Last updated on February 8th, 2024 at 02:23 pm

So, you have been shortlisted at Gallagher & Mohan, but you don’t have any idea on how to prepare for it? Also, in this small article cum tutorial, I’ll give you the step-by-step guide for the Gallagher company interview questions.

So let’s get started.

But first things first, I would highly recommend you to read the entire article because everything is connected including the face-to-face technical round.

Gallagher company interview questions- Rounds

So, Gallagher and Mohan is into real estate valuation services In the KPO industry. However, that being said the company is very liberal in terms of giving opportunities to everyone. That means, that you will get a chance to prove your skill. So let me briefly segregate the rounds of interviews.

- Firstly, the initial round is about two specific tests

- The MCQ type test

- Financial Modeling Test

- Secondly, the personal interview

- Finally, the HR round.

First Round- Gallagher company interview

So, at this stage you shall get a basic test, comprising of questions including;

- What is beta?

- Calculate NPV.

- Definition of cap rates

- Valuation methods

So, these questions are very easy to do, if you have learnt it any financial modeling course. And if you have done the course with mentormecareers, then you would have learned this for sure.

You really don’t want to screw up this round.

Take up this small test, to check if you know the concepts.

Second Round of Test- Gallagher Company Interview Questions

Now, along with this test you also get a case study, which is pretty extensive. So, if you haven’t learnt real estate financial modeling, then you are up for some good challenge. Real estate modeling, has a lot of nuances, which are different from the regular project finance model.

So, let me briefly explain what would be expected in the model;

- Creating projections of the real estate acquisition project

Here, the Gallagher company will give you some details of the real estate project. Which includes the number of apartments, expenses related to maintenance of the complex, entry price and also funding of the acquisition.

So, your job is to create a projection of the income and expenses and calculate the returns.

Important Terms for Real Estate Financial Modeling

So, in this section let me give you some overview of the various nuances of the industry.

What are Types of Assets in Real Estate Valuation

So, whenever a real estate project is undertaken, there are different types of real estate property;

- Multifamily: So a complex with around 500- 600 units of apartments would be called as a multifamily complex

Examples: Phoenix reality group

Investment objective

- Easier to finance the project

- Comparatively easy to acquire, rather than individual units

- Makes financial sense, in terms of management

- Office Space: I don’t think I really need to explain this, and there are various kinds of office including. Single offices, the entire floor of a building, retail shops etc. However, there might be different kinds of real estate offices available

- Industrial

- Storage

- Retail malls

- Hotels: There arises many opportunities, when certain hotels are not doing well. At the same time, you could purchase the property. Improve the property and sell it off.

What are the Types of Investors in Real Estate

So, as we discussed the various types of real estate property, the intent of each acquisition can be different. So, let me start knocking of the types below;

Acquisition focussed

Here the intent is to purchase properties that already built, and you acquire it in hopes of selling it off in the future.

Types of acquisitions

So, let me quickly outline the types of acquisitions in real estate investing;

- Stabalised core acquisitions: Purchasing a fairly stable new property, its less risky but the returns are low as well

- Value add acquisitions: Here, just like you buy a cheap stock in the stock market, you look for an old property which you aim to improve and sell it a higher rate

- Opportunistic acquisitions:These are distressed properties, may the business has closed down and on its way for foreclosure. That’s when you step in hoping for bargain price and improve and sell it later at a higher rate.

Development focussed

So, most of you will relate with this kind of a property wherein a real estate developer would build the entire project from zero. Here, there is a land owner and a developer who takes on the task of construction and selling off units.

So, let’s check the various types of developers

- Merchant developers: Here the developer builds the property and intends to sell it off shortly after.

- Long-term hold: Here the developer builds, but instead of selling It off, leases the property out and sells or may not sell too in the longer run.

Gallaher Interview Questions: Financial Terms to remember

Here, I am going to discuss the various financial terms particulary applicable for real estate interviews at Gallaher and Mohan.

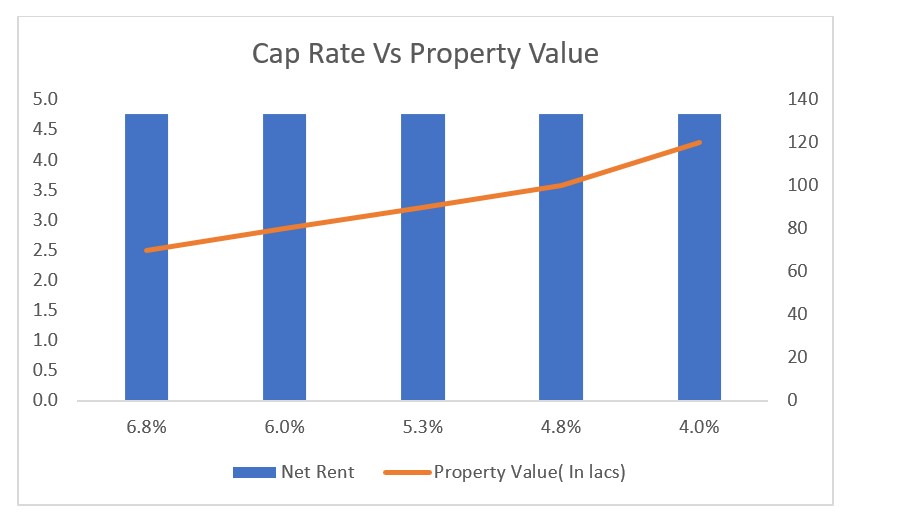

Cap Rate:

So, don’t get all bogged down by hearing this term. All that it means is a dividend yield but in real estate paralance.

So for example a 2bhk flat has a rent of INR 4 Lacs and maintenance is INR 24 K, then your net operating income is 4.76 Lacs. Now, let’s suppose the property is available for INR 90 Lacs. Then the cap rate is : 4.76 Lacs/ INR 90 Lacs = 5.2%. So that’s the acquisition cap rate.

Also, try to understand why we calculate this,

So, if we are acquiring a new property generally speaking you want the rent to be higher and property value to be lower. That is the ideal, situation because who doesn’t want a cheap stock and good dividends right? However, at the same time such properties will come with higher risks compared to properties with lower acquisition cap rates.

Other Applications of Cap Rate

Now, apart from the absolute meaning of cap rate, it is generally used to compare two different properties. For example;

- Property 1: Has a rent of INR 4 Lacs, purchase price of 80 Lacs. Which in term converts to a cap rate of 5%

- Property 2: Has a rent of 4 Lacs too, but the purchase price is 100 lacs. So, that has a cap rate of 4%.

Now, if interpret this the property 2 is more expensive than property 1.

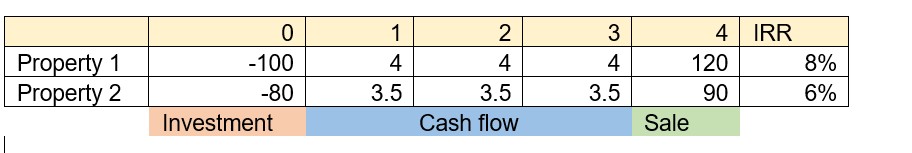

What is IRR( Internal Rate of Return):Gallagher Interview Question

So, I know you might be aware of the general definition, “ IRR is the rate at which NPV becomes zero”, but never explain this in an interview like this.

Simply explained, IRR is the average Compounded annual growth rate of cash flows which are uneven.

So, all that the IRR function is doing is that it is trying to find a rate at which all your initial investments become equalised to the cash flows. In return finding you the average rate of investment compounding.

Now, if you compare both the properties, then property 1 is giving you a better return prospect.

What is Cash on cash Return

So in real estate business everything revolves around cash. Any realtor would agree that all the matters is not paper returns, but how much you made in real. This could be also one of the tricky Gallagher interview questions, is to explain what is cash on cash return.

So, simply put cash on cash return is the pre-tax cash flow received divided by the total investment which is actually done.

Cash on cash Return Example

So let me take an example here;

Suppose you purchase an apartment In a posh locality, for INR 70 Lacs. Also, for the same purchase you took a 60 lacs debt and 10 lacs you paid as down payment. Apart from that you also paid INR 20,000 in maintenance, 10,000 for insurance. Along with this, you repaid 7 Lacs in EMI’s out of which 1 lac is principal repayment and 6 Lacs is interest.

Now after one year, you sold the property for 90 Lacs INR. So what is the cash on cash return?

So let’s calculate the total inflow of cash: INR 90 Lacs – 59 Lacs( Debt)-6 lacs (Interest)- 10 Lacs( Down payment)- 30,000( Other expenses)= INR 14 Lacs

Hence, the total of INR 14 Lacs is the cash inflow. But now, we need to compare that against the total investment we have done.

Total investment done= INR 10 lacs+ 30,000+ 6 Lacs interest= 16.3 Lacs.

So the cash on cash return=14 Lacs/ 16.3 Lacs = 90% Return

What is Discounted Cash Flow Analysis?

Now, no calculation is complete without discounted cash flow analysis. You can check the detailed discounted cash flow analysis with this template and video lecture.

You can download the template from this article of real estate valuation.

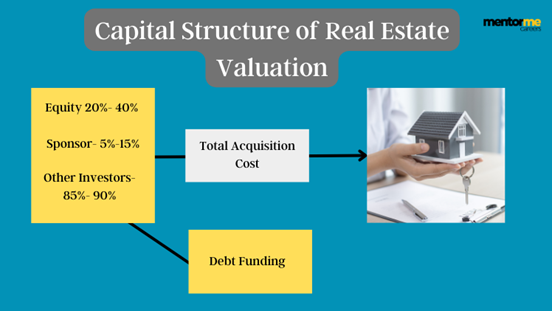

What is the capital structure of a typical real estate investment?

So, the above depiction is the general structure of funding a real estate investment. Where, in total the equity is around 20% to 40%, while that equity is funded by sponsors and other investors. While the same investments is again 80-90% funded using debt funding.

Conclusion:

This is the best possible way, I could give you a general direction of preparing for Gallagher company interview questions. Also, if you want to learn this properly and in more depth and also get placement support for the same then check mentor me careers, financial Modeling course.