Last updated on January 28th, 2026 at 11:22 am

If you are preparing for a Gallagher & Mohan interview, you are likely looking for real interview questions, process clarity, and placement expectations, not generic company information. Gallagher & Mohan is known for hiring freshers and early-career professionals into finance, insurance operations, risk, analytics, and compliance roles, and their interview process focuses heavily on process thinking, accuracy, ethics, and problem-solving ability.

This guide breaks down exactly what Gallagher & Mohan interviews test from HR and behavioral questions to case-based finance and risk scenarios that assess how you think, not just what you know. You’ll also understand the typical interview stages, skills recruiters prioritize, and how placements and role allocation work for freshers in India.

So, you have been shortlisted at Gallagher & Mohan, but you don’t have any idea on how to prepare for it? Also, in this small article cum tutorial, I’ll give you the step-by-step guide for the Gallagher company interview questions.

But first things first, I would highly recommend you to read the entire article because everything is connected including the face-to-face technical round.

Gallaghar & Mohan Interview Process

So, Gallagher and Mohan is into real estate valuation services In the KPO industry. However, that being said the company is very liberal in terms of giving opportunities to everyone. That means, that you will get a chance to prove your skill. So let me briefly segregate the rounds of interviews.

- Initial Rounds comprise of;

- The MCQ type test

- Financial Modeling Test

- Secondly, the personal interview

- Finally, the HR round.

About Gallagher & Its Business Lines

Gallagher operates through three major business lines, and interviewers expect candidates to understand these clearly.

1. Insurance Brokerage

Gallagher acts as an intermediary between clients and insurers, helping businesses:

- Assess risks

- Design insurance coverage

- Negotiate premiums and policy terms

Key focus areas:

Property & Casualty (P&C), Employee Benefits, Specialty Insurance.

2. Risk Management & Consulting

This vertical helps clients identify, measure, and manage business risks beyond insurance.

Includes:

- Risk assessments

- Claims management

- Compliance and governance support

- Financial and operational risk analysis

This is where many analyst, research, and operations roles sit.

3. Global Services & Analytics (India GCoE)

Gallagher’s India offices support global teams with:

- Finance & accounting

- Insurance analytics

- Policy administration

- Data analysis

- Compliance, AML, KYC, and reporting

Technical Questions

First Round- Gallagher company interview

So, at this stage you shall get a basic test, comprising of questions including;

- What is beta?

- Calculate NPV.

- Definition of cap rates

- Valuation methods

So, these questions are very easy to do, if you have learnt it any financial modeling course. And if you have done the course with mentormecareers, then you would have learned this for sure.you really don’t want to screw up this round.

Second Round of Test- Gallagher Company Interview Questions

Now, along with this test you also get a case study, which is pretty extensive. So, if you haven’t learnt real estate financial modeling, then you are up for some good challenge. Real estate modeling, has a lot of nuances, which are different from the regular project finance model.

So, let me briefly explain what would be expected in the model;

- Creating projections of the real estate acquisition project

Here, the Gallagher company will give you some details of the real estate project. Which includes the number of apartments, expenses related to maintenance of the complex, entry price and also funding of the acquisition.

So, your job is to create a projection of the income and expenses and calculate the returns.

Important Terms for Real Estate Financial Modeling

So, in this section let me give you some overview of the various nuances of the industry.

What are Types of Assets in Real Estate Valuation

So, whenever a real estate project is undertaken, there are different types of real estate property;

- Multifamily: So a complex with around 500- 600 units of apartments would be called as a multifamily complex

Examples: Phoenix reality group

Investment objective

- Easier to finance the project

- Comparatively easy to acquire, rather than individual units

- Makes financial sense, in terms of management

- Office Space: I don’t think I really need to explain this, and there are various kinds of office including. Single offices, the entire floor of a building, retail shops etc. However, there might be different kinds of real estate offices available

- Industrial

- Storage

- Retail malls

- Hotels: There arises many opportunities, when certain hotels are not doing well. At the same time, you could purchase the property. Improve the property and sell it off.

What are the Types of Investors in Real Estate

So, as we discussed the various types of real estate property, the intent of each acquisition can be different. So, let me start knocking of the types below;

Acquisition focussed

Here the intent is to purchase properties that already built, and you acquire it in hopes of selling it off in the future.

Types of acquisitions

So, let me quickly outline the types of acquisitions in real estate investing;

- Stabalised core acquisitions: Purchasing a fairly stable new property, its less risky but the returns are low as well

- Value add acquisitions: Here, just like you buy a cheap stock in the stock market, you look for an old property which you aim to improve and sell it a higher rate

- Opportunistic acquisitions:These are distressed properties, may the business has closed down and on its way for foreclosure. That’s when you step in hoping for bargain price and improve and sell it later at a higher rate.

Development focussed

So, most of you will relate with this kind of a property wherein a real estate developer would build the entire project from zero. Here, there is a land owner and a developer who takes on the task of construction and selling off units.

So, let’s check the various types of developers

- Merchant developers: Here the developer builds the property and intends to sell it off shortly after.

- Long-term hold: Here the developer builds, but instead of selling It off, leases the property out and sells or may not sell too in the longer run.

Gallagher Company Interview Questions: Financial Terms to remember

Here, I am going to discuss the various financial terms particulary applicable for real estate interviews at Gallaher and Mohan.

Cap Rate:

So, don’t get all bogged down by hearing this term. All that it means is a dividend yield but in real estate paralance.

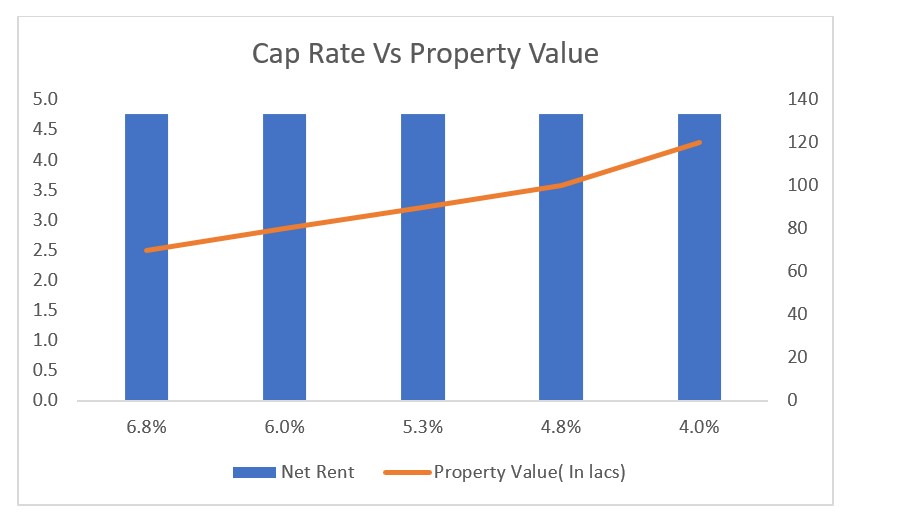

So for example a 2bhk flat has a rent of INR 4 Lacs and maintenance is INR 24 K, then your net operating income is 4.76 Lacs. Now, let’s suppose the property is available for INR 90 Lacs. Then the cap rate is : 4.76 Lacs/ INR 90 Lacs = 5.2%. So that’s the acquisition cap rate.

Also, try to understand why we calculate this,

So, if we are acquiring a new property generally speaking you want the rent to be higher and property value to be lower. That is the ideal, situation because who doesn’t want a cheap stock and good dividends right? However, at the same time such properties will come with higher risks compared to properties with lower acquisition cap rates.

Other Applications of Cap Rate

Now, apart from the absolute meaning of cap rate, it is generally used to compare two different properties. For example;

- Property 1: Has a rent of INR 4 Lacs, purchase price of 80 Lacs. Which in term converts to a cap rate of 5%

- Property 2: Has a rent of 4 Lacs too, but the purchase price is 100 lacs. So, that has a cap rate of 4%.

Now, if interpret this the property 2 is more expensive than property 1.

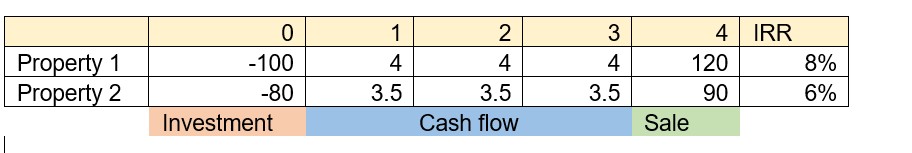

What is IRR( Internal Rate of Return):Gallagher Interview Question

So, I know you might be aware of the general definition, “ IRR is the rate at which NPV becomes zero”, but never explain this in an interview like this.

Simply explained, IRR is the average Compounded annual growth rate of cash flows which are uneven.

So, all that the IRR function is doing is that it is trying to find a rate at which all your initial investments become equalised to the cash flows. In return finding you the average rate of investment compounding.

Now, if you compare both the properties, then property 1 is giving you a better return prospect.

What is Cash on cash Return

So in real estate business everything revolves around cash. Any realtor would agree that all the matters is not paper returns, but how much you made in real. This could be also one of the tricky Gallagher interview questions, is to explain what is cash on cash return.

So, simply put cash on cash return is the pre-tax cash flow received divided by the total investment which is actually done.

Cash on cash Return Example

So let me take an example here;

Suppose you purchase an apartment In a posh locality, for INR 70 Lacs. Also, for the same purchase you took a 60 lacs debt and 10 lacs you paid as down payment. Apart from that you also paid INR 20,000 in maintenance, 10,000 for insurance. Along with this, you repaid 7 Lacs in EMI’s out of which 1 lac is principal repayment and 6 Lacs is interest.

Now after one year, you sold the property for 90 Lacs INR. So what is the cash on cash return?

So let’s calculate the total inflow of cash: INR 90 Lacs – 59 Lacs( Debt)-6 lacs (Interest)- 10 Lacs( Down payment)- 30,000( Other expenses)= INR 14 Lacs

Hence, the total of INR 14 Lacs is the cash inflow. But now, we need to compare that against the total investment we have done.

Total investment done= INR 10 lacs+ 30,000+ 6 Lacs interest= 16.3 Lacs.

So the cash on cash return=14 Lacs/ 16.3 Lacs = 90% Return

What is Discounted Cash Flow Analysis?

Now, no calculation is complete without discounted cash flow analysis. You can check the detailed discounted cash flow analysis with this template and video lecture.

You can download the template from this article of real estate valuation.

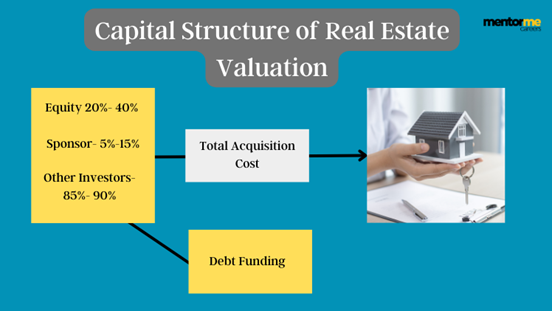

What is the capital structure of a typical real estate investment?

So, the above depiction is the general structure of funding a real estate investment. Where, in total the equity is around 20% to 40%, while that equity is funded by sponsors and other investors. While the same investments is again 80-90% funded using debt funding.

Behavioural + Role-specific questions

1. Why do you want to work at Gallagher, and what do you understand about our business?

I want to work at Gallagher because it is a global leader in insurance brokerage, risk management, and consulting. I understand that Gallagher helps clients identify risks, design insurance solutions, and manage financial and operational exposure. In India, Gallagher’s GCoE supports global clients through finance, insurance operations, analytics, and compliance work. The role aligns with my interest in structured finance work, accuracy, and long-term learning.

2. Tell me about a time you worked with data where accuracy was critical.

During my academic project/internship, I worked on financial statements where even a small error changed the final outcome. I double-checked formulas, reconciled totals, and cross-verified numbers with source data. This taught me that accuracy is more important than speed, especially when reports are used for decision-making.

3. How do you handle repetitive or process-driven work without losing focus?

I treat repetitive work as a responsibility, not a burden. I follow checklists, break tasks into smaller steps, and regularly validate outputs. Knowing that small mistakes can create bigger risks keeps me focused and disciplined.

4. Describe a situation where you had to follow strict rules or guidelines.

In academics/internship, I followed defined procedures for data submission and reporting. I ensured compliance by understanding the rules first, documenting my work, and verifying outputs before submission. If unclear, I asked for clarification instead of making assumptions.

5. How do you manage deadlines when working with global teams across time zones?

I plan tasks in advance, understand cutoff times, and prioritize work based on urgency and dependency. If there is a risk of delay, I communicate early. Clear communication helps avoid last-minute issues with global stakeholders.

6. What would you do if you noticed an error in a report already sent to a client?

I would immediately inform my manager with a clear explanation of the error and its impact. Correcting the issue transparently is more important than hiding mistakes. Gallagher’s credibility depends on integrity and accuracy.

7. Explain a finance or accounting concept you recently learned in simple terms.

Working capital is the money a company needs to run its daily operations. If receivables increase, cash is blocked. If payables increase, cash is temporarily saved.

Managing working capital helps a company stay liquid.

8. How do you prioritize tasks when everything seems important?

I prioritize based on deadlines, risk impact, and dependencies. Tasks affecting client delivery or compliance come first. I also communicate with my team to confirm priorities if required.

9. Tell me about a time you received critical feedback. How did you respond?

I received feedback on improving accuracy and presentation. I accepted it positively, corrected my approach, and applied the suggestions in future work.

Feedback helps me improve professionally.

10. Where do you see yourself in 2–3 years at Gallagher?

I see myself growing into a strong analyst role with a deeper understanding of insurance, risk, and finance processes. I want to add value through accuracy, reliability, and continuous learning within Gallagher.

Case-based finance & risk questions

1. Totals don’t match during reconciliation. What steps will you take?

First, I would recheck source data and system extracts. Then I would trace differences line by line, verify formulas, and identify mismatches. If unresolved, I would escalate with documentation. I would not finalize the report until the issue is resolved.

2. The client policy document has missing information but the deadline is close. What do you do?

I would flag the missing information immediately and inform my manager/client team. Submitting incomplete data creates risk, so I would prioritize correctness over speed and seek approval before proceeding.

3. Repeated small discrepancies in monthly reports. How do you handle this?

I would analyze patterns, identify root causes, and check whether it’s a system issue or manual error.

Then I would document findings and escalate for corrective action.

4. The senior asks you to bypass a process to save time. What do you do?

I would respectfully explain that bypassing controls may create compliance or audit risk.

If pressure continues, I would escalate to my manager. The following process is non-negotiable at Gallagher.

5. The insurance claim amount seems unusually high. What checks will you perform?

I would compare it with historical claims, review policy coverage, verify supporting documents, and check for data entry errors. If concerns remain, I would escalate for further review.

6. Two systems show different data for the same account. How do you decide which is correct?

I would check data sources, timestamps, and system ownership. I would validate against primary records and confirm with relevant teams before using any data.

7. You are unsure about an assumption but the report must be sent. What do you do?

I would raise the concern immediately, explain the uncertainty, and seek clarification.

It is better to delay slightly than send incorrect information.

8. How would you explain financial risk to a non-finance colleague?

Financial risk means the possibility of losing money due to unexpected events like default, market changes, or operational failures. Managing risk means identifying these possibilities early and reducing their impact.

9. You are assigned a task outside your comfort zone. How do you approach it?

I first understand the task, review available documentation, and seek guidance if needed. I break it into steps and ensure accuracy rather than rushing.

10. If an internal audit flags an issue in your process, how do you handle it?

I would accept responsibility, understand the root cause, implement corrective actions, and ensure the issue does not recur. Audits help improve processes, not punish individuals.

Roles Gallagher Hires For in India

Gallagher hires across finance, insurance, analytics, and operations functions in cities like Bengaluru, Pune, and Gurugram.

1. Finance & Accounting Roles

Common titles:

- Financial Analyst

- R2R / FP&A Analyst

- Accounting Associate

- Financial Reporting Analyst

Interview focus:

Basics of accounting, financial statements, reconciliations, accuracy, deadlines.

2. Insurance Operations & Analyst Roles

Common titles:

- Insurance Analyst

- Policy Administration Analyst

- Client Service Associate

- Risk Analyst

Interview focus:

Understanding insurance concepts, attention to detail, process orientation.

3. Analytics & Data Roles

Common titles:

- Business Analyst

- Data Analyst

- Reporting Analyst

Interview focus:

Excel, data interpretation, dashboards, logic, communication.

4. Compliance, KYC & Risk Roles

Common titles:

- Compliance Analyst

- KYC / AML Analyst

- Risk & Control Analyst

Interview focus:

Process understanding, regulatory awareness, documentation, risk mindset.

5. Technology & Support Roles

Common titles:

- Systems Analyst

- Application Support

- Automation / Reporting Support

Gallagher & Mohan Interview preparation tips

When interviewing at Gallagher:1.Do not oversell investment banking or trading ambitions

2.Show interest in insurance, risk, analytics, and operations

3.Highlight process orientation and attention to detail

This alignment significantly improves selection chances.

Conclusion:

This is the best possible way, I could give you a general direction of preparing for Gallagher company interview questions. Also, if you want to learn this properly and in more depth and also get placement support for the same then check mentor me careers, financial Modeling course.