Last updated on June 15th, 2024 at 02:24 pm

Think about a situation where you wanted to calculate how much rent will I have to pay if, let’s say, you were about to leave 3 months before the end of the year. The initiative calculation that follows is nothing but pro rata basis. However, we will try to dig this a little deep to understand how to calculate this under various scenarios. In this article, we shall discuss the calculation, of this basis with examples.

So read on!

What is Pro-Rata basis?

So,Pro-Rata is a Latin Term – meaning “in proportion” that we use to assign value in proportion to something that can accurately be measured or calculated.

So If I give something to you on a pro-rata basis, it means I am assigning you an amount proportionate to the whole amount.. Hence, pro rata basis calculate is basically telling you the proportionate division of the share.In finance also the same concept I can use to calculate proporationate shares, or proportionate pro rata distribution of dividends.Now in North American countries, Mostly pro-rata is often referred to or preferred as “prorated”.

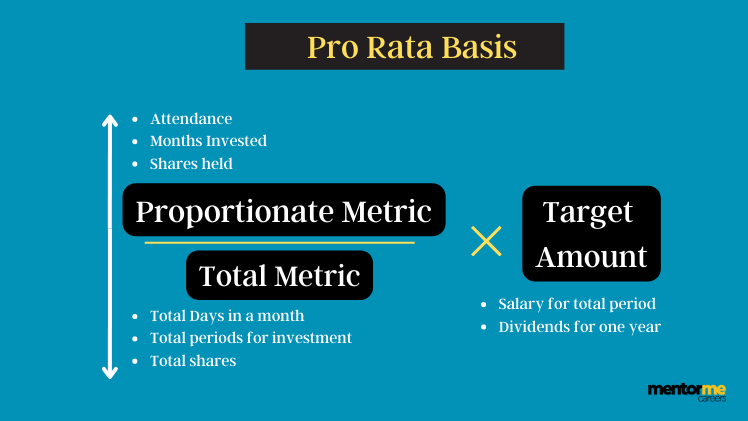

How to calculate Pro- Rata basis?

It’s best to understand the meaning of Pro-rata using an example;

Let’s say I was working in Goldman Sachs and was to receive a $240,000 bonus apart from my annual salary on completing 12 months of employment.

Now lets me create three distinct scenarios

- 3 Months

- 6 Months

- 9 Months

How much bonus would I get?

So, if you think of it without complicating it, you would simply do the following;

- Divide $240,000 by 12, i.e$20000 per month

- Multiply it by either 3,6,9

Hence $60,000,$120,000 or $180,000 respective for 3,6,or 9 months.

Here we calculated using the ultimate value and divided it by months.

Similarly, I could also calculate it by only sticking to time. For eg; 3/12 or 25%, 6/12 or 50% ,9/12 or 75%.

However, in both cases, the answer would be identical.

If this was a real situation and you had to communicate this as a policy then, you would rather use the percentage method.

Understanding Pro Rata Basis Rationale

Pro Rata basis means proportionate conversion of a value based on the linear relationship of two variables.

For eg;

Calculating the yearly bonus of an employee on a pro-rata basis, who joined in January 2022 with a signing bonus of $60,000. However, that employee decided to resign in September.Hence in this case the linear relationship is 12 months = $60,000. So one month is $5000 and hence on pro-rata basis the revised adjusted bonus on a pro-rata basis is $45000.

Interest Rates and Pro Rata Calculations

In financial scenarios, understanding the impact of interest rates is crucial when calculating pro rata distributions. For example, when distributing interest earned on investments on a pro rata basis, you must consider how varying interest rates can affect the overall distribution. This ensures that both full-time and part-time employees or investors receive their fair share according to the proportion of their investments or work hours.

Types of Calculation in Pro rata basis

So, you can use pro rata basis in so many applications without you actually realising it.

Pro rata Basis dividends

It literally means the division of something to make up a whole. Now I don’t mean that all parts are equal but that each part is given in proportionate to how much you own. Also,I find it particularly useful when the exact value of something can’t be easily determined by itself but I can easily calculate, a proportion value when compared to something else.

Let’s assume that Company ABC announces a $1,500,000 cash dividend payments for its shareholders. If the company owns 150,000 outstanding shares in the market, each dividend share is prorated to $10. The pro rata basis amount is determined using a simple formula:

Per Share Dividend = Total Dividend Amount / Total Number of Outstanding Shares

Using this formula, we get the per-share pro rata distribution of dividend amount: 1,500,000 / 150,000 = $10 per pro rata share

pro rata basis in investments

Even if you are not an investor or working in the financial sector, you will still encounter pro rata basisat some point in your life. For example, if you’re moving into an apartment on any day other than the first day of the month, then your landlord is likely to pro-rate your rent for the month.

They will do so by dividing the total monthly rent due by the number of days in the month to determine the amount of the rent that is proportionate to each day. They will then multiply that amount by the number of days that you will be occupying the apartment that first month. Let’s say that you are moving on the 15th of October and your monthly rent is $700.

- Determine your pro-rated per day:

700/31 = $22.58

- Calculate pro-rata for the month:

$22.58 x 16 (no. of days of occupancy) = $361.28

Valuation

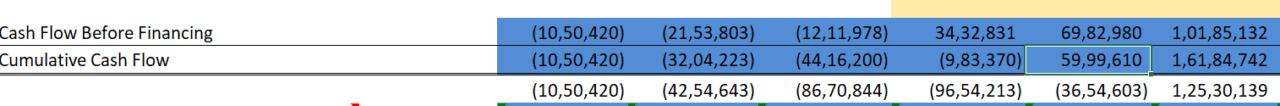

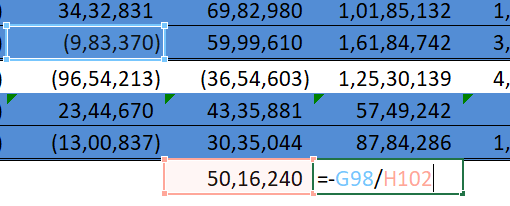

Consider the following financial model in the valuation stages.

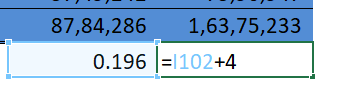

The cumulative cash flow shows that between the 5th and 6th year, the initial investment is recovered. However, if we want to know the exact number of years it takes to recover the investment of 3 years then again we need to use the pro rata basis concept.

- So what we could do in such cases is first to write down the integer value of the year preceding the positive cash flow year. i.e 4th Year.

- The actual fraction after 4 is what we need to find

- So let me subtract 5th-year cash flow and 4th-year cash flow to find the difference to be recovered; 5999610-983370=5016240.

- This means we have 5016240 to recover -983370.

- Divide 983370/5016240

- Now add 4 + the fraction calculated. i.e. 4.2

Pro Rata Basis for Part-Time Workers

Pro rata calculations are particularly useful for determining the benefits and pay for part-time workers. For instance, part-time employees might receive bonuses or benefits based on their working hours proportionate to full-time staff. If a company offers a $1,200 annual bonus to full-time employees, a part-time worker working 50% of the hours of a full-time employee would receive a $600 bonus. This ensures fairness and equity in employee compensation.

The disadvantage of Pro- Rata

I am unsure if you have noticed, but Pro-rata calculation has subtle yet strong assumptions. Consider my following arguments;

- In the bonus calculation, it automatically assumed that all months are equal but are they? There could be months like December which has 10-day holidays, but if an employee joins in October and leaves on 1st January, then you have paid him more.

- Similarly, in my valuation example, I have assumed that the investment has been recovered equally across all periods.

Sometimes, we also call this linear interpolation. However, things are not linear in the real world and such approximations need to be cross-checked for their purpose.

Conclusion

Pro-rata is no doubt anything but our instinctive approximation using a linear calculation. At the basic level, the concept should be clear that you need some form of an existing data series which is linear itself, like time.