Last updated on February 10th, 2024 at 12:41 pm

The word reconcilliation has many meanings but the simplest definition is “Compatible with another or restoration”.Thats precisely what reconciliation means in accounting and finance, with all the complexitites of small minute transactions and rules, regulations its imperative to reconcil or make it compatible. But compatible to what? Lets find out in detail, how it works. I promise you, after this read you will better understand this term and the careers and what you need to know to nail it.

Index

- What is Investment Banking Reconciliation?

- Trade Reconciliation Examples

- Trade Reconciliation Issues that get handled

- Why is the need of reconciliation?

- What are the jobs in reconciliation?

- Conclusion

What is Investment Banking Reconciliation?

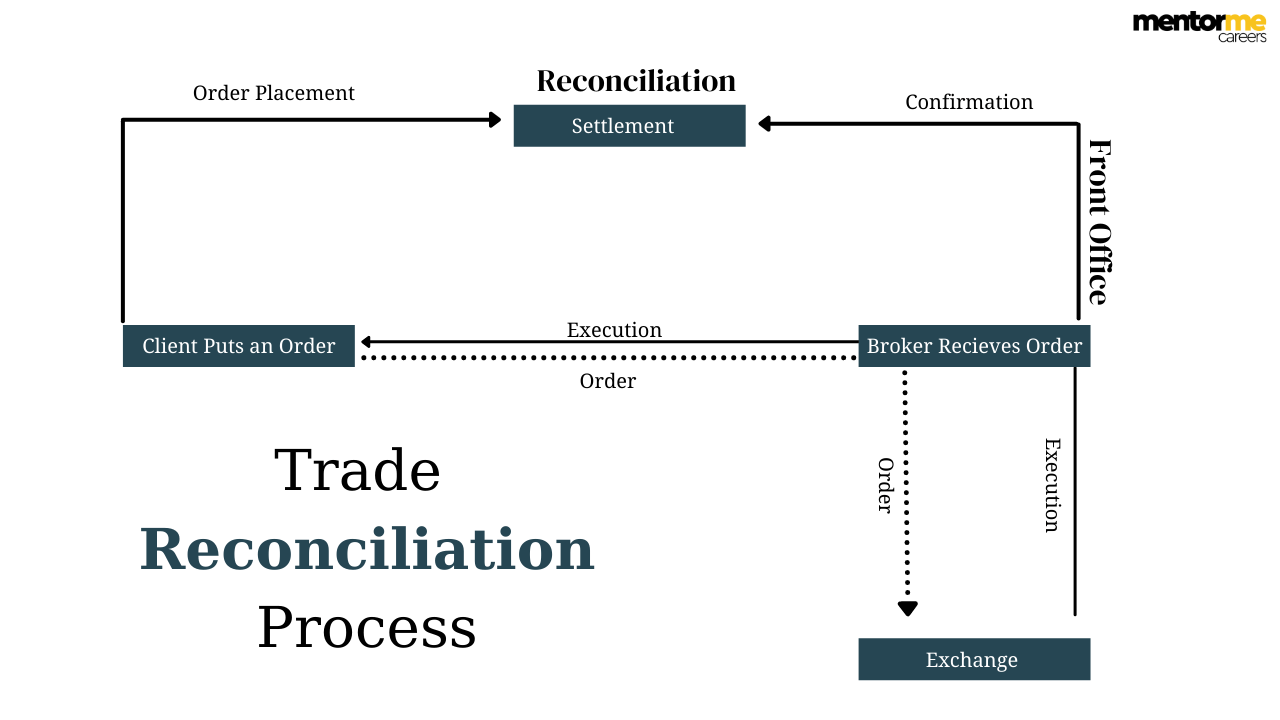

Refer to the image above and see what happens when a retail or institutional client puts a buy order for lets say a stock to buy, and this is where there are two simulatanous things happen 1) The order is sent to the broker 2) at the same time the order placement is sent to the depository. The broker then sends this confirmation on behalf the client to the exchange and the depository. This is where the settlementtakes place. Reconcilliation is taking the settlement note from the depository with the internal trade ledger. Softwares like intellimatch are used for reconciliation.

There are three major statements for reconciliation that is used:

- Agent Statements:These are transaction statements sent by agents or custodians during the day

- System Ledgers: These are system generated entries on transactions

- Journals: These are entries in case of manual adjsutments

There might be scenarios in which the statements provided by the agent and custodian might not match exactly, hence there might be a need to post journals in such cases.This is also called as the tolerance cash, the journal entry clears that from the reconciliation system

What are the Types of Trade Reconciliation

These are the four types of trade reconciliations that can take place in case of securities.

- One to One Stock Reconciliation

- End of Day stock Position Reconciliation

- One to one cash reconciliation

- End of day cash reconciliation

How the Reconciliation Team Works and their need

More so the trade reconciliation team needs to identify breaks, duplication in trades, then they might have to contact and agree on the reversals in such cases.

Examples of Breaks

Lets say we were planning to sell infosys shares to a counter party but by the time swift or the transaction reached the agent, the tradewas already settled, which means we would have delivered the shares twice to the counter party. This would appear as breaks to the reconciliation team and the they would have to agree with counter party on reversal.

Trade Reconciliation Issues that get handled

The reconciliiation and settlement team, manage very important functions for the smooth running of transactions and to avoid mistakes

- Resolve exceptions or unmatched trades

- Liase with local agent

- Esnure sufficient cash and stock

- Move positions across depositories

- Agree trade splits or pair off with counter parties

- Manual payments in case of net zero pair of

- Ask for coverage in case of buy in risks

What are the jobs in reconciliation?

There are plenty of jobs in investment banking reconciliation that you will find in India. Some of the top companies recruiting for this job are

- Jp Morgan chase

- Eclerx

- BNY mellon

- Bank of america

- Standard Chartered

and many more.

Education Required: Graduation (Bcom, BBA, BBM, BCA) / Post Graduation (Mcom, MBA, PGDM)

Knowledge Required:

Should have basic knowledge of finance, trade life cycle, investment banking, and derivatives.

Should be good with logical and quantitative abilities to derive information from data.

You can get this knowledge easily by just reading on simple finance books on trade life cylcle and revising on basic market structure. There is no need for you to pursue expensive courses, as it will be counter productive.

Conclusion

My advice is that trade reconciliation is one of the very important functions of the finance industry, and although a lot automation is happening but just because the ATM's came, didnt mean that the bank jobs were lost. Reconciliation will still need human intervention, because there are still a lot of areas where systems are not integrated to be fully reliant.