Last updated on January 16th, 2026 at 01:29 pm

Trade validation is the final step of checking the trade after the investment bank through a security trading organisation completes the trade purchase or sale.

This basically means that I am going to check, whether we got what we intended to purchase.

Moreso is it finally in our dematerialised account with the custodian?

You may say, why is that even a step?

That’s what I discuss in this article, so read on.

Refresher on the Trade Process & Trade Validation

So, in case if you don’t want to read through the entire trade life cycle process, which is by the way you can in my separate article.

Then I am going to quickly nail this!

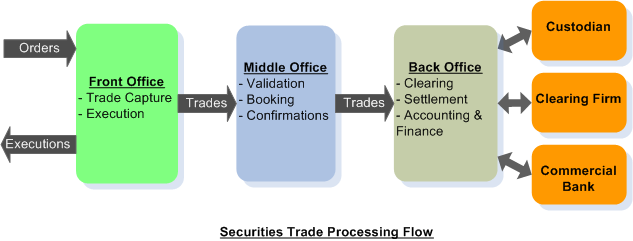

So, the blue box you see above is where the validation takes place.

Which is after the front office orders the trade and then the middle office, lands up with the task of cross-checking work.

For example; Allen is the front office trader at Goldman Sachs, he identifies a stock that he wishes to purchase at $500.

Accordingly, he calls up the sales guy at a securities trading organisation( Which can be brokers). Afterwards, the sales broker contacts the dealer through an internal communications network.

Furthermore, if the sales at the broker side return with the good news, that it’s possible then we start the game of operations.

Indeed a lot of work.

In brief, after the good news, the trade passes through the execution team, then the validation team.

Later landing up in the clearing and settlement team side and finally the reconciliation team.

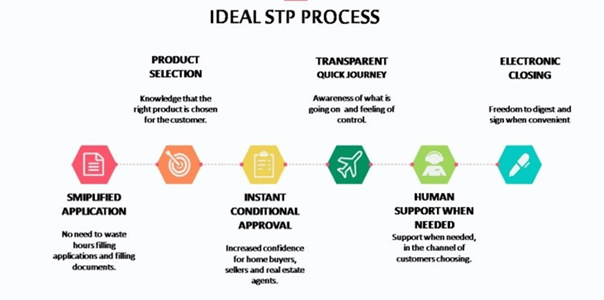

Straight Through Processing- Trade validation Process

That’s a mouthful but may sound cool at a dinner party!

Never mind, it’s just a simple process terminology used by not just investment banks but also most of the large e-commerce companies like amazon.

However, STP might be a thing for e-commerce and work excellent.

In contrast in investment banking operations, manual interventions are needed because automation is as good as a code.

The difference between a code and a human lies in learning.

Just as a trader faced with a situation of crisis, can tap into his previous experiences to find the correct solution. On the contrary, a code cannot.

Errors in Trading Operations-Trade validation Process

Trade Validation Purpose & Benefits

Trade validation plays a critical role in the post-trade process. It ensures that every trade is checked, confirmed, and corrected before it moves to settlement. This step helps financial institutions avoid costly errors and operational issues.

As soon as I start listing the errors, you would understand why validation is needed.

For example:

- The dealer (I) for eg; by mistake enters the wrong scrip code. Instead of putting AAPL, he puts AAP

- Another can be that I recorded the wrong quantity of stocks purchased

- Moreover, while the trade was correct, I incorrectly selected the wrong custodian

So, the validation step is essential to make sure that these are detected as fast as possible.

There is the urgency factor here.

Firstly, let’s say I purchase $1 Mn worth of U.S Treasury bonds, which I am going to hold only for two days.

If the validation doesn’t capture any mistake in the trade execution, then I might be slapped with a penalty.

Moreover, I might also lose a lot of money if the trade goes in the opposite direction.

Finally, If I purchased this on borrowed cash, then I also incur wasted interest costs.

Key purposes and benefits of trade validation include:

Ensures data accuracy before processing

Trade validation checks key trade details such as price, quantity, trade date, counterparty, and instrument. This ensures the data is correct before further processing begins.

Reduces operational risk

By identifying mismatches or missing information early, trade validation prevents errors from flowing into clearing and settlement systems.

Minimizes settlement failures

Accurate and validated trades are more likely to settle on time, reducing failed trades and penalties.

Improves compliance and auditability

Proper validation creates a clear audit trail. This helps firms meet regulatory requirements and respond quickly to audits or investigations.

Supports same day affirmation (SDA) automation

Trade validation enables faster confirmation and affirmation of trades which is necessary for same day affirmation and shorter settlement cycles like T+1.

Trade Validation Steps

On a normal sunny day, this is how the trade validation takes place.

- First, I check the trading date: The date should be today for a new trade, not past and neither future

- Second, I confirm the correct trade time, again making sure it’s today

- Third, I confirm the value date, which also means the settlement date i.e T+3. Also, make sure that it’s not earlier than the trading date.

- Afterwards, the quantity needs to be cross-checked, with the minimum denomination of the security. For eg; if I want to buy the U.S Treasury bond, then it might be available in lots of 1000.

- Also cross-checking the price and validating the security i.e I cannot validate a bond that’s already matured.

- Finally nailing it with cross-checks on cash value, and counterparty identification.

So much for making sure that you don’t go wrong.

Trade Validation Process in-detail

Trade validation follows a structured flow to ensure all trade details are correct before confirmation and settlement.

1. Capture Trade Data

The system captures trade details immediately after execution from the trading platform or exchange.

2. Cross-Check Instrument Details

The system verifies:

Security identifiers (ISIN, ticker)

Trade price and quantity

This ensures the instrument and pricing match market records.

3. Validate Counterparty Information

The system checks counterparty codes, broker IDs, and clearing member details to confirm the trade is booked against the correct entity.

4. Verify Settlement Instructions

Settlement details are reviewed, including:

Settlement date and value date

Custodian or depository instructions

This step prevents delivery or payment mismatches.

5. Compliance & Rule Checks

The trade is checked against internal and regulatory rules, such as:

Trading limits

Restricted securities

Client mandates

6. Cross-System Matching

Trade details are matched across front-office, middle-office, and clearing systems to ensure consistency.

7. Break Detection & Remediation

If mismatches (“breaks”) occur:

The system flags exceptions

Operations teams investigate and correct errors

This prevents downstream failures.

8. Confirmation Triggering

Once all checks pass, the system triggers trade confirmation and affirmation, allowing the trade to move safely into clearing and settlement.

India’s capital market transformation (2010-2025)

Systems Used for Trade Confirmations

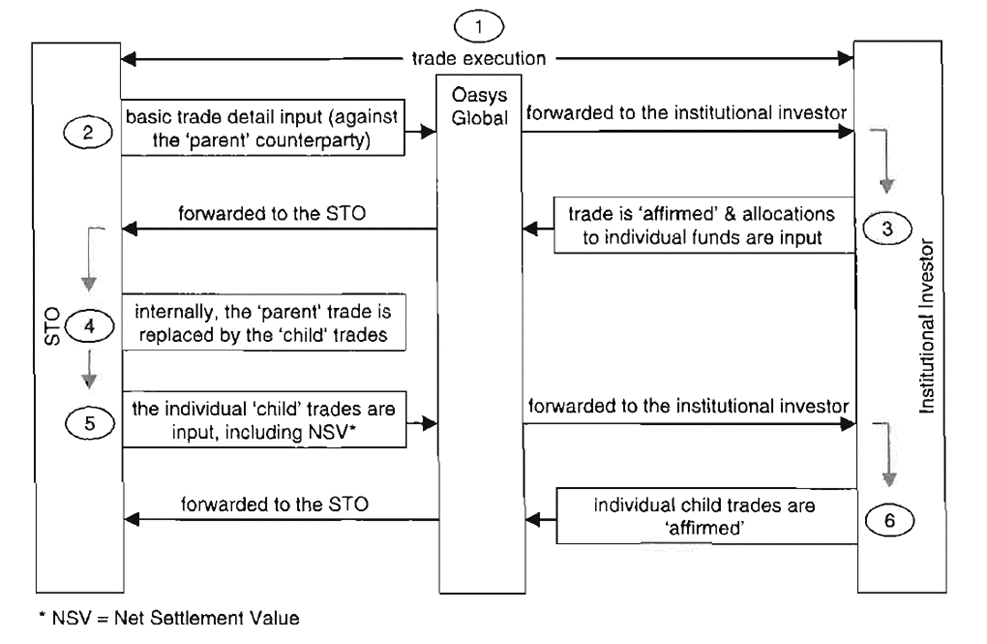

This is just for my information and not part of the validation process.

Companies(clients) frequently will use third-party systems to ensure that the trade is authenticated and to avoid a brawl with the STO.

Oasys global, now also known by DTC is a system used by large institutions for trade affirmations.

That is to say, the custodian who actually holds the security and the broker both are aware that this trade is authenticated.

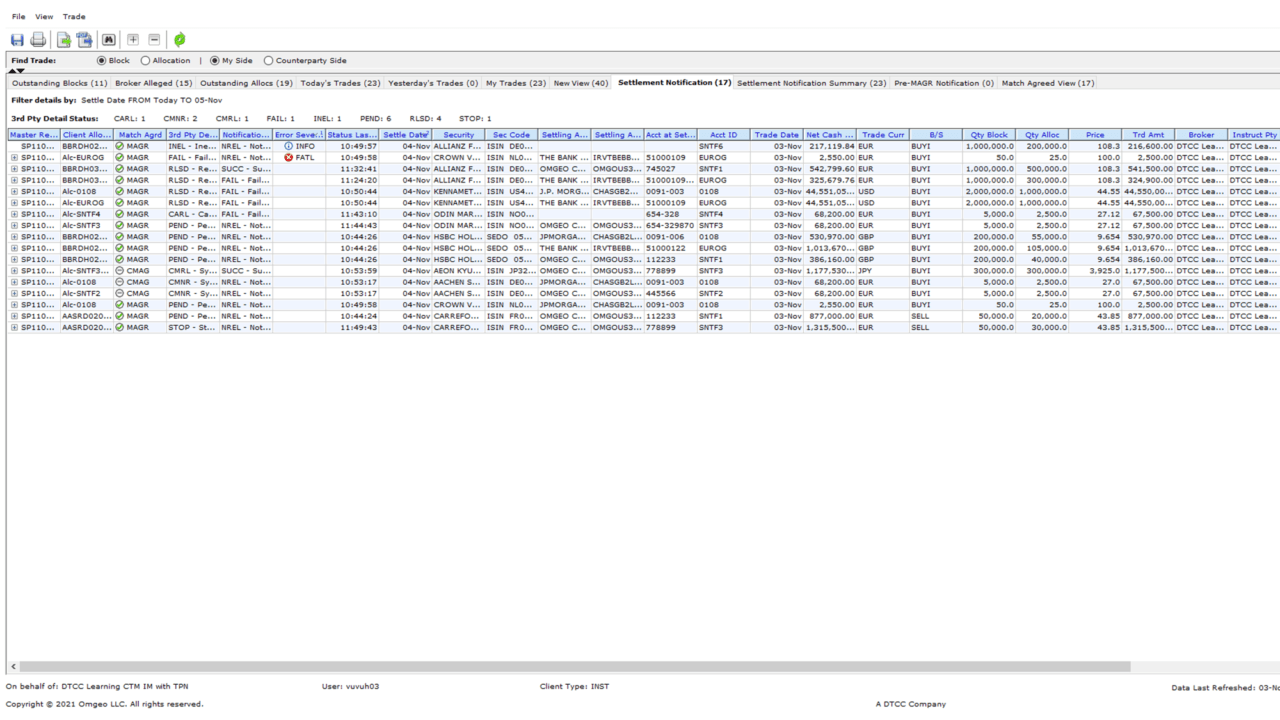

Finally, this is how the CTM trade management system looks like in real life

Trade validation use cases

Trade validation works slightly differently across asset classes, but the goal remains the same accuracy and risk reduction.

Equities

Validates share quantity, price, ISIN, and exchange details

Ensures correct buyer–seller matching before T+1 settlement

Prevents delivery or payment failures

Fixed Income

Checks bond identifiers, coupon rates, maturity dates, and accrued interest

Verifies settlement amounts and cash flow calculations

Reduces errors in interest and principal payments

Derivatives (Options & Futures)

Validates contract specifications, expiry dates, strike prices, and margins

Confirms correct position booking and exposure limits

Prevents incorrect margin calls and risk reporting errors

FX Trades

Confirms currency pairs, exchange rates, notional amounts, and value dates

Validates settlement instructions across different currencies

Reduces settlement risk in cross-border transactions

NSE capital markets report: Transformative shifts achieved through technology and reforms

Trading Operations Career Prospects

Trading operations is an exciting career and I would say rewarding too. It’s been growing and for the foreseeable future doesn’t look like it’s going to lose its steam.

So if you want to learn more then do care to check out our Certificate in Investment Banking Operations course for placements in India

FAQ

Trade validation is the process of checking whether all trade details (price, quantity, counterparty, dates, and instructions) are accurate and complete before the trade moves to confirmation and settlement.

Trade validation is critical because it prevents errors early, reduces operational risk, avoids settlement failures, and ensures trades comply with regulatory and internal rules.

Trade validation checks include instrument identifiers, trade price and quantity, counterparty details, settlement dates, settlement instructions, and compliance with regulatory limits.

Yes. Validation rules differ across markets and asset classes such as equities, bonds, derivatives, and FX because each has unique contract terms, settlement cycles, and regulatory requirements.

When a trade fails validation, it is flagged as an exception or break. Operations teams investigate, correct errors, and re-validate the trade before it can proceed further.

Trade validation checks whether trade data is correct internally, while trade confirmation is the formal agreement between counterparties that the trade details are accurate and accepted.