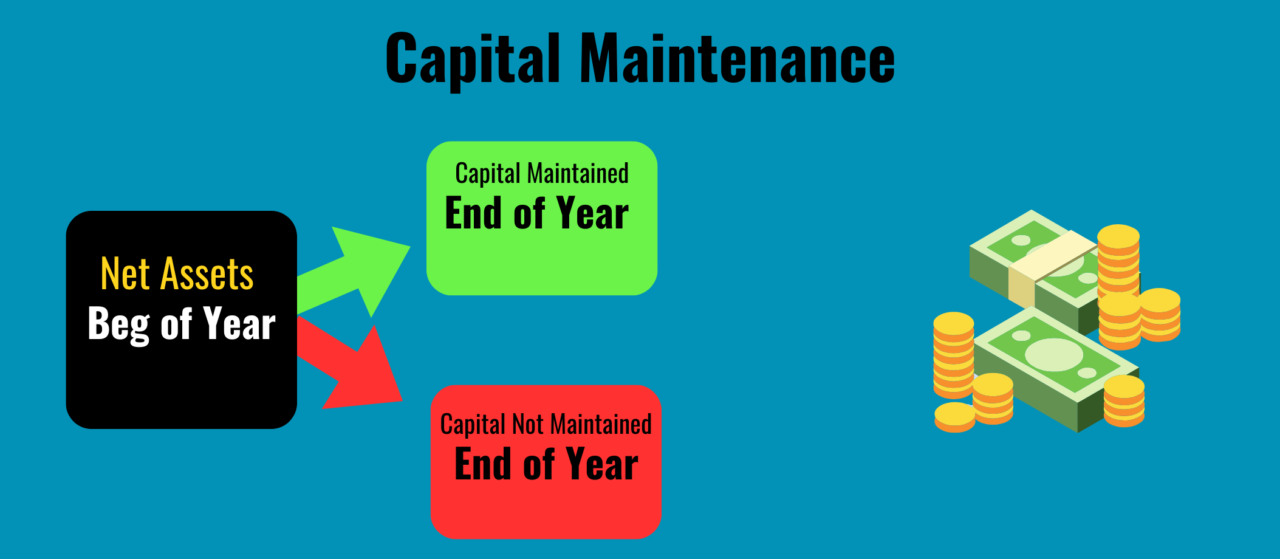

Capital Maintenance- Meaning

So, capital maintenance concept suggests that if your company has increased its net assets from the beginning of the year, then capital has been maintained. This means, that even if there are was any cash inflow or outflow but if your net assets have not seen an increase relative to the beginning of the year then capital was not maintained.

Example- Capital Maintenance

Let’s say there is a company called a Foxfurnitures, which manufactures furnitures in India for exporting it abroad. During the year the following events happened;

- The company at the beginning of the year had net assets of $100,000

- During the year the company generated a net income of $50,000

- Also during the year the company paid dividends of $5000, while also purchased new machinery worth $1000.

So has the company achieved capital maintenance?

The plain answer is yes, because the company’s net assets has increased in the following manner; Ending net assets = Beg net assets + Net income – Dividends+ Asset purchased=$100,000+ $50000 -$5000 +$1000= $146000.

At the end the net assets was higher than what was at the beginning hence capital was maintained.

Types

So, capital maintenance is of two types, physical and financial.

The financial Capital maintenance:

I have already explained it above, where the net assets should be higher. However, when it comes to

Physical Capital maintenance:

the condition is that the company needs to keep on investing a portion of its profit to buy new assets. As a result of old machinery becoming obsolete or old.

Impact of Inflation

Now, imagine that we are saying that net assets should be higher than the beginning values. However, that can be over exaggerated when the inflation rate is high. Which means that even if you buy the same asset, it would be appear as of the capital maintenance has been optimally done. But the reality is that there is misrepresentation.

Impact to Non Profit Organisations

Certain state laws in the U.S require endowments balances not to fall. Which means the balances will have to be replaced from different sources if the funding balances become negative. This serverly impacts the avaiblility of funds for operations.

IASB Approach

The IASB suggests that the capital maintenance is usually more relevant for business’s running in high inflationary environment. This has triggered the need to revise IAS 29. So what finally IFRS suggests is that companies should use their own sound judgment to present the best possible version of information in the financial statements.

Importance of Capital Mainteanance

The main objective of capital maintenance concept is to protect the interest of stakeholders,like shareholders and lenders. The rule, basically forces the companies to comply with this rules. If you think about the rule itself, it would mean that the companies will have to ensure not only positive cashflows but also increase in net assets. At the same time since capital maintenance metric would have been calculated anyways. Hence, it is imperative that a poor metric will show bad on the light of the management.

FAQ’s

Why is capital maintenance important?

It is important because it protects the interest of the shareholders and lenders. It forces the entities to focus on increasing the net assets at the end of the year.

What is adjustment of capital maintenance?

Capital adjustment maintenance, means the changes based on the overall currency purchase power.