Last updated on June 25th, 2024 at 01:43 pm

FIFO Full form stands for first in first out, and is an inventory valuation method available under most of the accounting standards like IFRS, U.S GAAP. However, in this article we shall discuss also, how this accounting method compares with LIFO.

You are free to use this image on your site, template etc. Just provide us the attribution link

FIFO full form stands for first in first out. A simple analogy to understand this could be:

You bought one kg of onions at $4.Another kg at $6 next day. Next day you used randomly one kg to cook a meal and sell it at $10.

Now as per FIFO, you would say that the cost is $4 but as per LIFO it would be $6

It wasn’t until I became a financial analyst while investing my own money that I realised how subtle things could significantly impact financial statements.

Let me explain why you should understand FIFO beyond the academic mandate of clearing exams.

As per the Cambridge Business School study over 25 years, this is what the guys concluded:

A powerful CEO with a reputation for always performing will generally resort to malpractices

Cambridge Business School

Enough of the jibber-jabber for now!

Principle Behind FIFO Full Form( First in First Out)

First things first, FIFO system or first-in, first-out accounting method works on the principle of, selling the goods we purchased first.

Sounds confusing?

Simply FIFO full form means, the oldest inventory of raw materials, get sold first. This means older costs are new and newer costs are old.

Also I can understand it by saying that older items are sold first and then we gradually progress to the newer purchased inventory.

Wait! That doesn’t mean I literally go out and search for the old cupboard and then lay out like a maniac.

lol!

It’s just a calculation man! You can sell whatever reaches your hand first, and anyway who cares?

All I care about, albeit, is the accuracy of my calculation, right?

Moreover, any financial statements should depict an accurate picture, which the FIFO principle proposes.

Let me first argue for:

- Firstly, if we do not take the old prices first and use current prices instead, hence the raw material bought before has no meaning.

- Secondly, the whole sequence of selling what we bought first is generally more intuitive and easy to understand.

- Finally, not using the FIFO principle could lead to obsolete and low-priced inventory, which could lead to higher profits on paper.

The FIFO method is allowed under all the popular accounting standards, including Ind As.

How to calculate FIFO?-(FIFO Full form- First in First out)

Trust me on this! but calculating FIFO is best understood with an example, rather than a formula.

Also, memorising formulas can be disastrous.

Too idealistic, eh?

Aye, sir! Here is an example for you.

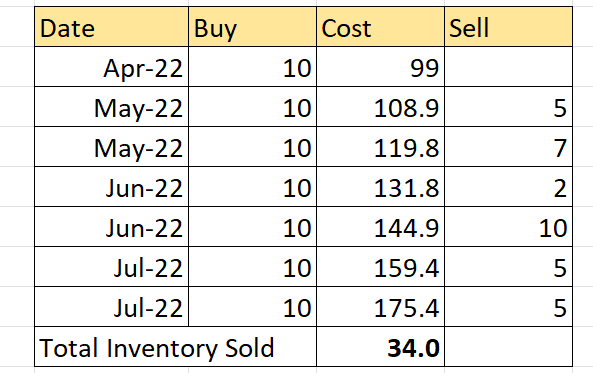

So, John Wick runs a gas station and has a capacity of 50,000 litres.

For which the supply of gas is done in barrels, and each barrel has 200 litres of petrol.

Below is the sequence of purchases with the date given

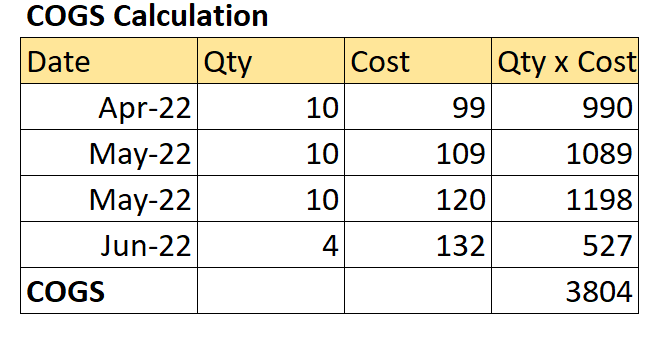

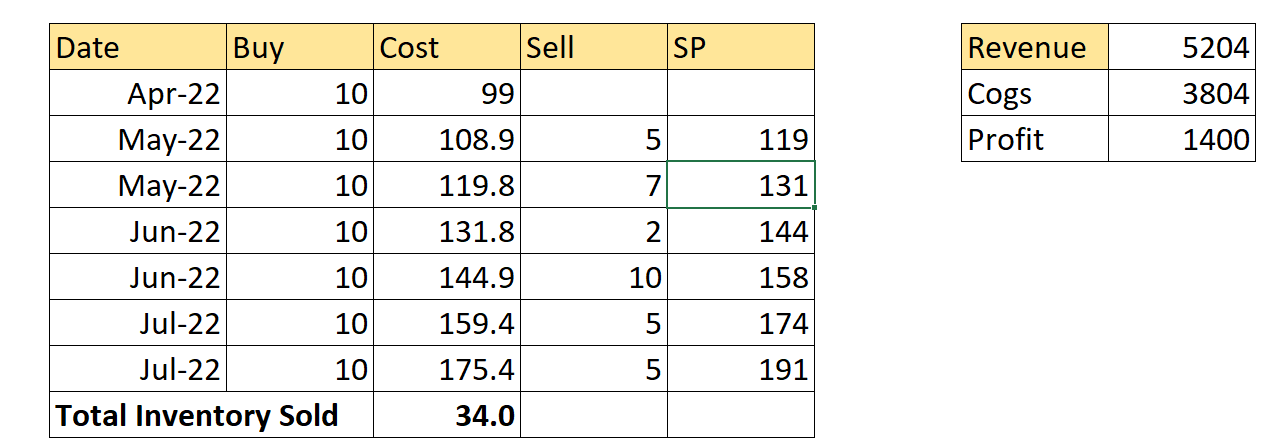

So, let’s start calculating the price paid. First of all, notice that we have sold 34 units in total.

Always remember to look at these calculations in total, rather than getting confused with the individual numbers.

So this is how the calculation would work:

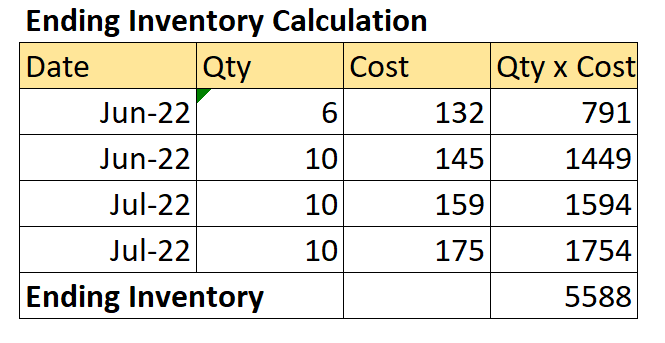

Hence, the June inventory is only partly used, which would mean that 6 units would accumulate in the ending inventory.

However, what’s the profit?

You can check and practice the entire calculation using this template.

FIFO Vs LIFO Vs Weighted Average Method

Now we know something about FIFO, likewise, the LIFO method of inventory valuation would start the calculation in reverse order.

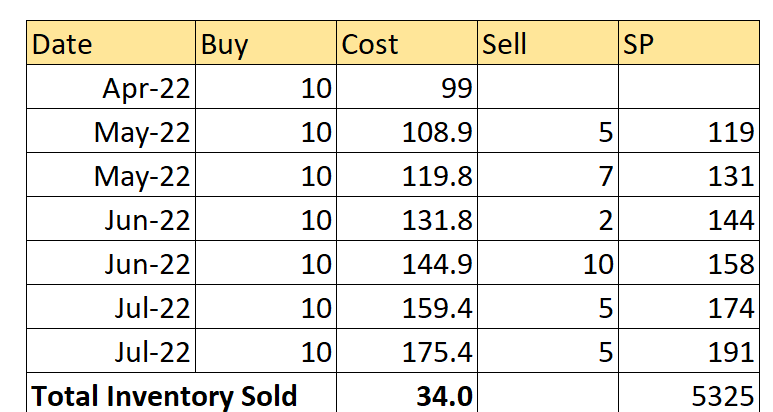

I am going to directly give the total calculation of LIFO, rather than going step by step life before.

Nevertheless, in summary, I started counting the 34 Units from July 22 to Jun 22.

Are you still with me?

Thus even without me saying this, indeed the COGS as per LIFO is higher.

Can you take a second to reason that?

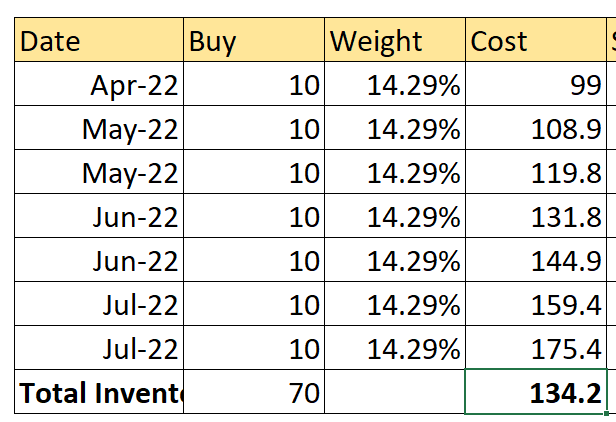

Furthermore, let’s look at the weighted average method, which rather than following an order conversely finds a middle ground.

What do I mean by middle ground?

For example, in our case, we can notice, that each lot of petrol barrel is the same. However, that doesn’t have to be the case always.

Even so, the weightage comes out to be 14.29%, as a result of which if we multiply the cost for each lot gives us the weightage average price.

As a result, our total cost of goods sold, thus becomes 4562.

I told you, just hang on! Clearly, the weighted average method is so easy, right?

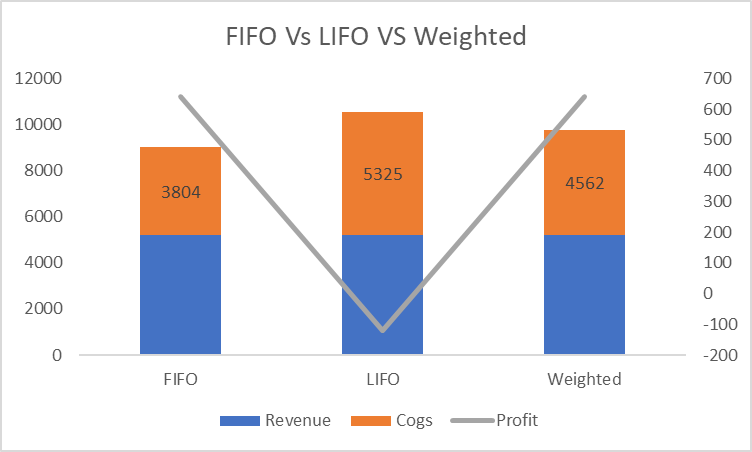

Of course, the chart should make things crystal clear!

Undoubtedly, LIFO shows the lowest profit, followed by the weighted method and finally the FIFO.

However, I said shows in bold letters, whereas this calculation has no effect on what we actually earned in cash.

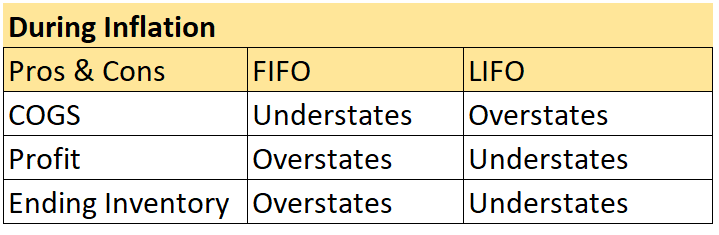

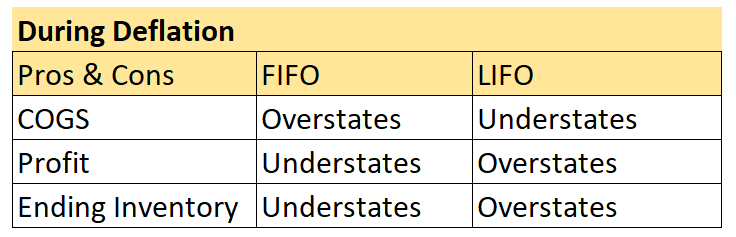

Pros and Cons FIFO Vs LIFO

For one thing, I expect now that you can read between the lines on this topic?

So, I hope you get the idea that both the methods are extremes, for this reason, the weighted average is the most used method.

Of course, who wants a roller-coaster income statement right?

Additionally, LIFO valuation methods is in fact banned in IFRS because it has the notorious reputation of being used for earnings manipulation. Trust me guys, earnings manipulation is as rampant as the cocaine trade, even if we have rules to stop it.

Understanding Inventory Management: Impact on Financial Statements

Inventory management is a critical aspect of business operations, influencing the cost of goods sold and overall profitability. Effective management ensures that items are sold in a timely manner, reducing the risk of holding obsolete inventory and achieving higher profit margins. Whether using FIFO or LIFO, the method chosen affects the financial representation of inventory and profit. Therefore, a thorough understanding of these methods is essential for accurate financial reporting and strategic decision-making.

Accounting Scams using FIFO & LIFO

Ok, this is the most interesting and I want you to hear this out because even if the methods weren’t clear to you, this will seal it.

So , this story relates to an analyst named,Gary Mishuris, who was hired as an equity analyst in one of the largest mutual funds.

So Gary was given the task of analysing a company named OM Group, which was at the time one of the famous metal processing companies.

I will cut things short and In summarise what exactly happened:

- The company had positive earnings but no cash flow, a big red flag

- Also, this led to the analyst to confront the management and CFO to get more answers.

- On confrontation, the question arose on which method they were using, namely FIFO or LIFO

I will injunct the story Just a little bit here, remember that LIFO can create some abnormal profits if we start selling oldest inventory from the balance sheet.

- At that year cobalt prices were falling and on asking the management they agreed they were buying more

- As terror stuck, the main question came:” Are you buying more cobalt now with all the cash flow, because oldest inventory would reduce your earnings?

As a result, the stock fell from $70 to $4 in three months.

You can read the full SEC Case.

What is Called LIFO?

LIFO stands for last in first out, is an inventory recognition method. Where the recent purchased materials are assumed to be sold or used first.

FIFO Method Questions

FIFO problems with some simple calculation based questions, I have made it below for your reference to just get a fair idea.

Question 1

Q: On May 10, I sold 150 widgets. My beginning inventory was 100 widgets at $10 each, and I purchased 200 widgets at $12 each on May 5. What is the cost of goods sold (COGS) for the May 10 sale?

A:

• 100 widgets from beginning inventory at $10 each: 100 \times 10 = $1000

• 50 widgets from the May 5 purchase at $12 each: 50 \times 12 = $600

• Total COGS for the May 10 sale: 1000 + 600 = $1600Question 2

Q: On May 20, I sold 180 widgets. The remaining inventory from the May 5 purchase is 150 widgets at $12 each, and I purchased 100 widgets at $13 each on May 15. What is the COGS for the May 20 sale?

A:

• 150 widgets from the May 5 purchase at $12 each: 150 \times 12 = $1800

• 30 widgets from the May 15 purchase at $13 each: 30 \times 13 = $390

• Total COGS for the May 20 sale: 1800 + 390 = $2190Question 3

Q: On May 30, I sold 120 widgets. The remaining inventory from the May 15 purchase is 70 widgets at $13 each, and I purchased 150 widgets at $14 each on May 25. What is the COGS for the May 30 sale?

A:

• 70 widgets from the May 15 purchase at $13 each: 70 \times 13 = $910

• 50 widgets from the May 25 purchase at $14 each: 50 \times 14 = $700

• Total COGS for the May 30 sale: 910 + 700 = $1610Question 4

Q: After the May 30 sale, how many widgets do I have left in inventory and at what cost?

A:

• 100 widgets from the May 25 purchase at $14 each: 100 \times 14 = $1400

• Total ending inventory cost: $1400Question 5

Q: What is my total cost of goods sold (COGS) for May if I had sales on May 10, May 20, and May 30 with the respective COGS calculated as $1600, $2190, and $1610?

A:

• Total COGS for May: 1600 + 2190 + 1610 = $5400Conclusion

I know, this was a long post for something this simple but I don’t care about the concept academically! I mean think about this analyst, even he knows LIFO and I am sure millions know it as well.

However, look at how a simple concept like FIFO, when learnt with the correct perspective and avert disasters worth billions.

So if you want to learn analysis that matters, then do care to check out our financial modeling course, which makes you more capable than educated.

Ciao!