Last updated on October 23rd, 2024 at 03:55 pm

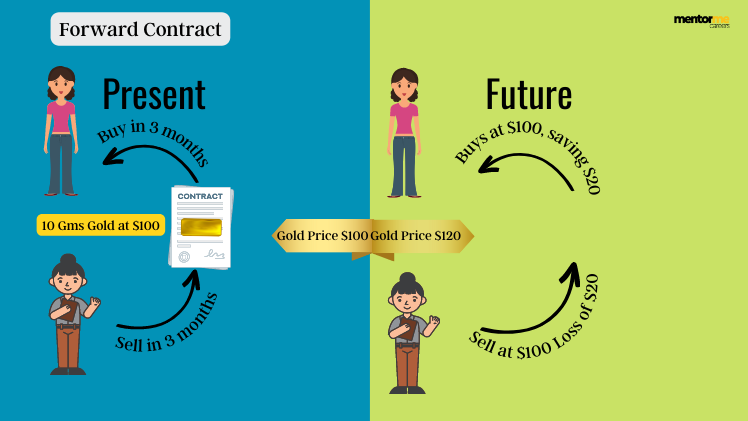

So, a very simple way of explaining to you a forward contract. Let’s suppose you want to buy 10 Gms of gold for your friends marriage, which is coming up in three months. Now, since gold price may fluctuate in the near future or let’s say you beleive that prices might become expensive. What would you do in that case?

So maybe, you approach your local jewellery shop and give a 10% advance, saying that I would like to book 10gms of gold. Also, the jeweller, might have an opinion that the gold prices will drop. So you both agree to the contract and create a forward contract. Where, the jeweller will give you 10 gms of gold, 3 months from now at lets $1000 per gm and similarly you will buy in 3 months the same. That is a forward contract.

What is a Forward Contract?

A forward contract, more commonly known as just forward, is an agreement between two parties to buy or sell an asset at an agreed-upon price on a specific date in the future. As this involves an underlying asset that will be delivered in the foreseeable future, it is considered as a type of derivative.

Also this mechanism is mostly used in hedging or speculation, but its nature makes it more apt for hedging. These contacts are not traded on exchanges but rather are over-the-counter (OTC) instruments.

You are free to use this image on any website, ppt. Just send us an attribution link to use it.

Understanding Forward Contracts

A forward contract can be customized according to the commodity, amount, and delivery date. Commodities traded can be grains, metals, natural gas, oil, etc. As stated earlier, these contracts are of an OTC nature which makes it easy and feasible for them to be customized. But as there isn’t any centralised exchange involved, the risk factor is considerably higher. Now these contracts use specific periods to avoid volatility. The buyer enters a long position, and the seller enters a short position. If the price of the asset increases, the long position benefits and if the price falls, the short position benefits.

There are 4 main components that are considered.

- Asset: The underlying asset which is specified in the contract

- Expiration date: The contract will no longer be valid past this date.

- Quantity: This is the size of the contract and will consist of the units of the assets being bought and sold

- Price: The agreed-upon price that will be paid on the expiration date. This also includes the currency in which the payment is to be made.

Risk of a Forward Contract

So its a huge market is huge as many big companies use it for hedging and interest rate risks. However, the details of the forward contract are restricted to the buyer and seller. The general public does not know details regarding the contract. As the market size is very large and the contracts are unregulated, they are vulnerable to many faults in the worst-case scenario. Another risk arises from the non-standard nature of the contracts that are only settled on the expiration date. The forward rate specified can widely differ as compared to the spot rate. In such scenarios, the financial institution that originates the contract is exposed to greater risk.

Example

Assume that an agricultural producer has two million milk cartons to sell six months from now. He is concerned about a potential decline in the price of milk. He thus enters into a contract with its financial institution to sell two million milk cartons at a price of $5 per carton in six months, with settlement on a cash basis. After 6 months, the spot price has 3 possibilities:

- Price is exactly $5: No money is owned or owed, and the contract is closed.

- Price is higher than $5, say $5.5: The producer owes the institution $1 million.

- Price is lower than $5, say $4.3: The financial institution will pay the producer $1.4 million.

Difference Between Forward Contracts Vs Future Contracts

| Forward Contracts | Future Contracts |

| It is a customzied contract between two parties | Standerdized contract avaible in a stock exchange |

| Clearing house is involved | Clearing house does the settlement of future contracts |

| Margins required are higher | Margin required is lower |

| Liqduidity is low | Liquidity is high |

| Counterparty risk is there | Exchange gurantees the settlement |

Forward Market Case- NSEL Scam

So, National spot exchange limited was set up in the year 2004, with a vision to create the first agricultural spot exchange. At the beginning, NSEL was allowed to trade in one day forward contracts to boost volume. This led to NSEL becoming India’s first electronic spot exchange. However, the problem that arose was the contracts were taking almost 25 days to settle, whereas the maximum norm was 11 days.

At the same time the regulator had prevented the exchange from conducting any short selling in the market, which was also not followed. This led the forward market comission to to close the existing forward contracts. When the winding down of contract was ordered, it led to a payment default. The major issue was when it was discovered that the contracts fell short of physical commodities in the warehouses.

So, intially it was believed that the promoters where only involved in the scam, but later it was discoverd that brokers had a big role to play in inducing clients.

Role of Brokers in NSEL Fraud Scam

The above image is a good representation of how the forward market scam took place. So if I try to simplify how this took place then let me explain it.

- The seller of a commodity would got to the NSEL warehouse and get their commodities inspected for sale.

- So, after inspection, they would receive, a warehouse receipt.

- Now, after getting the warehouse receipt the seller would take a forward sell position on T+2 at let’s say INR 100.

- At the same time, the seller would again go the exchange at take a buy position at T+25 Days at INR 125.

- Finally, leading to make a 25% guaranteed profit.

So, the funny part which was discovered later was the NSEL, didnt even have enough inventory to support the contract itself.

Aftermaths of NSEL Default

During 2013, forward markets were again introducted in select commodities. However, even after 6 months of trading, the volumes were only INR 6000 Cr. There are multiple reasons why this intiatve failed.

- Firstly, there was no counter-guarantee in the exchange.

- secondly, the traders were scared of the forward market scams at NSEL.

- Finally, the margin requirement was 10%, which was way lower than what was required to cover counterparty risk.