Last updated on October 23rd, 2024 at 02:23 pm

Ever wondered why you cannot exactly predict, stock prices no matter how much technology you use? Now, imagine a world where computers where able to actually predict stock prices. Which would mean that there was no need to analyse anything but just bet on predictions. A theory called as random walk theory, suggests that you cannot predict stock prices, because they follow a principle where each movement is independent of each other.

What Is Random Walk Theory?

According to the random walk theory, it is hard to anticipate how prices will move in the investment world. A random walk is followed by stocks and other financial assets. In other words, it’s impossible to predict whether another price action will be upward or downward or how steeply it will rise or fall. The term ‘random walk hypothesis’ is also used for the same interpretation.

A random walk is just a mathematical notation for a path that is made up of a series of random steps.

Many economists believe that because of this unpredictability, investors will not be able to consistently outperform the market.

Some economic experts, on the other hand, disagree, claiming that asset values do not implement a random path and can be predicted. In other words, they think that it’s possible to consistently outperform the markets.

Stock price changes, as per the random walk theory, have the same allocation and are entirely independent of each other.

Because of it, it is difficult to predict where such a stock will go based on past trends.

Simply put, the random walk theory states that stock prices follow an arbitrary, haphazard, and completely unexpected path.

Equation

So, with the risk of sounding too technical let me try to explain random walk using its technical equation. So, S t+1 basically means the price that we are trying to predict. Which is depending on the price today which St, plus the µ which is a drift constant multiplied by the change in time and the standard deviation at t. However, that is find the random element of the equation actually comes from the second part of the equation that says standard deviation of the random probability of an independent variable that no one knows.

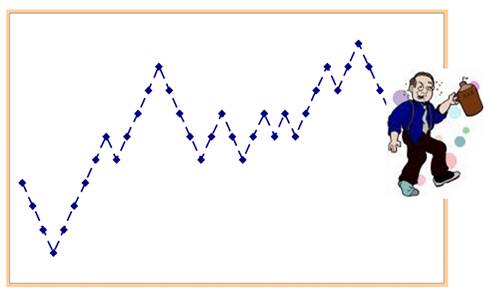

As per business dictionary.

“Theory of stock market analysis that share prices (and the equity markets) follow a patternless (random) path similar to a drunkard’s walk.”

“As a result, their potential course is uncertain, and the best stock price forecast is equivalent to its actual cost plus an unforeseen positively or negatively random error.”

We have a slim chance of surpassing the stock market. They’re no stronger than our chances of correctly predicting the drunkard’s path above. According to random walk theory, asset values move arbitrarily, i.e., they are hard to anticipate.

Explanation of the Random Walk Theory

According to random walk theory, the market can’t be surpassed without taking on more risk. Because chartists only purchase or sell a security after a pattern has emerged, it believes technical assessments to be unreliable.

Similarly, the theory considers the fundamental analysis highly unreliable because of the frequently low quality of obtained data available and its potential for misinterpretation. Opponents of the thesis say that stock prices will maintain their tendencies throughout time. That is, it is possible to outperform the market by carefully identifying entry and exit points for equities transactions.

History of the Theory

The random walk hypothesis was first proposed in a book written by Jules Regnault (1834-1894). Regnault was a stockbroker’s assistant in France. He was one of the 1st to propose a “stock exchange science” based on stochastic and statistical data.

In his 1900 Ph.D. dissertation, The Theory of Speculation, French mathematician Louis Bachelier (1870-1946) included several important insights and commentary.

In his book in 1964, The Random Character of Stock Market Prices, Paul Cootner (1930-1978) expanded on Bachelier’s ideas. Crootner was an MIT Sloan School of Management professor who specialized in financial economics.

In a 1953 paper titled The Assessment of Economic Time Series, Part 1: Prices, Maurice Kendall (1907-1983) discussed prices. Kendall, a statistician from the United Kingdom, proposed that stock prices fluctuated at random. To put it another way, he didn’t think there was a pattern or a trend.

Princeton University Economics Professor Burton Malkiel popularised the term “random walk hypothesis” in his 1973 book A Random Walk Down Wall Street.

Supporters of the non-random walk theory believe that by observing past trends, we can predict outcomes about stock prices.

As Simple As Flipping A Coin

Prof. Malkiel conducted a test wherein his students were provided hypothetical stocks worth $50, which was as random as flipping a coin. The terms stocks and shares are interchangeable in the corporate world.

Each day’s closing stock price was determined by a coin flip. Heads meant the price went up half a point. But on the other side, tails meant it was down half a point.

As a result, each day had a 50/50 chance of ending larger than the corresponding day’s close. Prof. Malkiel as well as his colleagues, attempted to deduce patterns or feedback loops from the tests.

Prof. Malkiel then published the findings of his tests to a chartist in the form of a chart and graph.

Someone who attempts to determine future movements is known as a chartist. They do so by attempting to decipher historical patterns. They think history has a proclivity for repeating itself.

The chartist advised Malkiel to invest in stocks right away. The fictionalized stock participants used in the experiment had no general trend because the coin tosses were random.

This, according to Prof. Malkiel, indicated that stocks and financial sectors could be as spontaneous as tossing a coin.

Theory of non-random walks

Many shareholders and economists agree that the market can be predicted to some extent. Several academics agree.

Prices, they believe, may follow certain patterns. As a result, they claim, we could really foresee which way stock prices will go by studying past prices.

This viewpoint has been supported by the findings of some economic studies. A book called A Non-Random Walk Down Wall Street was written by the Charles E, Andrew Wen-Chuan Lo and Susan T. Harris Professor of Finance at the MIT Sloan School of Management, and A. Craig MacKinlay, the Joseph P. Wargrove Professor of Finance at the University of Pennsylvania’s Wharton School. It attempts to prove that the random walk theory is incorrect.

Prof. Weber demonstrated the sharemarket for a decade in one study. He studied market rates for detectable trends over the course of ten years.

Prof. Weber ultimately noticed a pattern with stocks that had a considerable price hike in the first five years of their existence. During the 2nd half of the decade, they also underperformed.

This observation is frequently cited by Prof. Weber and colleagues, particularly when they criticize the random walk theory.

Implications for Passive Investing

The random walk theory suggests that active funds (i.e., passive “hands-off” investing) should make up the foundations of a portfolio, particularly for non-shareholders.

Index funds are a type of passive investing that has become increasingly popular as theories like the random walk theory and effective management has been scrutinized and found to be ineffective in terms of both time (and effort) and fees.

Index funds such as the following have benefited from the transition from active management to passive investing:

- Exchange-Traded Funds (ETFs)

- Mutual funds

Implications on Efficient Market Hypothesis

Random, unpredictable events, based on the random walk theory, cause share price fluctuations.

For example, the market’s reaction to unforeseen circumstances (and the price impact) is determined by how stockholders interpret the incident, which is also random and unpredictable.

The efficient market hypothesis, on the other hand, proposes that equity prices fully reflect all available insights in the market, which is divided into three tiers.

1. EMH with a Weak Form:

The market prices reflect all previous information, such as historical rates of exchange and trading volume.

2. EMH Semi-Strong:

The current stock prices fully reflect all publicly available data accessible to all market players.

3. EMH in its Strongest Form:

The current stock prices fully reflect all available information, including insider knowledge.

Criticisms

Although the random walk and market efficiency theories are based on different assumptions, they reach nearly identical conclusions — namely, that consistently outperforming the market is nearly impossible and that further supports passive investing over actively managed strategies.

Random Walk Theory is criticized.

- Because the share market is supposed to be efficient, market prices cannot be underpriced or overhyped, according to the EMH theory.

- The difficulty with the random walk theory is that stock prices would be rational if the industry were hypothetically efficient, as proposed by EMH (and changes are not necessarily out of the blue).

- In contrast, if somehow the random walk theory is correct, the assumption invalidates the EMH’s proposal because it implies that the share market is irrational.

- The assertion that the share market corrects itself instantly once fresh data is revealed publicly is also a flaw in the random walk theory.

However, the problem is that, particularly for thinly traded assets, share prices can take a long time to stabilize. Unexpected events have an undeniable impact on stock prices, but there are also observable trends and behavior tendencies among many market players that can have a direct effect (e.g., momentum, overreaction).We hope that through this blog we have provided you with the answers you were looking in terms of Random walk theory.

Recommended Books

If you are interested in reading a practical piece of random walk then I would highly recommend you to read, Fooled by randomness By Nicholas Taleb.