Last updated on December 31st, 2025 at 04:12 pm

So, let’s say you prepared all of the topics for interview but when you sat for the investment banking interview, you are bombarded with questions on equity products, fixed income yields and what not. Now, in this article I will cover in detail the financial market questions and answers that will help you for cracking that interview.

Now, I will not try to mix everything up but divide these questions across equity, fixed income, derivatives and a little bit about alternative investments too.

What is financial markets?

Financial markets are a platform where buyers and sellers trade financial instruments such as shares, bonds, currencies and commodities. These marketplaces allow businesses to raise funds, investors to earn returns and economies to grow. Financial markets connect people who have money with people who need money in simple terms.

| Market Type | What It Deals With | Why It Matters |

| Money Market | Short-term debt instruments (< 1 year) like T-Bills, CP, CD | Ensures liquidity & short-term funding |

| Capital Market | Long-term financial instruments like shares and bonds | Helps companies raise long-term capital |

| Forex Market | Currencies (INR, USD, EUR etc.) | Facilitates global trade & foreign investment |

| Derivatives Market | Futures, Options tied to assets | Used for hedging + speculation |

| Commodity Market | Gold, oil, metals, agri goods | Manages price risk in real assets |

Financial Markets Basics (Q&A)

What are the main types of financial markets?

Financial markets are broadly classified into:

Primary Market – New securities are issued (e.g., IPO)

Secondary Market – Existing securities are traded on exchanges

Money Market – Short-term financing instruments

Capital Market – Long-term financing instruments

Forex Market – Currency transactions

Derivatives Market – Risk management & price speculation

Commodity Market – Trading in physical goods & futures

Each market serves a unique purpose and supports different participants: investors, banks, corporations, government bodies, FIIs, and retail traders.

What are the key functions of financial markets?

Financial markets play a critical role in economic development:

| Function | Why It’s Important |

| Capital Allocation | Moves savings into investments and business projects |

| Liquidity | Enables easy buying and selling of assets |

| Price Discovery | Markets determine fair value of securities |

| Risk Management | Derivatives help hedge market and credit risks |

| Wealth Creation | Offers returns to investors through appreciation & interest |

| Efficient Transaction Mechanism | Fast and transparent trade execution |

Equity- Financial Market Questions and Answers

Firstly, a note here. When you prepare for gaining knowledge in general equity markets, it’s important to not just know, what it is. But also know the practical working of such knowledge. So, without wasting anytime, let me jump into the top equity based financial market questions and answers.

What do you understand by Capital Markets?

Now believe me, this question as simple as it looks, however you will find that frequently people get it wrong. So, what is capital market. Capital market is a market place for different types of securities, including bonds, stocks. At the same time it also includes market participants like exchange, brokers, asset managers , regulators and of course investors.

What is a Mutual fund and how does it work?

So, again this is one of the easiest questions related to financial market questions and answers. Now, this is how you need to answer this.

- Firstly, a mutual fund is pooled investment vehicle which involves a trust , asset management company and investors.

- Secondly, it’s important to know that the trust and asset management company are different. The trust is created to protect the capital of the investor, while the trust employs the asset management in exchange for a fee, usually 2% of the capital

- Thirdly, there are different kinds of schemes in a mutual fund, depending on the asset type. For eg; there is a large cap equity mutual fund focussed on top 50 or 100 biggest companies.

- Finally, a mutual fund has the mandate of beating individual benchmarks. For eg; a large cap mutual fund has the mandate to beat the nifty 50.

What is an Index? Give examples.

So, again one of the simpler financial market questions and answers, however students frequently just try to name them without giving further details on its mechanics.

Accordingly, let me give you the proper way of handing this question.

- Firstly, an index is a benchmark to show case the overall sector level or group level performance of companies.

- For eg; The auto index benchmark includes all the automobile stock and their prices.

- Secondly, the weightage is decided basis certain methods

- Price weighted index: Divide the sum of price of each stock divided by total number of stocks

- Fundamental weighted index: Here the company with highest market cap; Price x total number of stocks will have more weightage. For eg; In India HDFC has a weightage of close to 7% in NIFTY 50.

- Free float adjust index: This is calculated as:Index Value = (Current Free Float Market Capitalisation of index / Base Free Float Market Capitalisation of index) * Base Index Value

- Equal weighted index: Here each stock is given an equal weightage irrespective of its market cap

What is the difference between interest and dividend?

So, again a very simple financial market question and answers, I agree! However how you choose to answer it will make a big difference on how the interviewer perceives your knowledge.

- Firstly, you need to understand that in the capital structure of a company, bond is senior to equity. That’s right! In situations of liquidations, as an equity investor you would get paid the last.

- Secondly, Interest doesn’t fluctuate along with the profitability of the company but dividends you may get paid or not if your company decides to save the money instead

Now, again you might face this question in investment banking operations interview as a part of financial market questions. So, firstly this is how you need to approach this question.

- Firstly, equities are of two major types common equity or preference equity.

- Now, common equity means you do not enjoy and special treatment with respect to dividends.Again, related to the seniority. Hence, as a common equity shareholder you are lower in seniority compared to a preference share holder.

- Secondly, in case you are a preference share holder, you get priority of dividends irrespective of whether your company’s common shareholders get paid or not.

Fixed Income Based Questions

Now, let me dive into some fixed income based interview questions. So, you must remember that the investment banking companies, just don’t deal with equity but also fixed income products. While, you must have the basic understanding of how the fixed income markets actually work.

What are the different kinds of bond instruments?

So,again you might think that you know this answer but its important that you keep the answer short and brief, while at the same time keep it as detailed as possible.

So, this is how you should answer this question

- So, a bond is a fixed income instrument which is effectively like a loan that you take. However, the only difference is that instead of you taking a loan, its the company that is borrowing it from you.

- Now, if you take a loan from a bank, what do you do? You pay the interest and also return the principal. Which means interest is the cost you pay for the loan while the principal is just the return of the borrowed money.

Now, based on how you pay the interest and how quickly or late you pay the principal is what decides the different kinds of bonds.

- Zero Coupon Bond: Now, if you invest in a zero coupon bond, you don’t get your interest in the form of coupon payments but you buy the bond at a discount. However, you redeem it at a premium.

- Floating Rate Bonds: If you invest in a floating rate bond, your interest earnings will fluctuate. For eg; if the interest rate foes down, you get less coupons, while the same goes up in the opposite scenario.

- Debentures: A very interesting fixed income instrument that you can invest in, which gives you the option to convert to shares on various triggers.

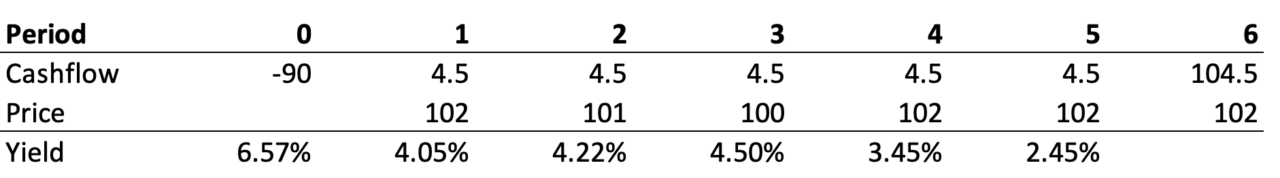

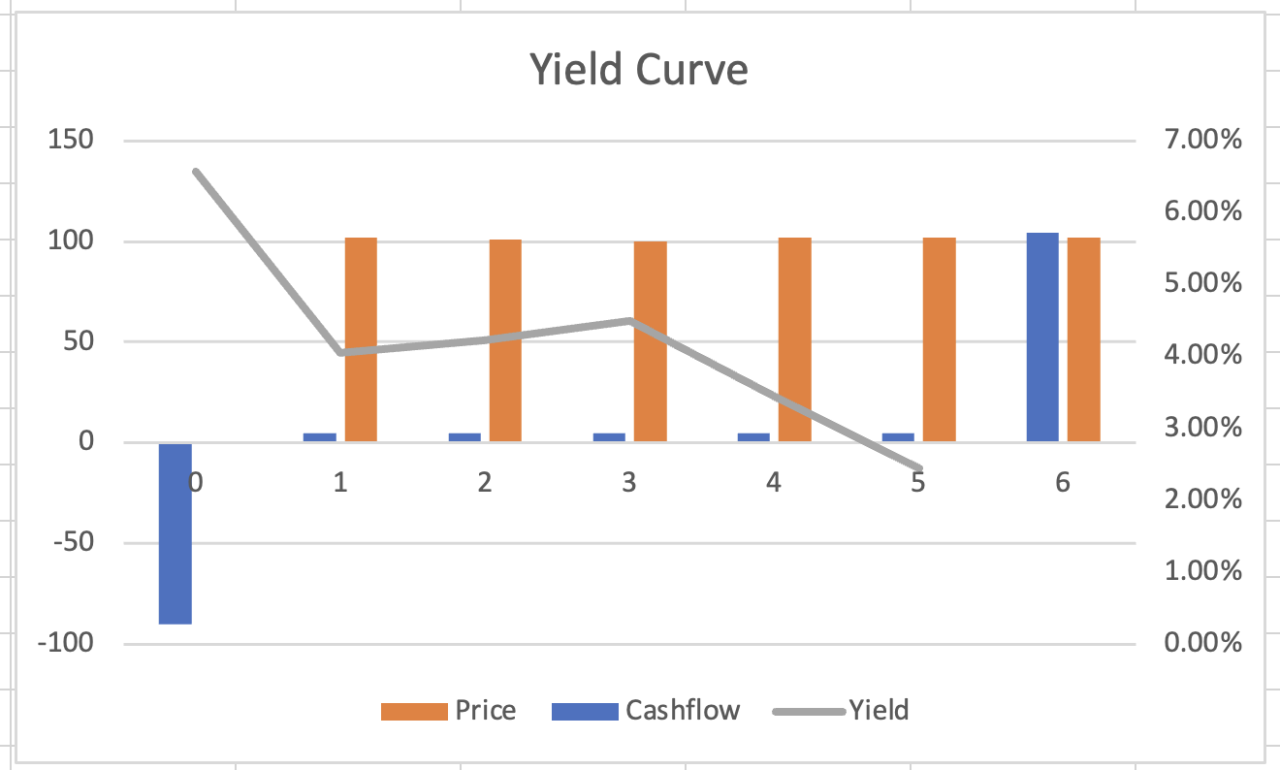

What is a yield curve?

Now, this might sound like a very difficult interview question, but I will say this that its the most simple question to answer in a investment banking interview.

Now, I want you to remember the basics of time value of money. How do you calculate the present value of future cash flows?

Present value of Future Cash flow= Future cashflows/(1+r)^n

Where, r is the discount rate and N is the number of periods.

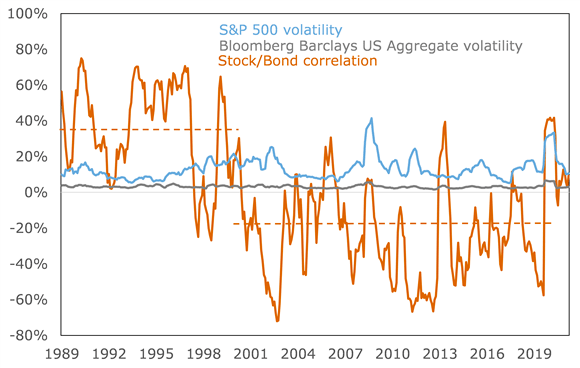

What is the relation between bond and equity markets?

I would categorise this question that you might face in a finance interview, as a trick question. So, do not just answer this saying that bond market and equity market is inversely correlated.

So, equity and bonds will show positive correlation or negative correlation depending on the time and situation in your markets. A simple explanation for positive correlation though is this. Remember the CAPM formula; Rf + Beta( RM- RF). Let me ask you this question, what is Rf? It is risk free rate, which is a bond yield. So if your bond yields drop, so will equity returns. However, there might be situations when your interest rates are high but volatility is high too which will lead to a negative correlation.

Derivative Based Financial Market Questions & Answers

Finally, let me walk you through some important derivative based question that you face in an investment banking interview.

What is the difference forwards and futures?

So, a simple answer that you will answer in this is;

- Firstly, the main difference between forward and future is that in case of futures is that it is standardised and traded through exchange.

- While, a forward contract is a customised contract, which also carries default risk.

What is a CDS?

Now, this is how you should answer this common question. Firstly, a CDS is similar to an insurance contract, where you pay a premium in exchange of protection against a default risk which can happen in case of a bond.

Conclusion

You must understand that in any investment banking interview, financial market questions fall under the top category of questions. While, even if you are not very aware of the various process related information, you will get some mercy. However, getting the financial market questions is very very important.

The financial markets form the backbone of the economy by facilitating the smooth flow of funds between savers and borrowers. Understanding these basics helps students, investors and finance professionals make informed decisions from money markets and capital markets to concepts like the yield curve and primary markets.

For careers in banking investment management, corporate finance and capital markets operations a strong grasp of financial markets is essential check out mentor me careers to start your journey!

FAQ

Financial markets are platforms where buyers and sellers trade financial instruments like shares, bonds, currencies, and derivatives to raise capital and manage risk.

The main types of financial markets include money markets, capital markets, foreign exchange (forex) markets, derivatives markets, and commodity markets.

Money markets deal with short-term funds (up to 1 year) like treasury bills, while capital markets handle long-term funding through shares, bonds, and debentures.

The yield curve shows the relationship between interest rates and bond maturities and helps predict economic growth, inflation, and interest rate movements.

The primary market is where companies raise funds directly from investors by issuing new securities, such as during an IPO or bond issue.

Related Articles

- What is the structure of Indian capital market?

- What is an IPO?

- Trade settlement process

- Forward contracts

- Securities lending and borrowing

- Short selling

- Stock market interview questions

- Financial statements

- Financial systems

- Average collection method