Last updated on July 9th, 2024 at 02:41 pm

EBITA or Earning before Interest tax and amortisation is often considered the surrogate for a company’s earnings. Yes, you heard it right! Moreover, EBITA can be used in multiple ways along with other line items like Revenue and company valuation to make meaningful judgements about the business quality.

What is EBITDA

EBITDA is a financial metric or a line item in the income statement of companies, which appears after gross profit.

EBITDA Full Form in Finance

- EBITDA stands for Earnings before interest taxes depreciation and amortization

- EBITA full form stands for Earnings before interest taxes and amoritisation.

What is Amortization in EBITDA?

Amortization meaning in EBITDA is related to the depreciation of intangible assets. For example in cases where the business is a company into semi conductors, and owns many patents. In such cases amortization is the substitute for depreciation.

EBITDA Meaning

You all are aware that the three financial statments include

- Income Statement- Measures profitability during a period

- Balance sheet- shows the position of assets & liabilities at a point

- Cash flow statement- Reconciles the cash inflow and outflow to understand the ability to generate cash.

Hence EBITA Meaning includes the operating level income generated in a business.

EBITDA Example

So, one of the darling stocks of long term investors in India. This company is an example of a model company for financial analysis.

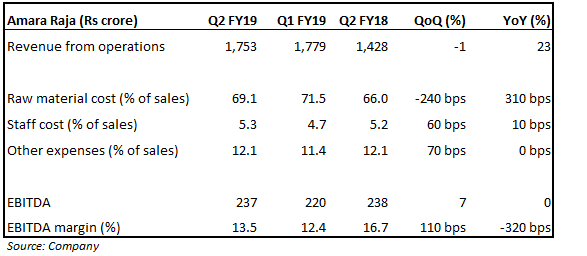

So if you see the income statement below, you will see something called as operating profit. Which is the ebitda calculation. The higher the EBITDA, the better the company’s overall domination in the market. This is what is ebita meaning in finance.

EBITDA Formula

Simply put at a very broad top view level, EBITDA calculation formula is;

- EBITDA =Revenue – Direct Cost- Indirect Cost

- What is Direct cost?

Here you need to understand that direct cost includes, costs which are directly attributed to the revenue. For example; In case of TITAN company the direct cost is Raw gold, because 80% of their revenue comes from jewelery business.

- What is Indirect Cost

Now , indirect costs include costs which are attributable to selling, managing, branding etc which although are necessary to generate revenue. But they do not include in the cost of the product.

So a detailed EBITDA formula can be written as:

EBITDA= Revenue- Cost of goods sold- Salary- Marketing expenses

What is EBITA In Business

So when I operate my own business, this is how the thinking goes.

- Salary cost is around 40%

- Marketing at around 15%

- IT expenses at around 5%

So EBITA margin is around 40%, which is great. Because it gives me the flexibility of 40% before I start loosing money. Over the years analysing many publicly listed companies, a respectable EBITDA margin is around 19%.

Another way to look at EBITDA is thinking of it as an apprixmator for operating cash flow. Let me explain.The formula for operating cash flow in cash flow statement is;

- Net Income+ Depreciation (+-)Change in Working capital

So you can see EBITDA is good approximation for the above formula.

EBITA Case Study: Lead Prices & Battery Manufacturers

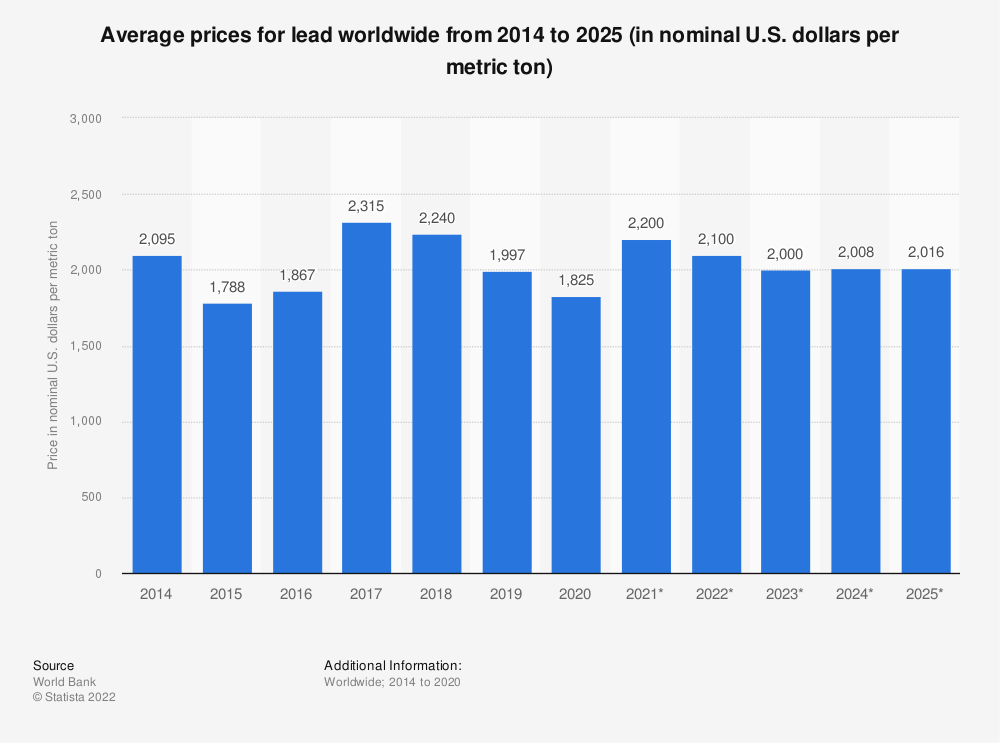

Now, Let me explain this with a live real example. In the battery manufacturing business, the main cost is the cost of Lead.

Prices of lead since 2014

Now, imagine a company like Exide industries, which manufactures lead batteries for cars.

However, If their margins are not good, such price fluctuations can lead to tremendous business shocks or even shutdowns.

Amaraja Battery EBITDA Margins

Companies operating AT High EBIDTA

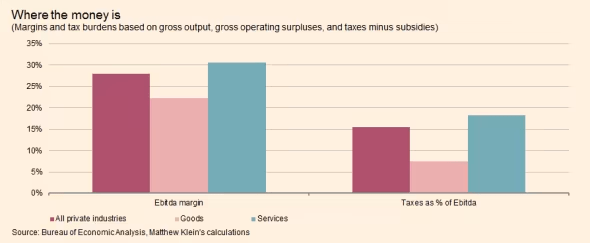

Now, the above image shows that, generally service industry will have higher EBITDA Margins.

Also, You may ask why? Well, because a service industry like Information technology has no cost of goods but the cost of service.

Whereas a manufacturing industry will have costs of goods plus salaries to pay. Now,I came across this very nice image, which shows margins across various industries

source: FT Times

However, It’s funny to see that no wonder people pay so much for real estate; it runs at 90% EBITDA margins.

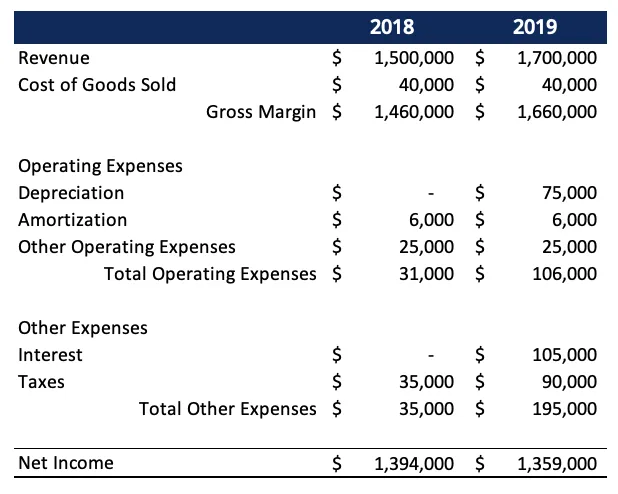

EBITA CALCULATION EXAMPLE

For example;In 2018, the company had total revenue of $1,500,000 and a net income of $1,394,000. In 2019, total revenue increased to $1,700,000 and the net income fell to $1,359,000. Higher sales with smaller profits can be explained using EBITA. When the company’s net income is adjusted for taxes, interest, and amortization expenses, the profit instead increases.

EBITA for 2018 = $1,394,000 + $6,000 + $35,000 + $0 = $1,435,000

EBITA for 2019 = $1,359,000 + $6,000 + $90,000 + $105,000 = $1,560,000

Now, The above calculation shows that even though the company’s net income decreased by $35,000, the earnings before interest taxes and amortization for the company increased by $125,000 in 2019.

Waste management Inc- Case study

So, i came accross this very interesting case study done by Moody’s on waste management Inc which is a market leader waster service industry.

- This business was high on cash requirement ( high capex and opex intensive industry)

- Due to this, its obvious that the company will have low free cash for debt reduction.

- Now during a 21 months analysis(1998-1999), it was found that waste management Inc. EBITDA was robust but not cashflow.

- Infact in 1999, EBITDA was $4 billion, however on closer analysis. The net cash from operatinng activities was only $1.5 Billion. While the company spent $4.6 billion on capex. Leading the company to borrow $2 billion to manage the shortfall.

So, the conclusion is that EBITDA is good measure of company’s profitability. However, a very dangerous financial metric to determine a company’s actual cash profits.

5 Limitations of EBITA

Now let me quickly summarise the marjor challenges with blindly following this financial metric.

- Ignores working capital changes

One thing that you don’t want to learn it the hard way, is to assume that working capital changes are going to be ok. Infact if company is into the practice of window dressing, then its quite likely that working capital changes will pull down the EBITDA significantly.

- Misleading Liquidity Picture of a company

In my early years, I used to use this ratio of EBITDA/ Interest + principal payments. Sometimes also called as interest coverage ratio. However, if your EBITDA itself is not indicative of real cash then the ratio also is misleading.

- Ignores Capex

When I was analysing GAIL, a couple of years back. I was very with the operation cash flow, however the size and scale of capital expenditires was significant. So significat that most likely the company would always be in the borrowing mode.

- Misses Earnings Quality

Quality of earnings depends on how closely does your revenue and profit match with cash earnings. Lower the difference, the bettter the quality.

- Vulnerability to Accounting Manipulation

Since you and me as an investor are anyways fascinated by EBITDA margins. So its quite likely that the company also will try to make sure they paint a rozy picture.

5 Uses of EBITDA

Now, Let’s discuss five ways in which we could use EBITA.

- Firstly to Filtering Companies: Calculate EBITDA/ Revenue to filter out profitable companies or decide on which business to enter.

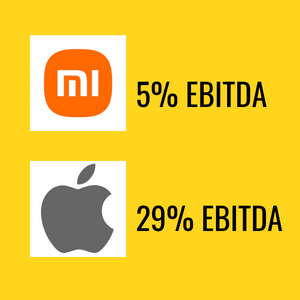

- Also, as an Indication of Product Quality: Look at the below data; there is a reason why AAPL margins because their products are amazing.

- Thirdly, to Increase Efficiency: A company could analyse its costs to understand where the leakages are and fix them.

- Also, an indication of an Increase in Capital Expenditure: A company could find ways to spend money on machines and automation, which could reduce operational expenses and increase EBITDA margins

- Finally, Work on Scale: Generally, margins are lower initially in a business because the sales haven’t taken off, but sometimes, this can also be due to the product not being scalable at all. Which would mean that company cuts its losses on unscalable business or products and work on scalable ones.

Conclusion

I would suggest playing around with company data and understanding how different business work with different margins. Also, understand that EBITDA margins don’t necessarily mean cash. A company could have great EBITDA Margins with products sold on credit. Then what? All noise but no real cash.

Frequently Asked Questions

How is EBITA Calculated?

There are two methods by which one can calculate the EBITA.

- Direct Method:

Firstly, In this method, the cost of goods sold (COGS) and operating expenses less amortization are subtracted from the company’s total revenue.

EBITA = Total Revenue – COGS – (Operating Expenses – Amortization)

- Indirect Method:

Secondly, In this method, the interest, taxes, and amortization are added back to the net income, giving the EBITA value.

EBITA = Net income + Interest + Taxes + Amortization

Also, Companies may not provide a breakdown of operating expenses of the cost of goods sold. In such scenarios, the indirect method can be used to calculate the company’s EBITA.

What is the difference between EBITDA and EBITA?

The only difference is that EBITDA includes depreciation and amortisation, whereas EBITA only includes amortisation