Last updated on July 12th, 2023 at 04:08 pm

Author: Sarthak Bhalerao

Table of Contents

- What is a Degree of Financial Leverage?

- The formula for Degree of Financial Leverage

- What does Degree of Financial Leverage Tell you?

- Example of how to use Degree of Financial Leverage

What is Degree of Financial Leverage?

A Degree of Financial Leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share (EPS). The DFL takes into consideration the fluctuations in the company’s operating income caused by the changes in its capital structure. The DFL is used to quantify a company’s financial risk. It measures the percentage change in EPS for a unit charge in operating income, also known as earnings before interest and taxes (EBIT). The higher the Degree of Financial ratio, the more volatile earnings will be. This is good when the operating income is growing, but it can be a problem when operating income is under pressure.

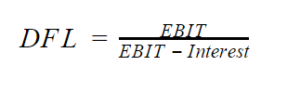

The formula for Degree of Financial Leverage

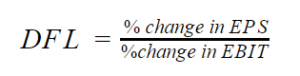

DFL can also be represented by the following equation:

What does Degree of Financial Leverage Tell you?

The higher the DFL, the more volatile earnings per share (EPS) will be. Since interest is a fixed expense, leverage magnifies returns and EPS, which is good when operating income is rising but can be a problem during tough economic times when operating income is under pressure. DFL is very valuable in helping a company assess the amount of debt or financial leverage it should opt for in its capital structure. If operating income is relatively stable, then earnings and EPS would be stable as well, and the company can afford to take on a significant amount of debt. However, if the company operates in a sector where operating income is quite volatile, it may be prudent to limit debt to easily manageable levels.

Example of how to use Financial Degree of Leverage

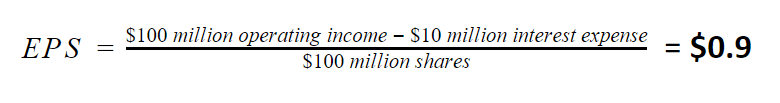

Let’s consider the following example. A Company ABC has operating income or EBIT of $100 million in Year 1 with interest expense of $10 million and has 100 million shares outstanding.

Solution:

EPS for ABC in Year 1 would be:

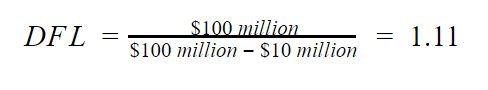

Using this, the DFL can be calculated as follows: