Last updated on January 28th, 2026 at 05:07 pm

In this post, you can find the top 40 valuation interview questions asked in the valuation, from everything related to the basics of valuation to advance scenario-based questions for investment banking careers. This post will be your passport to clearing most of the problematic interviews in investment banking with a breeze. Learn all of this in a live class with trainer support in our financial modelling course with placement

So, let’s bring this. We have divided these top 100 valuation interview questions into three parts; Beginner, Intermediate and advanced.

Table of Contents

Valuation Interview Questions- Beginner Level

What is Enterprise Value?

In an valuation interview, whenever you are asked this valuation interview question, you need to bear in mind that the question is not just asking for a formula but for context too.

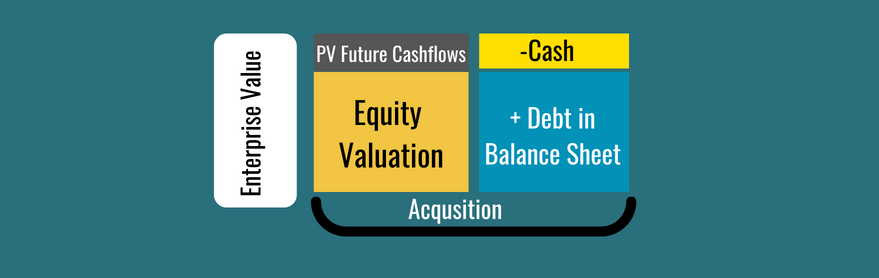

Enterprise Value= Market Capitalisation(Value of Equity)+ Market Value Of Debt – Cash & Cash Equivalents

Formula of Enterprise Value

Essential Points to Note:

- So, the most important point to note in answering this question is to answer its application. Which is the use of it when a company gets acquired.

- So if Byju’s bought white Hat Junior, it did not just pay for equity value but also took over the company’s liabilities.

- However, you won’t pay for the cash that the company holds because you can immediately use the cash to pay off the debt.

What is the best measure of calculating the value of the company?

Now that’s a tricky valuation interview question , which is trying to assess how much you understand about the various valuation methods. So let me give you some guidance on this.

First of all, the best measure of valuation depends on the following;

Company’s Financial position:

Is it profitable? And generating cashflows? Then Discounted cash flow would be the ideal candidate with relative valuation. If the company is not generating positive free cash flows, then we can’t discount cashflows because they don’t exist. So we are left with using the following methods.

- EV To EBITDA Ratio of similar companies in the industry

- EV to Sales ratio, if the company doesn’t even have a positive EBITDA

- Price to Book value of assets

- Optimistic forecast of negative cashflows if you have the conviction of future earnings.

In conclusion, the idea is that since the company is not profitable today but with scale, the company can turn profitable in the future.

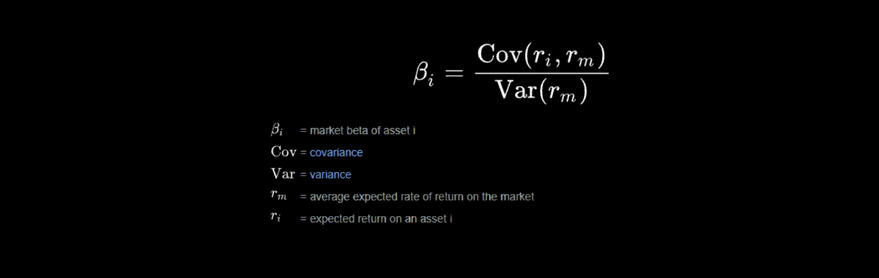

What is beta?

Beta is a measure of the risk of a stock (sensitivity), relative to the general market. So, for example, if we want to find the beta of Infosys, then we can compare it against NIFTY 50 or NIFTY IT.

- Where we assume that NIFTY 50 or market’s beta = 1.

- So if Infosys’s beta is 1.2, then all it means is that for every 1% change in NIFTY 50, Infosys moves by 1.2 Times 1%.

- Also, if the beta is 0.8, then it means that the price moves 80% relative to NIFTY 50.

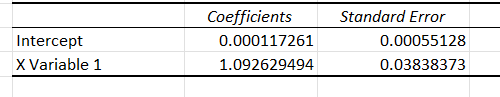

How to find beta?

Well, there are multiple methods; Also this is a very common valuation interview question for fresher candidates.

-Covariance Method

- Find the covariance of ( NIFTY 50, Infosys) returns.

- Divide the covariance by the variance of the NIFTY 50.

- Make sure to take at least 5-6 Years of price data for NIFTY 50 & Infosys.

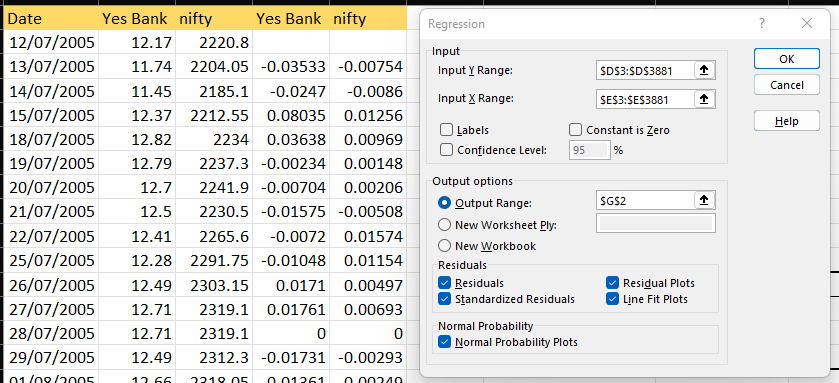

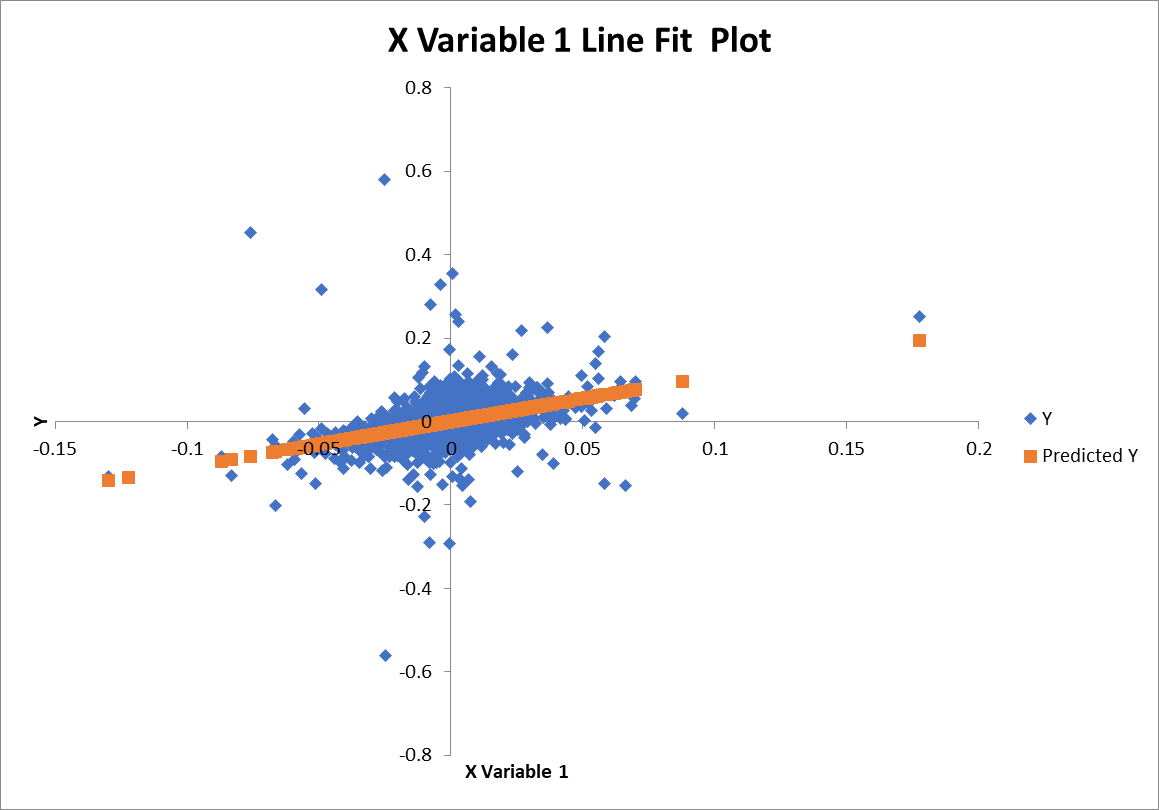

– Regression Method

- Take the price data of both NIFTY 50 & Yes bank stock

- Regress both of them using the data analysis tool pack in excel

The slope of the line is the beta of the Infosys

You can check our full tutorial on calculating beta in the video above. You don’t have to really show the calculation, but explaining can be expected in valuation interview questions in job interviews.

When should a company consider issuing debt instead of equity?

This is a simple one to understand but needs to be understood with exceptions.

E.g.;

- If the Business loan is available at 9%

- The Risk-free rate is 4%, and the return on the market is 15%

- Then even with a beta of 1, the Cost of equity will be 13% ( 4%+1(15%-4%))

- So the cost of equity is higher.

However, this can be a different case if the loan costs us 15% and the cost of equity is 13%.

So under normal circumstances cost of your capital is more expensive than the cost of debt.

These questions generally make it through to valuation interview question, just to test you basic knowledge.

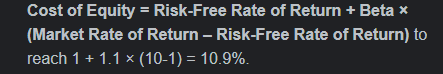

How do you calculate the cost of equity?

- The risk-free rate is the 10-year Government Bonds Yield.

- Market Return is the benchmark index for the stock. Large-cap stock will be NIFTY 50, MidcapT will be the Midcap index etc.

What is the best proxy for a risk-free rate?- common valuation interview question

The proxy for a Risk-free rate is always the 10-year GOI Bond yield.

Calculate Market cap from Enterprise value

How can you calculate terminal value?

What is the Gordon growth rate formula

Both questions are related to a single answer, which is finding the value of perpetual cashflows.

Perpetual cashflows mean a stream of income which remains the same or grows infinitely.

However, that doesn’t mean that the value keeps increasing perpetually. Let’s take an example here.

- If a stock gives dividends of $5 every year perpetually, then what is the value today?

The answer would be $5/ r ( r is the discount rate, you can use the cost of equity too).

- Let’s say I used a 12% discount rate so that the PV would be =$41.66

- What if the dividend now grows by 5% each year?

- Then we modify the same formula as $5(1+5%)/(12%-5%)

- So essentially, the discount rate decreases because the cash flow offers growth.

- The answer would be $71.428.

In the case of a DCF model, you also need to discount this back to the present year( $71.28/(1+12%)^n.

Also, N or the number of periods depends on which future cash flow you use for terminal value.

My advice here is not get this valuation interview question wrong at any cost, because it really shows poor conceputal understanding.

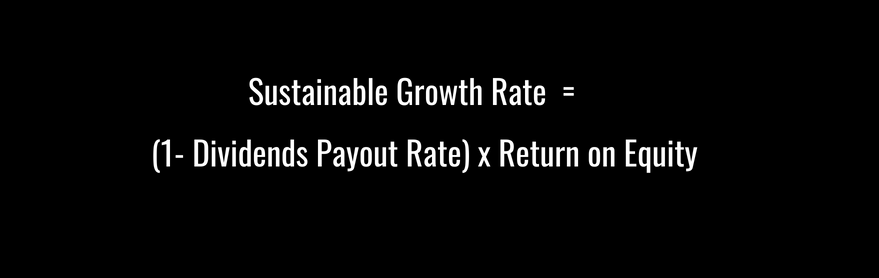

How to estimate the sustainable growth rate

The sustainable growth rate, in the theoretical sense, means using the company’s existing metrics of performance to get a forecasted growth rate.

There are two important variables in this.

- Firstly the amount of money the company retains every year; (Net Profit – Dividends)/ Net Profit or (1- Dividends distribution rate).

- Secondly, how much does the company generate returns on its equity, which is Return on Equity?

- So if we multiple ROE X RETENTION rate=, Sustainable growth rate.

Now a point to note here, sustainable growth does not mean that the company will exactly grow by it.

So, all that it means is that it’s a possibility.

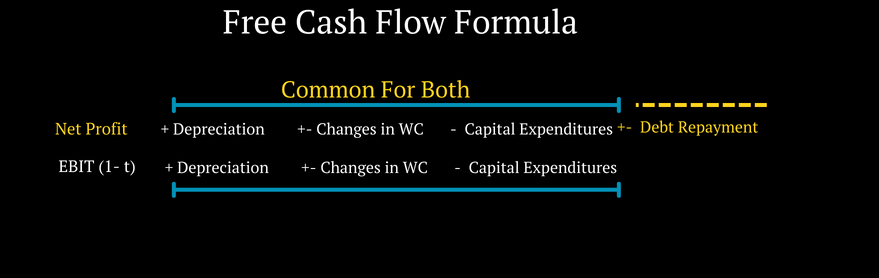

What is the formula of FCFF From EBIT?- common valuation interview question

Free cash flow to the firm is a frequently asked question in investment banking interviews.

Moreover, a student is expected to know this answer because it is used in analysis and valuation.

- The important thing to note is the final letter – ‘Firm.’

- Firm means the total business, including debt and equity funding.

- So, the cash flow available for the firm means making payments to bond investors along with equity.

Now, when you look at the income statement, you should be able to understand that EBIT is a good starting point.

However, EBIT still has tax to be paid on it. So the final formula comes out to be as follows;

- EBIT X ( 1- Tax rate) + Depreciation( Non cash)+ Changes in Working capital +- Investments( Capital expenditures)

Again very much tied to the basics of valuation, so this valuation interview question can be a given to be answered by a candidate.

Common valuation interview question

What is NPV? Where is it used?

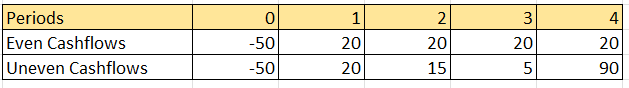

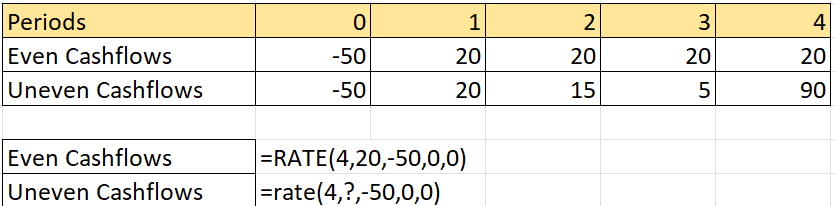

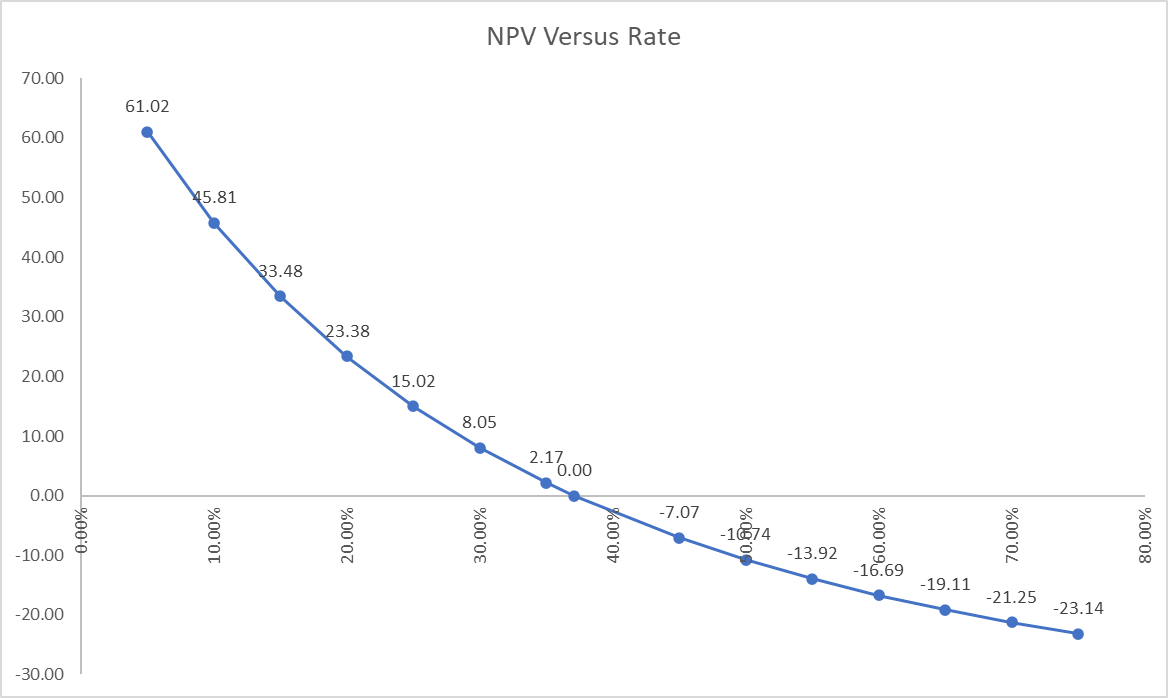

Internal Rate of return is a calculation method when the cash flows are uneven.

So, we need to know what is uneven cash flow first.

So, if I am asked to calculate the returns in the first scenario of even cash flows, then I can use the usual rate function.

However, in case of uneven cashflows, we can’t enter the PMT values because every year, it changes.

Hence what IRR does is that it tries to use various rates and test at what rate the net present value becomes zero.

Resulting in that point being called the Internal rate of return.

What do you mean by leverage?- advance valuation interview question

Leverage means total debt versus equity being used in any transaction.

Leverage is a two-edged sword; it can create immense magnified results on both the positive and negative sides.

There are various ways to measure leverage for a business.

- Leverage Ratio: Total Assets / Total Equity; a higher ratio means high leverage

- Debt to Equity Ratio: Total debt/ Total equity, higher ratio means more leverage

- Total debt to total capital: Proportion of debt compared to total capital structure.

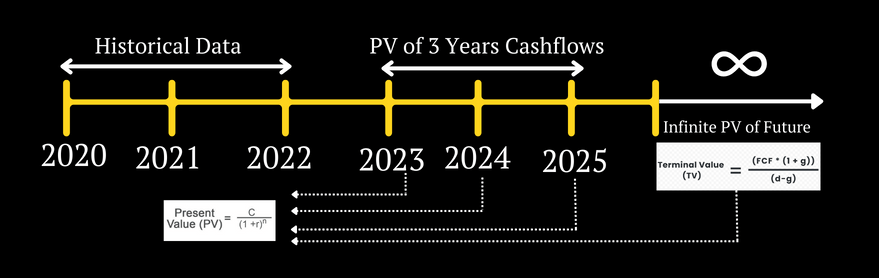

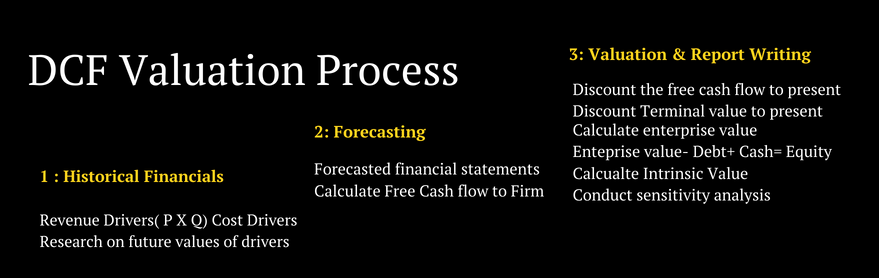

Explain the process of DCF Valuation.

I think the image is self-explanatory, but I’ll add some tips when answering these questions.

- Mention examples of revenue drives industry-wise. E.g. the IT services industry, revenue driver is the Billing rate per Hr x No of man hrs.

- Also, explain which parts of the financial statements we usually forecast. E.g., we don’t forecast very minute parts like differed taxes.

- Finally, emphasize the effect of discount rate on terminal value, which can shoot up the company’s valuation.

What is ‘capital structure’?

Any business needs capital, and cash can come from

- Your cash or equity

- Borrowed money or Debt

Hence, if I start a business with 50% of my savings and borrow the rest from the banks. Then my capital structure is 50% equity and 50% debt.

In the interview, the question can dive into various types of equity capital and debt. So ill list it out quickly.

Types of Equity Capital

- Common equity: Normal cash source without any extra privileges. Common equity shareholders are the lowest in the claim rank against the company’s resources.

- Preferred Equity: The same source as common equity but with a preferred privilege of getting dividends. E.g. 5% preferred share, under a profitable scenario, the investor would have to pay 5% dividends of the profits proportionately.

Types of Debt

- Bonds: Bonds can be issued just like shares to common public or institutions

- Bank Loan against an asset: Regular loan for the purchase of property, plant or machinery

- Convertible Debt: Bonds or debt with a feature of conversion to shares under specified conditions or events

What is ‘working capital’?

What are Changes in Working Capital, and how do they impact valuation- common valuation interview question

The red blood cell of the business, not having working capital, is like being open to being shut soon. Let me explain this most simply.

I start a business with grand plans of manufacturing sugar. The plant is set up, the raw material is bought. However, my monthly payment from customers is delayed because they have a longer credit period. Also, for every sale I make, even if it’s not in cash. I am obliged to pay goods and services taxes. If the customer defaults, I am stuck with defaulting on salaries and interest. This is a classic case of working capital management gone wrong.

Theoretically, working capital would be = Current Assets – Current Liabilities. However, try and notice what’s inside of it

- Current assets include Cash, Short term investments, inventory & Accounts receivables.

- Current Liabilities include Accounts payable, the current portion of long-term debt.

Notice that cash results from revenue being collected on time and investments.

Hence if you don’t have a good receivable strategy, then, invariably, you enter the negative working capital zone.

Recommended Article: Managing Working Capital Post Covid

What does a financial analyst do?- common valuation interview question

Believe it or not, I have seen so many candidates preparing for investment banking interviews, being asked on the roles they will take on.

The answers are so naive and ridiculous.

In the general sense, it is a comprehensive term. A financial analyst can be for;

- Analysing cost and budgets for a company

- Research on market demand and supply

- Finance operation process

- Bonds research

And many more.

However, before the interview, try to research the role. This might give you insights also to whether this role even makes sense for you. Don’t just go by the brand or company name.

For instance, Goldman Sachs has divisions in operations, risk management, equity research and even front office. They are not all the same in any respect of niche and benefits.

What are organic and inorganic growth?

This is easy. We will knock this out with a simple example of a real business.

We all know about Zomato or Uber & Ola, right?

For a second, put yourself in the shoes of the CEO of any of these companies. As a CEO, you are answerable to the investors and shareholders. Shareholders, on the other hand, have only one single interest.

Yes! You guessed it right. Returns, period.

How does a business like the one mentioned above give returns when there is no profit? As it turns out, with valuation! So If I invested in tomato a sum of $1.0 Mn, the only way for me to make any money is to find another investor in the next round of funding.

Now, what can the CEO do? I mean, Zomato can grow only so much as people order food on the weekends, and that too in metros. So there can be two ways of growing.

- Organic: Do more promotions, spend on PR, and improve the quality of service.

- In organic: Acquire uber eats or other such companies and gain customers.

Stop for a second and think about which is the more straightforward method.

The inorganic method is the more straightforward, considering that you are profitable and have enough access to reserve cash.

Not so much when you are making losses and buying the next company with investors’ cash.

Tell me this answer in the next interview, and I am sure you will have an offer at your hand at the end of it.

Difference between Depreciation and Amortisation.- common valuation interview question

This question is like a “Dumb test” for interviews. It’s like asking an engineer about an engine! Lol

Now, let me answer this.

- Physical asset: A physical asset physically deteriorates over time. A car becomes unusable as it approaches 500,000 Miles. Hence the word depreciates. So, as a result, in accounting, we depreciate the value of an asset across its life. But don’t mistake this. How does a car depreciate? By using it. This means when you buy a car as an asset and put it in the balance sheet, you intend to use it for business, and as it gets used, the use is reduced in the income statement in the form of depreciation.

- Non-physical asset: How about you purchased a “right” to produce a new pharma drug for five years? Now that’s not a physical asset, is it? Turns out, it doesn’t even deteriorate. Hence we are spreading the purchase cost over time as we use the intangible asset over a certain period. The process is called amortizing.

Valuation Interview Question- Intermediate

How can you value a company with negative cash flows?

I have seen some nervous faces when I have asked this question to aspire analysts. Believe it or not, the question is practical since most start-up investments fall in this category.

So, how do we value an opposing cash flow company after all the models you learned were profitable ones?

Well, it’s a desperate attempt, but we can try to figure first the following data;

- Is the company profitable at the EBITDA level?

- Does the company have competitors, and do they have a market valuation?

- Also, is the company at a loss today because of a lack of scale?

Enter the Comparable method; as the name suggests, we need something to benchmark against. For eg, A company has an EBITDA of $ 5000 Mn, & a comparable company is selling at an EV to EBITDA ratio of 3. Then we can adjust the ratio and may multiple the same without EBITDA of $5000 Mn to arrive at a $15000 Mn valuation.

Of course, there are other multiples you could use, like Price to sales; the choice of multiple depends on the data.

What are the Disadvantages of Using the Comparables Method?

- The comparable method is not as robust as a DCF valuation model. The primer reason is that in a DCF model, we are taking minute aspects of the business and its future cash flows.

- Also, in a comparable method, there is an implicit assumption that the identical company is priced appropriately.

- The comparable method also does not consider the unique factors of the business.

What is the LBO valuation model?- Rare valuation interview question

Here we go, the den of LBO, which I have seen many students being so curious about always. But it’s not as big a deal as you think.

At the simplest layman’s level, if you were asked, this asked. My approach would be to give an example of a home purchase using a mortgage. A leveraged buyout is nothing but the use of debt first to purchase the company and improve its operations. Followed by using the company’s cashflows to pay the debt and selling it off.

Hence, the catch is the source of capital, which is debt. Unlike a regular acquisition where the head is equity. However, what makes it interesting is the use of business cash flow to pay your debt payments and then sell it off at a higher rate.

How will you value a private company?-Tricky valuation interview question

The tenants of valuation won’t change, whether a company is private or public. Let me list what is needed for valuation, and then you can point to what you need.

- Financial statements

- Cashflow projections

- Beta

- Risk-free rate

Now, try to see what you won’t have. Your attention should go to beta. So, keeping everything the same, beta could be found using a comparable public company with a similar business and readjusting it. The readjustment part is called un-levering the beta and then re-lever it back to reflect the capital structure of the target company.

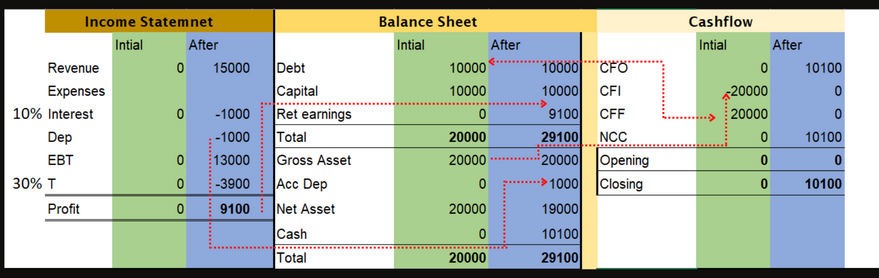

A company purchases a piece of new equipment. Explain the impact of the purchase on the income statement, balance sheet, and statement of cash flows

This is a classic question to test your understanding of the linkages between the three statements.

- Firstly, the purchase of equipment is a long-term expense. That means the asset gets used for multiple periods.

- Hence, this will enter the balance sheet directly as fixed assets.

- Secondly, as the asset gets credited to the balance sheet, cash will reduce by the same amount.

- Finally, the asset will get depreciated over time. Resulting in the asset reduction in the balance sheet and, at the same time income statement showing expenses.

- Which, by the way, will reduce the retained earnings in the liabilities & equity side.

Let me share an example here;

XYZ purchased a $20,000 Lazer 3D Printer with a useful life of 20 years. The purchase is made with a loan of $10000 and the remaining with cash. Show the various linkages.

How is it possible for a company to show positive net income but go bankrupt?- Tricky valuation interview question

The answer to that is, in many folds, possible!

Here, the question tests your understanding of revenue recognition principles. So you need to understand there are the following ways in which you can recognise revenue.

- Transfer of Risk, which means as soon as you hand over the product or service, you can recognise revenue. Without receiving cash. Now, that’s possible because you can capture unrecovered cash in accounts receivable/.

- Completion of the project, which means that even if you haven’t completed the real estate housing project. The company could still recognise the revenue basis percentage completion methods.

So, then how does a company go bankrupt? Many projects could be completed, but the cash never comes.

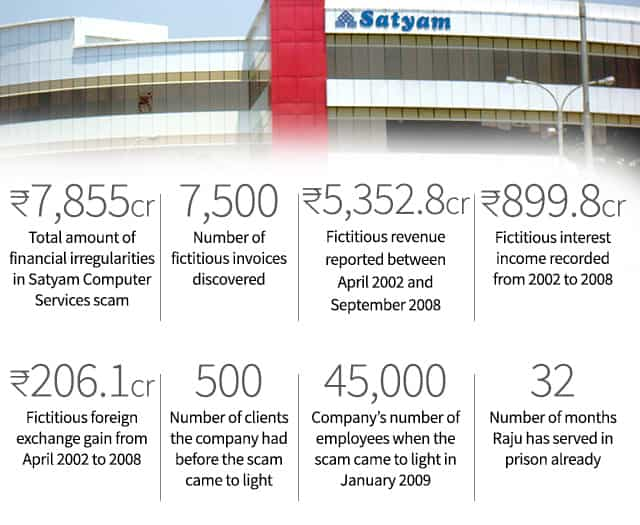

That could also be a case of the Satyam Case, where the invoices `were fraudulent.

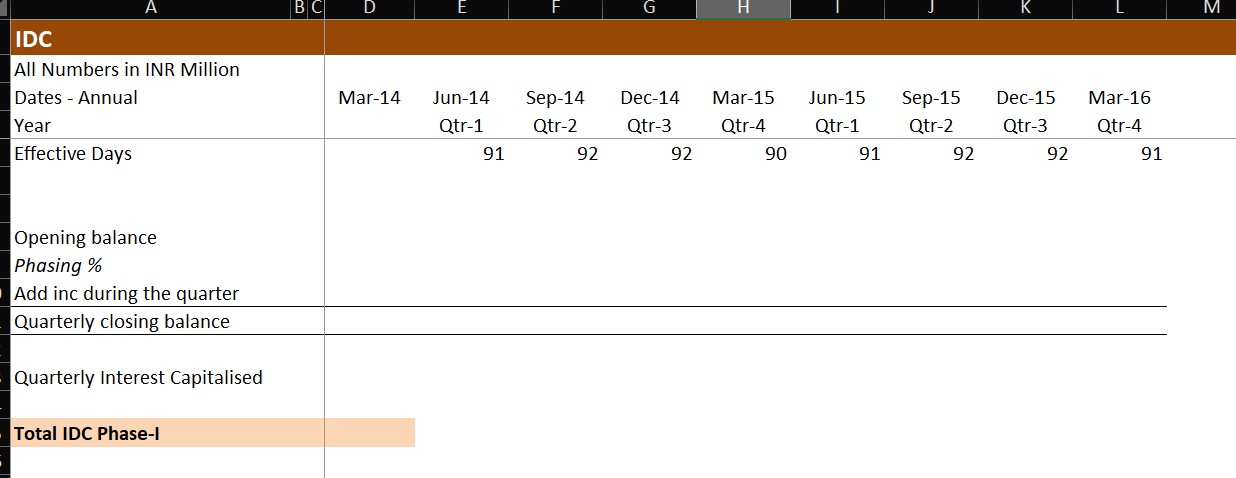

Explain quarterly forecasting and expense models.- Uncommon valuation interview question

Financial models, or in other words, the financial modelling process, can be done annually as well as quarterly. However, the decision depends on the availability of the data.

- Firstly, we create a template which considers both quarterlies along with annual numbers.

- Secondly, look at which data is available quarterly and which is not. Not all companies, especially in India, will have very detailed quarterly data.

- Thirdly, forecast quarter to quarter and sum it all up reflect the annual nos.

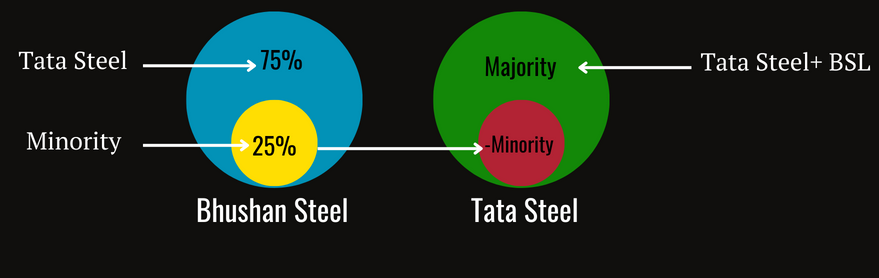

How would minority interest be treated in the valuation of the parent company?- accounting valuation interview question

Now, to understand the impact of a minority interest in valuation, we need first to understand the minority interest itself first.

Minority interest means created when a company acquires another company but not a hundred per cent. So, imagine yourself running Bhushan steel and TATA steel deciding to acquire seventy-five per cent and not a hundred. The first question that would pop up is, if it was me, why would a company do something like that?

- Firstly, seventy-five is enough to enforce control over the company while maintaining some incentive for the existing management.

- However, according to the accounting consolidation rules, TATA steel would now have to take 100% of the BSL revenue on Tata steel books.

- We know that Tata Steel doesn’t own 100% so the reporting would be incorrect, right?

- Hence, in the income statement, you would reduce profits accrued to minority interest.

Method 1: Adjusting The Enterprise Value Formula

After that, we arrive at enterprise value calculation. It’s important to note that while calculating the final valuation, you use the following equation.

Enterprise Value= Market Capitalisation+ Total Debt- Cash + Minority Interest

The reason for adding minority interest is because, at the time of acquisition, you also acquire the subsidiary company.

Method 2: Adjusting the Income statement.

The other method considers the minority interest calculation in the income statements themselves.

How is the income statement linked to the balance sheet?

The income statement and balance sheet are attached for everything related to

- Income-related balance sheet items:

- Retained earnings and Net income

- Revenue with accounts receivable or deferred revenue

- Cost of goods with accounts payable and inventory

- Depreciation with Fixed Costs

- Taxes with deferred tax asset

What are the exit routes for a Private Equity investment? Which one usually gives the higher valuation?

This question can be answered in a very elaborate manner, mainly because of so many examples. So that’s exactly what I am going to do, give you examples to pitch in the interview.

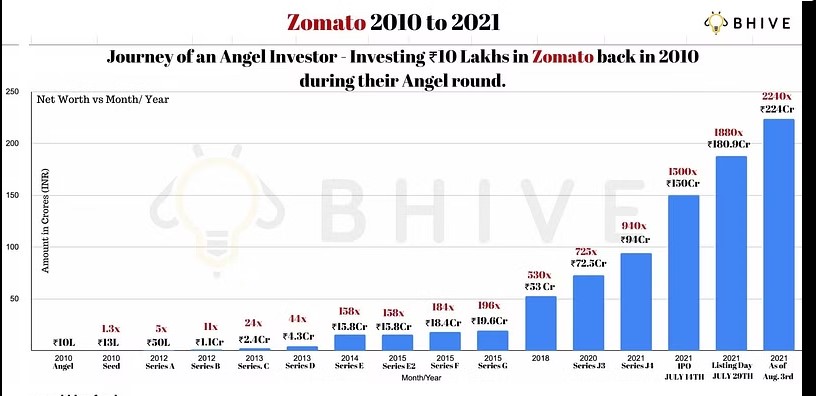

- There you go; the first example is through IPO. So in Deepika’s case, she stuck with her investment until the initial public offering.

Let’s look at a similar example of info edge(Naukri), one of the first backers of zomato.

Hence, we can say that out of the two routes of exit for private equity investors, the IPO route is the best route. Which happens because of the premium listing of IPOs in general. As opposed to this, a private exit is also possible, where the private investor sells his stake to a new investor.

5 Bullet Points of the Research Report?

The top 5 things to be included in every equity research report are

- The summary of the business drivers. In other words, what is the price x quantity of the business

- Include the industry dynamics and trends, also how the company is placed in it.

- Must include snapshots of your financial model projections, along with a valuation summary.

- Critical analysis of competitors and how the current company fares against them.

- Conclusion, target price and risk factors with investment in the target company.

How do you record PP&E, and why is this important?

The property plan and equipment are recorded in the following manner.

- The inflow of Asset in the balance sheet

- Reduction of cash if it’s funded using internal reserves or an increase in debt.

- Outflow in cash flow from investing as capital expenditure

- The following year, record depreciation in the income statement and reduce PP&E with depreciation.

How would you know if an acquisition is dilutive?

Let me explain this with an example. Let’s say Zomato acquires Uber eats for $500 Mn cash, but also that Uber eats gets $100Mn worth of zomato shares. There you go; the acquisition wouldn’t have been dilutive if the $100 Mn equity shares were not released. However, it’s essential to understand why; let’s break this down in the following steps.

- When the $100 Mn shares of Zomato were offered as one of the parts of the consideration.

- Now, $100 Mn shares don’t exist, so it needs to create.

- That means if we have $100, and until now, we have ten friends to share.

- We need to share with 11, but the $100 is still $100.

What is the best evaluation metric for analysing a company’s stock?

Let me break down this answer in steps;

- The first step is to find out which stock you want to analyse.

- Hence we need specific ratios, which I can use to shortlist certain features of companies.

- For E.g., we want to look at companies with a Price to earning ratio below 15

- Secondly, we could look at companies with a current ratio greater than 2.

- Thirdly, we also want to look at the companies that have low risk. So maybe debt to equity ratio.

- Once we are through finding the company that we want to analyse, we can jump into making sure we are researching the right company.

- We could look at free cash flow compared to the net profit. Ensuring that the profits exist.

- Moreover, let’s also look at if the company is selling its inventory using the inventory turnover ratio.

- You also don’t want the company just sitting on a pile of credit sales. Hence accounts receivable turnover

What is the systematic and unsystematic risk?

Systematic risk is the risk of investing in equities in general, so even if you diversify using 20 stocks. The risk of equities still exists, and that's called systematic risk. Unsystematic risk, on the other hand, means the risk related to a specific company. For example, investing in Exide industries exposes us to the risk that Exide's factors can get closed during union strikes.

Video Tutorials

Valuation Interview Questions-Advanced

Project finance model

Equity research Model Case

Real Estate Model

FP&A Model Case

DCF Valuation Interview Questions

Q1. What is DCF valuation and when do you use it?

Answer:

DCF (Discounted Cash Flow) valuation estimates a company’s intrinsic value by forecasting its future free cash flows and discounting them to present value using WACC. I use DCF when cash flows are predictable and I want a fundamentals-driven valuation independent of market sentiment.

Q2. What are the main steps in building a DCF model?

Answer:

I project financial statements, calculate free cash flows, estimate WACC, determine terminal value (using growth or exit multiple), discount all cash flows to present value, and arrive at enterprise value and equity value.

Q3. How do you calculate Free Cash Flow to Firm (FCFF)?

Answer:

FCFF = EBIT × (1 − Tax rate) + Depreciation − Capex − Change in Working Capital.

This shows cash available to all capital providers.

Q4. How do you calculate terminal value?

Answer:

I use either:

Gordon Growth Method: TV = FCF × (1 + g) ÷ (WACC − g)

Exit Multiple Method: TV = EBITDA × Exit Multiple

I prefer Gordon Growth for long-term stability and exit multiple for market-aligned valuation.

Q5. What happens to valuation if WACC increases?

Answer:

If WACC increases, the present value of cash flows decreases, so enterprise value falls. This reflects higher risk or cost of capital.

Relative Valuation Interview Questions

Q1. What is relative valuation?

Answer:

Relative valuation compares a company to similar firms using valuation multiples like P/E, EV/EBITDA, or P/B to estimate fair value.

Q2. Difference between EV/EBITDA and P/E?

Answer:

EV/EBITDA is capital-structure neutral and useful for comparing firms with different debt levels. P/E depends on capital structure and is affected by interest and taxes.

Q3. How do you select comparable companies?

Answer:

I match industry, business model, size, growth, margins, and geography. Poor comps lead to misleading valuations.

Q4. Why might two similar companies trade at different multiples?

Answer:

Differences in growth outlook, margins, risk, capital structure, management quality, or market perception can justify multiple gaps.

Q5. Is a higher P/E always better?

Answer:

No. A high P/E may reflect growth expectations but can also indicate overvaluation. I always analyze growth and risk together.

Mini case-based valuation questions

Q1. A company shows high profits but negative cash flows. How do you value it?

Answer:

I investigate working capital and capex. I rely more on cash-flow-based valuation like DCF rather than earnings multiples.

Q2. EBITDA is growing but stock price is falling. Why?

Answer:

Possible reasons include rising debt, poor cash conversion, regulatory risks, or market sentiment turning negative.

Q3. How would you value a loss-making startup?

Answer:

I avoid DCF initially and use relative valuation, unit economics, revenue multiples, and scenario-based valuation.

Q4. Two firms have the same EBITDA but different EV. Why?

Answer:

Differences in growth, risk, capital intensity, or working capital needs affect valuation.

Q5. Would you trust DCF or market price during volatility?

Answer:

I trust DCF more for long-term value, but I cross-check with market multiples to stay realistic.

Excel-based valuation tests

Q1. Build a simple DCF in Excel. What sheets do you create first?

Answer:

I start with assumptions, then income statement projections, cash flow calculation, WACC, and valuation summary.

Q2. How do you create a sensitivity table in Excel?

Answer:

I use Data Tables to test valuation sensitivity to WACC and terminal growth rate.

Q3. How do you link the three financial statements?

Answer:

Net income flows into retained earnings, depreciation links to cash flow and balance sheet, and changes in assets/liabilities affect cash flow.

Q4. How do you check if a model is correct?

Answer:

I balance the balance sheet, check cash flow logic, use error checks, and stress-test assumptions.

Q5. What Excel skills do interviewers expect?

Answer:

Strong shortcuts, clean formulas, scenario analysis, sensitivity tables, and logical structure not fancy formatting.