Last updated on June 27th, 2024 at 02:14 pm

So, you have finally entered the top one per cent, who made it? and if you want to explore the courses after CA.After all, consider the millions who come and drop out every year. Also, please do not take yourself on a guilt trip, that you no longer have the first love for accounting anymore.In fact, if you realise this today, then it’s even better because not everything we do has to really be directly proportional to the career that we are in. So, here is how I will discuss this.

The framework for Courses After CA

Super important! I can’t stress more, after all a blind swing in the dark is ultimately just a swing.

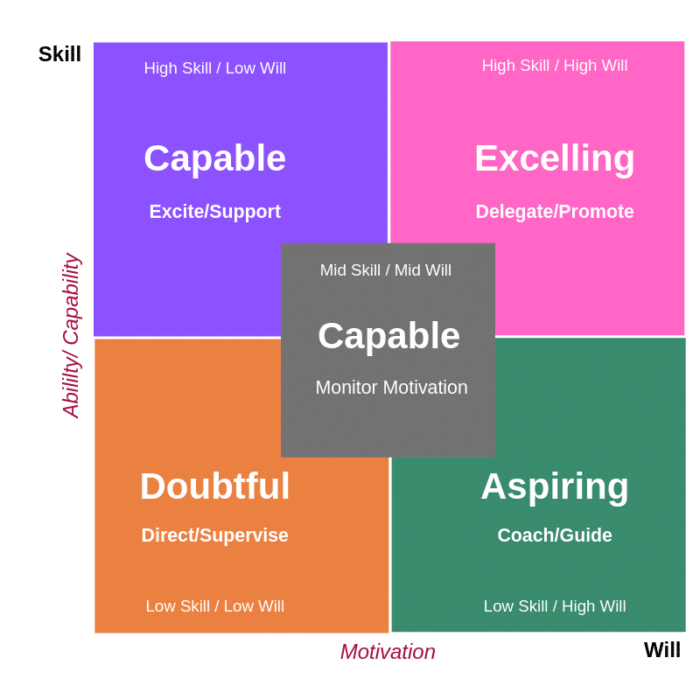

So, how can we know what exactly to do? The first approach is called the interest ability matrix.

Interest-Ability

This is a very old concept of career planning, where we list out our interests professional. Afterwards marking our ability and rated ourselves.

For example for me:

- High Will and High skill would; business planning, ideation, mentoring, or rating, excel.

- On the other hand high will but a low skill for me; python programming and machine learning.

However frequently many of you will face a single most important question, which is “High Skill for what?”.

Now, to answer that you also need to mark the industry where you feel confident.

Industry Selection

This usually takes time to figure but it should be very clear before your 30th Birthday. After all, the more time you are not married to the industry, the bigger frustrations can come later.

For eg; It became eventually clear to me, that I liked the education field and not so many investments or fund management. Pay close attention to what I said, ” I didn’t like investment management”, but I like investing for myself and teaching that too. So that requires you to be brutally honest with yourselves, it can’t happen when we have a fascination with working in the industry.

In other words, don’t look for things which are cool today, anyways it won’t last in another 5 years let alone you get bored anyways.

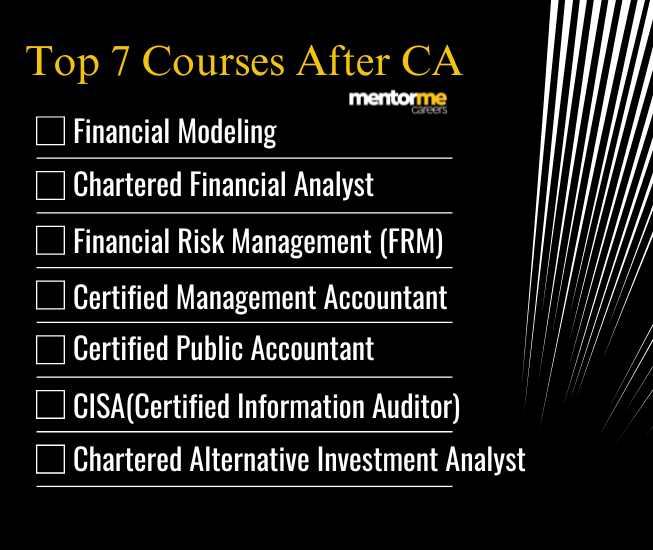

Top 10 Courses After CA

Investment banking again is a very large wide field but we can look at specifics of the three most important and relevant courses

Financial Modeling Course

First and the most important course that you can’t ignore whether you decide corporate finance or investment finance is financial modeling. It’s a small short term 3 months course which includes excel for finance valuation, projection and analysis of companies.

Chartered Financial Analyst

This needs some commitment, because if you have just finished CA then chances are you might want to relax a bit. But if you are ok for the challenge then by all means get started with CFA. Its a global standard on investment finance, which is recognised across more than 200 countries.

CFP

If you plan to operate more in the advisory side of investments, because many of you will also be operating in the accounting practice. In which case if you want to extend your services to include investments, then CFP can be a good trust badge to show. It is much easier than many courses and you should be able to complete this within a years time.

FRM- financial risk management certification

Now be careful and read this carefully. If you plan to work in a global bank or are a part of a company which provides risk management products then it might make sense to develop some depth in risk management.

In fact I had the oppurinity to interact with a senior risk management professional at Morgan Stanley. You can watch the following full interview

So over I feel there three four major courses for CA in investment domain. The first course financial modeling is a must whether you work in research or corporate finance, it’s the basic skill required to operate in this industry.

CMA U.S

Again I am recommending this if you wish to develop a niche in corporate finance functions. CMA U.S can be finished quickly within a year. The entire courses consiststs of two exams with 12 topics which are covered. You can read more about CMA U.S here

CPA

So, I am sure that not everyone really wants to shift but may be also operate in their own course sector. In that case in my experience and watching the industry closely. Following are the accounting courses after ca that you can consider.

So this makes logic because, you have already mastered Indian accounting standard which is very closely related to IFRST. But you also have tonnes of working coming in from the U.S which still follows U.S GAAP. Also CPA in terms of duration and effort should be a cake walk for chartered accountants from ICAI. Also as per the CPA data, there are about 16800 CPA members in India.

In fact let me list down some of the CPA members’s own experience

- Dhyey Jatania :Doing CPA after my CA and joined at EY as GDS Tax senior in Mumbai

- Prathamesh shinde: Completed CA final, then got into CPA & Now working with an MNC

So CPA can definitely open global and domestic borders for you as a chartered accountant.

Read In Detailed about CPA, in my special article: Scope of CPA

Diploma in IFRS

Now, this should be very easy and not like a big planned course. DIP IFRS either you read it yourself or just get hold of the official text and complete the certification. This will just help you in creating your niche towards a certain accounting standards. You can read in detail about IFRS on my article.

CAIA

So again a very niche based course very specific to alternative investments. The CAIA charter is usually pursued by CFA charter holders. So I would recommend this charter only if you have also completed CFA.

Certified Information Systems Auditor

CISA can make sense for many because you as a chartrered accountant are anyways doing the statutory audit. Which can increase you wide variety of audits that you provide.

Certified Information Systems Auditor is a premium certification from ISACA in IT auditing; it brings an IT auditor’s perspective to systems. This is essential for any professional in IT audit, risk management, and information security. Passing the exam is one thing, but gaining the required experience is crucial to being officially termed a CISA. This certification doesn’t come with a guaranteed six-digit salary but opens doors to interviews with reputable organizations. Salary packages depend on current salary, market standards, organizational urgency, work quality, and the company’s perception of that value. Many internal auditors think their job is to report that everything is fine, but skilled auditors can proactively address issues, preventing future audit comments and saving employers from embarrassment. I’ve seen CISA-certified professionals with three years of experience earning over Rs. 10 lacs annually, and those with six to seven years earning Rs. 7–8 lacs in Bangalore. Generally, you can expect “years of experience *2.5 or 3 lacs” as a salary, varying by city.

My Own Experience

The reason why I am sharing my story is to make you see the bigger picture. After all, when we are young we tend to see a very short version of our career map.

So this is how it goes.

I was not a commerce student, in fact, I passed my class XII in science, which by the way was selected just because I qualified the grade requirements.

Then the bug of investments bit me, while I was in eleventh grade, and I felt pursuing engineering didn’t make any sense at all.

So, I enrolled on a commerce graduation program and got thoroughly disappointed.

Mostly because the commerce program, didn’t have anything about investments.

So then I started looking around, stumbling upon courses like CA, CS, ICWAI etc. Which, again didn’t make sense because it was all focused on accounting, law or costing.

Afterwards, I came across my senior reading a book which had something like CFA written on it. However even after doing CFA and working in investments for a long time, I ended up in product management.

So, nothing that I learned directly in the CFA program had anything to do with product management or now entrepreneurship but it helped indirectly in understanding products as assets.

Hence, instead of looking at products and thinking about marketing in a conventional way, I looked at them as investments. For eg; I used the diversification concept of portfolio management, in selecting the new domains of product or deciding the new product based on the risk appetite of the organisation to invest.

However, it would be an exaggeration that I didn’t have to work on other skills, which were not perceptive but unique to the profession. Take for example; making product maps, which was an alien concept.

Moreover, you will need to obviously keep on exploring specific education continuously and they won’t always be available in the form of a qualification.

Conclusion Courses after CA

You must have been perplexed that I did not suggest any accounting courses. Since you don’t require any and anything you do is simply just adding more baggage. You can work for big fours even with CA, and no one really forces or requires you to do IFRS/CPA or ACCA.