Project reveune, cashflow and costs with help of financial models.

4. Performing investment analysis for making data driven decisions.

5. Collaborate with sales, marketing departments to gain essential views.

3.What are the three main financial statements?

- Income statement also called Profit and loss statement which shows company’s performance over period, we can conclude if the company is profitable or not.

- Balance sheet shows company’s financial level at a certain point in time.

- Cashflow statement shows us in and out cash flow of business.

Equity Research:

1.What is a LBO ?

Leveraged buyouts (LBO) means acquiring company through borrowed amount to meet the acquisition cost. This improves operations and revenue, eventually sell the company at profit.

2.What is industry cyclicality ?

Cyclical industries are dependent on economic performance for their revenue and profitability, meaning when economic conditions drop these industry sales drop.Usually cpmanies like automobile industry, luxury goods come under this.

3.What is rollover equity ?

Owners or stakeholders sometimes retain part ownership. Example, Owner sells 80% of the company and keeps 20% invested in the business, Rollover equity is 20%

Investment banking:

1.How would you value a company ?

Estimating the company’s worth by discounted cash flow analysis (DCF) calculated with the help of free cash flows and discount rate also add terminal value best for mature companies, comparable company analysis identify same industry companies compare metrics like EV/EBITDA also P/E ratio, asset based valuation meaning company’s net asset worth, market capitalization is generally for public companies where the calculation is share price x total shares outstanding.

2.What might cause company’s present value to increase or decrease ?

There are many reasons why will this happen: Profit growth, new product launch, cost efficiency, industry growth, reduced growth are some increased value examples where as decrease in value can happen because of legal issues, high debt, product failures, bad acquisitions.

3.What does working capital mean?

We calculate capital of business by subtracting current asset, current liabilities this measures company’s financial well-being and operational efficiency.

Company specific Financial Modelling Interview Questions

Fintech company

1.EV/EBITDA vs EV/EBIT?

We use valuation methods to understand a company’s financial performance, though they differ slightly. EV/EBITDA shows us cash operating performance by dividing enterprise value (EV) by earnings before interest, taxes, depreciation, and amortization. We typically use this in early-stage analysis. EV/EBIT reveals core profitability by dividing EV by earnings before interest and taxes, and we usually apply it to mature companies.

2.EV/EBITDA vs EV/Net Income?

EV/Net income by dividing Enterprise value (EV) with net income this gives earnings after all expenses. Both focus of different parts, use EV/EBITDA to compare operations whereas use EV/Net income to compare earnings per stock price.

Consulting Firm

1.What is venture capital?

A type of financing where investors invest in startups at early stages which have high growth potential in exchange of equity where the Venture Capitalist’s also mentor and guide the founders.

2.What is private equity?

Investment in private companies or public with the intention of improving the performance, sales and also revenue to sell later for profit.

3.What is 2/20 rule in hedge fund?

A hedge fund charges 2% Management fee on total asset under management annually to cover the operation costs and payments. It also takes 20% Performance fee is of the profit to reward the manager for his/her performance.

4.What is mutual fund?

Here, investors provide the investment money, and the fund manager professionally manages it by investing in a diversified portfolio of assets.

5.What does Bloomberg terminal mean?

Finance professionals use Bloomberg software to analyze real time financial data, news, and analytics which they considered gold standard in financial information system. Bloomberg terminal helps with data driven decisions, investment decisions, trading and monitoring.

Common modeling mistakes

1.Jumping into Excel Without Structuring the Model

Mistake:

Candidates start typing formulas without laying out assumptions or model flow.

What interviewers think:

“This candidate can use Excel, but doesn’t think like a modeller.”

How to avoid:

Always explain the structure first:

- Assumptions → Calculations → Outputs

2.Not Linking the Three Financial Statements Correctly

Mistake:

Incorrect flow of net income, depreciation, or working capital between statements.

What interviewers think:

“They memorized answers but don’t understand accounting logic.”

How to avoid:

Practice explaining how one change affects all three statements.

3.Overcomplicating the Model

Mistake:

Using unnecessary sheets, complex formulas, or excessive detail.

What interviewers think:

“This model is hard to audit and risky.”

How to avoid:

Keep it simple, clean, and scalable.

4.Weak or Unrealistic Assumptions

Mistake:

Random growth rates or margins without justification.

What interviewers think:

“They don’t understand the business.”

How to avoid:

Base assumptions on:

- Historical trends

- Industry benchmarks

- Logical business drivers

5.Hardcoding Numbers Inside Formulas

Mistake:

Typing numbers directly into formulas (e.g., =A1*1.12).

What interviewers think:

“This model will break easily.”

How to avoid:

Keep assumptions separate and link everything.

6.Ignoring Error Checks

Mistake:

No balance sheet checks or cash flow validation.

What interviewers think:

“This model can’t be trusted.”

How to avoid:

Add:

- Balance sheet check (= Assets – Liabilities – Equity = 0)

- Cash flow reconciliation

7.Poor Excel Hygiene

Mistake:

No formatting, inconsistent formulas, messy layout.

What interviewers think:

“This would fail in a real work environment.”

How to avoid:

Follow best practices:

- Consistent formulas across columns

- Clear labels

- Color coding (inputs vs formulas)

8.Not Understanding the Business Model

Mistake:

Modeling revenue without understanding how the company actually earns money.

What interviewers think:

“They model numbers, not businesses.”

How to avoid:

Explain revenue drivers, cost structure, and industry logic.

9.Failing to Explain the Model Clearly

Mistake:

The candidate builds the model but cannot explain it verbally.

What interviewers think:

“They won’t be able to present to clients or management.”

How to avoid:

Practice explaining:

- Key drivers

- Assumptions

- Outputs in simple language

10.Not Managing Time in a Modeling Test

Mistake:

Spending too long perfecting one section.

What interviewers think:

“They can’t work under deadlines.”

How to avoid:

Refine later if time permits

Finish core structure first

Recommend courses, books, and online tutorials

Courses & Books to Check Out

Here are some recommended courses, books, and online tutorials to further enhance your financial modelling skills:

- Here are some recommended courses , books, and online tutorials to further enhance your financial modelling skills:

Online Tutorial

Financial Modelling Questions Case Study.pdf

FAQ’S

No. The above questions are specifically testable for freshers

Candidates under KPMG financial modeling assessment would require a testing of various technical, practical, and behavioral skills as well. Most probably you will have to create, present or modify a three-stated financial model, undertake a DCF, and structural and operational things such as handling circular references and scenario analyses etc in Excel. It is essential to know the basics core financial ratios, valuation basics, as well as how to treat difficult issues such as modeling depreciation, capex and other complex items.

In a modelling interview the type of questions can vary but majorly the focus will be on financial statement linkages, valuation basics, Ratio analysis and some business understanding.

We apply financial planning, analysis in the form of capital budgeting and forecasting decision making.

Related Articles

- Advanced Excel Interview Questions

- Financial modelling interview questions for freshers

- How to build a financial model