Last updated on April 7th, 2023 at 02:32 pm

So, in case you are really serious about entering investment banking jobs in Delhi then in this blog I review 4 investment banking courses in Delhi & NCR, that you can consider.

| Investment Banking Courses In Delhi- For Placement | |||||

| QAW | Course | Institute | Ratings on Google | Fees | Mode |

| 1 | CIBO | Mentor Me Careers | 4.9 | 24999 | Live Online |

| 2 | CIBOP | Imarticus Delhi | 4.5 | 1.3 Lacs | Classroom |

| 3 | IB Course | Career Bulls Delhi | 4.9 | 35000 | Classroom |

| 4 | PG Diploma in Banking & Finance | American Institute of Banking & Finance Delhi | 4.7 | 1.5 Lacs | Live Online |

Investment Banking Courses in Delhi for Investment Banking Jobs

Believe it or not, different investment banking job roles require different types of skills. Hence, there is no one size fits all. For eg; Ask you self, do you see yourself as the one pitching deals to clients for mergers? Or you see yourself as the one handling real operations of trading?

So, the answers to those type of questions will decide which course is suited for you. Now, lets discuss in technical nuances, what these different parts of investment banks are.

Structure of an Investment Bank

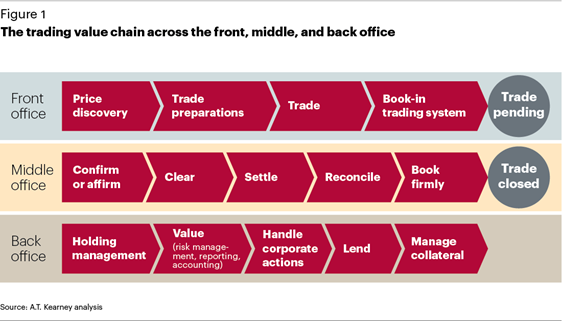

An investment bank is broadly divided into three categories and I will explain first what these terms mean.

- Front office

- Middle office

- And Back office.

Front Office roles in Investment Banks

So, to simplify as I said at the start these are roles that generate revenue for a company. Now even in a normal business, who do you think is the front office or customer-facing person?

So SALES IN INVESTMENT BANKING = FRONT OFFICE ROLES.

Now, don’t panic and make a picture of you selling credit cards or stocks because that would have been easy. However, remember sales in investment banking is some serious large-scale sales, albeit buying a company.

Now, that’s a difficult thing to sell, considering that the buyer is no Mr. John your neighbor. In fact, your client here owns a business or business’s. So, to be successful at making that deal(sale), you are going to need some help.

So what’s the help you need? Well, let me jot it down for you.

- Research- You would need some serious knowledge, coming from your team of analysts

- Customer Support- Whether it is, a client who wants to use your broking services or consulting services. They have to be introduced to your system, systematically and without any hiccups.

- Traders: You would need some serious people who are good at negotiating deals with other investment banks when your client says “ Hey I need Tesla at $500, per share qty is $1mn”

Middle Office roles in Investment Banks

Things don’t end, once your deal is through or that trade is made right? Imaging, your new rookie trader, filled on the Tesla stock but accidently gave a wrong quantity. Some, serious loss of clientele, would happen if we didn’t have some checks and balances.

So, let’s jot down the kind of work we need in middle office.

- Trade support: You need people sitting at the back of the trader, making sure that the trade is confirmed and cleared of any errors.

- Trade Settlement: It’s not easy buying shares, in the units of millions. So, a delay of couple of days could mean hundreds of thousands of dollars just wasted.

- Reconciliation: Your client, needs data and data has to be correct free of errors. Once every month, each and every transaction, fees, taxes and volume needs to be checked.

So, that covers middle office roles in investment banking jobs.

Back Office roles in Investment Banks

Don’t just discredit by the term, “Back”. Because, the value they add, affects the front in a great way. Think of this department, as the watchmen of your investment bank. So, let’s discuss, the various roles in the back office of investment banks.

- Holding Management: Once, you buy the asset or stock, digital needs to be kept safe and secure. Since most large investment banks are also the custodians of these assets.

- Corporate Actions: The term might sound alien, but it literally means what the term says. There has to be a team, which tracks the actions of corporates. For eg; Dividends repurchases, dividends declared, bonus issues, and many more. Moreover, this becomes very useful, to the front office team when they need the data immediately.

- Lending: Once, you buy the stock it will just keep sitting there probably just earning nothing, apart from the appreciation of the stock or bond itself. How about, if we can lend the stock for a couple of weeks and earn a little more money. Your clients will be very happy, when they see that you have added a little more than usual.

So, that covers all three areas of investment banking jobs. Now, hopefully, you realize that, how could someone do a course, and expect to learn everything?

Hence, roles in equity research would be classified as front office & Trade operations roles would be classified as middle office roles. At the same time, corporate actions would be called back office roles.

Ingredients of the Right Investment Banking Courses in Delhi

So, again lets go back to the basics again and chart out the essential knowledge components in a course which is absolutely, non negotiatble for different roles.

Front Office Investment Banking Courses in Delhi:

- So, front office careers usually start with research i.e equity research. Hence you should have a deep understanding of

- Financial statement analysis

- Valuation methods

- Understanding of understanding businesses. Yes, that’s a skill to, its not good enough to just know, that indigo airlines fly planes and takes passengers from point A to Point B

- Excel: Not a lot but essential things are required.

- Financial math: How can you value a stock unless you don’t understand the present value and future value?

- Storytelling practice: Any course that you decide to use it embark on your journey of investment banking, needs to teach you this prime skill. You, have to be a good storyteller, that can combine technical research into simplified stories that a client can understand.

- Writing: No one mentions this but research has some similarities to journalism. If you can’t write a thousand words, that forces me to read then you are going to struggle.

If you want to know which course suits best for these skills then check this link out.

Middle Office & Back Investment Banking Courses in Delhi:

Middle and back office roles, require a lot more technical knowledge of investment banking operations, which a lot of front office guys also might not know.

- Financial instruments: You have to be good at this, trust me! You need to have deep knowledge of fixed income, derivatives, hedge funds, commodity markets, and equity works.

- Trade life cycle: Now, at the entry-level, no one will grill you a lot but still understanding the trade life cycle, is important to gain how the system works.

- Corporate Actions: Similar to the trade life cycle, an entry-level candidate, needs to prove that he understands things like; When does a stock become eligible for dividends, or if a coupon is paid by the bond and the bond is due to get sold. Then, who gets the coupon?

- Settlement: A basic understanding of various settlement techniques and systems used is a bonus

- Risk Management: You should have a basic understanding of the various laws and rules for AML.

List of Investment Banking Courses in Delhi

So, now that we know the coverage required in the course. So, lets stream through the available and my recommended list of investment banking courses in Delhi. So, the first course, happens to be our course too, however the opinions are unbiased.

Investment Banking Courses in Delhi- Number 1

Certificate in Investment Banking Operations(CIBO)- Mentor Me Careers Delhi

The investment banking operations course offered by Mentor Me Careers in Delhi, is three months live online training program. The Course has been curated based on the CISI Certification course, hence students can also attempt the CISI exam after completion.

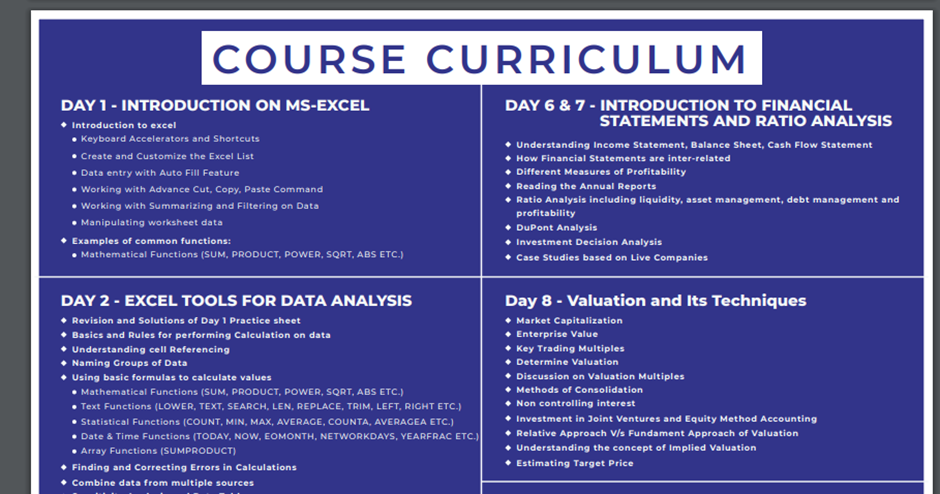

Course Structure:

| Modules 1 | Modules 2 | Modules 3 | Modules 4 |

| Investment Banking Foundation | Trade Execution | Securities Lending & Borrowing | Risk Management |

| Equity Markets | Trade Agreement | Safe Custody | Anti Money Laundering: |

| Derivatives | Custodian | Corporate Actions | Basic Excel |

| Fixed Income securities | Settlement Failure | Reconciliation: | Interview Preparation |

| Asset Management | SWIFT | Excel and Advance Excel | English Communication |

| Corporate Governance | Internal Reflection | Financial Mathematics |

So the four modules mentioned above are the absolute minimums, required to crack technical rounds of interviews.

Download the course brochure here

Course Duration:

CIBO course in Mumbai is an investment banking training which offers 200 hrs. of live online training with case studies,mock interviews which is approximately completed within 8 weeks.

Course Fees:

Mentor Me Careers Certificate in Investment Banking course in Delhi, is priced at

Placement:

Mentor Me Careers, has around 290 recruiters in Mumbai like SS&C, JP morgan chase, Morning star, Morgan stanley , and BNP Paribas to name a few. You can check the full list of recruiters in our website.

What you can expect in placements

- The company doesn’t guarantee placement assistant but does guarantee interviews in Hyderabad as well as surrounding metros. Students have an option to either look for jobs in Hyderabad or other cities as well.

- The average package can be expected to be around INR 3.5 to 4.5 LPA for freshers. For experienced candidates, the packages can be up to 10-12 LPA as well.

- The placements start usually around 4 Weeks after the commencement of the course. Hence you don’t have to wait for the course to end.

- The company doesn’t charge any hidden fee for placements.

- The institute also offers communication training to students which is included in the course fee itself.

- Also, there is no limit on the number of interviews that you can give. So you can give as many interviews until you get placed.

- Download the placement report here.

Placements Report

Check the entire placement report here.

Reviews and Ratings:

Mentor Me Careers is rated as 4.9 on Google.

Opinion

Mentor Me Careers course can be explained with an analogy. So you can buy your fancy clothes in DLF mall, or you could save money without paying for the mall infrastructure on amazon. So, we are the amazon option, for those who want the core part of the product.

Investment Banking Courses in Delhi- Number 2

Certified Investment Banking Operations- Imarticus Delhi

I have a lot of respect for imarticus, especially for making this course and providing jobs to students until date. This, is their flagship course, that made imarticus, well imarticus.So,lets check their course out.

Course Details

The Certified Investment Banking Operations Professional course, is a four months course to train candidates for operations roles in investment banking.

The modules covered in this course are:

- Introduction to financial markets- 4 Weeks

- Trade lifecycle- 3 Weeks

- Risk Management & Interview Preparation-2 Weeks

So, in total 3 Months of duration

Reviews & Ratings

Course Fee

INR 1,30,000/-

Placements:

Check their placement reports here.

Opinion:

Honestly, the course is good no doubt. However, for a lot of candidates the price will be way beyond what they can afford. So, again that’s because you want to go to the mall and hence the price is high.

Investment Banking Courses in Delhi- Number 3

Certificate in Investment Banking & Equity Research- Career Bulls Delhi

I don’t have a lot of background on career bulls, but atleaast in terms of the course it deserves a review.

Course Structure

Now, I don’t really understand why two courses with the exact same content would have different names but let’s give them the benefit of doubt. However, the course curriculum, is not apt for investment banking middle office and back office operations. This course is just plain financial modeling.

Course Duration & Price

However, what I really appreciate about their course, is that the price. Especially, the price on classroom training which is priced at INR 35,000/- . Unlike a lot of ed tech companies, in this space, who price the course, at obscene amounts, which are unsustainable.

Reviews & Ratings:

Also, because these guys are serious about their training for equity research course, the ratings clearly show the outcome. Maintaining a 4.9 star rating is not easy, take it from me. You have to keep your students really cared for. So a big thumbs up here.

Placements

The placements seem ok too for careerbulls. Considering, their major recruiters are in NCR Region. Also, the placements do look genuine, however it would have been even better, if they had detailed placement reports.

Opinion:

Now, I am going to be really happy to rate Careerbulls, as a genuine trainer for equity research course, financial modeling course. Not so much for the investment banking operations, because that course doesn’t really exisit. So, if you want to learn financial modeling in a classroom mode, then they are good.

Investment Banking Courses in Delhi- Number 4

PG Diploma in Banking & Finance- American Institute, New Delhi

So, this is like a blanket types degree course, offered by American institute in Delhi for banking and finance. So, let me show you my review.

Course Structure:

Now, they have divided the course into five overall modules

- Module 1: Wealth management , Private banking, Financial Markets

- Module 2: Securities market, Life cycle,

- Module 3: Analysis of equity,derivatives, currency & Commodity

- Module 4:Alternative products, Fixed income and portfolio management

- Module 6: Behavioral finance, Relationship management, Debt management

So, I get what they are doing, but I am not really inspired by the focus of this degree program. There seems to be an overlap of modules and module 3 & 4 is derived entirely from the CFA curriculum. However, the CFA curriculum itself, takes 6 months to prepare atleast for level 1.

Course Duration & Fees

I am surprised they could actually completely justify teaching these many concepts in ten months, but I can be wrong.

So, their website says three days a week from 6 to 8 p, and considering it’s a ten months program. Then it comes to around 240 Hrs of training, which is more or less like a one semester of a degree course. Also, do note that the class is online.

Fees is a bummer: priced at 1,50,000/- , that’s extremely high, given that a student can pursue CFA level 1 at that cost.

Review and Ratings

The institute is rated at 4.7, on google. However,at the level of their courses, the number of reviews seem a little too now.

Opinion:

So my honest feedback for this course, is that the PG tag was unnecessary. The course is not accredited by UGC and the only way it is justifying its PG is my claiming certification preparation for CWM & NISM, which is available at miniscule rates, compared to the fees quoted by them.