Last updated on July 9th, 2024 at 10:44 am

In this article I give you the detailed eclerx interview questions and also specifically focus on the eclerx financial analyst interview questions

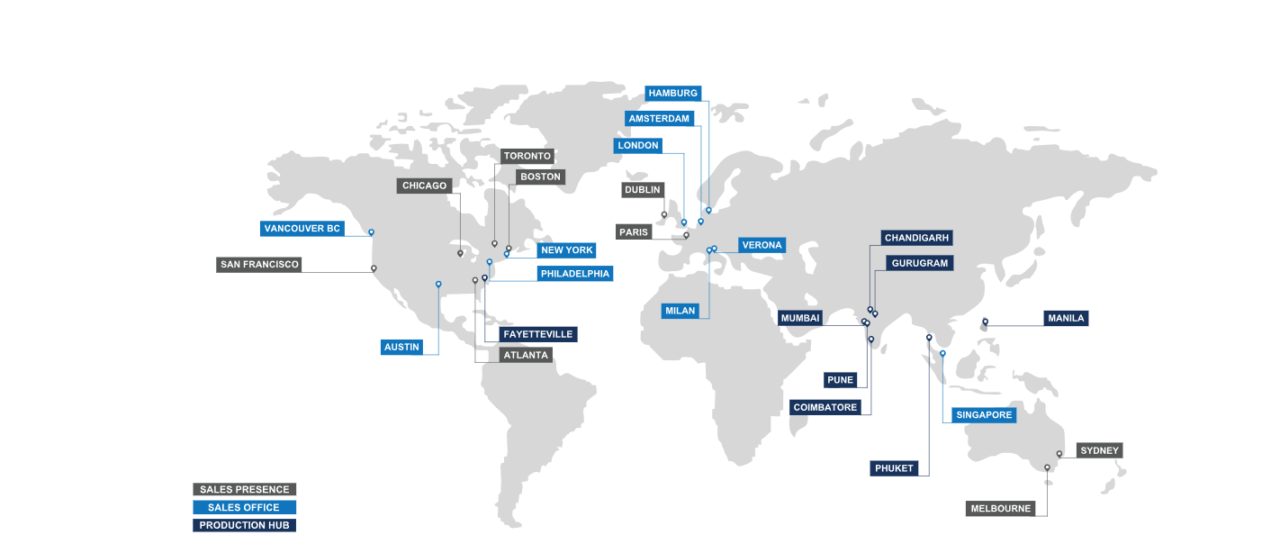

Eclerx is an outsourcing KPO, based out of Pune with operations in other cities like Mumbai.

Also, the company is listed in the Indian stock exchanges, with services rendered to Fortune 500 companies.

So, this is how you are going to achieve the final result of getting through the interview.

Roles offered at Eclerx

Alex over the years has grown from just capital markets services to now digital services like creative production, process management etc.

Moreover, Alex is also into analytics, and technology solutions.

Just to be clear, I am going to focus particularly on the finance roles.

So to summarise the roles in finance, they would be

- Dertivative Trade Support

- Cash Securities Operations

- Regulatory Compliance

- Document Management

- Analytics

Now, you might be already wondering, how am I supposed to know which role and plus how to prepare?

So don’t worry!

Basic eclerx interview questions

Eclerx is a business process management company that provides a wide range of services to clients in various industries. The interview process and questions will depend on the specific role you are applying for, but some common questions that may be asked during an interview with eclerx include:

- Why do you want to work for Eclerx?

- What are your strengths and weaknesses?

- How do you handle a high-pressure work environment?

- Can you give an example of a time when you had to work with a difficult team member?

- What experience do you have with data analysis and management?

- How do you stay current with industry trends and developments?

- How do you prioritize your tasks and manage your time effectively?

- Can you give an example of a project you have worked on and the outcome?

- How do you approach problem-solving and decision-making?

- Can you give an example of a successful business process improvement you have implemented in the past?

It’s important to note that the questions asked during an interview with eclerx will depend on the specific role you are applying for and the department, but preparing for these types of questions can give you a sense of what to expect. Additionally, it’s always a good idea to come prepared with specific examples of your relevant experience, skills, and accomplishments.

Eclerx interview questions by job category

Now one of the two major locations of their operations in finance is either Pune or Mumbai

. However, the requirement for preparations is pretty much similar.

eclerx interview questions–Financial Market Analyst

Experience Required:0

It’s funny that many of their designations finally end up doing the same job. However I guess they still have to give different names to it.

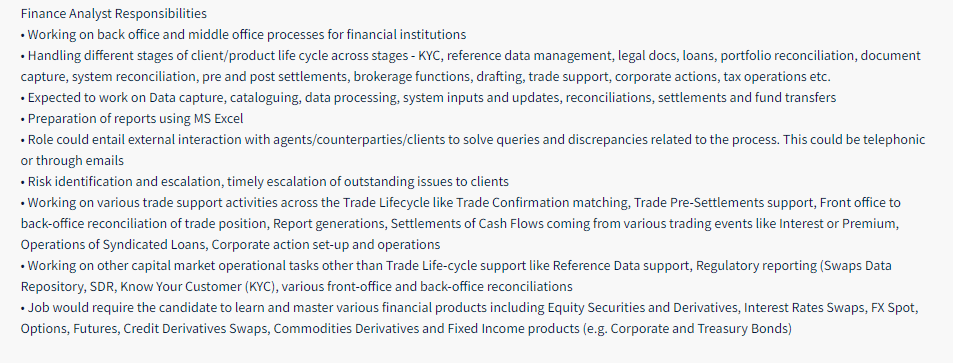

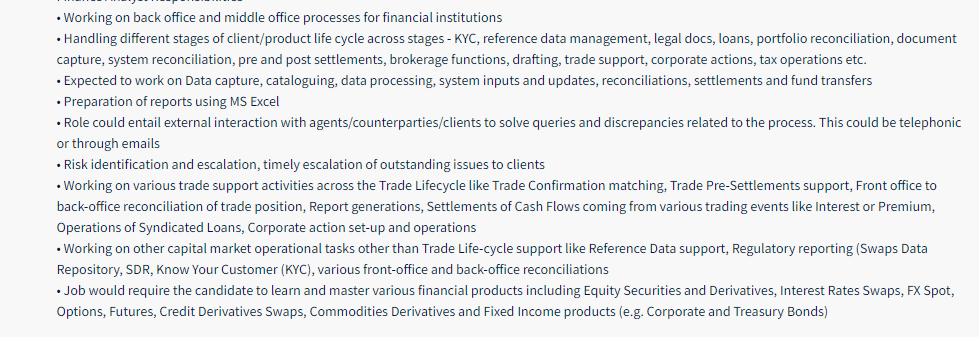

Firstly, try to look closely at the second line, which clearly means that this is a middle office role with the trade life cycle.

Secondly, the tricky part is, that each of the next lines mentioned is large departments by themselves.

- Financial Market Analyst- Oasys

Now, that’s a designation to have. Oasys analyst!

Anyways just to be clear, oasys is trade management system by DTCC.Which by the way is already getting decommissioned from operations.

Now I kid you not, look at the job description below and see if you find any difference from the previous role?

- Financial Analyst -C1

I am not going to write it again but if you want to check this job description, as well the job requirements Are the same.

In conclusion, what I am trying to get at?

That you don’t need role-specific interview preparation but generalised preparations will rock their way!

Preperation Tips- eclerx interview

If you listen to me 100%, then I guarantee you will clear this interview.

Now, lend me your eyes!

Firstly, understand that we are talking about trading operations support.

So you are expected to participate in various stages of the trading process, from trade capture all the way up to trade settlement.

This brings me to a point, that you can’t do this work unless you know the following;

- Equity, Fixed Income and Derivatives assets and markets

I recommend approaching these contents up to the following depth. So for each of these asset classes, you should know;

Some common eclerx interview questions

- How they are priced?

- Various businesses related to these asset classes like hedge funds, mutual funds etc

- Understand how these are traded in the exchange and Over counter market.

- Basic corporate actions related to these assets like bonus shares, dividends, coupon payments and so on.

Advance Eclerx Interview Questions

Trade Life Cycle

Believe me, there is a 99.9% chance that any interviewer will ask you this question.

“What is the trade life cycle?”.

While I also guarantee you, that 50% of the candidates will not know the answer.

Which for me is a sweet deal to crack the interview.

So spend some good time reading about Trade Life Cycle.

Industry Knowledge of Middle Office

Most of the candidates land up in these interviews like sheep, not knowing what they are getting into.

First and last piece of advice please read about how the front office, back office and middle office work.

Also, spend some time researching the company you are going to give an interview for.

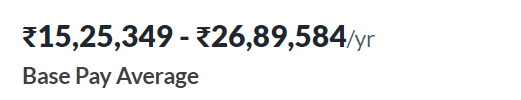

Salary & Growth

So, I'll be upfront with you here!

Don't expect the stars when you start!

You are a new bee, you don't know how to fly so far.

So keep your head down and learn for at least 2 years and you will realise that there is an ocean of opportunity available.

However, I know you will be disappointed if I don't share the climax.

So here it is!

- Fresher:18 to 20k per month

- After 1 or 2 years of super-fast learning: 30-40 K

- Another year of studying and going deeper in the industry- 8-10 lacs

Any projections beyond this is just projections, so leave it to rest!

Conclusion

If you need my help in doing all of the above them come and join me in the investment banking operations course.