Last updated on February 3rd, 2023 at 05:39 pm

MBS stands for mortgaged backed security,a synthetic security with underlying as mortgages or collection of mortgages.

Full form of MBS

In 2007, one of the worst credit crises in history was done by this intelligent security. By no means I am being sarcastic!

Trust me, it’s smart security but not all smart things are used intelligently.

Artificial intelligence is smart, but I can also use it to be greedy and harm society.

I mean think about this for a sec, intelligent security like MBS brings an intelligent firm like Lehman Brothers to its knees and eventually kills it.

If the Lehman brothers couldn’t understand it, then can we?

Let’s wait and find out.

Contents

- The concept of MBS

- Advantages of MBS

- Types of Mortgaged Backed Security

- 2007 Crisis

- Present Day MBS Regulations

- MBS Securities in India

- Conclusion

The concept of MBS

So here is how it works.

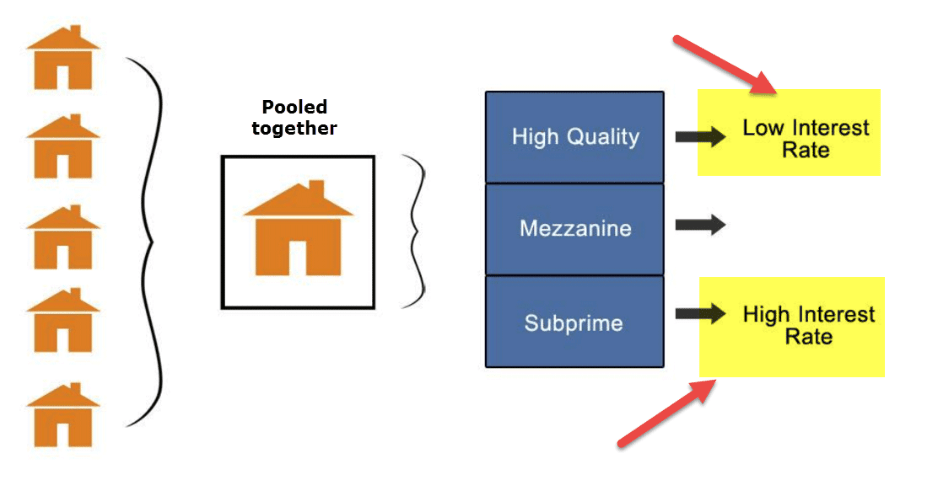

Imagine I had five home loans taken by customers with different values, time and interest rates. Now there are two things I can do.

Either wait 25 years until Mr.borrower pays me back, which is a long wait. While taking the risk that Mr. Borrowers might default on the payments.

What then?

So you come up with a brilliant idea, why don’t we combine all of them?

And then what?

Aah! Then I come up with a tactical strategy. Why can’t I break those housing loans into smaller bits and sell them off to some other investor?

However, you ask me a valid question, who would buy it? and why?

So, maybe someone needs a 13% high-interest rate for 3 years and finds this security interesting.

In fact, I come up with the following offerings

- First- 20 Year High-quality mortgage belonging to Mr Ramesh who has a great credit history, and a 10% interest rate.

- Second- 10 Year medium quality mortgage belongs to Mr Somesh, who has defaulted once on his credit card payments and 12% interest rate.

- Finally, in the last part is a 20-year low-quality mortgage belonging to Mr. Sohan, who has defaulted on the same mortgage twice but promises a 15% interest rate.

Indeed, that’s a lot of variety.

Now obviously, you would ask who would really be interested in buying the low-quality mortgage?

Well, just the same way some people buy low-quality stocks and probably I understand that the risk can be managed.

Advantages of MBS

Such an intelligent idea without advantages? Of course not, there are many.

- First and foremost I reduced my risk as a bank and transferred it to many different smaller investors. So basically overall I contributed to diversifying the risk.

- Second, I created opportunities for investors to expose themselves to new kinds of securities. I mean who would have given you the opportunity to be an investor in a normal man’s mortgage lifecycle?

- Third, it creates liquidity for me. And now I can use the money I get from selling the loans off to you and lend it further to business.

More so, this makes loans affordable and lowers interest rates. If there was no MBS, then lending would just be waiting for 25 years.

Types of Mortgaged Backed Security

So, now is where like many things, becomes complex. There are different types of mortgaged back security

- Pass through Securities:

Under this arrangement, the cash flows from the underlying mortgage is passed through to the investor on a pro-rata basis. This means that if I hold 20%, then I get 20% of the cashflows. For which I hold a trusted certificate.

Now the same pass-through security, if it includes residential mortgages then it’s called RMBS & CMBS if commercial.

- Collateralised Mortgage Obligation

Now, if we get Mr Goldman Sachs to instead clean it up and make it more presentable then we call it collateralised mortgage obligation or CDO. Which is something very similar to a bond.

- SMBS

The stripped mortgaged back security, strips the interest and principal. This means I can now create an interest-only MBS, you only get the interests. The principal can be stripped and given to someone who gets only that.

You see, how the gene is unravelling?

It’s plain evolution, once you start you keep getting creative. Until you doom!

2007 Crisis

Let’s continue from doom! You see this is where an intelligent idea converts to greed and that leads to some uncomfortable situations.

So, try painting this scenario. Federal funds rates are low, which means banks are giving loans at throw-away prices.

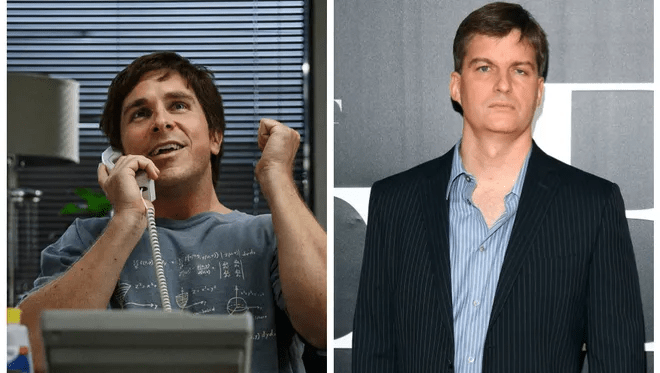

While the Mr smarts of wall street keep getting creative with mortgage securities. To the extent that, unaware that some other smart investors also created another security to bet against those MBS.

Voila!

Oh yes! Christian bale created that asset, I mean not Christian bale but Michael Burry.

So now, such smarty pants start buying huge numbers of CDS’s against the MBS.

All this while, the banks were completely unaware of the exposure of the loss that could happen.

Finally, when the borrowers start defaulting, you can imagine what happened.

Present Day MBS Regulations

A mortgage-backed security is still sold today and there is a market for them. In fact, the FED themselves own a large chunk of it.

Remember the idea is still great but the euphoria is not.

So banks have been forced from 2007 onwards into multiple regulations like Basel 1,2,3 etc. Which fact made the banks lose to fintech too.

MBS Securities in India

India was in the game and is in the game of mortgage securitisation.

In fact in 2021, the securitisation market in India is worth 1.2 Lakh crore.

RBI has put the following structure for securitisation

- Minimum instalments of six months

- The retention rate of 5%

- If the home loan pool is worth INR 500 CR, then you can list it for securitisation.

Conclusion

MBS is a great tool. In fact, this is not a new idea, it was first conceived in 1857. For many years, the securitisation industry was not taken seriously until lending became so popular that it became more essential than a luxury. It’s still useful and I think it’s a great tool to reduce the risk of banks.