Last updated on October 23rd, 2024 at 04:57 pm

What is a Fraud Triangle?

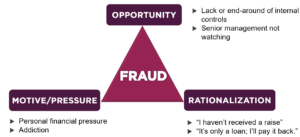

The fraud triangle is a concept that explains the reasons behind committing fraud by workers at a workplace. According to the Fraud Triangle, there are three elements that are responsible for committing fraud – pressure, rationalization, and opportunity. According to this concept, fraud occurs when these conditions for fraud are favourable to the fraud committer.

What is Fraud?

Fraud refers to a deception by an individual or organization caused intentionally for personal gain. It is usually done to generate illegal profit. This illegal act benefits the perpetrator and harms other parties involved. For example, an employee is committing fraud if they are pocketing cash from the company’s register. The employee would be benefitting from getting additional cash at the expense of the company. We will now discuss the components of the fraud triangle.

Components of the Fraud Triangle

- Pressure:

Pressure is the main motivation behind committing fraud. The pressure can be either personal financial pressure or pressure from superiors. If the pressure remains unsolved, then the individual might go in irrational ways. Some common examples of personal financial pressure are un-sharable financial problems, shortage of revenue, pressure from banks to pay loans, and maintenance of lifestyle.

- Opportunity:

When pressure is present employee looks for an opportunity for committing the fraud. For example, if there is no internal control over the inventory room, then the employee finds the chance to pilferage it and sell it in the market. It can be done by abusing the position, for example, pressure by superior to subordinate to show accounts by window dressing.

- Rationalization:

It is the last stage in the fraud triangle. This stage requires fraudsters to justify fraud in an acceptable way. Most fraud committers do not see themselves as criminals; instead, explain the situation of committing fraud. Similarly, fraud by management gives reason for performance and pressure from shareholders for dividends.

How can the Fraud Triangle help to identify fraud and avoid it?

- The motivation for committing fraud varies from person to person. The company must implement strong internal controls to avoid fraud.

- Strong fraud deterrence policies also help to prevent fraud as the employees have a fear of the consequences.

- During audits, management and operational audits should be motivated so that management can detect fraud easily.

Conclusion

Fraud Triangle is a concept that explains the reason behind committing fraud. The main elements are pressure, opportunity, and rationalization. To prevent fraud, there must be strong internal controls, zero tolerance, and a proper code of ethics, which motivates employees to be ethical. To prevent and detect fraud, there must be surprise checks and audits, and management audits should also be encouraged, and there must be strong fraud deterrence policies so that no employee can think of committing fraud.