Last updated on June 25th, 2024 at 01:03 pm

So, remember the movie, ” The big short, where Christian Bale visits goldman sachs and tells them to create a credit default swap, to short the mortgage back securities like CDO”. So CDO full form is collateralized debt obligation, where the loans and mortagages are collected together, converted into a bond type structure and sold to investors.In this article I will explain the definition of a CDO as well as the CDO FULL form.

CDO Full Form

CDO full form stands for collateralised debt obligation, also known as asset back security, is a an asset which is created by pooling credit card loans, auto loans, commercial project loan etc all clubbed into a single instrument with different payoffs.

What Are Collateralized Debt Obligations (CDOs) and How Do They Work?

The cdo is collateralized debt obligations, which are financial instruments used by banks. Below I have explained this concept in my CFA classes, if you wish you can have a look.

Illustration of CDO

In a nutshell Let me explain what is CDO. Let’s say you are a bank and you provide Auto loans, credit card debt, mortgages, and corporate debt. Now in one of the review meetings you realise the following

- 15% of your auto loans have delayed payments

- 20% of credit card debt is not getting recovered

- 10% of your mortgages are NPA(Non performing asset)

So you start to think of ways of solving this problem. As practically as possible, if you put yourself in that position, then one solution comes to your mind. Either forget the loans, take it as a loss and write it off. Or Start pursuing your customers. Both these solutions will either cause you loss or waste of time, money and resources.

But your junior comes up with a brilliant idea. He starts to think of similarity between a regular bond which payments coupons and principal. There seems to be some characteristics which are very similar. Except the fact the in case of auto loans, you have your individual customer as the issuer and you as the bond holder. So then what if

Packaging Loans

- First combine the auto loans and segregate the EMI’s into various qualities

- The on time payment marked as AAA

- The slight delayed ones As BBB

- Non responding EMI’s as CCC

- Now we approach a company, which specialises in recovery of these loans and start making a deal.

- We are ready to sell the AAA at 99% discount of the original value. Which also means 1% fees to the recovering company.

- Similarly BBB at 95% discount. Relives you of collection responsibilities.

- Finally CCC at 50% Discount. Always you won’t recover this so at least you can get 50%

The Asset recovery agency now, packages these AAA,BBB, CCC loans into small size bonds and starts selling it to investors. Those who want to get higher returns will buy CCC, whereas if you want more safety you buy AAA.

What does CDO Mean?

A type of derivative known as collateralized debt obligations (CDOs) is one of the most common. Derivatives are financial tools whose value is taken from the value of another underlying asset. Derivatives have been long used in the stock and commodities markets. It is used just like put options, call options, and futures contracts.

What Are Derivatives?

Derivatives are financial contracts whose value is taken from an underlying asset. These assets can be stocks, commodities, currencies, or other financial tools. They are contracts between 2 or more parties in which the derivative’s value is determined by the value fluctuations or the price of the underlying assets. Derivatives can be employed to hedge a position, speculate on an underlying asset’s directional movement, or leverage holdings. Futures and options are two kinds of derivatives.

Derivatives are traded over the counter or through an exchange. Over-the-counter trading is conducted between two private parties without the involvement of a centralized authority. Furthermore, because the contract is signed by two private parties, it is vulnerable to counterparty risk. The possibility, or the danger, of one of the parties defaulting on the derivative contract, is referred to as this risk.

Understanding Collateralized Debt Obligations (CDOs)

The first CDOs were created in 1987 by Drexel Burnham Lambert, a former investment bank where Michael Milken, dubbed the “junk bond king” at the time, was in charge. These early CDOs were created by Drexel bankers putting together portfolios of junk bonds. These bonds were issued by various companies. CDOs are referred to as “collateralized” because of the underlying assets’ promised repayments. They serve as the collateral that gives the CDOs their value.

Other securities firms eventually launched CDOs containing more predictable income streams. They are auto loans, student loans, credit card receivables, and aircraft leases. CDOs, on the other hand, remained a niche product until the U.S. housing boom in 2003–04. It was that time when CDO issuers turned to subprime mortgage-backed securities as a new source of collateral for CDOs.

The popularity of collateralized debt obligations exploded. The sales nearly tenfold from $30 billion in 2003 to $225 billion in 2006.

CDOs were one of the worst-performing instruments in the subprime meltdown. This began in 2007 and peaked in 2009. Their subsequent implosion, triggered by the US housing correction, saw them become one of the bad-performing instruments in the subprime meltdown. It started in 2007 and peaked in 2009.

Collateralised Debt Obligation Structure (CDO)

Investment banks with extensive financial knowledge of investment products make collateralized debt obligations (CDOs). These investment banks group cash-generating assets. They are bonds, mortgages, and loans together to form a single financial product.

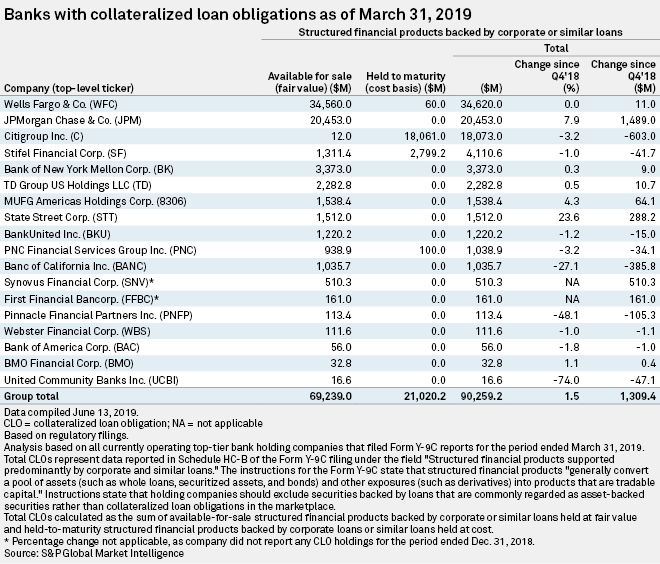

So after the market crisis in 2007, officially CDO’s just disappeared. Well, of course because the bad name it had generated for itself. It was going to be difficult to keep the same name. But guess what? They are back! Yes and it’s now called CLO. Which is collateralised loan obligations.

So the investments bank just got a synonym to debt and replaced it with the word loan. And miraculously its supposed to become safer.

Institutional investors are offered collateralized debt obligations (CDOs) in tranches or discrete classes. It is based on the credit risk associated with each CDO. The final products are made up of these tranches or classes. This reflects the type of debt included. MBS (mortgage-backed securities) includes a variety of mortgage loans with varying underlying assets or collateral. ABS (asset-backed securities) includes a variety of loans such as auto loans, credit card debt, corporate loans, and so on.

A lower coupon rate is associated with a higher credit rating. It’s because the creator of a CDO attaches a higher coupon rate to a low-rated CDO. It is done in order to entice investors with significantly higher returns. Furthermore, if the loan defaults, the holder who is senior receives payment from the collateralized pool of assets before anyone else. Holders in the other tranches are paid according to their credit ratings only after senior holders have been paid. The lower the credit rating, the lower the priority of repayment.

Corporate bonds (bonds issued by private companies), sovereign bonds (bonds issued by the government), and bank loans are the most common underlying assets in a collateralized debt obligation (CDO) (loans taken from the bank for personal purposes).

CDOs are on the rise.

CDOs, which had fallen out of favor following the financial crisis of 2007, began to resurface in the market in 2012.

For the first three to five years, adjustable-rate mortgages offered “teaser” low-interest rates. After that, higher rates took effect. Borrowers accepted the loans because they knew they could only afford to pay the low-interest rates. They planned to sell their homes before the higher interest rates kicked in.

CDO tranches were created by quant jockeys to take advantage of these different rates. Only the low-interest portion of mortgages was held in one tranche. Another tranche only included the portion with the higher interest rates. Conservative investors could invest in the low-risk, low-interest tranche. Aggressive investors, on the other hand, could invest in the higher-risk, higher-interest tranche. Everything went smoothly as long as housing prices and the economy grew.

CDOs: What Went Wrong?

Unfortunately, the extra liquidity resulted in housing, credit card, and auto debt asset bubble. Housing prices have risen far beyond their true value. People bought houses solely to be able to sell them later. People overused their credit cards due to the easy availability of debt. In 2008, credit card debt reached nearly $1 trillion as a result of this.

People defaulting on their debt was not a concern for the banks that sold the CDOs. They had sold the loans to different investors, who had then taken possession of them. They became less disciplined in adhering to strict lending standards as a result of this. Banks made loans to uncreditworthy borrowers, which resulted in disaster.

Buyers may not have done sufficient research to ensure that the CDO packages were worth their prices. The research would have been futile because even the banks were unaware. The CDOs’ value was calculated using computer models that assumed housing prices would continue to rise. The computers would be unable to price the products if they fell.

In 2007, market panic arose as a result of the opacity and complexity of CDOs. Banks realized they couldn’t price the products or assets they still had on their books. The market for CDOs vanished overnight. Banks refused to give money to one another because they didn’t want more CDOs on their books.

When the music stopped, it was like a financial game of musical chairs. The panic that ensued led to the 2007 banking crisis.

The Role of CDO in the Subprime Mortgage Crisis

Mortgage-backed securities were the first CDOs to fall out of favor. When housing prices began to go down in 2006, mortgages on homes purchased in 2005 quickly became “upside down,”. This resulted in the subprime mortgage crisis. Investors were reassured by the Federal Reserve that the crisis was limited to housing. Indeed, some praised it, claiming that housing prices had reached a peak and needed to settle down.

They were unaware of how derivatives amplified the impact of any bubble and subsequent downturn. Not only banks but also pension funds, mutual funds, and corporations were left holding the bag. It wasn’t until the Treasury and Federal Reserve began buying these CDOs that the financial markets began to function again.

The Dodd-Frank Wall Street Reform Act of 2010 was enacted. Its goal was to prevent the type of exposure that led to the failure of several banks during the financial crisis. When small banks were removed from coverage in 2017, the federal law was weakened. The Trump administration attempted to repeal it entirely.

The CDO Methodology

Investment banks collect cash flow-generating assets—such as bonds, mortgages, and other types of debt. They repackage them into tranches or discrete classes, based on the investor’s level of credit risk.

These securities tranches become the final investment products, bonds, whose names may reflect the underlying assets. Mortgage-backed securities (MBS) are made up of mortgage loans. Asset-backed securities (ABS) are made up of corporate debt, auto loans, or credit card debt, for example.

Other variations of CDOs include collateralized bond obligations. They are investment-grade bonds backed by a pool of high-yield but bonds with a lower rate. Collateralized loan obligations (CLOs), are single securities backed by a huge amount of debt. They often contain low-credit-rated corporate loans.

- Collateralized debt obligations are complicated. They are created by a team of experts:

- The notes are structured into tranches and sold to investors by securities firms. They approve the collateral selection.

- CDO portfolio managers, who select collateral and frequently manage CDO portfolios.

- Rating agencies evaluate CDOs and assign credit ratings to them.

- In exchange for premium payments, financial guarantors promise to reimburse investors for any losses on CDO tranches.

- Pension funds and hedge funds are two types of investors.

What Should Investors Know About the Different CDO Tranches?

The risk profiles of a CDO’s tranches are reflected in their names. Senior debt, for example, has a better credit rating than mezzanine and junior debt. If the loan defaults, the senior bondholders receive payment first from the collateralized pool of assets. They are followed by bondholders in the other tranches in order of credit rating, with the lowest-rated credit receiving payment last. Because they possess the first claim on the collateral, the senior tranches are generally the safest.

Understanding Rated Tranches

In the structure of a CDO, rated tranches play a vital role in determining the risk and return profile for investors. Tranches are segments of the CDO that are categorized based on their credit ratings. Senior tranches have higher credit ratings and lower risk, offering lower yields. In contrast, junior tranches carry higher risk with the potential for higher returns. The credit rating of these tranches is crucial as it influences the decision-making process for investors looking for a balance between risk and return. Rated tranches help investors align their investment strategies with their risk tolerance.

What Is a Synthetic CDO and How Does It Work?

A synthetic CDO is a type of collateralized debt obligation (CDO) that invests in noncash assets. It can provide investors with extremely high returns. They differ from traditional CDOs in that they generate income by investing in noncash derivatives. They are Credit default swaps (CDSs), options, and other contracts, rather than traditional debt products like bonds, mortgages, and loans. Synthetic CDOs are usually divided into credit tranches based on the investor’s tolerance for credit risk.

Collateralized Debt Obligation Benefits (CDO)

A collateralized debt obligation (CDO) is a useful investment tool that allows the creator to lower the overall risk associated with a variety of debt products. The following are some of the benefits of collateralized debt obligations (CDOs):

Repayment priority

People who invest in a collateralized debt obligation can be sure that they are prioritized by the CDO creator in the event of a loan default. It can be accomplished by investing in the senior tranche of a collateralized debt obligation (CDO). It can avoid lower-rated bonds due to their high coupon rate.

Liquidity

Without a buyer, a single bond held by a bank may become highly illiquid. A collateralized debt obligation (CDO) allows banks to find liquidity for individual contracts, such as a single bond, by pooling debt and creating a single investment product.

Risk of Repayment

Collateralized debt obligations (CDOs) enable lenders, such as banks, to effectively lower their risk profile on their balance sheets. Because most banks are required by law to keep a certain amount of their assets in reserve, they can use a collateralized debt obligation (CDO) to ensure the securitization. They can also ensure the sale of assets as holding them in reserve becomes too expensive.

Securitisation of Debts in India

In India securitisation has slightly different nomenclature. For example, When I went to research about how to buy a CDO in India, there exists no market. However, on digging deeper I found that there are two ways in which this happens;

- Pass Through Certificates: Just like a CDO gives the owner of the certificate the right to income generated by the underlying debt.

- Direct assignment: Where the entire debt is assigned to the owner.

The securitisation market is still too small at 0.004% of GDP in 2022, versus 9% in United States of America.

Final Thoughts

The Collateralized Debt Obligation (CDO) is a useful product. It combines different debts into one diversified financial product. It can be a stable source of money for holders who receive interest payments directly from the original borrowers. Furthermore, if the tranche is senior, a collateralized debt obligation (CDO) guarantees that the investor is paid first. It results in a secure investment. However, because the structure of a collateralized debt obligation cdo full form is considered complex, you should only invest in one after thoroughly understanding its meaning.

Related Articles