Last updated on December 2nd, 2025 at 06:00 pm

MBS stands for mortgaged backed security,a synthetic security with underlying as mortgages or collection of mortgages.

Full form of MBS

Are you interested in what “MBS” represents and its significance in the current financial and real estate landscape? Whether you’ve encountered the term during banking dealings, investment paperwork, or mortgage conversations, grasping the complete definition and implications of MBS (Mortgage-Backed Security) is essential. This article will clarify the concept of MBS, its operational mechanics, various types, advantages and disadvantages, and its ongoing importance in the capital markets of 2025. Whether you are a finance student, a professional involved in real estate finance, or just looking into investment choices, this guide provides you with clear and straightforward information on the full meaning of MBS and its importance in today’s economy.

In 2007, one of the worst credit crises in history was done by this intelligent security. By no means I am being sarcastic! Trust me, it’s smart security but not all smart things are used intelligently. Artificial intelligence is smart, but I can also use it to be greedy and harm society. I mean think about this for a sec, intelligent security like MBS brings an intelligent firm like Lehman Brothers to its knees and eventually kills it. If the Lehman brothers couldn’t understand it, then can we? Let’s wait and find out.

The concept of MBS

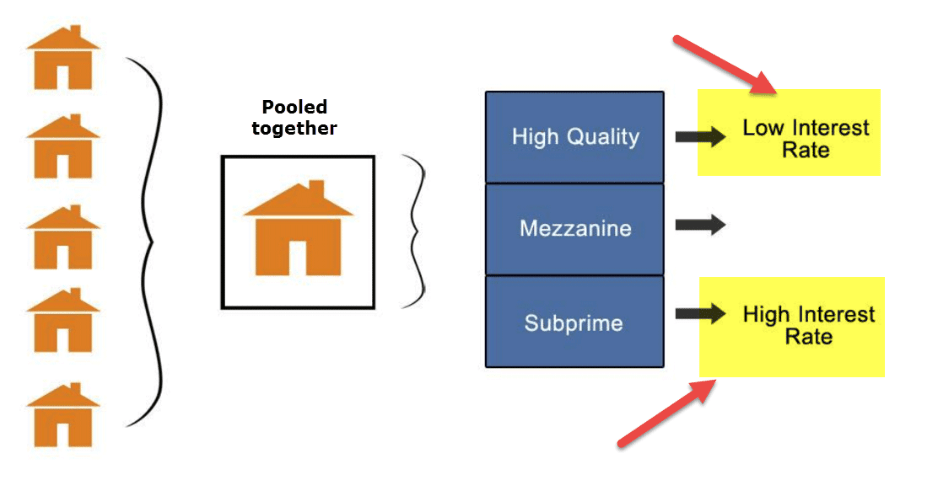

So here is how it works. Imagine I had five home loans taken by customers with different values, time and interest rates. Now there are two things I can do. Either wait 25 years until Mr.borrower pays me back, which is a long wait. While taking the risk that Mr. Borrowers might default on the payments. What then? So you come up with a brilliant idea, why don’t we combine all of them? And then what? Aah! Then I come up with a tactical strategy. Why can’t I break those housing loans into smaller bits and sell them off to some other investor? However, you ask me a valid question, who would buy it? and why? So, maybe someone needs a 13% high-interest rate for 3 years and finds this security interesting.

In fact, I come up with the following offerings

- First- 20 Year High-quality mortgage belonging to Mr Ramesh who has a great credit history, and a 10% interest rate.

- Second- 10 Year medium quality mortgage belongs to Mr Somesh, who has defaulted once on his credit card payments and 12% interest rate.

- Finally, in the last part is a 20-year low-quality mortgage belonging to Mr. Sohan, who has defaulted on the same mortgage twice but promises a 15% interest rate.

Indeed, that’s a lot of variety. Now obviously, you would ask who would really be interested in buying the low-quality mortgage? Well, just the same way some people buy low-quality stocks and probably I understand that the risk can be managed.

Advantages of MBS

Such an intelligent idea without advantages? Of course not, there are many.

- First and foremost I reduced my risk as a bank and transferred it to many different smaller investors. So basically overall I contributed to diversifying the risk.

- Second, I created opportunities for investors to expose themselves to new kinds of securities. I mean who would have given you the opportunity to be an investor in a normal man’s mortgage lifecycle?

- Third, it creates liquidity for me. And now I can use the money I get from selling the loans off to you and lend it further to business.

More so, this makes loans affordable and lowers interest rates. If there was no MBS, then lending would just be waiting for 25 years.

Types of Mortgaged Backed Security

So, now is where like many things, becomes complex. There are different types of mortgaged back security

- Pass through Securities:

Under this arrangement, the cash flows from the underlying mortgage is passed through to the investor on a pro-rata basis. This means that if I hold 20%, then I get 20% of the cashflows. For which I hold a trusted certificate.

Now the same pass-through security, if it includes residential mortgages then it’s called RMBS & CMBS if commercial.

- Collateralised Mortgage Obligation

Now, if we get Mr Goldman Sachs to instead clean it up and make it more presentable then we call it collateralised mortgage obligation or CDO. Which is something very similar to a bond.

- SMBS

The stripped mortgaged back security, strips the interest and principal. This means I can now create an interest-only MBS, you only get the interests. The principal can be stripped and given to someone who gets only that.

You see, how the gene is unravelling? It’s plain evolution, once you start you keep getting creative. Until you doom!

2007 Crisis

Let’s continue from doom! You see this is where an intelligent idea converts to greed and that leads to some uncomfortable situations.

So, try painting this scenario. Federal funds rates are low, which means banks are giving loans at throw-away prices. While the Mr smarts of wall street keep getting creative with mortgage securities. To the extent that, unaware that some other smart investors also created another security to bet against those MBS.

Voila!

Oh yes! Christian bale created that asset, I mean not Christian bale but Michael Burry.

So now, such smarty pants start buying huge numbers of CDS’s against the MBS. All this while, the banks were completely unaware of the exposure of the loss that could happen. Finally, when the borrowers start defaulting, you can imagine what happened.

Present Day MBS Regulations

A mortgage-backed security is still sold today and there is a market for them. In fact, the FED themselves own a large chunk of it. Remember the idea is still great but the euphoria is not. So banks have been forced from 2007 onwards into multiple regulations like Basel 1,2,3 etc. Which fact made the banks lose to fintech too. The current MBS market operates under stringent regulations that emphasize borrower protection, lender responsibility, and investor clarity.

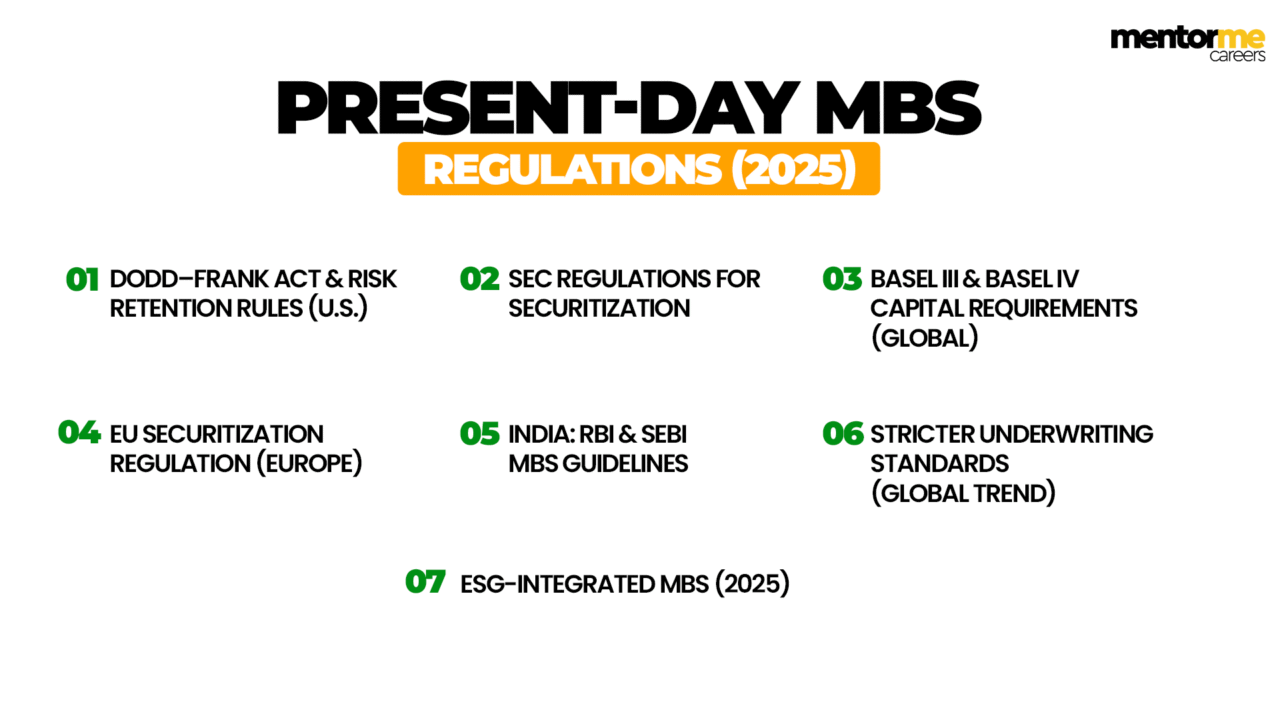

1. Dodd–Frank Act & Risk Retention Rules (U.S.)

The Dodd-Frank Wall Street Reform Act continues to influence MBS regulation.

Important provisions include:

1.Risk Retention (“Skin in the Game”): Issuers are required to keep 5% of the credit risk associated with any MBS they issue to promote responsible underwriting.

2.Enhanced Consumer Protection via the CFPB (Consumer Financial Protection Bureau)

3.Standardized documentation requirements for mortgages to qualify as Qualified Residential Mortgages (QRM).

2. SEC Regulations for Securitization

The U.S. Securities and Exchange Commission requires:

1.Comprehensive loan-level information for investors.

2.Clarity on borrower credit scores, LTV ratios, DTI, and prepayment risks.

3.Stricter regulations for credit rating agencies under the Credit Rating Agency Reform Act.

4. Ongoing reporting mandates like Reg AB II.

3. Basel III & Basel IV Capital Requirements (Global)

Banks holding MBS must comply with revised global standards:

1.Increased risk-weighted capital necessities for assets tied to mortgages.

2.Compulsory liquidity coverage for high-quality securitizations.

3.Stress testing in response to housing market declines.

4. EU Securitization Regulation (Europe)

Europe imposes some of the most rigorous securitization regulations:

1.STS Framework (Simple, Transparent, Standardized).

2.Obligations for issuer due diligence.

3.Template requirements for investor reporting.

4.Prohibition on “re-securitizations” such as CDO-squared (with limited exceptions).

5. India: RBI & SEBI MBS Guidelines

India’s mortgage securitization sector is regulated by:

1.The RBI’s Securitization of Standard Assets Guidelines.

2.Minimum Holding Period (MHP).

3.Minimum Retention Requirement (MRR).

4.Transparency in asset pools.

5.SEBI rules governing MBS issuance through pass-through certificates (PTCs).

6.Increased scrutiny for Housing Finance Companies (HFCs).

6. Stricter Underwriting Standards (Global Trend)

All regions are implementing:

1.Verification of income.

2.Assessments of the ability to repay loans.

3.Checks on loan documentation.

4.Limits on high-risk products like negative-amortization loans.

7. ESG-Integrated MBS (2025)

Contemporary MBS markets are incorporating environmental and social risk assessments:

1.Green MBS supported by energy-efficient properties.

2.Social MBS aimed at financing affordable housing.

3.Mandatory ESG reporting for issuers in key markets.

In 2025, MBS regulations emphasize transparency, risk retention, borrower safeguarding, enhanced loan data quality, stricter capital requirements, and ESG compliance. These enhancements ensure that mortgage-backed securities are safer, more reliable, and better governed, thus protecting both investors and the overall financial ecosystem.

MBS Securities in India

India was in the game and is in the game of mortgage securitisation.

In fact in 2021, the securitisation market in India is worth 1.2 Lakh crore.

RBI has put the following structure for securitisation

- Minimum instalments of six months

- The retention rate of 5%

- If the home loan pool is worth INR 500 CR, then you can list it for securitisation.

Mortgage-Backed Securities (MBS) are becoming an important element of India’s debt and housing finance landscape. While the MBS market in the U.S. is fully developed and highly liquid, India’s market, mainly consisting of Pass-Through Certificates (PTCs) and Direct Assignment pools, is experiencing steady growth. In 2025, this sector is benefiting from clearer regulations, a thriving housing industry, and increased involvement from non-banking financial companies (NBFCs), housing finance firms (HFCs), and banks.

In India, MBS securities consist of securitized collections of residential mortgages, which are originated by entities such as HDFC Ltd, LIC Housing Finance, PNB Housing, Can Fin Homes, Aavas Financiers, Home First Finance, major NBFCs, and various private-sector banks. These pools of loans are sold to investors, who then receive monthly payments stemming from the underlying mortgage cash flows.

The growth is being propelled by several significant factors:

The RBI’s Securitization Guidelines (2021) have enhanced transparency through Minimum Holding Period (MHP), Minimum Retention Requirement (MRR), and improved cash-flow reporting.

There has been a surge in demand from institutional investors like mutual funds, insurers, pension funds, and provident fund trusts searching for long-duration, high-quality AAA-rated assets.

India’s affordable housing boom is further fueled by government initiatives such as PMAY.

The digitization of loan origination and the use of AI in underwriting are enhancing asset quality and lessening risk perception.

Improved credit-support frameworks, which include over-collateralization, cash reserve accounts, and thorough oversight from rating agencies (CRISIL, ICRA, CARE), have also contributed.

By 2025, India’s total securitization market, encompassing MBS and retail ABS, is expected to exceed ₹1–1.5 lakh crore in annual issuance. Mortgage-backed PTCs are considered one of the safest investment options due to historically low default rates on home loans in India.

Nonetheless, there are challenges: liquidity in the secondary market remains restricted, investor engagement is largely limited to major institutions, and Direct Assignments continue to dominate over PTC issuances. However, with enhanced regulations, an expanding digital credit framework, and increased participation from banks and NBFCs, India’s MBS sector is on track for sustained growth.

Conclusion

MBS is a great tool. In fact, this is not a new idea, it was first conceived in 1857. For many years, the securitisation industry was not taken seriously until lending became so popular that it became more essential than a luxury. It’s still useful and I think it’s a great tool to reduce the risk of banks.

FAQ

MBS full form is Mortgage-Backed Security, a tradable debt instrument backed by mortgage loans.

RMBS are backed by residential mortgages; CMBS are backed by commercial property loans, CMBS tend to have different credit and vacancy risks.

Investors receive cash flows from borrowers’ monthly principal and interest payments, allocated according to tranche rules.

Prepayment risk occurs when borrowers repay mortgages early (refinance), reducing future interest payments to MBS investors and changing expected cash flows.