Call Date Meaning

So, when I talk about call date, it refers to me as an issuer of the bond to retire the bond on a specific date. This usually happens at a pre decided price called as call price. This is actually a negative feature to the buyer of the bond because it poses a call risk to you as an investor.

Why Do Bonds have a call date?

So, it is interesting to note and understand that why would a issuer of a bond have this feature? And the answer to that question is that you need to think from the perspective of the issuer of the bond. There are two major scenarios which can happen;

- Firstly the interest rates can be higher in the future

- Secondly it’s also possible that interest rates are lower in the future

Now, imagine what would you do as an issuer of the bond when interest rates are low in the future? You could firstly take a new debt at lower interest rates and pay off the higher interest rates bond. While when the interest rates are high, as an issuer you would not want the bond to be repaid or closed. Because newer debt would be more expensive.

Callable Bonds Versus Putable Bonds

So, when I talk about callabale bond and putable bond, I am basically talking about the two major features. Which is the call date option & the put date option

- Callable option, the issuer of the bond has the right to redeem the bond before the maturity date

- Whereas the putable bond when the buyer of the bond has the right to redeem the bond before the maturity.

Now from the general market perspective, most of the bonds issued by government and state entitites are usually callable. While bonds issued by U.S treasury as not callable. While the feature of putable is fascinating but very uncommon.

Yields on Callable & Putable Bond

Now, let me explore for you what would be the effect on returns when I talk about this feature.

- Usually a callable bond will sell at higher yield (for the investor), since you are taking the risk of the bond being called back on the call date.

- Conversely, the putable bond would sell at a lower yield(for the investor).Since you are getting the flexibility of selling the bond back to the issuer before the maturity

Example:Call Date

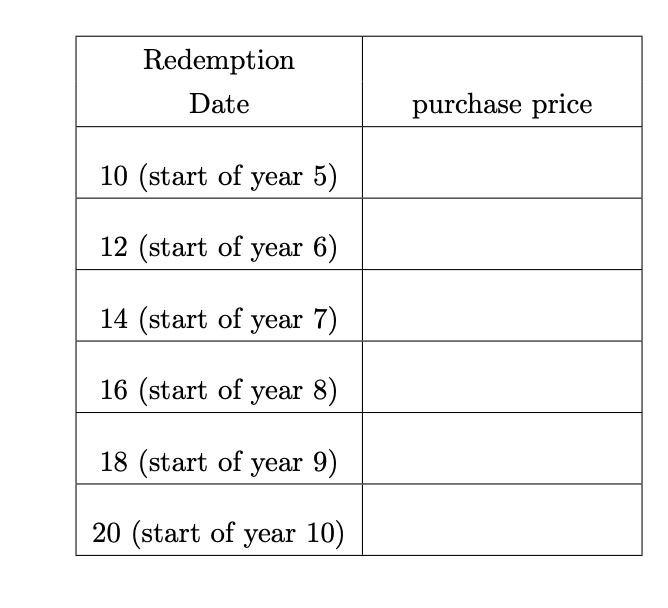

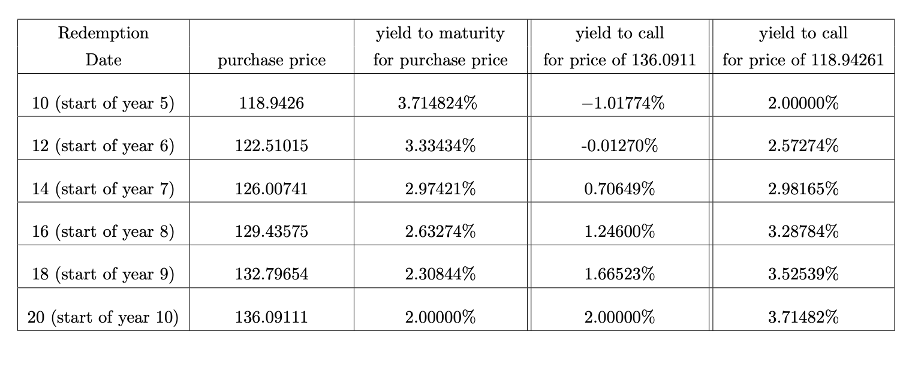

Consider a 10 year 100 par value 6% bond with semiannual coupons callable at start of year 5, 6, 7, 8, 9, and 10 (after the coupon payment). Assume callable at par value and a nominal yield of 2% convertible semiannually. Compute the price of the bond at all call dates.

So the approach to solving the above question of doing the valuation of the price of the bond at call date. Firstly, you will to calculate the present value of the couponds and the final call price which is at par at different call dates.

The Market for Callable Bonds

There is big motivating factor for callable bonds,can you guess? Well, firstly since the past 10 years interest rates have been falling. The federal reserve has been cutting the benchmark rates to record lows and has held it at the level for years.

- On January of 2005 the 10 years U.S treasury rate was 4.22%

- While in early February it just yielded 1.74%

Look at the below chart of 10 year treasury yield trend. Since early ninetees, the yield has been in one direction which is lower. Now it should be very clear to you on why we have a market for callable bonds with the call date feature, instead of putable bonds.

Call Date Bonds in India

Now, let me explore for you if there are markets for callable bonds with call date feature in India. And the answer is indeed there are? Because the interest rates are expected to decrease even in India in the longer run.

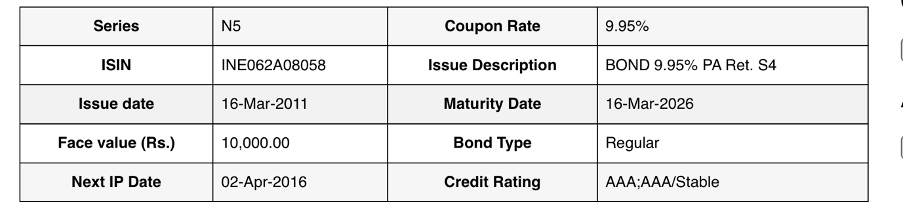

For example: State Bank of India(SBIN-5) Bond with a call date of 2021, Trading at Rs 10969 with yield to maturity of 9.95%. Now even in this case when this bond was issued, during the time SBI was paying a very high cost for the interest rate. And there was a very high likelihood of the bond being called back.

And as was expected SBI Bank did exercise the call option in 2021. Here is the news cut from economic times.

Frequently Asked Questions(FAQ’s)

What is the difference between call date and maturity date?

The difference is significant. Call date refers to the pre- decided date on which the issuer of the bond may call back its bond at a pre decided yield to maturity. Whereas the maturity date is the date on which the bond matures, without the issuer calling back the bond.

How does call date affect investors and issuers?

The call date option affects the investor negatively, whereas positively for the issuer. The issuer can refinance the debt at a lower interest rate, while the investor looses on the yield and has to reinvest the cashflows at lower interest rate.

Is it possible that the call date be changed?

The call date is an option for the issuer, hence it is upto the issuer to either call back or not call back the bond. Which will depend on the market conditions. There can be more than one call dates.