Last updated on December 2nd, 2025 at 05:59 pm

Risk Management is often misunderstood, complicated and made as the out of the world career with puzzles and skills that are impossible to achieve with an ordinary background. Utter crap! Just like other careers, the education industry has made huge profits even on this unawareness. Its funny how the education, instead of making it easy has further complicated the problem. Anyways I don’t really want to talk about the education industry, but help you understand in the most simple way, how to get risk management jobs.

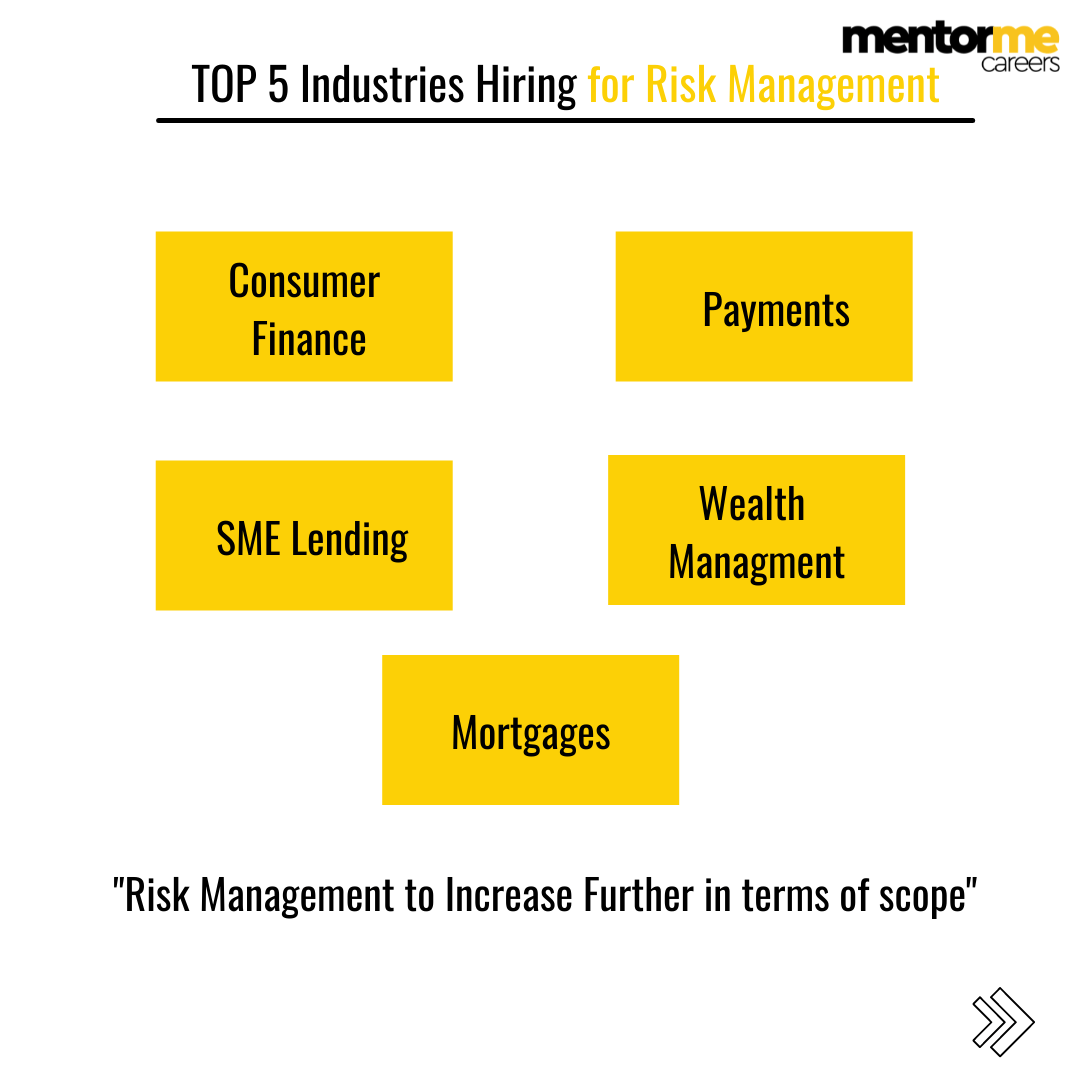

Risk management roles in the finance industry have become some of the most desirable career options in today’s job market, a trend that is increasingly acknowledged by students who recognize the substantial opportunities this field presents. For those looking to step into financial risk management or seeking a straightforward approach to land such positions in five simple steps, this guide serves as a useful tool that can reduce much of the ambiguity involved. As banks, non-banking financial companies (NBFCs), fintech startups, the Big Four accounting firms, and multinational corporations improve their risk management systems, the need for skilled risk analysts has reached record highs.

This is what we cover to break this problem:

its important that you read each section, so as to not be again confused with why I am suggesting the 5 steps at the first place.So hang on till the end.

What is Risk Management

Risk management is in simple language: The risk tolerance or what is the limit of risk you wish to take. However whenenever we think of risk management, we think that its always just financial risk but thats not so. Risk management includes:

- Financial Risk: Risk of loss of capital or money when investing

- Regulatory or Compliance risk: Not following local goverment rules under many areas

- Operational Risk: People risk, internal policies

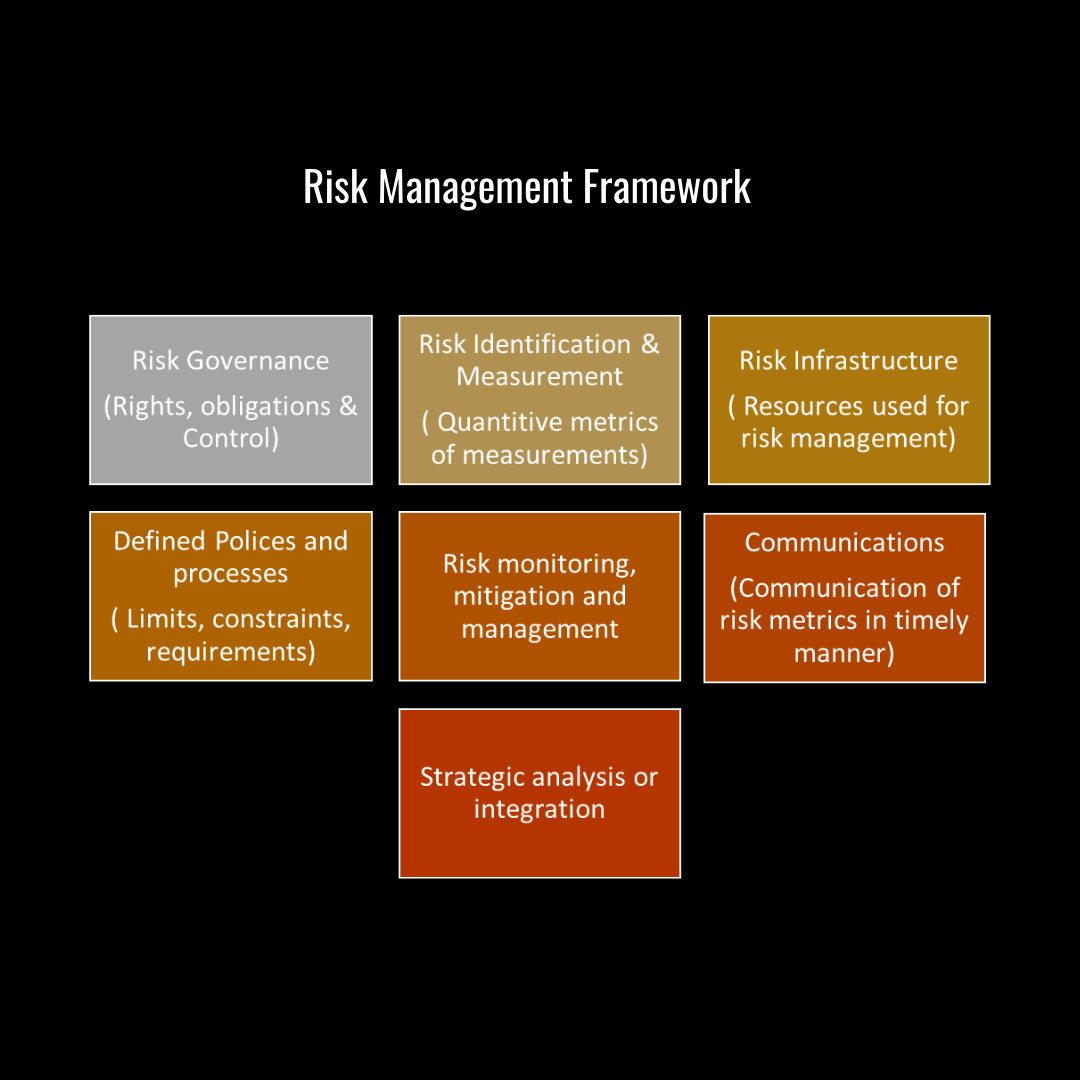

I have avoided getting into many other risk management functions, which are also there but at this stage its unncessary for you to understand. Now all of these risk management areas are thought through and structured in the framework shown below

So lets say you were managing a mutual funds, you would lets say set the financial risk as: stocks should be atleast a mid cap stock with volatility not more than 25%, similary you would set various risk measurement techniqies, create process and people to monitor this risk and also structure the communication of risk data to the management. This would be similar to even regulatory risk and operational risk.

Types of Jobs & Roles in Risk Management?

Risk management roles in India are diverse and growing across areas such as Market Risk, Credit Risk, Operational Risk, Model/Model-Validation Risk, and Liquidity & Treasury Risk. Each field necessitates a mix of specialized expertise, quantitative skills, and an understanding of regulations. Recruitment firms like Michael Page, Robert Walters, Hays, eFinancialCareers, and Morgan McKinley consistently highlight a strong demand and competitive salaries for technical risk roles in 2025.

Market risk

Typical roles: Market Risk Analyst, Market Risk Modeller, VaR Analyst, Risk Quant, Market Risk Manager.

Core responsibilities: Measure and monitor market exposures (VaR, sensitivities, stress tests), support trading desks, backtest models, produce risk limits and daily risk reports.

Who hires: Investment banks, proprietary trading firms, asset managers, large banks, fintechs.

Key skills: Derivatives, options/forwards, VaR methodologies, time-series analysis, Python/R, Monte-Carlo simulation, Bloomberg/Refinitiv.

Market signal: Market risk roles command premium pay and strong demand in hubs like Mumbai and Bengaluru. Recruiter job listings and salary guides show market risk positions as a high-pay, technical niche.

Credit risk

Typical roles: Credit Risk Analyst, Credit Underwriter, Portfolio Risk Analyst, Credit Risk Manager, IFRS9 / Expected Credit Loss Analyst.

Core responsibilities: Assess borrower creditworthiness, build PD/LGD/EAD models, run stress tests and scenario analyses, prepare regulatory credit reports, manage provisioning.

Who hires: Retail & corporate banks, NBFCs, rating agencies, fintech lenders, consultancies.

Key skills: Financial statement analysis, credit modelling, IFRS9/IFRS standards, stress testing, SQL/Excel, familiarity with lending platforms.

Market signal: Recruiters (Robert Walters, Investopedia) highlight demand for credit risk hires, especially after tighter regulatory scrutiny and recent RBI model-guidance updates. Salaries for credit risk specialists are competitive in 2025.

Operational risk

Typical roles: Operational Risk Analyst, Risk Control Officer, Business Continuity Manager, Operational Risk Manager.

Core responsibilities: Identify/process operational loss events, maintain KRI frameworks, run RCA (root-cause analysis), build controls, manage business continuity and vendor risk.

Who hires: Banks, insurers, brokerage firms, Big 4 consultancies, large corporates.

Key skills: Process mapping, control design, incident investigation, KRI dashboards, SOX/GRC tools, stakeholder engagement.

Market signal: Operational risk roles are widely recruited through specialist agencies (Hays) and are essential for regulatory compliance and resilience programs.

Model validation risk

Typical roles: Model Validation Analyst, Model Risk Specialist, Quant Validation, Model Risk Manager.

Core responsibilities: Independently validate pricing, credit and market models (conceptual soundness, assumptions, inputs), benchmark models, backtest, approve model governance and lifecycle.

Who hires: Banks, global investment firms, model vendors, regulators, consulting boutiques.

Key skills: Statistical validation, Python/Matlab/R, knowledge of model governance, experience with Monte-Carlo, derivative pricing, stress-testing.

Market signal: Demand is rising (see eFinancialCareers job ads) after regulators (including RBI) required stricter model governance and independent validation. These roles are technical and command strong compensation.

Liquidity & Treasury risk

Typical roles: Liquidity Risk Analyst, Treasury Analyst, ALM (Asset-Liability Management) Analyst, Liquidity Risk Manager.

Core responsibilities: Manage LCR/NSFR metrics, intraday liquidity, funding plans, stress tests, coordinate with treasury on hedging and funding strategies.

Who hires: Banks (Treasury/ALM desks), large NBFCs, corporates with treasury functions, central banks/regulatory teams.

Key skills: Treasury systems, cash-flow modelling, interest-rate risk, ALM tools, regulatory reporting.

Market signal: Recruiters like Morgan McKinley list liquidity risk specialists as high-demand in 2025, particularly in banks strengthening treasury & ALM teams.

- Credit Risk Roles: Example

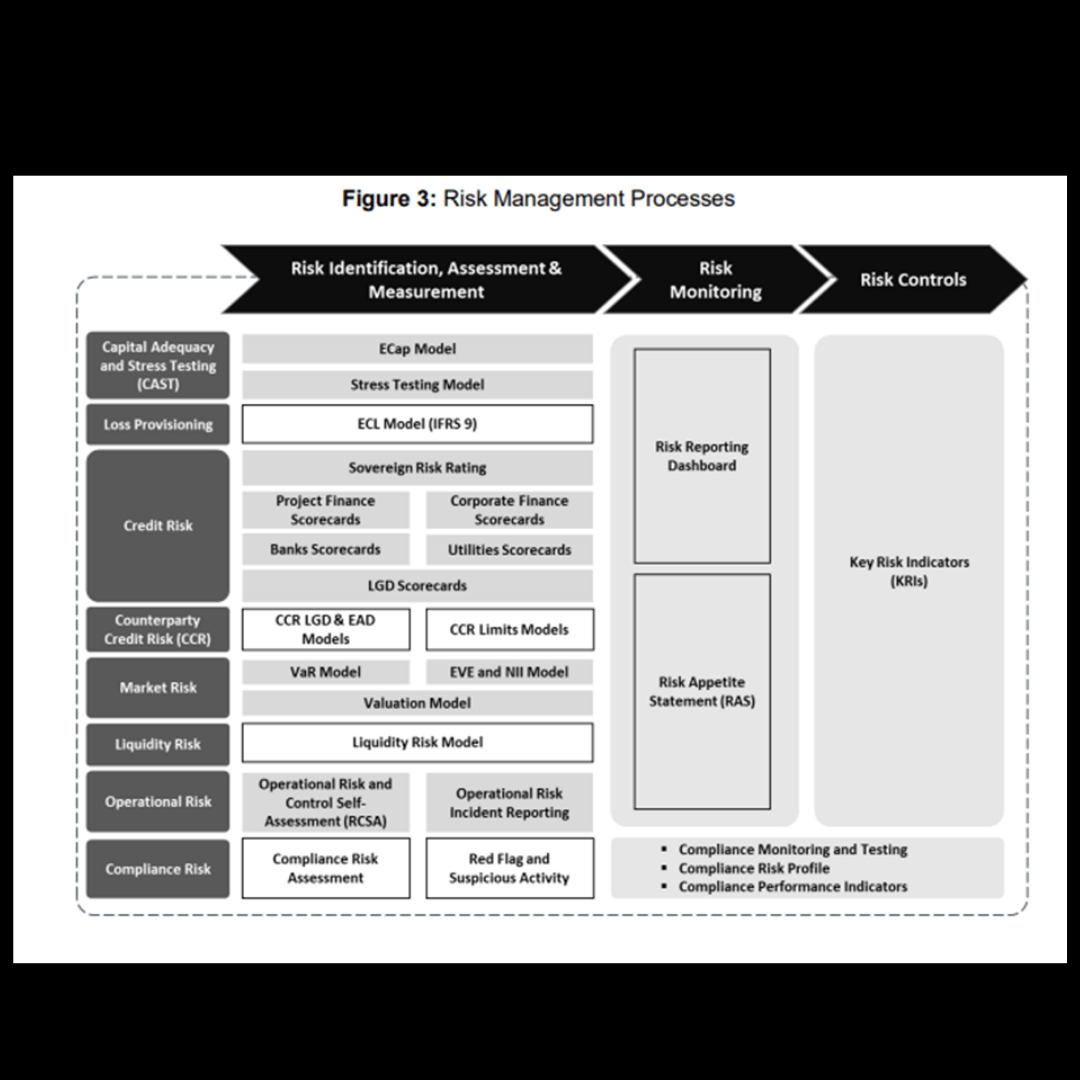

Lately risk roles have increased, and it has increased for a reason since regulations have become more stricter, more complex, more wide but the category of roles discussed above are the major ones. This becomes more clear when we see the risk management process of ICICI bank below. You can clearly see the three role categories

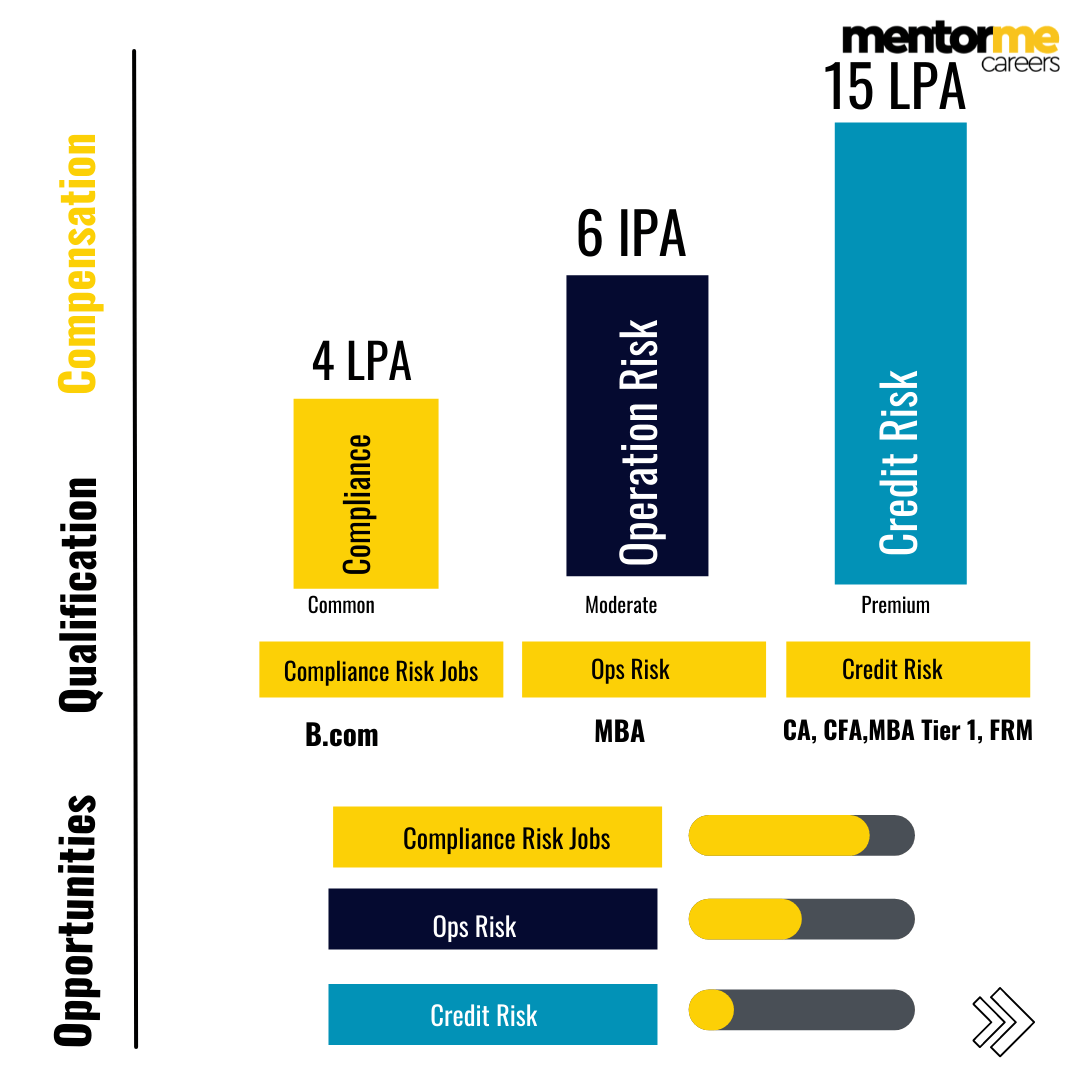

Compensation & Salary in risk management

I know a lot of you want to know this, so ill keep it short and cut the chase.

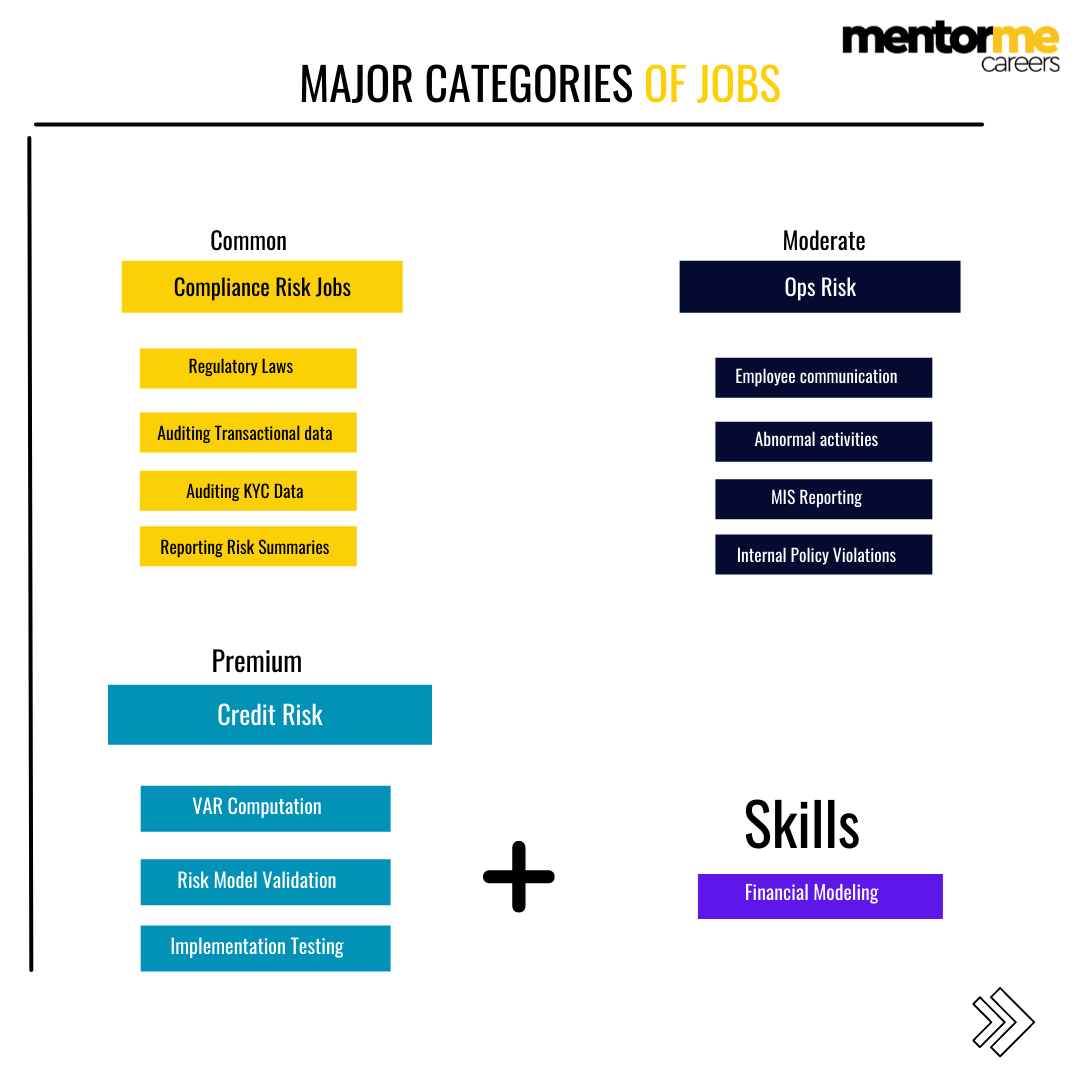

- Compliance Risk: These jobs tend to be the lowest on the pay scale because these are more process oriented jobs and manual.

- Opertation Risk: Operational risk jobs are moderate payers, higher than compliance risk jobs.

- Credit risk or risk modelling jobs: These are the most premium jobs in risk management, and are the highest payers

| Role | Typical Salary Range (₹ LPA) | Notes |

| Risk Analyst / RM Analyst | ₹5.5 – 15.5 | Entry → 3 yrs; Glassdoor median ~₹8.7 LPA (25th–75th: ~₹5.5–15.5). |

| Credit Risk Analyst / Credit Risk | ₹8 – 21 | Banks, NBFCs, fintechs; Glassdoor / 6figr show averages ~₹13–17 LPA. |

| Market Risk Analyst | ₹8.5 – 19 | Derivatives / VaR roles; Glassdoor average ₹13 LPA. Higher in trading desks. |

| Operational Risk Manager | ₹8 – 20 | Process risk, BCP, KRIs; mid-senior managers in banks/insurers. |

| Liquidity / Treasury Risk | ₹10 – 22 | Treasury teams in banks/large NBFCs pay premiums. |

| Model Validation / Model Risk Analyst | ₹9 – 26 | Requires quant/stat skills; higher pay in major banks & vendors. |

| Quantitative Risk Analyst | ₹12 – 30+ | Quants (market/credit) command top mid-career pay; strong Python/R/Math helps. |

| Enterprise Risk Manager / Head of Risk (mid) | ₹12 – 35 | ERM, risk appetite, board reporting in corporates/consulting. |

| Chief Risk Officer (CRO) / Senior Leadership | ₹30 – 100+ | Large banks, insurance, or multinationals; wide band depending on org size. |

Skills to acquire for risk management specific roles

A lot of courses which are nothing but hollow pipes are selling in the market, claiming to get you trained for risk management but in reality all you need is written below with each categories

- Compliance Risk: No course required

- Operation Risk: Good analytical skills like excel, reporting

- Credit risk or risk modelling jobs: You need to know financial modelling, strong statistical understanding.

1. Excel (Advanced Beginner Level)

Pivot tables, lookups, conditional formatting

Basic financial modelling (P&L, sensitivity tables)

Data cleaning & trend analysis

Why it matters: Almost every risk report, model output, and daily MIS runs on Excel.

2. SQL for Data Extraction

Risk teams heavily rely on databases and large datasets.

Writing simple SELECT, JOIN, GROUP BY queries

Extracting daily risk numbers from internal systems

Why it matters: Banks and fintechs prefer freshers who can pull data independently.

3. Basic Python (For Analytics + Automation)

Pandas, NumPy for data handling

Using Python to automate repetitive tasks

Why it’s key: Python is now the top skill for quant, market, and credit risk teams.

4. Understanding of Financial Instruments

Recruiters want candidates who can explain:

Bonds, loans, derivatives (futures, options, swaps)

How interest rates, FX, and credit risk work

Why it matters: Risk roles are technical; understanding products is non-negotiable.

5. Core Risk Concepts

At fresher level, you must know:

VaR (Value at Risk)

PD/LGD/EAD (credit risk models)

Stress testing & scenario analysis

Liquidity ratios (LCR/NSFR)

Why it matters: These appear in interviews even for entry-level roles.

6. Basic Statistics & Probability

Mean, variance, correlation

Regression basics

Tail risk & distributions

Why it matters: Risk analysis is fundamentally statistical.

7. Regulatory Awareness (Beginner Level)

Know at least basics of:

RBI regulations

Basel norms

Stress testing guidelines

Why it matters: Shows industry awareness recruiters love this.

8. Power BI / Tableau (Nice-to-have)

Build simple dashboards

Visualise risk trends

Why it matters: Data visualisation is increasingly part of daily reporting.

9. Communication & Documentation Skills

Writing clean reports

Explaining risk findings to managers

Why it matters: Risk roles require clarity in communication, especially STR/SAR-like documentation in operational/AML risk

Optional Certifications for Risk Management

FRM(GARP) For credit risk jobs only but you can enter risk management even without FRM.

1. FRM (Financial Risk Manager) – GARP

Most recognized global certification for market risk, credit risk, liquidity risk, VaR, Basel norms, and risk modelling.

Ideal for roles in banks, NBFCs, consulting, and investment management.

2. CFA (Chartered Financial Analyst)

Covers valuation, equity, fixed income, derivatives, portfolio management, and risk analytics.

Preferred for market risk, investment risk, and treasury roles.

3. PRM (Professional Risk Manager) – PRMIA

Focused on model risk, quantitative methods, governance, and advanced risk frameworks.

Best for model validation, enterprise risk, and quantitative portfolios.

4. CERA (Chartered Enterprise Risk Analyst)

Enterprise-wide risk qualification covering strategic, operational, and insurance risk.

Suited for ERM teams in large companies.

5. Certificate in Credit Risk / ICA AML / NISM

Specialized certificates for credit risk, AML/KYC, regulatory compliance, and financial crime risk.

Good entry route for freshers.

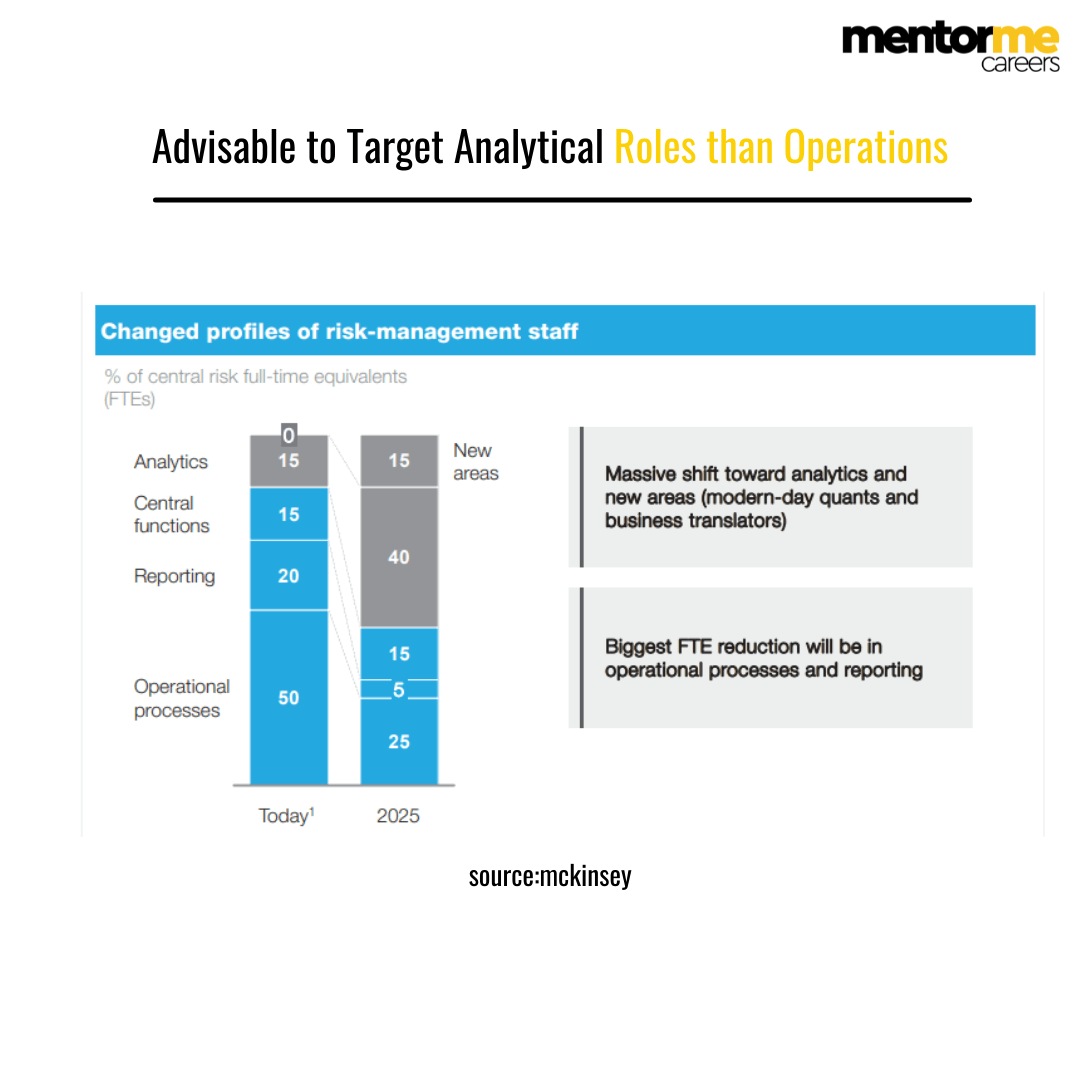

Risk management roles that will disappear

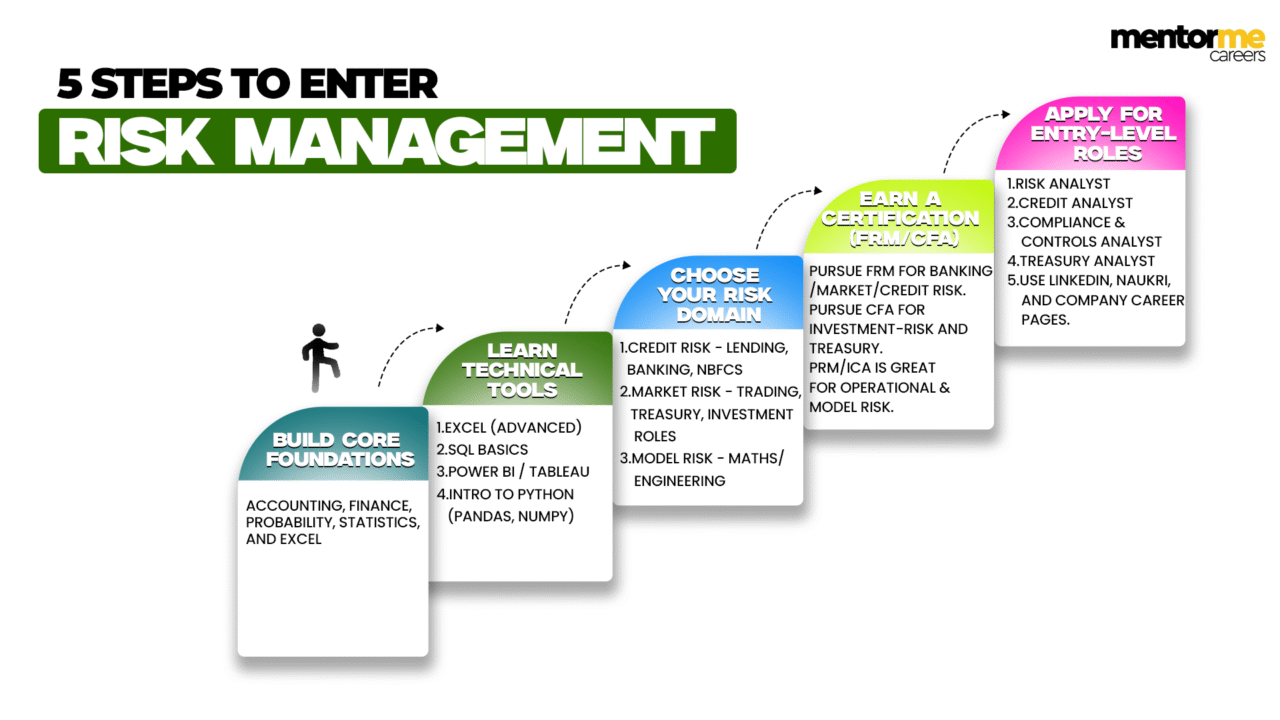

5 steps to enter risk management

You cannot enter risk management in one year and earn the highest salaries, but you need to progress slowly and steadily. Here are my 5 simple steps

Step 1: Build Core Foundations

Start with strong fundamentals in accounting, finance, probability, statistics, and Excel. These are non-negotiable for all junior risk roles.

Step 2: Learn Technical Tools (Beginner Level)

Freshers should learn:

1.Excel (advanced)

2.SQL basics

3.Power BI / Tableau

4.Intro to Python (Pandas, NumPy)

These tools help in data analysis, reporting, and modelling.

Step 3: Choose Your Risk Domain

Pick the field that suits your interest and background:

1.Credit risk – lending, banking, NBFCs

2.Market risk – trading, treasury, investment roles

3.Operational risk – compliance, controls, audit

4.Model risk – maths/engineering/statistics students

Align your profile accordingly.

Step 4: Earn a Certification (FRM/CFA)

Pursue FRM for banking/market/credit risk.

Pursue CFA for investment-risk and treasury.

PRM/ICA is great for operational & model risk.

Step 5: Apply for Entry-Level Roles

Start with titles like:

1.Risk Analyst

2.Credit Analyst

3.Operational Risk Associate

4.Compliance & Controls Analyst

5.Treasury Analyst

6.Use LinkedIn, Naukri, and company career pages.

Prepare for interviews with case studies, VaR basics, PD/LGD, and Excel tests.

Attach a Good Respected Qualification: I don’t necessarily mean FRM, any strong global or national well respected qualification should be added at this stage to create more visibility of your profile.

Closing Remarks

Risk management has become one of the fastest-growing finance careers in India, driven by digital lending, fintech expansion, Basel III/IV norms, and rising fraud risks. Whether you’re a fresher or early-career professional, entering risk management in 2025 is far more accessible with the right mix of skills, tools, and certifications. By mastering the basics of finance, learning data tools like Excel, SQL, and Python, and pursuing certifications such as FRM, CFA, or PRM, you can build a strong foundation for high-growth roles in banks, NBFCs, consulting firms, and global capability centers.

If you follow the five-step roadmap, learn fundamentals, build analytical skills, pick a domain, get certified, and apply strategically, you can start your journey confidently and stand out in the competitive job market. Do not do too many things and confuse your self, risk management is just like any other career. It requires learning, patience, industry experience. More so it requires patience and depth. So use the above 5 steps and reach out for any questions, happy to help.

FAQ

Risk Analyst, Credit Risk Analyst, Market Risk Analyst, Operational Risk Manager, Model Validation / Quant Risk Analyst, AML/Compliance Officer, Liquidity Risk Manager, Enterprise Risk Manager, Risk Consultant and Chief Risk Officer (CRO).

Entry-level risk analysts: ₹4–8 LPA. Mid-level (3–6 yrs): ₹8–18 LPA. Senior/specialist roles: ₹18–40 LPA+ depending on sector (banks, fintech, consulting) and credentials.

Top credentials: FRM (market/credit/operational risk), CFA (investment & risk roles), PRM (professional risk management). Helpful add-ons: CFA Institute certificates, CERA, Data/ML certs, and domain certs for AML or model validation.

Yes, freshers should target risk analyst roles. They’re excellent entry points to learn modelling, regulatory exposure, and domain knowledge. Internships, basic quant skills and Excel proficiency make freshers highly hireable.

Core tech skills: Advanced Excel (pivot, modelling), SQL (data extraction), Python or R (analytics), VaR & stress testing, data visualization (Power BI/Tableau), plus familiarity with SAS, Bloomberg, or risk platforms for market/credit roles.

Typically 5–8 years: ~2–4 years in analyst roles, 2–4 years in senior/specialist roles, plus certifications (FRM/CFA) and demonstrated ownership of risk projects to move into manager level.