Last updated on January 19th, 2026 at 01:41 pm

So, considering that you are specifically looking for equity research analyst jobs in Mumbai. Hence, I’ll take the liberty of assuming you do understand the meaning of equity research. Some of these jobs would also qualify for equity research analyst jobs in Mumbai for freshers.

Also, since you are in the land of equity, i.e Mumbai, so there is no dearth of equity research jobs.

So let’s get to the list directly first. However, if you also want to understand some more details about these jobs and how to prepare for them. Then I would suggest you to read the full article.

| Company | Type | Sector | Experience | Qualifications |

| IDBI | Sell-Side | Omni | 1 | Any |

| IIFL | Sell-Side | Omni | 0 | MBA/CA- Tier 1 |

| Motilal Oswal | Sell-Side | FMCG | 0 | Any |

| Vallum Capital | Buy Side | Omni | 1 | CFA level 2 |

Equity Research Job Market in Mumbai

Mumbai is the largest and most active equity research job market in India. It hosts the headquarters of major brokerages, investment banks, mutual funds, PMS/AIFs, and global research centers, making it the first choice for students and professionals aiming for a career in equity research.

Hiring Landscape

Equity research hiring in Mumbai is driven by:

- Sell-side firms expanding coverage for Indian equities and derivatives

- Buy-side funds (mutual funds, PMS, hedge funds) increasing research depth due to rising retail and institutional participation

- Global banks and asset managers growing offshore research and KPO teams

As a result, there is consistent demand for research associates, junior analysts, and sector specialists.

Who Is Hiring in Mumbai

- Sell-side: Domestic and global brokerages, investment banks

- Buy-side: AMCs, PMS, AIFs, hedge funds

- KPOs / Global Research Centers: Offshore teams supporting US/EU markets

KPO and offshore research roles remain the largest entry point for freshers, while buy-side roles are more selective and performance-driven.

Skills in Demand

Employers in Mumbai actively look for:

- Financial modeling and valuation (DCF, comps)

- Strong Excel and PowerPoint skills

- Sector knowledge (Banking, IT, Pharma, FMCG)

- CFA Level 1 or progress toward CFA

- Clear written and verbal communication

Candidates with hands-on modeling projects or internships get shortlisted faster.

Market Outlook

The equity research job market in Mumbai is expected to remain stable to growing through 2026, supported by:

- Rising equity market participation

- More IPOs and capital market activity

- Increased outsourcing of global research work

Bottom line: Mumbai offers the widest range of equity research roles in India, from fresher-friendly KPO jobs to high-paying buy-side analyst positions, making it the best city to start and scale a career in equity research.

Career Progression in Equity Research in Mumbai

Entry level roles: Research assistant, junior equity research analyst, Research associate (0-2 years)

The salary in Mumbai for these positions range from 5-8 LPA on an average.

When you gain more experience, which is more than 3 years, you get the position of equity research analyst in this role you work a little more deeper in the company for model building, managing meetings and recommending clients. After 2-3 years of experience you are expected to know advanced valuation models, strong Microsoft excel skills. At this position you can expect a salary range of 8-15 LPA which might also differ if you are preparing or passed level 1 of CFA.

Senior analyst is the position you gain after 5+ years of experience in which you are now an important part of the company. Your roles and responsibilities have increased that includes mentoring juniors, managing workstreams. Senior analyst salary ranges from 15-25 LPA.

Above senior level there is no limit in finance. The more you work hard, gain experience and understand the industry, the more you earn which actually is the fact for any career.

Key employers of equity research analyst jobs in Mumbai

1.Goldman Sachs

- Active postings for mid-level Global Investment Research / sector analysts

- Known for strong pay packages, exposure to global markets, and demanding recruiting standards.

2. Citi

- Hiring Assistant Vice President – Equity Research Analyst (Infrastructure)

- Offers a blend of institutional research exposure and leadership development.

3. HDFC Securities

- Frequently seeking Fundamental Equity Research Analysts at both entry and senior levels

- Strong banking network and research-driven culture.

4. LIC Mutual Fund

- Hiring for equity analyst roles supporting fund managers

- Offers stability and exposure to public-sector fund management.

5. BlackRock Investments

- Recruiting Fundamental Equity Research Associates

- Global asset manager with strong training programs and cross-asset exposure.

Types of equity research roles in Mumbai

Mumbai is India’s equity research hub, with roles spread across buy-side funds, sell-side brokerages, and global research/KPO teams. Below are the main types of equity research roles in Mumbai, explained simply for students, freshers, and early professionals.

1. Sell-Side Equity Research Analyst

- Where: Brokerages, investment banks

- What you do: Build financial models, write research reports, publish buy/sell/hold recommendations, support sales teams

- Who it suits: Freshers and early-career professionals

- Why Mumbai: HQs of brokerages and capital markets teams are concentrated here

2. Buy-Side Equity Research Analyst

- Where: Mutual funds, PMS, hedge funds, AIFs

- What you do: Research stocks for internal investment decisions, track portfolios, support fund managers

- Who it suits: Analysts with prior sell-side or strong modeling skills

- Pay upside: Higher performance-linked bonuses

3. Equity Research Associate (KPO / Global Research)

- Where: Global banks, asset managers’ offshore centers

- What you do: Financial modeling, earnings updates, data analysis, report support for global teams

- Who it suits: Freshers, CFA Level 1 candidates, career switchers

- Why popular: High hiring volume in Mumbai

4. Sector / Industry Research Analyst

- Coverage areas: Banking, IT, Pharma, FMCG, Energy, Industrials

- What you do: Deep-dive sector analysis, company comparisons, industry notes

- Growth path: Can move to senior analyst or buy-side roles

5. Institutional Research Analyst

- Where: Firms serving mutual funds, FPIs, insurance companies

- What you do: Custom research, management interaction notes, investment theses

- Skill focus: Strong presentation and communication skills

6. Quant / Data-Driven Equity Research Analyst

- Where: Quant funds, hedge funds, fintech firms

- What you do: Use data, Python, and statistical models to generate investment signals

- Who it suits: Analysts with coding + finance background

7. Junior / Trainee Equity Research Analyst

- Where: Small brokerages, research boutiques

- What you do: Data collection, basic modeling, report drafting

- Why important: Common entry-level role in Mumbai

Quick Career Tip

- Freshers: Start with KPO or sell-side research roles

- 2–4 years experience: Move to sector coverage or institutional research

- Strong performers: Transition to buy-side or quant roles

Mumbai offers the widest range of equity research roles in India, making it the best city to start and grow a long-term career in equity research.

Equity Research Analyst Jobs in Mumbai

So, you might wonder out of so many companies, why have I selected only four? Well, to start with their demands are with qualifications and experience is minimal. Also, these companies are proper domestic Indian markets-based brokerage houses.

IDBI Equity Research Analyst Job in Mumbai

Now, you might wonder in the world of big brokerage houses where IDBI comes in. However, IDBI capital is a subsidiary of IDBI Bank Ltd. Moreover, IDBI capital is also one of the leading investment banking and securities companies.

Now, in the range of their services for the Indian capital market, they have the following;

- First, Investment Banking

- Secondly, Capital market products.

- Thirdly Private Equity

- Finally, more services include equity research.

IDBI Capital- Equity Research Associate

The expected job roles include in this profile are;

- Responsible to support the lead analyst in terms of sectoral news updates, making financial models, writing research reports.

- Support Lead Analyst in the quarterly result preview/review/IC/MVN and in other reports.

- Daily tracking the sectorial and company specific news and giving a brief to the lead analyst and if required update in the morning meeting.

- Preparing/updating valuation model post every quarterly result and during the initiation or whenever required.

- Preparing insightful financial content from sell-side research using financial modeling and sector knowledge and providing forecasts.

- Support lead analyst in addressing client queries.

You can read some equity research reports by the team Here.

IIFL Equity Research Jobs In Mumbai

As per their website and other information sources, I would categorise IIFL as a BFSI firm. Hence, it provides services in loans, research, including raising capital for companies.

The company has a nationwide presence with a thriving network of 3,119 branches across 500+ cities.

Equity Research Analyst :Job Description

The candidate will work closely with the lead analyst on the following tasks

- Model creation and maintenance

- Industry and company research

- Report writing

- Client queries

The job offers candidates working in KPOs to move onshore, and offers candidates (both currently working either in KPOs or onshore) a path to become a lead analyst over a period of time. While initially, the job will not involve lead coverage or client interaction, we hire candidates only if they have the potential to become a lead analyst in due course of tim

So, in summary I can understand that this job, is looking for a candidate with some experience in equity research with KPO’s. However, the catch is that they want to hire such candidates and make them in the front office side of the business.

Preparation

So, you can see in the job description that , eventually they want their hires to get into client coverage. Hence, In my opinion the following things are critical.

- Excellent ability to communicate via various mediums.

- Also, have the ability to research and create a value proposition.

- Finally, key skills like financial modeling and research are of course non -negotiable.

Salary in IIFL Equity Research Job

Now, 16.4 Lac salary, I feel is normal if a candidate gets into institutional equity research job. However, in the longer term with the right exposure and attitude, you can expect to cross INR 30 Lacs with around 10 years of solid expereince.

Motilal Oswal Equity Research Jobs in Mumbai

Now, MOSL as it is popularly known in the industry has obviously gained its popularity because of Ramdev Aggarwal. Also, rightly they deserve to be known because they started with humble beginnings in the broking business.

Now, if you have watched or are a frequent reader of markets, then you will understand that MOSL is from the days of Harshad Mehta. Just like the late Rakesh Jhunjhunwala.

Equity Research – FMCG Sector

So, the job description of the equity research job in Mumbai, of MOSL states the following.

- Actively tracking Consumer Discretionary employing thorough fundamental research to identify investment opportunities for the client’s portfolio.

- Insight: Here I can understand that, most likely this job is related to their very popular PMS business, because it talks about client’s portfolio.

Developed and maintained comprehensive financial models, authored daily client notes highlighting earnings releases, press releases, and management & analyst meets, and organized roadshows & investor conferences to provide a platform for effective communication between buy-side clients and company managements. - Insight: Also, in this line I can make out that the job role will also deal with research for the broking clients. Since, they mention road shows for buy side clients.

Regularly updating clients with key takeaways and near-term triggers from company earnings calls/quarterly results, analyst meets, and our interactions with industry experts.

Analysing companies in the sector and aiding in preparing research reports with maximum Impact.

Compensation for Equity Research Jobs in Mumbai

So, I feel seeing this survey that MOSL doesn’t have deep pockets.

Although, it says that 92% more than average but believe me for the work that is supposed to be done. Unfortunately, the money is peanuts.

Eligibility for Equity Research Job in Mumbai at MOSL

However, what I like about this job is that they don’t fancy premium qualifications. I can’t get my head around the fact, that how many companies just miss great talents. Since, how many CA’s and IIM’s , or CFA charter holders are really there?

Even If I combine all these three qualifications, the total number of premium candidates, could be somewhere around 5000. Out of which, may be 10% might be actually interested in this field, which is 500.

While, there are so many talented work force out in the open, who just don’t like the idea of pursuing qualifications. Not everyone has the money or interest in spending lacs.

- Candidate should have 1 year of experience with in-depth knowledge of the Consumer Discretionary sector & should have experience in writing reports & be able to articulate well.

- Candidate should have good analytical capabilities

- Strong Accounting and Financial skills

- Advanced level of Excel knowledge and PowerPoint Presentation

- Familiarity with research software like Capital-line, Bloomberg, Reuters, etc.

- Excellent communication, Relationship management and Networking skills

- Ability to work in a self-managed, entrepreneurial environment and should be a good team player

Skills Required for Equity Research Jobs

There is a line in the job description that states;

Familiarity with research software like Capital-line, Bloomberg, Reuters, etc.

However, I wouldn’t worry too much about this. In case you have any premium MBA college nearby then you can request the college to grant you access for a week. Also plenty of online videos, which can give you the required knowledge on these terminals.

Also, some of you who are not aware of these terminals might be wondering what I am talking about.

So, Bloomberg, reuters or capital line are basically data aggregators. Which, means they consolidate all the required data in the financial field in one platform. For eg. I want to know what is the consensus forecast of exide batteries, for the next three years. This is where Bloomberg comes in handy, you just search or put the scrip code and you get everything. Plus it’s reliable.

To succeed in equity research roles, candidates need a mix of technical, analytical, and communication skills.

1.Financial Analysis & Valuation: DCF, comparable analysis, ratio analysis

2.Financial Modeling (Excel): 3-statement models, forecasting, sensitivity analysis

3.Accounting Knowledge: Income statement, balance sheet, cash flow analysis

4.Market & Industry Research: Sector analysis, company tracking, earnings analysis

5.Tools & Data: Excel, PowerPoint, Bloomberg/Capital IQ (basic familiarity)

6.Communication Skills: Clear report writing and presentation of investment ideas

7.Certifications (Preferred): CFA Level 1 or progress toward CFA

Quick tip: Strong modeling + sector understanding matter more than degrees alone.

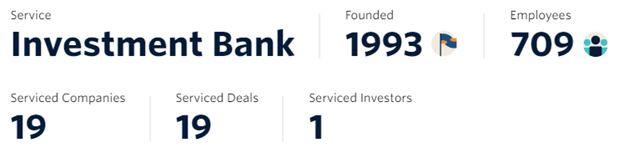

Vallum Capital Equity Research Jobs in Mumbai

Now, in very brief terms Vallum capital is a boutique investment firm based out of Mumbai. They provide the following services;

- PMS- Portfolio Management services

Which is headed by Manish Bhandari, CIIA, CEO & Portfolio Manager. Now, if you have to consider this job, then I would have one reason to get into this equity research job in Mumbai . Which is to work and get mentored by Manish.

Team Information:

Manish Bhandari, CEO Vallum capital advisors

So, Manish, Director and Principal Officer of Vallum Capital Advisers Private Limited, aged 47 years, has two decades of experience in the Indian Capital Markets and has co- founded Vallum Capital, an investment management and advisory firm in 2010, advising Institutional, Family Offices and HNIs on Equities and Asset Allocations. Now, Prior to founding Vallum, he has worked as a VP & Portfolio Manager (Equities) with ING Management in India for six years. He has featured in the Editorials in Economic Times, Wizards of Dalal Street, and Next generation promising Investment Manager of India for CNBC. He is a regular contributor to various financial publications in India and abroad. Also, He is Post Graduate in Business Administration and Certified International Investment Analyst (CIIA), in Switzerland.

Job Description

Responsibilities:

- Evaluate companies under coverage and identify broader industry trends

- Create and maintain financial models of companies under coverage and conduct valuation analysis

- Contribute to investment ideas

- Interpret data and perform channel checks on industry and competitive outlook

Requirements:

1. Minimum 3+ years of experience Boutique Buy side Investing firm. Research exposure to Pharma/IT/Cap Goods sector is preferred.

Insight: I like this requirement, although it says 3 years, but even if you have experience with a small equity research set up then it’s game on.

2. Excellent Financial modeling skills are required as well as a solid grounding in accounting/financial fundamentals

3. CFA/CFA Level II or a graduate Degree in finance with a strong academic track record

4. Effective verbal and written communication skills.

5. Entrepreneurial Nature, Ability to work in a fast-paced, high-energy environment.

6. Right candidate will catapult itself to fund management role in due course.

Conclusion:

So, these are my top 4 picks on the best equity research jobs in Mumbai. Now, as I said at the start that the picks or not all the jobs in Mumbai but only the best and niche one’s. I hope, this article was of some use to you and I wish you all the best. If you want to get into equity research in Mumbai, then please visit our mumbai financial modeling course page

FAQ

What is salary of equity research analyst in Mumbai?

Salary ranges from 5LPA to 7LPA for fresher in Mumbai which is good for entry level employee. The salary can range upto 18LPA depending on experience.

Do i need CFA for equity analyst job?

Not necessary but it is a big plus point if you do have CFA level 1 passing.

What is the highest pay equity research analyst in Mumbai?

Highest pay you can get as a equity research analyst can range upto 18-24LPA.