Last updated on October 23rd, 2024 at 02:41 pm

A liability, in accounting or financial terms, refers to the obligation that a business must pay at the end of a certain period. In this article, I will be going over in detail the components of balance sheet and finally, I will give you an example of the liabilities of Britannia from its annual report.

What is a liability?

A liability, in economic terms, is a term used to describes the financial obligation payable by the business to either an internal or external party. Liability is a crucial aspect of any business. They point towards the company’s financials and well-being. It is important because the liabilities of a company implies that they provide an economic benefit to another entity. [1]

Liabilities are settled by transferring assets such as goods, money, or services. You can find all the liabilities of any company usually on the right side of its balance sheet. Liabilities include bank loans, mortgages, payable accounts, warranties, bonds, accrued expense, etc. [2]

Types of Liabilities:

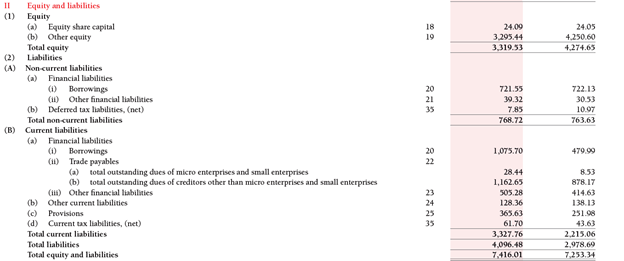

Liabilities are segregated based on how early an organization is liable to settle them. They are primarily 4 types of liabilities viz. equity, current liabilities, non-current liabilities, and contingent liabilities. Before getting into all this, let’s take a look at the liability side of the balance sheet of Britannia.[3]

Here you can see all the liabilities Britannia has in the financial year 2020-2021. The right column represents the liabilities from 31st March 2019 to 31st March 2020 and the left column (red background) represents from 31st March 2020 to 31st March 2021. All the values are in ₹ Crores.

Equity:

You must be wondering how equity is under the liabilities side and not the asset side as the shareholder’s funds in a true sense are an asset. To make better sense out of this, you must look at the company’s financial statements from a different perspective.

Shareholder’s equity = Assets – Liabilities

From the company’s perspective, the shareholder’s funds do not belong to the company as they rightly belong to the shareholders. So, the company is actually liable to pay that capital to its shareholders. Hence equity is considered as a liability to the company and not an asset.

Current Liabilities:

All the liabilities which the company is obliged to pay within 1 year (365 days) are called current liabilities. They are also known as short-term liabilities. Current liabilities directly affect the working capital of the company and impact its liquidity. A few examples of current liabilities are listed below [2] [4]:

- Short-term loans

- Accrued expenses

- Bank overdraft

- Interest payable

- Accounts payable

- Dividends payable

- Bills payable

- Taxes payable

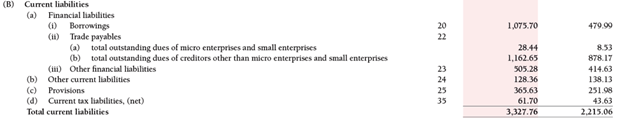

Britannia Industries Ltd. Liabilities side of the Balance sheet 2020-21

As you can see that they are further classified into financial liabilities, other current liabilities, provisions, and current tax liabilities.

Borrowings are short term obligations of the company usually undertaken to meet the day to day working capital requirements. The number next to each of the liabilities refers to a note which details the respective liability. These notes are found in the annual report itself.

The next line is Trade payables. These include obligations payable to the vendors who supply to the company. These include raw materials, services, etc.

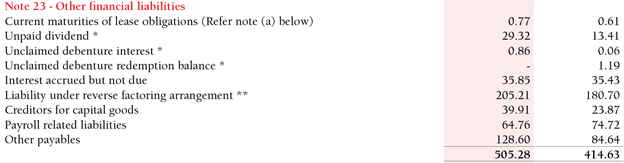

Other financial liabilities are obligations that are indirectly related to the company’s operations. Have a look at Note 23 which gives the details:

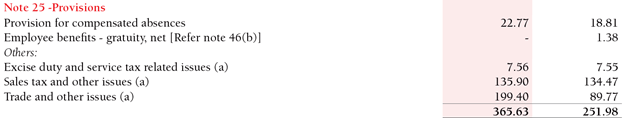

Provision deals with setting aside the funds for the employees as benefits such as leave encashment, gratuity, provident funds, etc. The details are given in Note 25 as follows:

Non-current liabilities:

The liabilities of the company which are due in over a year’s time are known as non-current liabilities. They are also called long-term liabilities [5]. Non-current liabilities are usually settled after 12 months of the reporting period. They are crucial in determining the company’s long-term solvency. Here is a snapshot of the non-current liabilities of Britannia.

The company has 2 types of non-current liabilities. Let us look into each of them.

In financial liabilities, borrowings are further classified into 2 types: long term and short-term borrowings. Long term borrowing is also one of the key inputs while calculating some of the financial ratios. [6]

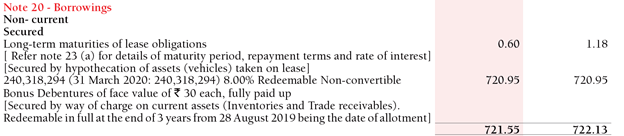

The details of the borrowings are given in Note 20 stated below:

Other financial liabilities include deposits from customers and security deposits. [3]

Deferred tax liabilities are nothing but a tax provision for any unenforceable future. The company puts aside some money where it may have to pay additional taxes

Contingent liabilities:

These are the liabilities that may or may not occur in the future. The company is liable to pay for these depending on the outcome of the event that may take place in the future. They are included in the books if they are at least 50% likely to occur in the future[1]. The best example of contingent liability is a lawsuit against the company as any lawsuit has a 50% chance of being successful [1]. Some other examples of contingent liabilities would be:

- Product warranty claims

- Warranty liability

- Investigation

Conclusion:

The liabilities are often evaluated in the end as investors and analysts focus more on the sales growth and sales revenue. This does not mean that they do not play a crucial role. Many financial ratios are calculated using liabilities It is very important for the investor to know how much the company is liable to pay and how quickly can the company pay off the liabilities. The liability side of the balance sheet tells how a company finances, plans and account for all the money which they might require to pay in the future.