What is Bird in Hand Theory?

The bird in hand theory comes from the proverb that, “A bird in hand is worth more than two in the bush”. While the context of this theory in investment is that you as an investor would invariably prefer stocks which pay higher dividends, compared to stocks which don’t. Also this theory stands on the principle, that there is certainty of dividends. While, if that was not true, then the same money would be invested, in hopes of higher returns in the future. But the future is uncertain.

Effect of Dividend Paying & Non Dividend Paying on Returns

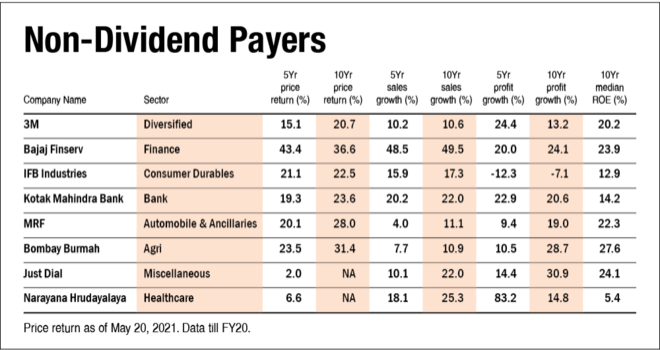

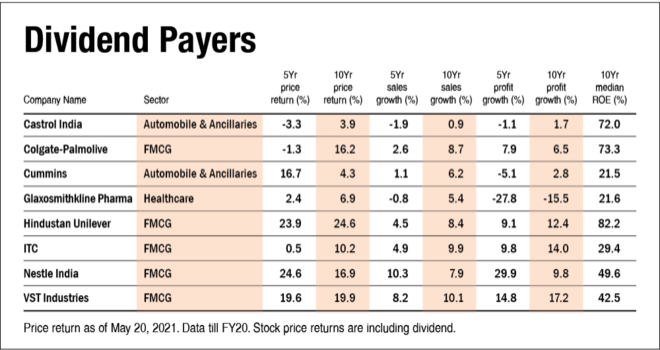

So, let’s try to see if dividend paying stocks have any effect on returns. Because, this theory suggests that non dividend paying stocks should not ideally give price returns. So I am relying on a case study done on this by value research. Which used BSE 500 stocks as the universe. In this universe, stocks were chosen which paid more than 40 percent dividends in each of the last 10 years. While at the same time, comparing it with stocks which paid less than 5 percent of profits as dividends.

Results of the Bird in Hand theory

The results are surprising but here are some of the observations done using the bird in hand theory on real stocks:

- Top dividend paying companies comprised majorly FMCG companies

- Whereas most of non dividend paying companies where of Indian owners.

- Non dividend paying stocks return double digit returns at 19.7%, while dividend paying stocks returned only 9.6% on an average.

Background Factors

Sometimes, there is a problem with data analysis, is that you try to join the dots which are basically the outcomes. However, you don’t look at the inputs. Where my question is that, is this because of dividends or because of plain good business.

Try to think about it. Why would a company perform better just because whether they pay the dividends or don’t pay? And why would some companies not pay dividends? Well, first of all because they have a place to invest, instead of distributing it. And at the same time if those investments, generate higher returns then it is shown in higher profitability. Which finally is spotted by investors and results in better stock performance.

The Bird in Theory in terms of Taxation

Firstly, the major problem with the bird in hand theory is that it allows the dividends to be taxed at the hands of the investor. While if the same dividends was not given, it won’t be taxed. Hence, that is better utilization or use of taxation strategy.

Also if you look at the price gains that you get from reinvesting the cashflows in the business. Is that the increase in stock price enjoys the benefit of indexation and lower tax rate at 15%.

Disadvantages of Bird in Hand theory

It would be interesting for you to know that over the long term the pure dividend paying stocks have earned lower returns compared to non paying dividends. And that makes sense too, because dividend paying stocks are guaranteed returns, versus non dividend paying stocks. But remember that guaranteed returns will always be lower than uncertain returns.

International Example of Bird in Hand Stock

The biggest company in the world which falls under the bird in hand theory is, COCA cola which began paying dividends since the 1920’s. And has never stopped paying it. Moreso, the company has only kept on increasing the dividend over the years.

Frequently Asked Questions(FAQ’s)- Bird in Hand theory

Who and when was the bird in hand developed?

The bird in hand theory was initially proposed by Linter in the year 1956, while the theory was officially presented by 1963. This was done as a contradiction to the theory of dividend irrelevancy proposed by Modigliani -miller.

Why the bird in hand theory doesn’t work in real life?

For a simple reason, that companies that who don’t pay dividends use those undistributed profits to invest in newer business opportunities to generate new returns.