Last updated on April 25th, 2023 at 05:44 pm

Interim dividend meaning is simply dividend payments which company pays either quarterly or semi-annually before the annual general meeting of the company or the annual results.

Interim Dividend Meaning Summary

- Firstly, The company gives many types of dividends before the annual general meeting.

- Secondly, it Indicates a good year or profitable period

- Thirdly, it is Paid out of previous reserves

- Also, The final dividend is paid out of the current fiscal year’s profit

- Finally, They need approval from the board of directors

Colgate announced that they would be thinking about giving interim dividends.

Why would they think of it?

The answer to that is multifold, and motivations can be many!

So next time you see anything apart from final dividends given during the annual results, by all means, try looking beyond just the news!

Now, Let me get started!

What is a Regular Dividend?– How is it Different from Interim Dividend Meaning

Let me put it this way; final dividends are simply the distribution of profits to its owners when the company doesn’t have growth plans.

I find this tricky that the board of directors represents the decision to give dividends since a single shareholder won’t have much say always.

Ideally, in the rational world, dividends should signal pessimism!

However, the research has mixed results with no clear answer as to its effects.

Let’s look at some essential features of dividends:

- First, as per my observations, a company with a consistent annual dividend distribution on annual basis is looked at positively.

- Secondly, this is not my opinion but dividends are declared on a per-share basis or on a pro-rata basis.

- Thirdly, if I have to qualify for dividends, I need to be invested before the ex-dividend date.

- Lastly, all the investors who have that company’s share in their portfolio on the ex-dividend date are eligible to get the dividend. [1] [2]

Moreover, if you don’t understand dividends, please read this article.

Interim Dividend Meaning in Detail

Why would a company do that midway?

Typically this kind of dividend is paid out quarterly, semi-annually from retained earnings.

Also, in My opinion, is that by all means, interim dividends paid out of profits could be a sign of either.

- First, there is new cash with no reinvestment options, so it’s better to give it back.

- Second, the quarter is so good that it makes sense to distribute some earnings to boost the morale of the market.

In the UK, the frequency of giving dividends is more than in the other countries.

Before I forget, Why are we even discussing this?

Simply because logically

- That’s because, these are paid out of old cash reserves, hence dipping into the share capital.

- Ordinary dividends are always paid out of current financial year performance.

So, the need for running back on old reserves does deserve a blog!

Interim Dividend Meaning Example

Advani Hotels Resorts India Ltd is a small-cap company having a market cap of ₹382.93 Cr and the company deals in the Consumer Discretionary sector. The company has declared an interim dividend of Rs. 2.00 and the Board of Directors of the company have fixed December 29, 2022, as the record date for the purpose of ascertaining the eligibility of shareholders for the payment of interim dividend.

Special Dividend Example

The stock announced a special interim dividend of 8500% or Rs 850 per equity share earlier this year. It announced the massive dividend on November 9, 2022. The large cap diversified sector stock last trading price is Rs 23173 apiece. It has a market capitalisation of Rs 26,104 crore. The stock has given maximum 50% return in the last 5-years.

Eligibility

To qualify for this kind of dividend, you need to fall under the below scenarios.

- Be an equity shares shareholder before the announcement and dividend declaration date or the record date.

You can’t just buy the stock after the company declares it!

Unobvious Differences between both: The Hidden objective?

Apart from the apparent difference between them, on the contrary, let’s also look at some interesting differences between them.

- An interim stock dividend can be released to increase the stock’s liquidity in the market.

- Distribution of which can increase the dividend yield making the stock more attractive.

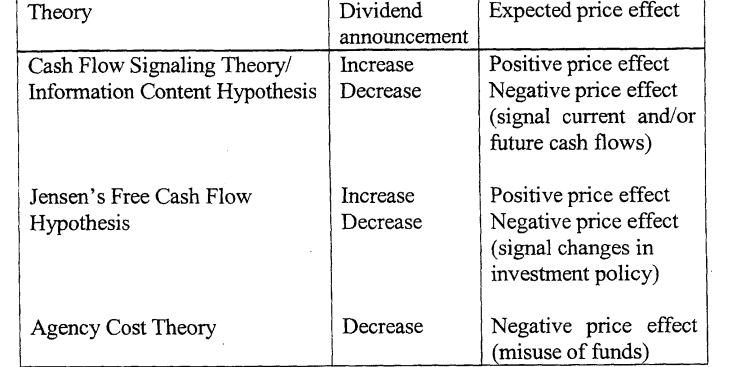

- As per the dividends signalling theory, there is a strong relation between abnormal stock returns post interim tips announcement.

- The interim announcement also proves the asymmetry in the information between the management and the investors.

- Interim dividends usually are declared during sluggish times.

The third point is important because usually, no one expects an announcement!

If I were an analyst, I would dig more profound when a company announces this!

Another critical research also found that during economic downturns, these announcements have almost had positive effects on the stock/ share price.

So, I hope you get the point.

Are you ready to dig further?

Studies On Interim Dividend Effects

It’s hard to find research on dividends; however, after some digging, I was able to find some good solid research on this.

Let’s look at some of them below:

Source:ac.Uk

Asquith and Mullins Research

I had a hard time finding research on corporate actions( Dividends)!

However, I was able to get hands-on with some deep digging.

Therefore, I will take the risk here, going a little deeper.

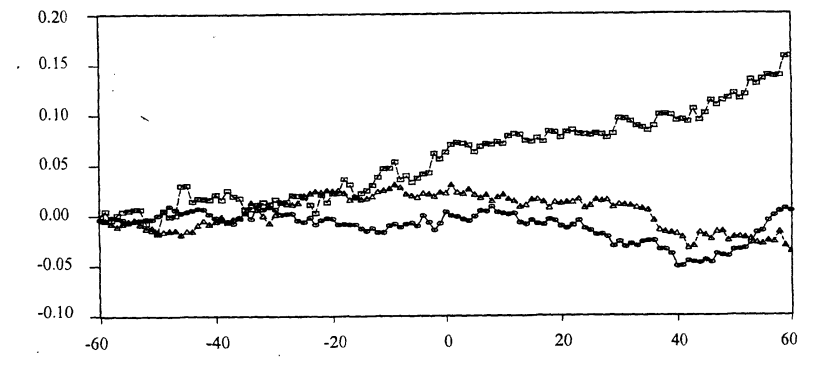

Asquith and Mullins (1983) initiated a comprehensive study, including the following scenarios.

- First,131 companies paid dividends for the first time

- Second, 172 companies didn’t pay dividends after ten years.

The year prior to the interim dividend announcement showed erratic stock performance, either financialy or price.

Observations Made

Mitra and Owers (1995)

I came across another identical research, which Mitra and owners conducted.

The financial results showed a strong relationship between the announcement and the stock performance.

Model shows a CAR 2.19%, Z statsitic of 5.08 for the study.

Above is the chart that shows the CAAR on event days, including both increments and decrement.

Fooled by Randomness

Is there a natural pattern, or does the randomness of corporate action fool us?

Why do I say this?

In the Malaysian context, announcing a decrease or reduction in dividends makes them happy!

Logically, that behaviour is rational because retaining dividends means companies got a plan.

However, the increase in dividends has a mixed reaction, which means people are happy and sad!

Conclusion

At the moment, I can only say that the effect of the dividend announcement is still in the nascent stages.

However, in the Indian context, ideally, such announcements should not generate abnormal returns.

Why?

The answer to that is two folds,

First, dividend distribution leads to double taxation, first at the hands of the company.

Second, dividend distribution is similar to spending or expense.

Why on earth? Should spending money be taken as positive?

I’ll leave that thought to you!