Last updated on July 9th, 2024 at 03:13 pm

So, you want to become the Indian Gordon Geko, trading where money never sleeps? And you are looking for the best Stock market courses in Mumbai, which can do the job for you? In this article, I am going to discuss and cover the top 4 best share market classes & trading courses in Mumbai.

Below is the list of four courses, but hold on before you decide to take any one of them because each of these share market courses in Mumbai is different. So, I advise you to read the whole article and then decide.

| Ser | Institute Name | Course | Type | Google Ratings | Fees |

| 1 | Tips 2 Trade Mumbai | Advance Technical analysis | Technical | 4.8 | 34000 |

| 2 | Share wolves Mumbai | Trade alchemist | Algo | 4.9 | On Request |

| 3 | Trading4living Mumbai | Swing Trade | Event Based | 4.9 | 50000 |

| 4 | Mentor Me Careers | Financial Modeling | Fundamentals | 4.9 | 14999 |

Stock Market Courses in Mumbai Overview

First, let us understand that trading is not as simple as doing any random course. Even if you are the best student in the share market class, you might never actually end up making any money. Not every strategy is aligned with your personality.

My Own Experience in Trading

Now, you can either skip this part if my story seems boring, but the only reason why I am sharing this is so that you understand the mistakes and how much time it takes to settle down with a strategy.

I was never a born trader, but I had this curiosity about markets since high school. The values of companies going up and down fascinated me. However, I was absolutely confused, and since no one in my entire family had the faintest idea about markets, I ended up ditching my engineering career pursuits and switched to the commerce stream after high school.

As I was walking one day down the streets of the Camp area, near the famous coffee house right next to Dorabjees, I saw this book named “Rich Dad Poor Dad.” As far as I remember, I did not pick up that book because I knew it was related to money. However, I picked it up because we were not wealthy. When we approached the bank for a loan for my education abroad, the bank asked for collateral. We didn’t have that, and I felt that spending twenty lacs on graduation was not worthwhile.

Around the same time, I read the book, and to my utter surprise, the book was about how money gets made. To this day, I give credit to Robert Kiyosaki; if it wasn’t for that dusty pirated book on the road, I would have never understood money in the real sense.

Next Steps

Once I was clear I wanted to learn more about money, I somehow knew in my soul that eventually, I would never work for someone in the long run. However, it was important to also understand the alternative. So, my quest for the truth began.

I foolishly chose a Bachelor’s in Business only to realize it was not about making money. Then one fine day, just like the “Rich Dad Poor Dad” incident, I came across the CFA qualification. I chose CFA because I didn’t want to give 17 Lacs to an Ivy League MBA college in India. Neither did I have that money, but I felt I would rather invest that money.

Trading Methods

Once I was done with CFA, I had the fundamentals in place and understood all the technical terms. But CFA doesn’t teach how to make money. It teaches you the tools. It has safely given this job to you, to figure out, just like they did themselves by making the CFA qualification itself.

One fine day, one of the colleagues who was also a CFA charterholder and was experimenting with trading strategies suggested I read around 100 books. Not to learn trading but to appreciate that there are 100 ways of making money.

Eventually, I settled for systematic trading and fundamentals. Fundamentals were more convincing when I started running a business.

There are various types of trading, each with its own set of characteristics and strategies. Some examples of trading types include:

-Day Trading: Involves buying and selling securities within the same trading day, with the goal of profiting from short-term price movements. Day traders often use technical analysis and chart patterns to make their decisions.

Swing Trading: Involves holding securities for several days to a few weeks, with the goal of profiting from medium-term price movements. Swing traders may use a combination of technical and fundamental analysis to make their decisions.

-Position Trading:Involves holding securities for a longer period, such as several months or even years. Position traders focus on long-term trends and fundamentals to make their decisions.

Scalping Involves making multiple trades in a very short period, such as seconds or minutes. Scalpers use technical indicators and chart patterns to make quick decisions and take advantage of small price movements.

Algorithmic Trading: Uses computer algorithms to make automated trading decisions based on technical and fundamental analysis, and can be applied to different time frames.

-High-Frequency Trading (HFT) Uses advanced technology and algorithms to make trades at extremely high speeds, often measured in microseconds, and is mostly used by institutional traders and hedge funds.

-Options Trading Involves buying and selling options contracts, which give the holder the right but not the obligation to buy or sell an underlying asset at a specific price within a specified time. Option traders use different strategies such as covered call, protective put, and bull or bear spread.

Top List of Stock Market Classes in Mumbai

Now, let’s begin discussing the various courses that you can explore for stock market classes in Mumbai.

Tips2Trade – Stock Market Courses in Mumbai

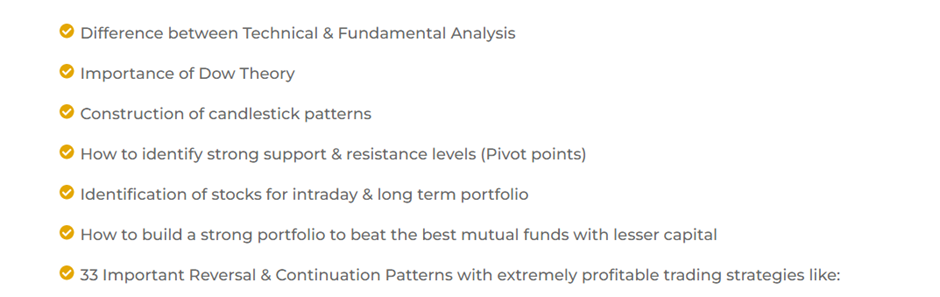

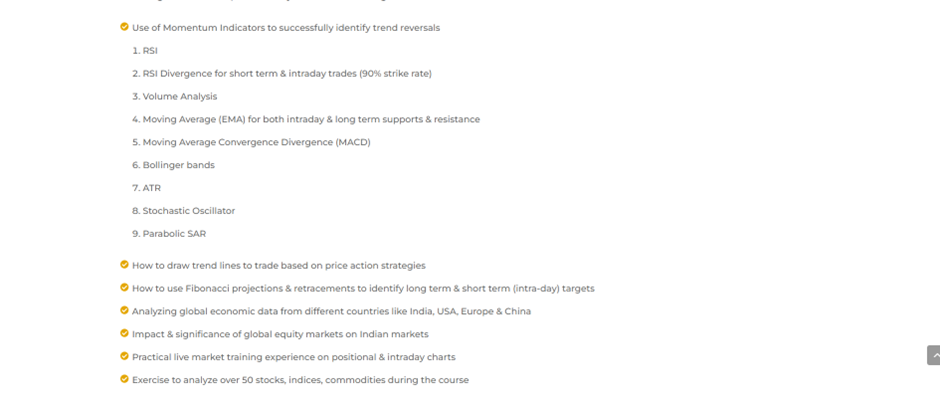

Tips 2 Trade offers a very specific course on advanced technical analysis, which I recommend if you are interested in technical analysis specifically.

Below is the total coverage of the advanced technical analysis stock market course in Mumbai.

**Course Duration**: The stock market course in Mumbai provided by Tips2Trade consists of 10 sessions of 1.5 hours each.

**Fees**: The share market classes in Mumbai fees provided by Tips2Trade is priced at INR 34000.

Share Wolves is an interesting share market institute in Mumbai, and my top pick would be the Trading Alchemist, which is more geared towards a systematic style of trading.

Below is a snapshot of the coverage of the course.

– Basics of Algorithmic Trading

– Understanding Terminology

– Basics of MS Excel, Omega Software

– Options Pricing, Basic Statistics

– Multicharts Tutorial

– Introduction to Machine Learning for Trading

– Writing and Backtesting Trading Strategies

– Introduction to Brokers Platform

**Course Duration**: The course duration and fees of the share market course are not given, but you can get in touch with them through the brochure mentioned here.

#### Trading4Living Mumbai – Stock Market Course in Mumbai

I like the name of the company because I had read one book with a similar name and hoped that the company too had the same vision as the book.

Below is the coverage of the course.

– Candlestick Patterns

– RSI Swing Strategy

– Volatility Strategies

– Trendlines and Channels

– Fibonacci Levels for Swing Trading

**Course Duration**: 60 Hours (40 sessions of 1.5 hours each). Timings can be flexible as per the trainee and trainer’s work schedule.

**Program Fees**: Rs. 50,000/- per student.

### Conclusion

Now that you know the various stock market courses in Mumbai, I would suggest doing your due diligence and finding your fit. However, if you can’t decide, then start somewhere and begin your exploration from there. Whether you are looking for the best share market classes in Mumbai, trading training in Mumbai, or learning technical analysis fundamentals, these courses provide a variety of options for all levels of interest and expertise.

If you’re interested in stock trading courses in Mumbai, there are several trading institutes in Mumbai that offer comprehensive programs. For beginners, many online stock market courses cover the basics of stock market trading, risk management, and the fundamentals of technical analysis. Working professionals can benefit from flexible schedules and specialized programs available at these institutes.

Whether you want to delve into the commodity market or learn technical analysis in-depth, these courses have something for everyone. From the top share market classes in Mumbai to the best trading classes in Mumbai, these training institutes ensure you get the best stock market training in Mumbai.

Don’t forget to check the share market classes in Mumbai fees and find the best fit for your financial market education needs. With the right course, you’ll be well on your way to mastering the stock exchange and making informed trading decisions.