Last updated on December 27th, 2022 at 03:08 pm

What is Annual Return?

The annual return is the capital gain on an investment generated over 1 year and it is calculated as a percentage of the initial amount of investment. If the return is positive, it is considered as a gain on the initial investment and if the return is negative, it is considered as a loss. The rate of return may change depending on the level of risk of the investment. For e.g., the rate of return in equities is more than compared to debt funds but it is riskier than debt funds. The returns also include dividends, returns of capital and capital appreciation. The annual return signifies a geometric mean rather than an arithmetic mean. Annual returns are useful when a person wants to check the performance of their investment over time or even to compare two investments with different time periods.

Understanding Annual Return

The annualized return expresses the investments grow in value over a designated period of time. To calculate an annual return, one needs information regarding his initial investment and the current price of the investment. In stock securities, if any splits have occurred, the price needs to be adjusted accordingly. A simple return percentage is calculated by subtracting the purchase price from the current price and then dividing it by the purchase price.

The formula for Annual Return

Here,

CAGR = compound Annual Growth rate

Years = holding period, in years

Example

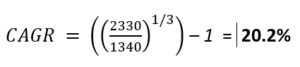

Consider an investor who purchases multiple stocks on Jan 1, 2018, at a total price of $1,340. The investor then sells it on Jan 1, 2021, at $2,230. The investors receive $100 as dividends over the 3 years. His total return will be 2230-1340+100 = $990 which is 73% of the initial investment. The annual return can be calculated as follows: