Last updated on September 29th, 2023 at 02:43 pm

Risk Management is often misunderstood, complicated and made as the out of the world career with puzzles and skills that are impossible to achieve with an ordinary background. Utter crap! Just like other careers, the education industry has made huge profits even on this unawareness.Its funny how the education, instead of making it easy has further complicated the problem. Anyways I don’t really want to talk about the education industry, but help you understand in the most simple way, how to get risk management jobs .

This is what we cover to break this problem:

its important that you read each section, so as to not be again confused with why I am suggesting the 5 steps at the first place.So hang on till the end.

What is Risk Management

Risk management is in simple language: The risk tolerance or what is the limit of risk you wish to take. However whenenever we think of risk management, we think that its always just financial risk but thats not so. Risk management includes:

- Financial Risk: Risk of loss of capital or money when investing

- Regulatory or Compliance risk: Not following local goverment rules under many areas

- Operational Risk: People risk, internal policies

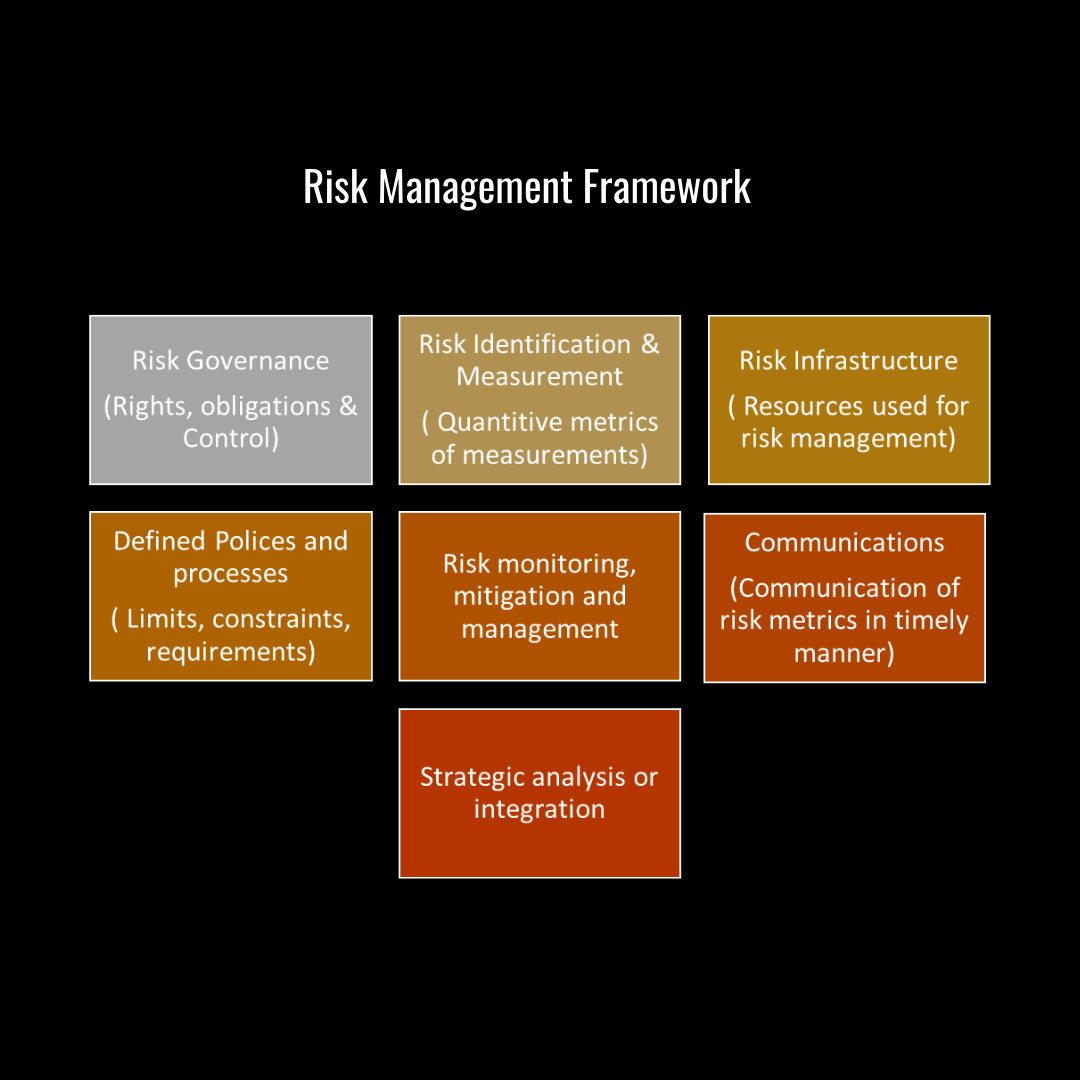

I have avoided getting into many other risk management functions, which are also there but at this stage its unncessary for you to understand. Now all of these risk management areas are thought through and structured in the framework shown below

So lets say you were managing a mutual funds, you would lets say set the financial risk as: stocks should be atleast a mid cap stock with volatility not more than 25%, similary you would set various risk measurement techniqies, create process and people to monitor this risk and also structure the communication of risk data to the management. This would be similar to even regulatory risk and operational risk.

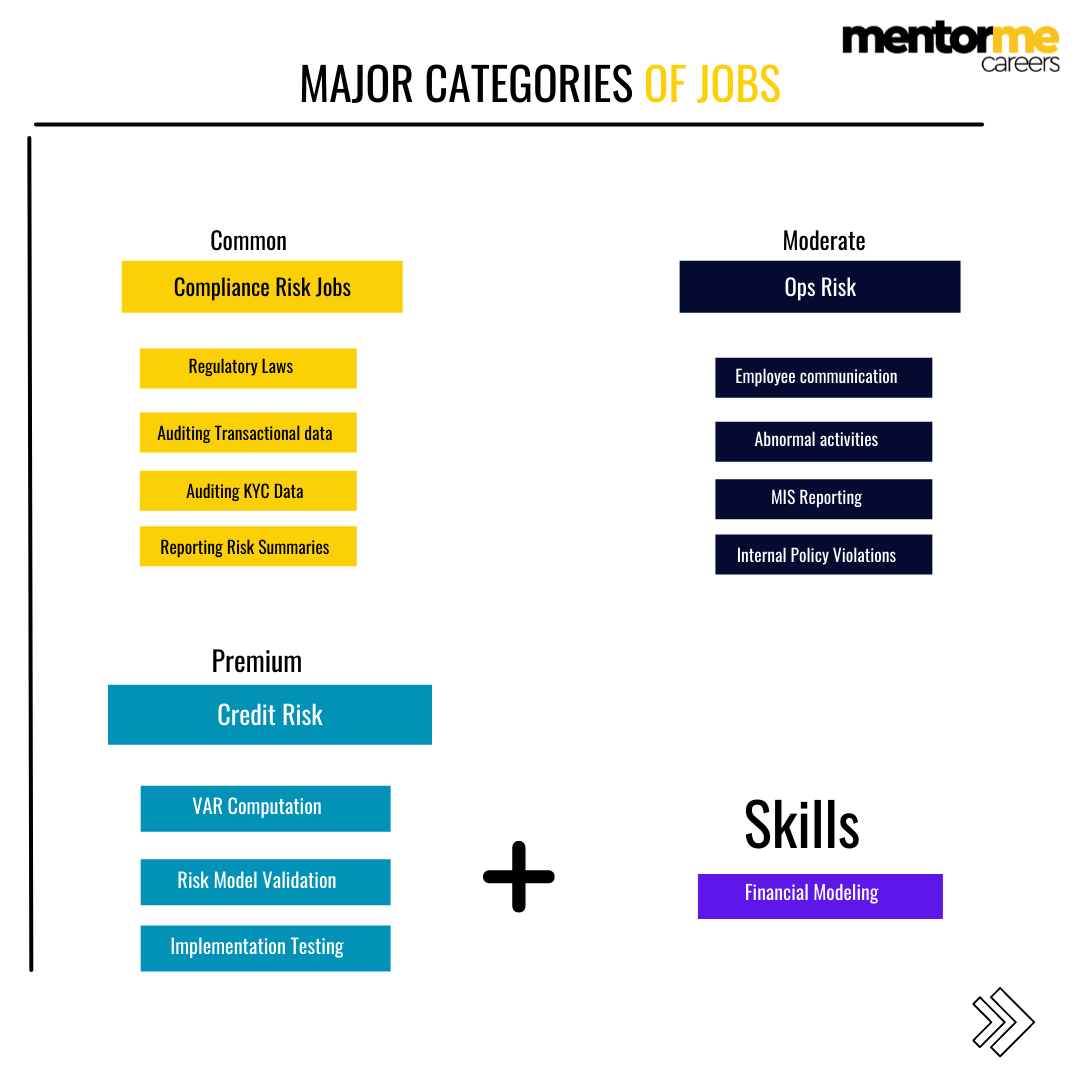

Types of Jobs & Roles in Risk Management?Compensation & Salary in risk management

- Credit Risk Roles:Example

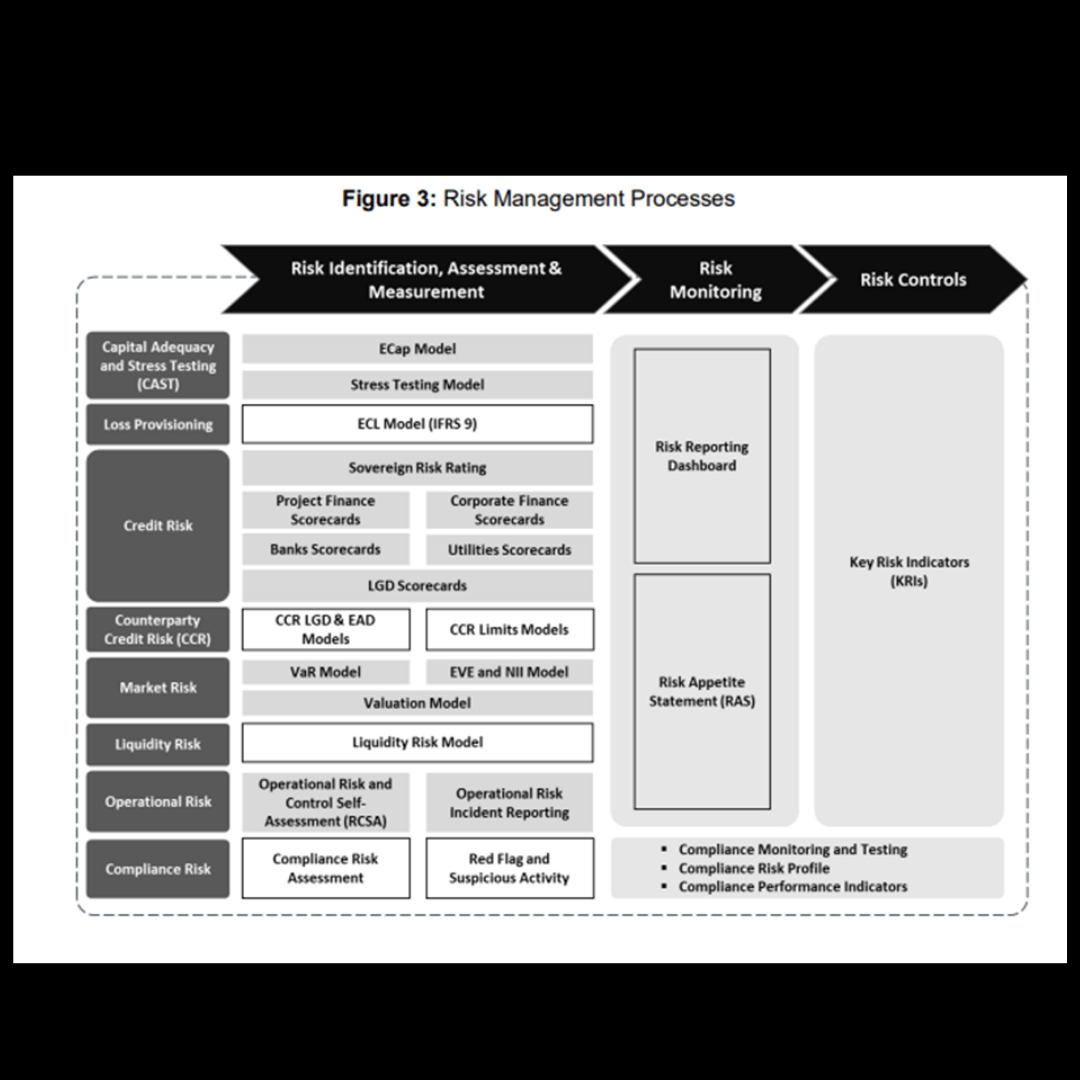

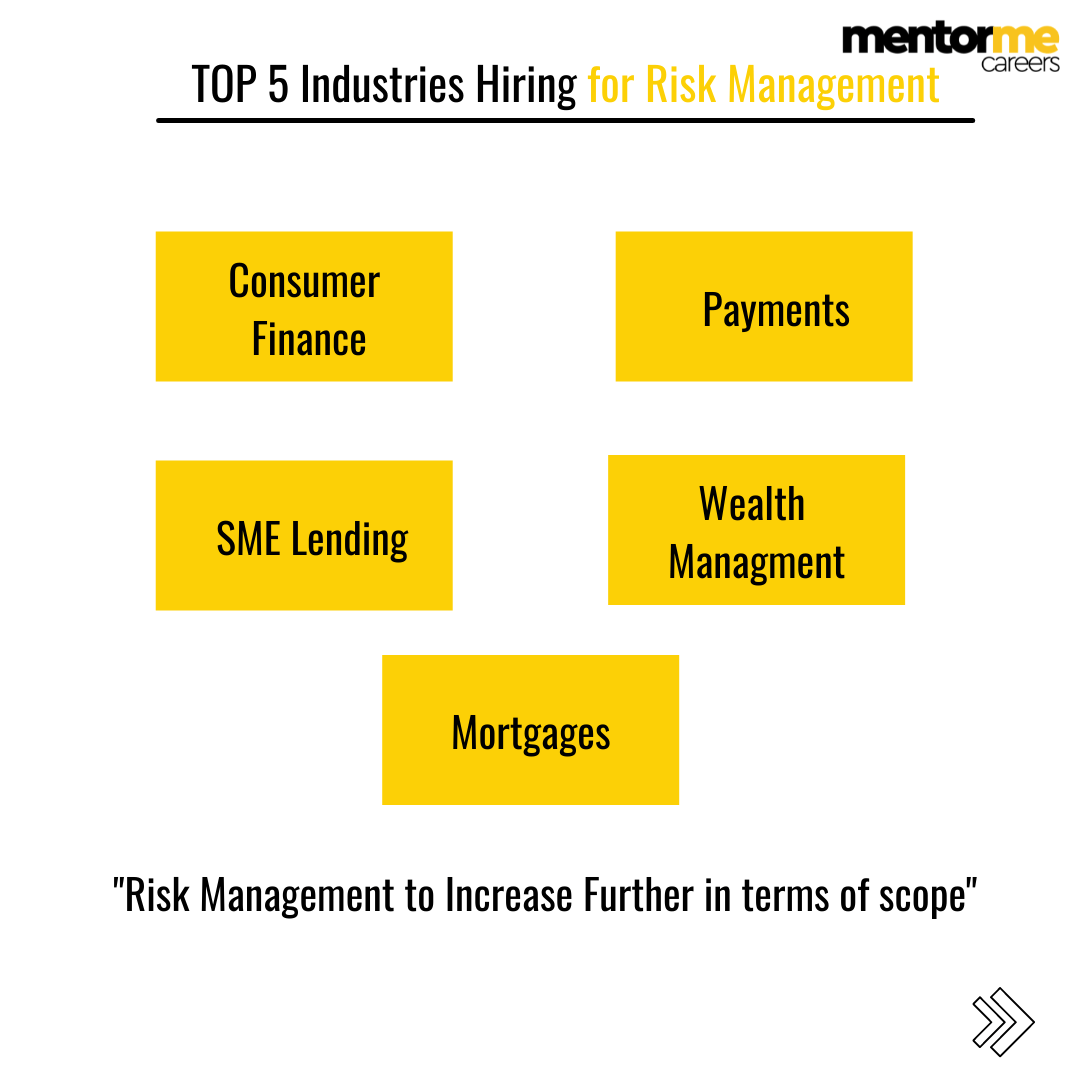

Lately risk roles have increased, and it has increased for a reason since regulations have become more stricter, more complex, more wide but the category of roles discussed above are the major ones. This becomes more clear when we see the risk management process of ICICI bank below. You can clearly see the three role categories

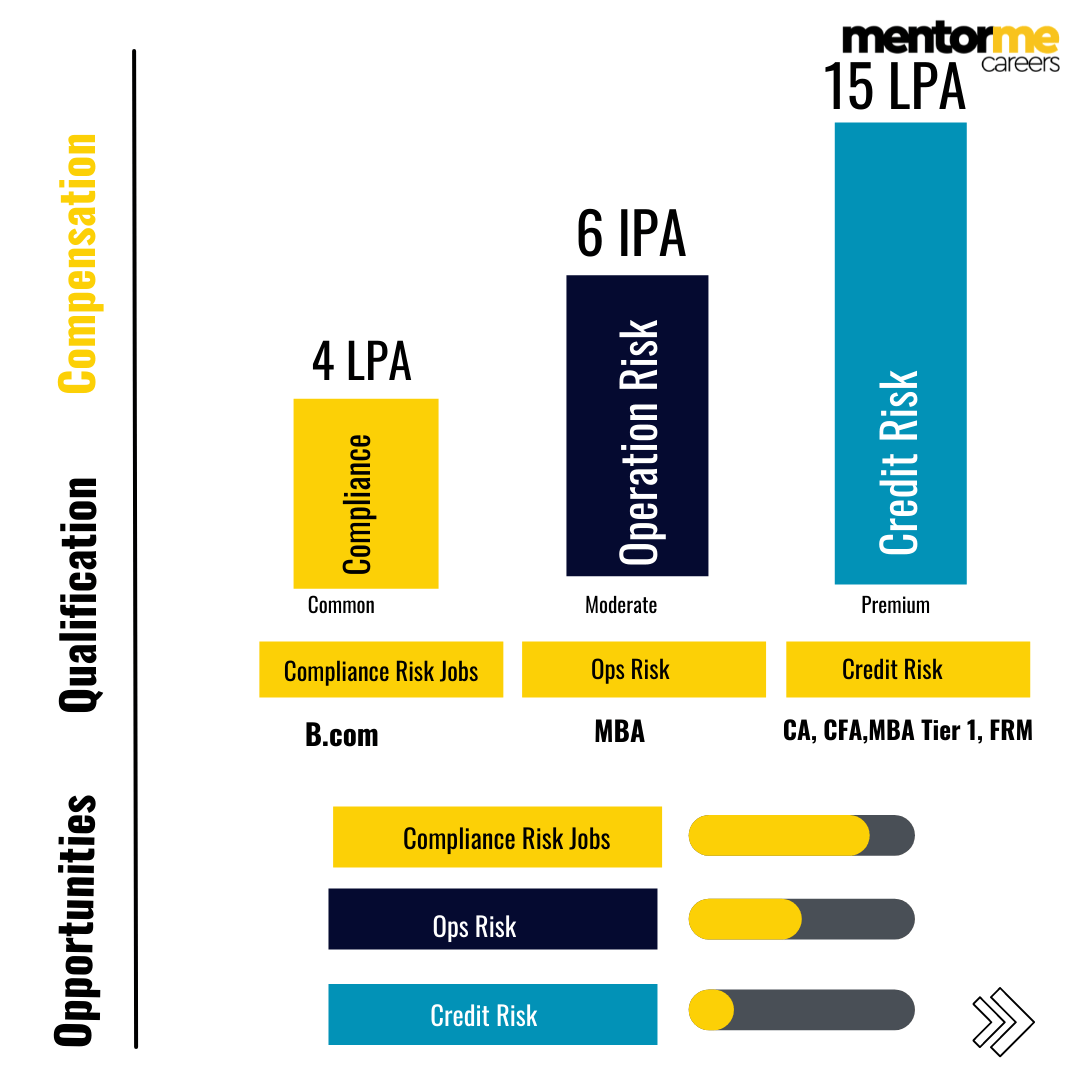

Compensation & Salary in risk management

I know a lot of you want to know this, so ill keep it short and cut the chase.

- Compliance Risk: These jobs tend to be the lowest on the pay scale because these are more process oriented jobs and manual.

- Opertation Risk: Operational risk jobs are moderate payers, higher than compliance risk jobs.

- Credit risk or risk modelling jobs: These are the most premium jobs in risk management, and are the highest payers

Skills to acquire for risk management specefic roles

A lot of courses which are nothing but hollow pipes are selling in the market, claiming to get you trained for risk management but in reality all you need is written below with each categories

- Compliance Risk: No course required

- Opertation Risk: Good analytical skills like excel, reporting

- Credit risk or risk modelling jobs: You need to know financial modelling,strong statistical understanding.

Optional Certifications for Risk Management

FRM(GARP) For credit risk jobs only but you can enter risk management even without FRM.

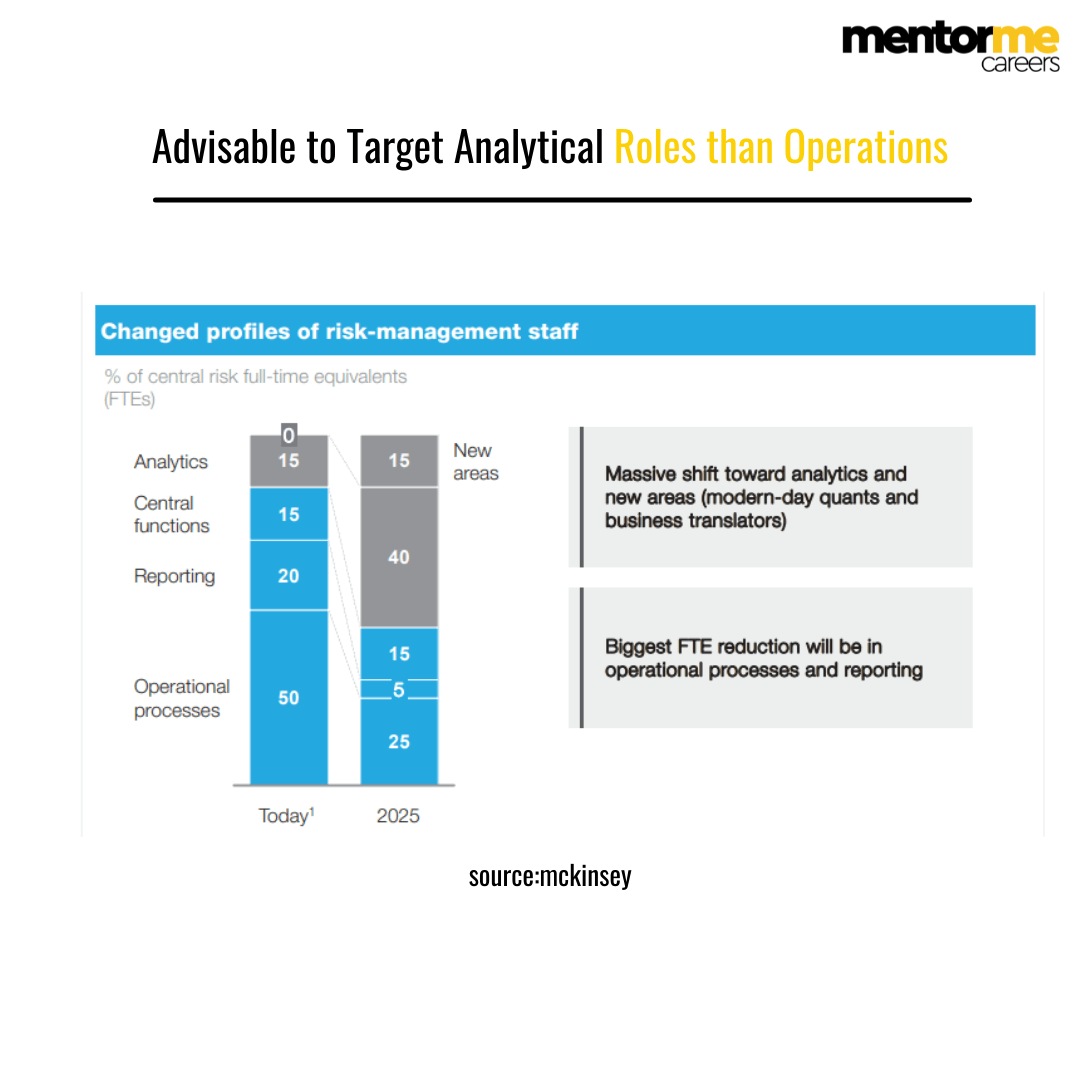

Risk management roles that will disappear

5 steps to enter risk management

You cannot enter risk management in one year and earn the highest salaries, but you need to progress slowly and steadily. Here are my 5 simple steps

- Enter compliance risk roles as a graduate or MBA : Don’t wait for the perfect role, that’s a biggest mistake. More time spent not working is more harmful than helpful.Even compliance risk expereince can help you. Infact in can help you more compared to a degree or certification

- Learn Financial Modeling: You need to learn how to deal with data,oeganise data and solve problems. Risk management activities in premium roles are problem solving. Hence you should absolutely learn financial modelling. What is financial modelling-check my article here

- Master Statistics: You need to have practical and working understanding of statistics. Specifically you should learn about distributions, VAR, Hypothesis testing, ANNOVA etc. Any simple book on statistics should be a good start, but make sure to use financial modelling to implement it

- Read More: Read books on credit risk management, particularly if you are interested in finance. This book on credit risk can be a good start.

Attach a Good Respected Qualification: I don’t necessarily mean FRM, any strong global or national well respected qualification should be added at this stage to create more visibility of your profile.

Closing Remarks

Do not do too many things and confuse your self, risk management is just like any other career. It requires learning, patience, industry experience. More so it requires patience and depth. So use the above 5 steps and reach out for any questions, happy to help