Last updated on July 20th, 2024 at 01:29 pm

ACCA full form is The Association of Chartered Certified Accountants, is a globally recognised certification recognised in more than 200 countries. Now unless you came to read this article only to know the ACCA full form then the buck stops here. However, I would highly recommend you to read my full piece on the ACCA and its real use, reputation and jobs in India. Now I am writing this article while being in the education industry and liasoning with these qualification bodies since 2013. So all the information I will present to you will be from my own experience of managing these products, as well as creating content for them.

ACCA Full form in Accounting

Now, ACCA course Full form I have already discussed but you might wonder why is ACCA even there in India? The answer is that ACCA has gained popularity as a course in India for two reasons;

- High number of CA candidates not passing the CA exam

- No Alternative options in accounting education

- Rise of large number of accounting work that gets outsourced to India

There are about 60,000 students who start with their CA preparation every year, while only 2% actually become a CA. That means around 1200 CA’s every year. Also, the fact that CA preparations can start as early as during graduation after class XII.

Let me summarise all about ACCA in a small summarised way

- ACCA is an accounting qualification from U.k

- It can be pursued as fast as during class xii

- ACCA members have limited signing authority

- The program can be completed within 3 years of starting.

- Entry level jobs after ACCA offer on an average 4.5-6 Lacs P.A

Diploma in Accounting and Business

One of the initial steps in the ACCA journey is earning a diploma in accounting and business. This foundational qualification provides a strong base for aspiring accountants, covering essential accounting, business, and finance topics. It sets the stage for more advanced studies and is an excellent credential for those looking to enter the accounting profession quickly.

ACCA Eligibility Criteria in India

So, ACCA course eligibility is very simple, you can start as fast as after class x and as late as after completing your post graduation.

ACCA Qualification Requirements in India has the following eligibility requirements; Either of them a

- 10+2 / India School Certificate / Intermediate Certificate / Higher School Certificate / Higher Secondary Certificate / Pre-University Course / Intermediate Public Examination are all eligible for registration.

- All India Senior School Certificate/ Senior School Certificate /Senior Secondary School Examination

So that summarises the basic eligibility for acca in India.

Levels: Knowledge, Skill, and Professional

The ACCA qualification is structured into Knowledge, Skill, and professionalism. Each level builds on the previous one, ensuring a comprehensive understanding of accounting and business. The Knowledge level covers core subjects like Business and Technology, Management Accounting, and Financial Accounting. The Skill level advances to topics such as Corporate and Business Law, Performance Management, and Taxation. Finally, the Professional level hones strategic and leadership skills through papers like Strategic Business Reporting and Strategic Business Leader.

Pursuing ACCA: Benefits and Opportunities

Pursuing ACCA can open a plethora of job opportunities globally. The ACCA professional qualification not only equips students with comprehensive knowledge in accounting but also enhances their skills in areas like ethics and professional skills. ACCA students benefit from a curriculum that balances knowledge, skill, and professional level subjects, preparing them for high-level roles in accounting and finance. The ethics and professional skills module, a crucial part of the ACCA curriculum, ensures that graduates are not just technically proficient but also adhere to the highest ethical standards.

Opinion on ACCA after Graduation by members

So I happened to know my friend who is both an ACCA & CA from ICAI. I Asked him what is his opinion on overall ACCA program. This is what we had to say;

“Starting with ACCA right after school is a much better choice for various reasons:

1. Economical: It saves a lot of your money. I’m settled in Dubai, and it’s not cheap for me to study in the universities of Dubai. You need a minimum of 150,000 AED to complete a degree from there. But with ACCA, you can get the whole qualification done by spending 80,000 AED, including ACCA fees and mentoring.

2. Time-Saving: The bachelor’s degree course, on average, takes around 3 to 4 years for completion, whereas direct ACCA can be wrapped up within 2.5 to 3 years. By then, you would already be the proud holder of an ACCA qualification and a Bachelor’s Degree at the age of 21.

3. Stand Out from the Crowd: One of the most significant distinctions of ACCA is that it is one of the most challenging qualifications, coming in at 1st place in level of difficulty. Employers value the high efforts that must be committed by a candidate to clear the ACCA since global pass rates range between 35% and 40%. To clear an exam, you need to secure at least 50% in the papers.

4. Better Opportunities: Due to the difficulty level, most ACCA students quickly get an internship. Usually, employers first look for ACCA candidates rather than people with average bachelor’s degrees.

5. Route to a Bachelor’s Degree: ACCA has a tie-up with Oxford Brooks University in London. After completing 9 papers out of 13, you can submit your Thesis to Oxford Brookes and get a bachelor’s degree. In this way, one can achieve the qualification of ACCA and a bachelor’s degree on the way of studying for ACCA.”

ACCA Exemptions and Career Prospects

One of the significant advantages of the ACCA qualification is the exemption policy. Depending on prior qualifications, students can be exempted from certain exams, making the path to becoming a chartered certified accountant more efficient. These exemptions are designed to recognize the previous learning and qualifications of students, allowing them to focus on advanced topics that build on their existing knowledge. A career in accounting with ACCA is versatile and rewarding, offering opportunities in various sectors such as public practice, corporate finance, and financial services, among others.

ACCA Course Duration & Fees

Now there is no absolute accurate time line to complete the course. However, I will briefly categorise the ACCA duration from different starting points.

ACCA After 12th

- After completion of your higher secondary exam, you will take approximately 2.5 to 3 years to complete 13 exams. Post the completion of 13 paper, you will need another 3 years of relevant experience to become a charter. After finishing 12th grade, you will take 3 papers for the knowledge exams, which are scheduled based on demand.

- The three papers in foundation level are foundation in accounting or accountant in business, management accounting and financial accounting i.e F1,F2 & F3

- After you complete the foundation level, you will be appearing for skill level, however you can appear for only 8 distinct exams in a year in the acca certification. Which means that if there are total of 13 papers, then by graduation you should be done with the accounting qualifications.

ACCA course duration After Graduation

Now let me quickly look at the acca course duration after bcom

- Now, acca after graduation has certain benefits like exemptions of 4 papers. Namely F1,F2,F3 & F4.

- So you need to complete total of 9 exams with the maximum cap limit of 8 exams per year. However, you also need to understand that these exams are only conducted 4 times a year.

- Son realistically, acca course duration after boom should be around 2 years.

ACCA Fees

- If you start after class 12th then you first include the registration 34 Pounds plus 134 Pounds of annual subscription fee.

- Each exam of knowledge level will cost around:£84 x 3= £252 or approximate around INR 27000.

- Each Exam of skill level will cost you around $150 per exam, so total is £450. Or around iINR 50,000

- Finally the professional level or Strategic level as they say will cost £252 x 3+ £74(ethics)=£830. Or around INR 87000.

- Consider that each training paper requires around INR 20,000 as training fees, in case you opt for one.

Now let me summarise the acca cost basis where you start,

- After Class 12th, the total cost would be K- level exams= INR 27000, Skill level = INR 50,000, strategic level = INR 87000. Hence exam cost = INR 1,62,000 & Training fees around 3.5 Lacs INR. Which totals to INR 4.8 Lacs

- After Graduation it would be INR 50,000 For skill level exams, iINR 87000 For strategic level and the exemptions fees of INR 27000 For knowledge level . Making the cost almost similar

When Can you start with ACCA?

- Hence, ACCA also can be started right after your class XII.

- Another requirement is; you must have atleast 65% in accounting, maths and English

- Finally you need minimum 50% in all the other subjects in class XII

ACCA Entrance Exams

ACCA doesn’t really have any entrance exams but has minimum elgibility requirements. In fact, for that matter even CA doesn’t have any entry requirements. Unless you are entering after class XII through CPT.

- 10+2 / India School Certificate / Intermediate Certificate / Higher School Certificate / Higher Secondary Certificate / Pre-University Course / Intermediate Public Examination

- (providing passes are held in 5 subjects (at least 3 in Year XII) including English and Mathematics / Accounts, mark of 65% in at least 2 subjects and over 50% on the others)

- (For the Higher Secondary Certificate the marks are out of 200, so over 130 meets the 65% requirement and over 100 meets the 50% requirement.)

- Below is a breakdown of the grades in terms of percentage and actual grade.

- 50%-60% = Satisfactory = C1

- 60%-70% = Good = B2

- 85%+, 80%-85%, 70%-80% = A1–A2, B1

- All India Senior School Certificate/ Senior School Certificate /Senior Secondary School Examination

- (providing passes are held in 5 subjects including English and Mathematics / Accounts, mark of 65% in at least 2 subjects and over 50% on the others)

ACCA Syllabus in Detail

| ACCA Syllabus | Subjects |

| Knowledge Level | Business and Technology (BT) • Management Accounting (MA) • Financial Accounting (FA) |

| Skill Level | Corporate and Business Law (LW) • Performance Management (PM) • Taxation (TX) • Financial Reporting (FR) • Audit and Assurance (AA) • Financial Management (FM) |

| Professional level | Essentials • Strategic Business Reporting (SBR – INT) • Strategic Business Leader (SBL) Optional (2 of 4) • Advanced Audit & Assurance (AAA – INT) • Advanced Performance Management (APM) • Advanced Taxation (ATX – UK) • Advanced Financial Management (AFM) |

ACCA Exam Structure

So, firstly all of the ACCA exams are conducted online in CBE format.However you must note that not all exams are available all the time. Some of the exams are based on the set calender schedule.

ACCA ExamExam nameExam typeACCA QualificationBT, MA, FAOn-demand LW (UK & GLO)On-demand LW (other versions)Session-based TX, FR, PM, FM, AASession-based SBR, SBL, AFM, APM, ATX, AAASession-basedFoundations in AccountancyMA1, FA1, MA2, FA2On-demand FBT, FMA, FFAOn-demand FAU, FFM, FTXSession-based

Top Colleges- ACCA College Integrated Programs

So, ACCA many years back also integrated their regular degree based courses with the ACCA syllabus. Also the objective of doing that, was to increase the level of learning for students. Now, I will warn you certain things which you know about the top ACCA colleges program;

- ACCA intergrated programs, grants you exemption but the exemption is not free and is chargeable.

- Secondly the ACCA top college programs grant you exemption, also on clearing the exams of B.COM. Which by the way is nothing but the ACCA papers itself.

- Thirdly, if you opt for the ACCA college based programs and change your college or drop it then your application to ACCA drops too.

Comparison of ACCA Course In India with Other Qualifications

So, now it’s time to check the credibility of the ACCA course in comparison with other qualificaitons.

ACCA Vs Other Qualifications

So, now let me take you through the comparison between the three major qualfications apart from ACCA i.e CA, CS & CPA.

| Parameters | Association of Certified Charted Accountants | CA- ICAI | Company Secretary | CPA |

| Fees | 2,50,000 | 2,50,000 | 50,000 | 4,00,000 |

| Recognition | 200 Countries | India | India | 200 Countries |

| Entry level salary | 3.5 Lacs P.A | 6 Lacs P.A | 4 Lacs P.A | 5 Lacs P.A |

| Eligibility | Class XII | Class XII | Class XII | Post Grad |

| Examination Type | MCQ – 13 CBE Based | Relative | 3 Examinations | 4 Papers |

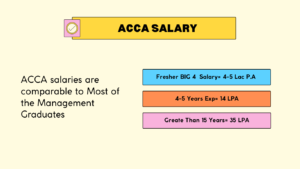

ACCA Salary per Month

So, ACCA salary is misinformed in many websites. While I have covered an entire article on debunking the ACCA salary myth. However, for the sake of information you must know that the average entry level ACCA salary is around 3.5 Lacs P.A for freshers.

on deeper analysis let me give you a quick comparison of fresher salaries in case of CA & ACCA while specifically look at the big fours.

So, ACCA salary is misinformed in many websites. While I have covered an entire article on debunking the ACCA salary myth. However, for the sake of information you must know that the average entry level ACCA salary is around 3.5 Lacs P.A for freshers.

on deeper analysis let me give you a quick comparison of fresher salaries in case of CA & ACCA while specifically look at the big fours.

ACCA Certificate

Conclusion

So, to conclude I would say that ACCA is a qualification that must be pursued by candidates who are not seeking a job in India. Yes! You heard that exactly right. The reason I say, is that until today nor in the future it is next to impossible for any other qualfications. Like ACCA to compete with ICAI’S CA Program.

However, in the middle east, U.K, to certain extent Australia also regard ACCA as a credible qualification.

Frequently Asked Questions

What is the cost of pursuing acca in 2024 exams?

The total cost of ACCA examinations in 2024 will depend on the number of papers I need to sit, at what entry stage each paper is, and the exemptions I may claim. Here’s a more detailed breakdown:

Registration and Subscription Fees:

• Initial registration fee: £89

• Annual subscription fee: £134, payable each year.

Exam Fees:

• Applied Knowledge exams: £86 per paper.

• Applied Skills exams: £114 per paper for standard entry.

• Strategic Professional exams:

• Strategic Business Leader: £266 for standard entry.

• Strategic Business Reporting: £196 for standard entry.

Ethics and Professional Skills Module: £79.

Exemptions:

• The exemption fees vary; for example, the exemptions for the Applied Knowledge exams are £86 per paper, and for the Applied Skills exams are £114 per paper.

Other Costs:

• The late entry fees are considerably more than the standard fees, with the amount being £385 for the Applied Skills exams and £440 for the Strategic Professional exams.

• Additional administrative costs will be incurred if alterations are carried out beyond the registration closure dates.

So, in summary, as a beginning student who would take all the papers right from the start without any exemptions, the total cost would range between £1,800 and £2,200, not including possible extras like books and tuition. For an elaborate and specific fee structure, it’s better to check directly with ACCA or its official website, as prices differ slightly based on location and personal circumstances.

Can I sit the ACCA qualification exams in any order?

I am allowed to sit for a maximum of four papers in one examination cycle, with two examination cycles provided in a year, that is, from 1st February to 31st July and from 1st August to 30th January. The papers/examinations must be taken in the order listed above, that is, Knowledge/Skills/Professional modules, although I can sit there in any preferred sequence I may have.

How many times in a year are ACCA exams done?

The ACCA exams are offered four times a year — March, June, September, and December.

How do I qualify for the ACCA exams?

To become eligible to sit for the ACCA exams, I need to have at least three GCSEs and two A-Levels in five different subjects, which should also include English and Maths or equivalent qualifications.

What are the career opportunities after completing ACCA?

After finishing ACCA, I could open myself to various careers such as financial accountant, management accountant, auditor, tax specialist, and financial consultant.

How long does it take to complete the ACCA qualification?

How long it will take me to complete the ACCA qualification depends on how many exams I attend in a session and how fast I pass them. Generally, completion of all the exams, professional experience, and the ethics module takes about three to four years.

Can I get any exemptions from ACCA exams?

Yes, I will probably be exempted from some ACCA papers if I have relevant qualifications or professional experience. I will check my exemption eligibility on the ACCA website.

What resources are available for the use of ACCA students?

Being an ACCA student gives me the right to access many resources for studies that this association makes available, including study guides, past examination papers, e-learning modules, and lists of tuition providers.

How can I enroll in the ACCA course?

To register for this ACCA course, one needs to register on the ACCA website and submit the necessary documentation, as well as the required registration fee.

What type of support do ACCA students receive?

ACCA provides a wealth of support services, including study resources, career advice, local tuition providers, and a dedicated student support team for me throughout the qualification process.

What is the full form of ACCA?

ACCA stands for association of chartered certified accountants.