Last updated on April 8th, 2023 at 01:12 pm

In this article we discuss the financial modelling salary in India, with examples and real job descriptions.

Basics of Financial Modeling

Financial modelling certification or also popularly known as the financial modelling and valuation certification is a primary skill used in decision-making roles in core finance. Typically financial modelling is a structured approach to solving complex decisions involving financial data, projection and valuation.

Financial modelling is not a new concept, it has been there since the time spreadsheet started getting used. In fact spreadsheets came into getting used, because of financial modelling.

Almost all of the core finance jobs would require a candidate to have a good understanding and applicative skill of financial modelling.

You can read more on this skill in detail here: What is financial modeling

What are the Jobs that require financial modelling certification?

The real question should be which jobs don’t require this certification. There are very few domains in core finance, which don’t use this skill either directly or indirectly.

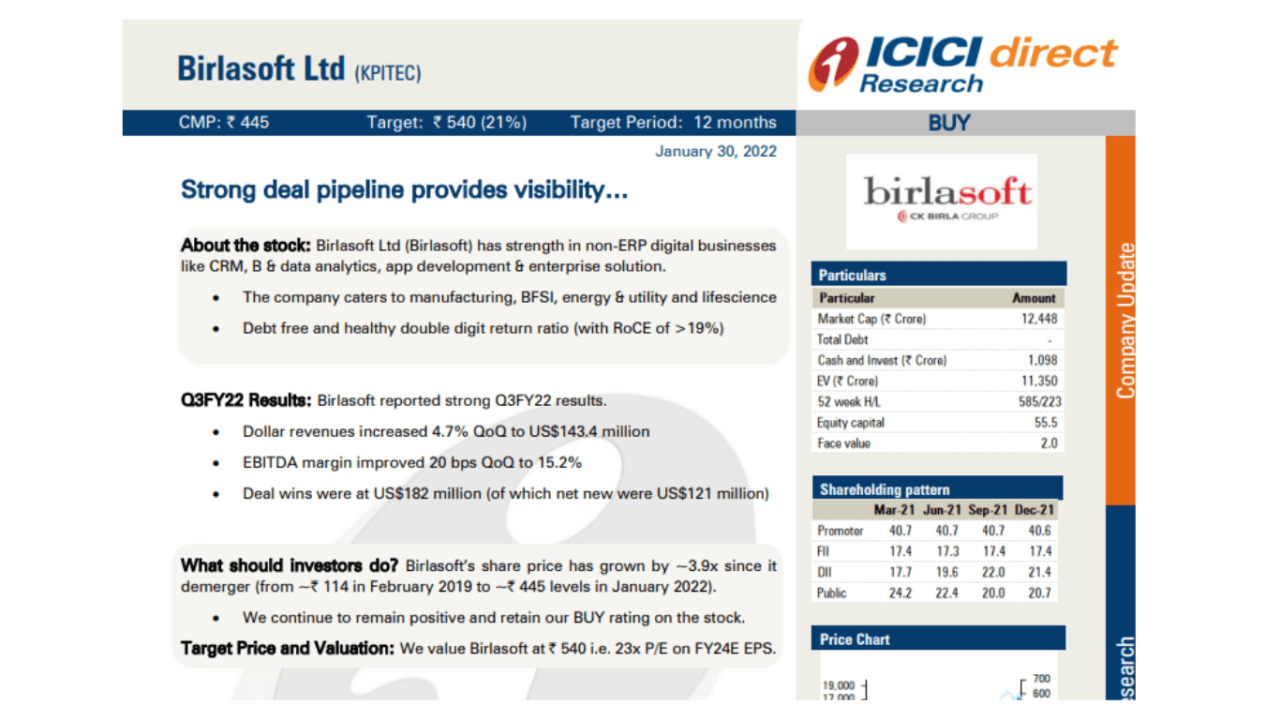

- Equity Research Analyst: An equity research analyst can be either a part of a broking firm or a part of a fund. In both the cases, they are responsible on covering a sector, a company and continuously staying on top of any updates on the company performance. They are expected to give buy, Hold or sell calls on companies they cover. Look at the below equity research report. This is an outcome of financial modelling

- Credit Modeling (Risk Management): Risk management has gained popularity since the 2008 market crash, and banks and financial institutions are on the lookout to identify new risk parameters. A risk modeler has the job of identifying such risk and calculating the impact of it financially. This also requires the financial modelling

- Project finance: Companies require debt to make ports, roads, power plants, factories etc. Project finance is different from regular business, because the they are limited by time. For example a road construction company would make the expressway, own it for 10 years and transfer it back to the government. These are also called as PPP model, public private partnership. In project finance companies have to model the project and forecast its revenues and profits, in order to raise the capital. On the other hand, banks would scruitinise the model, to check the viability of the business and also measure the credit risk of the project

- Mergers and Acquisition & IPO’s: A company acquiring another company, may be merging with it or a company raising capital in the IPO market requires financial models to be made.

- Corporate Finance: A regular large corporate also has tons of financial decisions and analysis to be done for example

- Investing the surplus capital- Treasury

- Budgeting the expense for the year-FP&A

- Finding ways of becoming more profitable- financial planning and analysis

- Corporate strategy

All these requires a structured approach of thinking, which can be done using financial modelling

What are the various financial modelling courses in the market?

There are many financial modelling courses and each one has its own pros and cons

- For Certification: I would recommend the FMVA certification by corporate finance institute

- Pros:

- Well recognised certification

- Self paced

- Cons

- No live interaction

- No placements support

- Very expensive

- Pros:

- For placements: I would recommend the mentor me careers course, which also comes with NSE Certification, high ratings on google and a good placement record

- Pros

- Strong placement assistance

- Live training and good trainers

- Strong mentoring support

- Affordable fees

- Cons

- NSE certification, which might be too common now days

- Pros

What is the financial modelling course syllabus

A good financial modelling and valuation course should cover the following areas:

- Excel : basic and advance

- Financial statement analysis- especially a lot of focus on basic accounting and ratio analysis

- Financial mathematics: Time value of money concepts in excel

- Valuation Concepts: DCF, Relative valuation, beta calculations

- Project finance: Modeling on various project finance cases

- Equity valuation: DCF & Relative along with report writing

You can check the financial modelling detailed syllabus here: Financial modelling syllabus download

financial modelling salary for freshers

So, now that we know the basics of what this job is all about and what are the various requirements. Now, it’s time to get into the real question, what are the financial modelling salary ranges?

So let me first classify the financial modelling salary for freshers basis the industry and Tier of companies. This means the salary also depends on the size of the company that you are in.

| Salary Ranges | Tier 1 | Tier 2 | Tier 3 |

| Equity Research | 6 -7 LPA | 4-5 LPA | 2 -3.5 LPA |

| Private Equity | 10 -12 LPA | 5-6 LPA | |

| Project Finance | 7-8 LPA | 5-6 LPA | |

| Investment Banking | 10 -12 LPA | 5-6 LPA | 2 -3.5 LPA |

| Wealth Management | 5-6 LPA | 4-5 LPA | |

| Risk Management | 12-15 LPA |

Proof of Financial Modelling Salary for Freshers

You might think that may be the above salary ranges are not true. Hence, What I will be doing here is giving you actual proof that such salary exisits

Tier 1 Example- Crisil Fresher Financial modelling salary

Tier 2 Example- SG Analaytics Financial Modelling Salary for Freshers

Compare the salary of CRISIL to SG analytics, which would fall under tier 2 category of research companies. In this case you can clearly see that the salary expectation drops by close to 2-3 Lacs

Tier 1 Risk Management Salary for Financial Modeling

Now, look at how well a fresher level employee gets compensated for risk mangement positions at Company like Credit suisse

financial modelling Job Descriptions

Let’s look at some of the recent financial modelling salaries in India using various job opportunities

Financial Advisory – Valuations – DM – Financial modelling

Support domestic /international client through the Model Development process or Model Review process Take an active role in delivering Modeling advisory services to high growth organizations in collaboration with a diverse Modeling team members and other cross functional teams Executing assignments within tight deadlines, providing value add to clients, maintaining client relationship Work as part of a team to design, develop and test models taking into consideration various scenarios and sensitivities the model will be exposed to, in order to enhance our diverse range of clients analysis and decision-making process Be expected to bring more to the table and be innovative in developing client solutions as well as driving Financial Modeling business strategy forward Be required to have strong business diagnostic skills and the ability to apply a logical and analytical approach to problem solving Qualifications CA / CFA (International) / CWA / MBA with 3 to 4 years of relevant work experience of financial modeling Skills Required In order to be considered for the role, your competencies will cover the broad scope of Financial Modeling services, leveraging your professional background and skills such as: Strong academic achievements Excellent verbal and written communication skills Advanced knowledge of Microsoft Excel Strong mathematical and quantitative skills Interest in working in a challenging and dynamic work environment Ability to work with cross functional teams of the organization Ability to undertake client facing projects independently with minimal supervision Proactive and an inquisitive mind, with a passion to provide world class client service Working knowledge of model build, reviews, VBA coding, SQL, Power BI, Power Pivot, Power Query and/or Tableau is an asset How you’ll grow At Deloitte, our professional development plan focuses on helping people at every level of their career to identify and use their strengths to do their best work every day. From entry-level employees to senior leaders, we believe there’s always room to learn. We offer opportunities to help build world-class skills in addition to hands-on experience in the global, fast-changing business world. From on-the-job learning experiences to formal development programs at Deloitte University, our professionals have a variety of opportunities to continue to grow throughout their career. Benefits At Deloitte, we know that great people make a great organization. We value our people and offer employees a broad range of benefits. Our purpose Deloitte is led by a purpose: To make an impact that matters. Every day, Deloitte people are making a real impact in the places they live and work. We pride ourselves on doing not only what is good for clients, but also what is good for our people and the communities in which we live and work-always striving to be an organization that is held up as a role model of quality, integrity, and positive change

Senior Equity Research Analyst

SGA is looking for an experienced equity research professionals with hands-on experience in writing investment memos, fact-sheets, Initiation reports, building financial models from scratch, conducting valuation exercises, etc. The candidate should have the ability to conduct thorough quality checks of the output produced by the team and guide them by providing constructive feedback. Other responsibilities include: • Tracking the multiple stocks/sectors assigned by the client/in-house project manager, updating client/lead analyst with news and events. knowledge and tracking of macro data. • Writing sector/initiation reports on assigned sectors/stocks, identifying ongoing themes and continuously interacting with the client exchanging opinions and views • Regularly communicating with the in-house project manager / lead analyst / assigned clients on project updates and be up-to-date with sector happenings • Supporting the client analyst/in-house senior and lead analysts on various ad hoc tasks, which could vary from data gathering, populating data in financial models, preparing reports independently (sector, thematic, result updates), ratio calculation and analysis, deep-dive secondary research to populate industry/company presentations, etc. • Maintaining a task list of ongoing/pending tasks on a regular basis, and finalizing task priorities with the project manager / client. • Ensuring that the tasks assigned are completed within the deadline, and ensuring top quality output with a thoroughly conducted self-driven quality-check process • Maintain flexibility to learn new techniques and functionalities, and gain exposure to various types of assignments • Contributing to internal knowledge creation and ad hoc assignments • Knowledge of databases like Bloomberg, Thomson Reuters

CRISIL – Research Analyst – Equity Research (1-3 yrs) What you should expect from the role? A Research Analyst is responsible for executing research of a designated sector / geography for a leading sell-side research firm – Build and update company and industry models – Create and maintain databases using data from different sources – Work on regular research publications – earnings previews, reviews, event updates, flash notes etc. – Contribute meaningful research ideas for thematic publications – Carry out sector analysis and come up with investment themes /ideas – Keep a track of latest developments in the companies under coverage and the sector and incorporate these into the research publications etc. – Conduct independent company-specific, economic, or trend analysis – Publish written articles and research reports that summarize analysis & findings – Develop and publish own industry forecasts, subject to review by senior team member – Write and publish analytical articles with minimal supervision, and requiring

Conclusion

Financial modelling is an ever green skil in finance and will remain so in the future too. A single word of advice for every candidate aspiring to progress in finance to learn this skill and practice continuously. In the longer run the perspective will get build and you wont regret learning this skill