Last updated on January 18th, 2023 at 06:18 pm

You must have heard in the news that recently BPCL announced an Rs58/ dividend per share on September 2021. So, whenever you invest in the shares of a company you become the owner of the company. A dividend is given to the owners (shareholders) whenever the company makes a profit. So, what exactly is a dividend per share and how to calculate dividend share? Also, we will touch upon, the dividend share formula

Dividends of course attracts a dividend distribution tax, close to around 15%. Hence, let’s say that I as the owner of a company declare that INR 200, would be declared as total dividends to all the shareholders. For now, let’s assume that the total shareholders are 5.

Hence, first, the dividend post-tax needs to be calculated. Which is, 200 /(1-15%)= 235.29. Which, means 35.29 is the dividend distribution tax.

After the introduction of the finance act 2000, now dividends is taxable in the hands of the investors. So, continuing with the same example, let say you had received, a total dividend per share of 20. Now, previously you didn’t have to worry too much on the taxation, because DDT was already paid.

However, now the companies don’t have to pay DDT, & you will have to pay that 15%. Now, the calculation, would look something like below

| Particulars | Amt |

| Dividend | 200 |

| Number of shares | 5 |

| Dividend per share | 40 |

| Tax rate | 15% |

| Dividend Including Tax | 47.05882 |

| Tax | 7.058824 |

| Tax % | 0.176471 |

What is Dividend and what is Dividend Yield?

A Dividend is a distribution of cash or stock to the company’s shareholders as a reward. The decision of giving dividends is made by the Board of Directors. This decision is then approved by the shareholders through their voting rights. The dividend is a part of the profit that the company shares with their shareholders. It is not mandatory for companies to give dividends but giving dividends may attract a lot of new investors. The dividend is declared on a per-share basis. This dividend is paid to the company’s shareholders on the ex-dividend date. All the investors who have that company’s share in their portfolio on the ex-dividend date are eligible to get the dividend. [1] [2]

The dividend yield is expressed as the dividend per share divided by the current market price of that stock [3]. It is expressed in percentage. In other words, dividend yield calculates the percentage of a company’s share price that is to be paid to its shareholders. So, if a company’s share price is $60 and they declare a dividend of $3.5/share, then the dividend yield is 3.5/68 = 0.058 =5.8%

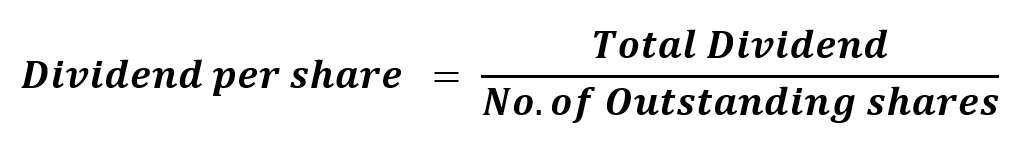

In simple words, dividend per share (DPS) is calculated by using the Total dividend and the total number of outstanding shares [4]. Its formula is:

DPS = Total Dividends Paid / Number of Outstanding Shares

Total Dividends Paid: This is the total amount of dividends paid out by the company in a specific period, usually a quarter or a year. This information can be found in the company’s financial statements or in the company’s dividend history.

Number of Outstanding Shares: This is the number of shares of stock that are currently owned by shareholders. This information can be found in the company’s financial statements or by looking up the company’s stock information on a financial website.

For example, if a company paid out $1 million in dividends for the year and had 10 million outstanding shares, the DPS would be:

DPS = $1,000,000 / 10,000,000 = $0.10 per share

It’s worth noting that, the DPS is calculated on a per share basis, so it gives investors an idea of how much they will receive in dividends for each share they own.

It’s also important to keep in mind that, companies may also pay stock dividends which is the distribution of additional shares of stock to shareholders. In this case, the calculation of DPS may not be possible as the company is not paying cash dividends.

In summary, calculating the dividend per share is a straightforward process that involves dividing the total dividends paid by the number of outstanding shares. This calculation provides investors with a useful metric for evaluating a company’s dividend policy and potential returns on their investment.

Types of Dividends

1. Cash Dividend

A cash dividend is a type of dividend which is paid in cash to the company’s investors. Cash dividends are the most common type of dividends given to the shareholders. These are paid on a per-share basis, and they are directly credited to the bank account. Cash dividends are further classified into [6]:

- Special dividend: Special dividends are one-time dividends that a company pays to its shareholders in the form of cash. Since it’s a one-time affair, special dividends are also tied to particular events which may have led to windfall gains for the company.

- Interim Dividend: An interim dividend is a dividend payment made before a company’s annual general meeting (AGM) and release of final financial statements.

- Final Dividend: The final dividend is declared for a preceding financial year and after the accounts and financials have been prepared for the fiscal year under consideration.

2. Stock Dividend

Stock dividend is when a company issues extra shares to its shareholders and gives them as a bonus. For example, if a company issues a 3:1 bonus, this means that the shareholder will be getting an additional 3 shares for every 1 share he has in his portfolio. So, if you have 15 shares of that company, you will get an additional 15/3=5 shares.

One of the main factors that determine the DPS is the company’s earnings. Companies with strong earnings are more likely to pay higher dividends, as they have the financial resources to do so. Additionally, the company’s dividend policy and the overall state of the economy can also affect the DPS.

Another important consideration for investors is the dividend yield, which is calculated by dividing the annual dividend per share by the current stock price. A higher dividend yield indicates that the company is paying out a higher percentage of its earnings to shareholders in the form of dividends.

In India, companies are required to pay out at least 30% of their net profits as taxes. Some companies may choose to pay out a higher percentage depending on their financial position and future growth plans.

It’s worth noting that the dividend pay-outs are not guaranteed and companies may change the dividends as per their financial conditions. Additionally, the company’s management may choose to retain earnings to invest in growth opportunities, rather than paying out high dividends.

Dividend per share (DPS) and stock dividends are two different ways in which a company can distribute profits to its shareholders.

Dividend per share refers to the amount of cash that a company pays out to each shareholder for each share they own. This amount is determined by the company’s board of directors and is typically paid out on a quarterly basis. The dividend per share is usually expressed in terms of rupees per share.

Stock dividends, on the other hand, involve the distribution of additional shares of stock to shareholders, rather than cash. These additional shares are issued in proportion to the number of shares already owned by the shareholder. For example, if a company declares a 10% stock dividend, a shareholder with 100 shares would receive 10 additional shares.

Both dividend per share and stock dividends represent a distribution of a company’s profits to shareholders, but they differ in the form in which they are paid out. Dividend per share is paid out in cash, while stock dividends are paid out in the form of additional shares of stock.

Stock dividends are generally less preferred than cash dividends as they don’t provide immediate income to shareholders, also the value of the additional shares may be affected by the market conditions and the company’s future performance. On the other hand, cash dividends provide shareholders with immediate income, which they can choose to reinvest or use for other purposes.

In summary, while both DPS and stock dividends are ways for companies to distribute profits to shareholders, they differ in the form in which they are paid out. Investors should consider both options when evaluating a company’s dividend policy and potential returns on their investment.

DPS effect on Stock Price

The effect of dividend per share (DPS) on stock price is a topic of ongoing debate among investors and financial analysts. Some argue that a higher DPS can lead to a higher stock price, while others believe that it has little impact.

One of the main arguments in favor of a positive relationship between DPS and stock price is that dividends provide a tangible benefit to shareholders in the form of cash payments. This can make a stock more attractive to investors, leading to increased demand and a higher stock price. Additionally, a company that consistently pays dividends may be seen as more financially stable and reliable, which can also contribute to a higher stock price.

On the other hand, some argue that dividends have a limited impact on stock price. This is because the amount of dividends paid out is typically a small portion of a company’s overall earnings, and the stock price is more heavily influenced by factors such as earnings, revenue, and overall economic conditions.

Another argument is that dividends can also signal that the company does not have any good investment opportunities to retain earnings, which can lead to a decrease in the stock price.

It’s worth noting that the relationship between DPS and stock price can vary depending on the specific company and the broader economic conditions. For example, in a strong economy with a positive outlook, a company with a high DPS may be more attractive to investors than one with a low DPS.

Conclusion

A high DPS tells us that the company is performing well, is turning in good profits and has enough liquid cash so that it can reward its shareholders. Dividends paid are also helpful for the company to get tax benefits. On the other hand, the dividend money is not being re-invested in the company. This can serve as a not so good sign. This means that high dividend-paying companies should not be considered as the deciding factor to invest in a company. Also, a high dividend giving company might be fundamentally flawed so do not forget to do your own research regarding the company.