Last updated on November 11th, 2025 at 02:15 pm

In this article I will be discussing in depth on, What is CA? also discussing on how to become a chartered accountant(CA), from various qualification backgrounds.

Believe it or not, I feel, everyone knows what is a chartered accountant in the general sense. However very few know the details and depth of this question, which I will cover in this comprehensive article.

If you’re planning a career in finance, one of the most prestigious qualifications in India is the Chartered Accountancy (CA) course. Let’s understand what a CA is, how to become one, and what opportunities it brings.

What is full form of CA?

CA stands for Chartered Accountant.

A Chartered Accountant is a finance professional who is trained and certified to manage financial records, auditing, taxation, budgeting, and business advisory services.

In India, the Institute of Chartered Accountants of India (ICAI) regulates the CA course and profession.

To become a CA, a student must:

- Pass the CA Foundation, Intermediate, and Final exams conducted by ICAI.

- Complete a 3-year practical training (articleship) under a practicing CA.

Once qualified, a Chartered Accountant can work in:

- Auditing & Assurance (checking company financials)

- Taxation (filing and planning taxes)

- Finance & Accounting (managing budgets, reports, compliance)

- Corporate Advisory & Consulting

In short, a CA ensures a company’s finances are accurate, compliant, and optimized making it one of the most respected finance careers in India and worldwide.

What is CA( Chartered Accountant)?

So, this simple statement should clarify the position of CA designation in India.

“ According to the Chartered accountant act 1949, a chartered accountant is a member of the Institute of Chartered Accountants of India( ICAI). Also, the ICAI is the governing body enacted by law in the parliament to discharge official accounting functions.”

Chartered Accountancy(ICAI), enacted by law

Now, that means that if you are an accountant in India, holding a CA membership then you are appointed by an act of law. My point here is, that there is no higher qualification In India than chartered accountant by ICAI.

Classes of Members

Associates (ACA):

So, if you have completed the exams and have just started your practice then you get to call yourself an associate member.

Fellow:

On the other hand, if you already are an associate and have a practice of more than five years then you get your self registered as an FCA

Also currently, ICAI has around 3.3 Lac members in India.

Official Functions of a Chartered Accountant

CA is a professional qualification, by professional I mean just like a doctor or a lawyer. So, there are some important responsibilities that lie in the hands of chartered accountants.

Now, officially according to law, a chartered accountant is expected to do the following for the government.

- Audit Financial statements of companies

- File and check the return filing of individuals

- Prepare financial statements for companies

- Ensure compliance of individuals to applicable tax regulations

- Also, ensure the payment of indirect taxes like GST.

- Represent clients for tax-related litigation.

So, if you think of it a chartered accountant is like a trustee of the government to the masses. Hence, the signing authority lies with a chartered accountant to approve balance sheets and returns.

In fact, FCA members can empanel their firms for statutory audits with ICAI and earn up to 1.5 Lac per audit fee.

History & Prominence in India

History Of ICAI

In 1913, the companies act was passed which mandated the registration of companies. Also, this meant that it requires qualified trainer personnel to audit the books.

Now, you might be surprised to know that initially

- In 1918, the government launched a program called as “Government Diploma In Accountancy” in association with Sydenham College of Commerce, Mumbai.

- After the students passed that course, they had to undergo three years of articles under an approved accountant.

- Once, this was done you could practice as a certified auditor.

However, in 1930 the structure was changed and the registrar was maintained and the certified personnel was to be called “Registered Accountants”.

Now, long story short in 1949 after independence an autonomous body was envisioned. Which led to the establishment of ICAI, under section 3, of the ICAI Act.

Meaning of Chartered

approved by the sovereign( King or Queen). So, the name chartered doesn’t mean the same it was before since India is a republic.

For example; countries like the U.S. called the same accountant as certified public accountants.

Amendment Bill of the Chartered Accountants Act

There has been quite a big lobby to ensure, ICAI remains the holy grail. Hence, Rao Inderjeet, MOS(Corporate Affairs), has introduced a bill to amend this act. The bill proposes to end the monopoly of ICAI, ICWA & ICSI and establish IIA( Indian Institute of Accountants).

However, in my opinion, even if IIA is formed the end result would be the same “Intense Competition”.

Shortage of Chartered Accountants

In a country with 125 crore citizens, and 6.8 Crore taxpayers, we only have 1.25 Lac practising CA’s. So, in my opinion, there is no shortage of demand for CA’s whether they come from IIA or ICAI.

How to become a CA?

There are various ways you can enter into the CA journey, however, it depends on your education status.

- Completed Class XII

- Commerce Graduate/Postgraduate

- Intermediate Level Passed of ICSI (Company Secretary) or ICWA( Cost accounting

Completed Class XII

You can decide to pursue CA, as early as after completing Class X. I am going to jot, down the main and important points to remember.

- Register with the board of studies: This basically provides you with the foundational knowledge needed in accounts.

- Apply for the foundation course before 1ST Of January or the 1ST Day of July for the exam in May every year.

- Complete your class XII exam.

- Register for the Intermediate course.

- Complete 8 months of study course

- Finish Both intermediate and in both groups.

- Complete the AICITSS course before the final examination.

- Appear in the final examination during the last six months of practical training.

- Complete Practical Training.

- Qualify both groups of the final course.

- Become a chartered accountant.

Graduate & Post Graduates

Now, if you are already a commerce graduate or postgraduate, then you fall under the direct route. However, it’s important to note that you need to have a minimum of

- 55% if you are a commerce graduate or postgraduate

- 60% if you are a graduate in some other field, other than commerce

- Or if you are in your final year of graduation, with the same criteria you can get a provisional admission for the intermediate course.

If you fall under the above category, then below are the steps;

- Register with the board of studies

- Complete the ICITSS Training

- Register for three years of article ship

- Appear for the intermediate examination after nine months of article ship.

- Finish, the intermediate course.

- Register for the final course.

- Appear for finals(Both groups), six months before the end of the article ship.

- Become a member

Intermediate Level Passed of ICSI OR ICWA

If you have already been pursuing ICSI or ICWA and finished the intermediate level. Then the following steps apply:

- Register with the board of studies

- Complete 8 months of study course

- Appear and pass both groups of the intermediate course.

- Complete ICITSS.

- Register for articles for 3 years.

- Register for the final course, after completing both groups of intermediate.

- Complete the final examination during the last six months of the article ship.

- Qualify for both the course of the final course.

- Become a member.

In short, the only difference between being an intermediate student or a graduate student is:

- A graduate student has to appear for the intermediate exam for nine months before the article-ship.

- Whereas, an ICSI or ICWA student doesn’t have to wait for the article ship to give the examination.

More or less, the ICIS/ICWA student saves a year to finish the intermediate examination

Syllabus for CA

Intermediate Level Syllabus

So, here I am covering the syllabus of the intermediate and final levels of CA only. Now the intermediate level has a total eight papers, which is split into two parts.

Group 1 has Accounting, Corporate and other laws, Costing & taxation.

| Particulars | Details |

| Exam Mode | Pen and paper-based |

| Type of question | Objective cum subjective |

| Exam Duration | 3 hours per paper |

| Medium of Exam | English/ Hindi |

| Number of Papers | Eight |

| Number of Marks | 100 per paper |

| Negative Marking | None |

Group 2 has advanced accounting, audit and assurance, Enterprise information systems and strategic management, and financial management.

Also, I have listed out the various levels of the content tested in the exam. Comprehension and knowledge mean, a basic understanding of concepts. And application means the real-world application of the knowledge in terms of calculation.

| Paper | Comprehension and Knowledge | Application |

| Paper 1: Accounting | 5%-15% | 85%-95% |

| Paper 2 Part 1: Corporate Laws | 40%-55% | 45%-60% |

| Paper 2 Part 2: Other Laws | 35%-55% | 45%-65% |

| Paper 3 Cost and Management Accounting | 20%-30% | 70%-80% |

| Paper 4A: Taxation- Income Tax Law | 5%-20% | 80%-95% |

| Paper 4B: Taxation- Indirect Tax Laws | 20%-45% | 55%-80% |

| Paper 5: Advanced Accounting | 30%-55% | 45%-70% |

| Paper 6: Auditing and Assurance | 5%-15% | 85%-95% |

| Paper 7A: Enterprise Information System | 30%-55% | 45%-70% |

| Paper 7B: Strategic Management | 50%-70% | 30%-50% |

| Paper 8A: Financial Management | 20%-30% | 70%-80% |

| Paper 8B: Economics for Finance | 60%-80% | 20%-40% |

Marking Scheme for Intermediate Level- CA

| Paper | Marks Distribution |

| Group I | |

| Paper 1: Accounting | 100 |

| Paper 2: Corporate and Other Law Part 1: Company Laws Part 2: Other Laws | 100 60 40 |

| Paper 3 Cost and Management Accounting | 100 |

| Paper 4: Taxation Part A: Income Tax Law Part B: Indirect Tax Laws | 100 60 40 |

| Group II | |

| Paper 5: Advanced Accounting | 100 |

| Paper 6: Auditing and Assurance | 100 |

| Paper 7: Enterprise Information System and Strategic Management Part A: Enterprise Information System Part B: Strategic Management | 100 50 50 |

| Paper 8: Financial Management and Economics for Finance Part A: Financial Management Part B: Economics for Finance | 100 60 40 |

A point to note here is that in CA inter-mediate level, there are four papers that have mcq marking for 30 marks

- Corporate law and other law

- Taxation

- Auditing and assurance

- Enterprise systems and strategic management

Final Level

The CA final-level exam has the following pattern:

| Particulars | Details |

| Mode of exam | Pen & Paper based |

| Medium of exam | English & Hindi |

| Duration of exam | 3 hours for each paper |

| Number of Groups | 2 Groups |

| Types of questions | Both Objective & Subjective |

| Exam conducting body | Institute of Chartered Accountants of India (ICAI) |

| Total number of papers | Eight papers |

| Frequency | Twice a year (May & November) |

| Marking scheme | 100 marks on each paper |

| Negative marking | No negative marking for wrong answers |

CA Final Syllabus

| Paper | Level I Comprehension and Knowledge | Level II Application | Level III Evaluation and Synthesis |

| Paper 1 Financial Reporting | 5%-15% | 60%-85% | 10%-25% |

| Paper 2 Strategic Financial Management | 10%-20% | 20%-40% | 50%-60% |

| Paper 3 Advanced Auditing and Professional Ethics | 20%-35% | 45%-70% | 10%-20% |

| Paper 4 Part I: Corporate Laws | 10%-20% | 60%-70% | 15%-25% |

| Paper 4 Part II: Economic Laws | 40%-60% | 40%-60% | |

| Paper 5: Strategic Cost Management and Performance Evaluation | 10%-15% | 45%-55% | 35%-40% |

| Paper 7 Part I: Direct Tax Laws | 5%-10% | 60%-80% | 15%-30% |

| Paper 7: Part II: International Taxation | 15%-25% | 75%-85% | |

| Paper 8: Indirect Tax Laws | |||

| Part I: Goods and Service Tax | 10%-30% | 40%-70% | 20%-30% |

| Part II: Customs & FTP | 20%-40% | 40%-70% | 10%-20% |

Detailed Mark Distribution for CA under the new scheme

Duration for Complete CA

Now since you can start CA, from multiple routes we need to look at the total preparation time from the entry route perspective.

- Class 12th– CA course duration: If you clear the exams in one attempt then it takes 4.7 Years.

- After Graduation or Post graduation- It will take almost 3.5 Years to complete CA. 10 Months to complete the intermediate level and 2.8 Years to complete the final level. The 2.8 Years is because you also have an article ship of 3 years.

The total cost of Pursuing CA

Below I have mentioned the direct exam cost, provided a student completes the levels in one attempt.

| CA Course Fees | Indian Student | Foreigner Student |

| CA Foundation (CPT) | ₹11,300 | $1065 |

| CA Intermediate- Single group | ₹28,200 | $925 |

| CA Intermediate- Both groups | ₹34,200 | $1500 |

| CA Intermediate- Direct | ₹34,000 | $1500 |

| Article ship Fee | ₹2,000 | – |

| CA Final | ₹39,800 | $1550 |

Hence, the total direct cost comes out to be

- 1.47 Lacs if you start from the foundation level

- 1.37 Lacs if you start at the direct entry route.

However, we also need to consider the additional cost for training, which also I have mentioned.

Training Cost for CA

| CA Foundation ₹ 48,000 |

| CA Intermediate (Single Group) ₹ 45,000 |

| CA Intermediate (Both Group) ₹ 83,000 |

| CA Final (Single Group) ₹ 50,000 |

| CA Final (Both Group) ₹ 1,00,000 |

Now, if you start from the foundation level then the total cost of training comes up to be somewhere around 2.3 Lacs. However, you need to note that this cost is provided you complete the exams in one go.

At the same time, if you start from intermediate groups, then the training cost is 1.8 Lacs.

So, to sum up the total cost of exams plus the training cost, the bifurcation is

- After Class XII: Around 4 Lacs

Direct Entry Route:3.2 Lacs

CA subjects & marks

CA Foundation Level

The Foundation level consists of 4 papers.

| Paper No. | Name of Paper | Marks |

| Paper 1 | Principles & Practice of Accounting | 100 |

| Paper 2 | Business Laws, Business Correspondence & Reporting | 100 |

| Paper 3 | Business Mathematics, Logical Reasoning & Statistics | 100 |

| Paper 4 | Business Economics & Business and Commercial Knowledge | 100 |

CA Intermediate Level

Under the 2025 “new scheme”, the Intermediate level is organised into 6 papers, grouped into two groups (Group I and Group II)

| Paper No. | Subject | Marks (Subjective + Objective) |

| Paper 1 | Advanced Accounting | 70 + 30 = 100 |

| Paper 2 | Corporate & Other Laws | 70 + 30 = 100 |

| Paper 3 | Cost & Management Accounting | 70 + 30 = 100 |

| Paper 4 | Taxation | 70 + 30 = 100 |

| Paper 5 | Auditing & Code of Ethics | 70 + 30 = 100 |

| Paper 6 | Financial Management & Strategic Management | 35 + 15 = 50 + 50 = 100 |

CA Final Level

The Final level consists of 6 papers, divided into Group I and Group II.

| Paper No. | Subject |

| Paper 1 | Financial Reporting |

| Paper 2 | Advanced Financial Management (AFM) |

| Paper 3 | Advanced Auditing, Assurance & Professional Ethics |

| Paper 4 | Direct Tax Laws & International Taxation |

| Paper 5 | Indirect Tax Laws |

| Paper 6 | Integrated Business Solutions (Multidisciplinary Case Study + Strategic Management) |

Exam Pattern & Passing Criteria (2025)

Exam Mode: Computer based testing format

Question types: Subjective (long answer) and objective (MCQ’s) questions

Attempts: Foundation and intermediate are held thrice a year. In new scheme, final is held thrice a year too.

Passing criteria: A minimum of 40% in each paper and 50% aggregate across all papers in group.

Career paths for a chartered Accountant

Most of the students, pursuing CA or planning to pursue CA have a big conception. And the misconception is that they can make their careers only in traditional, accounting and taxation roles. This is true, they can and that is the obvious choice. However, there are many other fields where a CA degree equally holds its weight.

So, ill categorize the career paths into three categories.

- Auditing & Taxation

- Financial Controlling

- Private Practice

The above three categories are the generic obvious choices, however, there are multiple other opportunities which I will discuss below.

Investment Banking

I think I have seen most of the times-chartered accountants, contemplating pursuing additional qualifications like CFA or MBA. However, most of the job descriptions in this field would accept a CA & CFA or MBA equally.

An exception here, is that please don’t think that this means you don’t need skills. For example; the most important skill to pursue in investment banking is

- Financial Modeling: You can read more about this skill in this article. Also, the reason why you need to learn this will be more clear when you read the questions which come up in the interview.

Financial Planning & Analysis:

This is again a very easy area for you if you have either completed the entire CA program or even completed inter levels. Financial planning & analysis roles are related to budgeting and forecasting. You can check out the type of jobs in fp&a in this article.

Compensation Trends in CA

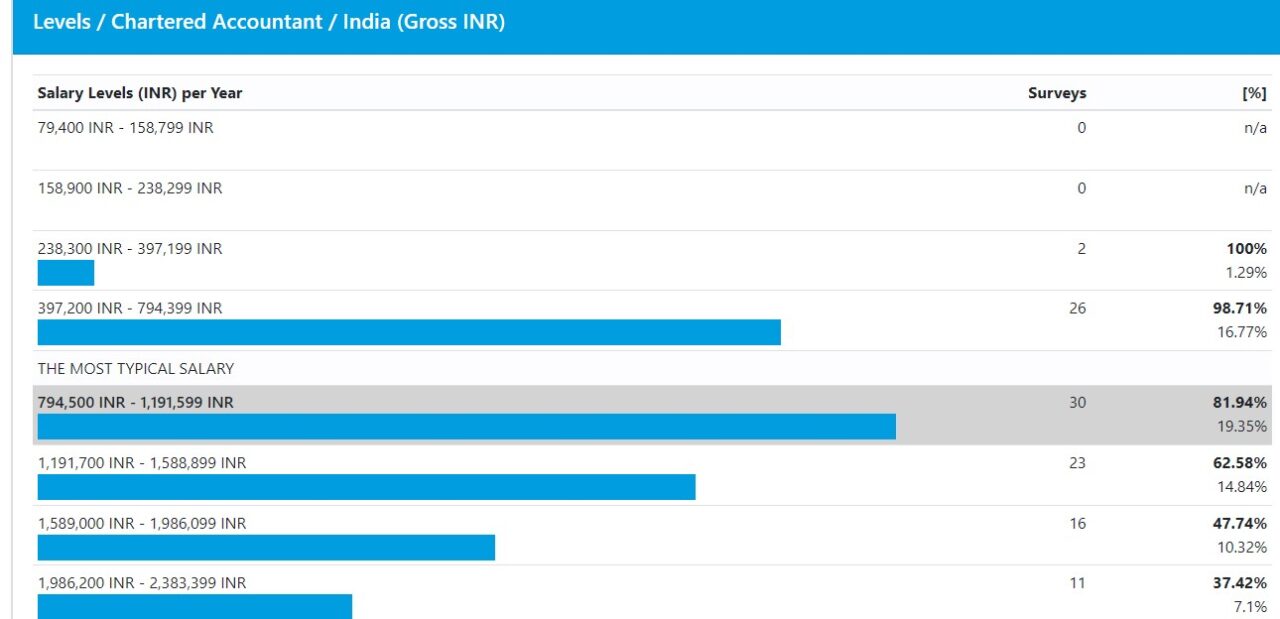

Now, this is where a lot of y’all will be very interested and hence I will cut to the chase and show you the salary trend for CA directly. Also, I would agree with the following numbers, which is 7.95 Lacs to start with as a fresher. However, note that after-tax would be somewhere around INR Fifty-five thousand for a fresher. Which is by the way, pretty decent. As you progress through experience in your area of expertise, the salaries are in line with what most of the premiere MBA college alumni would experience

Pass rates in CA Levels (2025)

Now, I have also shown a practical look at the let’s say 1500 candidates. Then how many candidates are statistically expected to clear the final level? And the harsh answer is one!

| Exam Level | Category / Group | No. of Candidates Appeared | No. of Candidates Passed | % of Pass |

| CA Foundation | Male | 51,120 | 8,046 | 15.74% |

| Female | 47,707 | 6,563 | 13.76% | |

| Total | 98,827 | 14,609 | 14.78% | |

| CA Intermediate | Group I | 93,074 | 8,780 | 9.43% |

| Group II | 69,768 | 18,938 | 27.14% | |

| Both Groups | 36,398 | 3,663 | 10.06% | |

| CA Final | Group I | 51,955 | 12,811 | 24.66% |

| Group II | 32,273 | 8,151 | 25.26% | |

| Both Groups | 16,800 | 2,727 | 16.23% |

Data taken from: The institute of Chartered Accountants of India

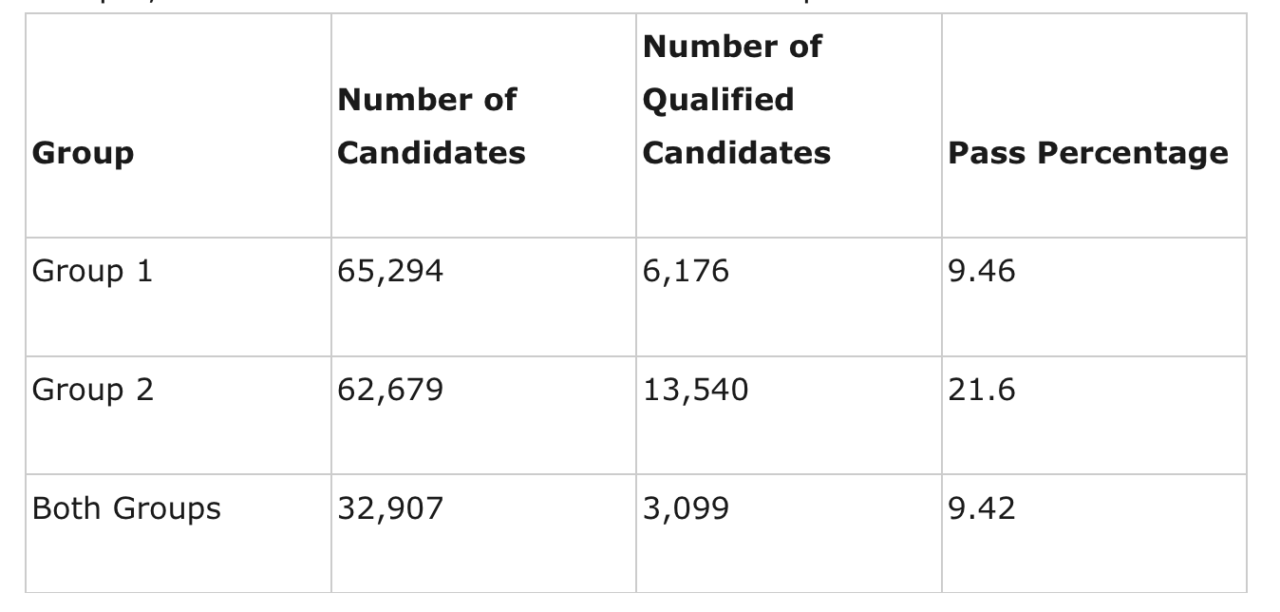

Pass Rate in 2023- CA Finals

So just to make sure that the pass rate data is updated, I am adding this 2023 results update of Intermediate group & CA Final. In short the pass percentage for CA final exams has fallen significantly but the intermediate groups results have improved. You can check my detailed blog on the difficulty of CA in my article is CA tough?

However, the same is the scene with IIMs, CFA, ICWA or anything that is worthwhile in this field. Read more about these myths around CA pass rates to get more clarity.

Key changes in 2025

Greater inclusion of objective/MCQ components in more papers.

Final level paper reduced to 6 papers from 8.

Conclusion

Now, that I have discussed almost all the aspects of this qualification, let me summarize my opinion. CA is the and will always be the dominant qualification for accounting careers in India. Neither CPA, nor ACCA can ever replace the grind and the rewards associated with it.

The sooner you believe this, the less regret you will have later. So get your attitude in place, and be prepared to struggle, fail and stand up again and conquer this tall mountain.

FAQ

CA is a very good career if you want to enter into finance and auditing also taxation. It has low passing rate but once passed gives you numerous opportunities.

Yes, almost all the students who register for CA are of commerce background as it helps in the preparation of CA, but anyone can apply for CA there are no restrictions.

If you want to enter into accounting and finance core with the core functions of it then CA is a better option. MBA is good option when finance core + management roles is something targeted. Both of them have their own pros and cons. Getting into Top-B schools is also difficult with this competition level.

It takes almost 4-5 years to complete CA this includes three levels foundation, intermediate and final level along with mandatory period of articleship.