Last updated on January 28th, 2026 at 04:47 pm

Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) are two of the most well-respected financial qualifications in India. CFP is a professional certification for financial planners, whereas CFA is a credential for investment professionals. Individuals’ and families’ financial well-being is dependent on financial planning and investment management. With the rise of complicated financial products and shifting market circumstances, it is critical that individuals interact with trained experts who have the knowledge and ability to assist them in achieving their financial objectives.In this blog article, we will look at the distinctions and similarities between the CFP Vs CFA designations, as well as aspects to consider while deciding which one to pursue.

CFP Designation

A. Education and Requirements

In order to become a CFP professional in India, individuals must finish a six-module education programme that includes financial planning, retirement planning, and investment planning. Candidates must also pass an extensive exam that assesses their understanding of financial planning concepts and techniques.

B. Career Paths

Financial planners, investment advisers, and wealth managers are all examples of CFP professions. They assist individuals and families in developing comprehensive financial plans that cover both short- and long-term financial objectives.

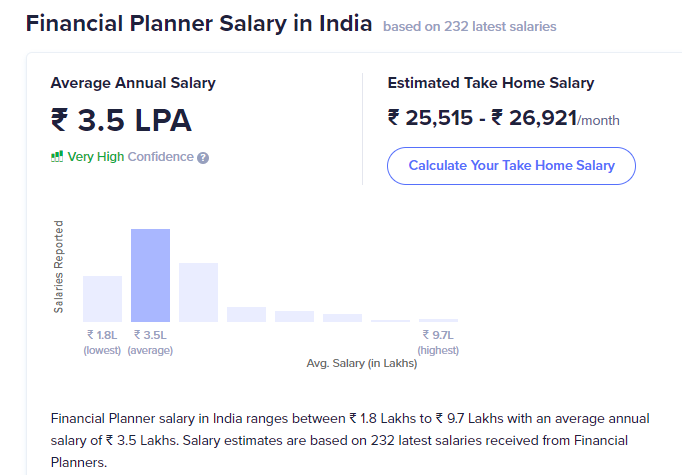

C. Salary and Earning Potential

The average compensation for a CFP professional in India is INR 3,56,000 per year, according to Ambition box.

D. Benefits of CFP Designation

Individuals holding the CFP credential have the knowledge and abilities needed to excel in the financial planning sector. It also reveals to clients and employers that they have met stringent professionalism and competency criteria.

E. CFP Update

Steps have been taken to enhance the curriculum in 2025, introduction of the “Psychology of Practice” course, emphasizing behavioral finance and understanding client psychology in financial decision-making. Focus on ESG is increased for more sustainability. Training includes AI driven strategies. This AI upgrade will help process get faster with more accuracy. More real world case studies are emphasis. This will increase more practical knowledge and approach.

III. CFA Designation

A. Education and Requirements

To become a CFA charter holder in India, candidates must finish a rigorous education programme that includes financial analysis, portfolio management, and ethics. Candidates must also pass three tests that assess their understanding of investment management principles and procedures.

Check More Details on What is CFA

B. Career Paths

CFA charter holders can work as investment analysts, portfolio managers, and financial advisers, among other positions. They do financial market research and make investment recommendations for their customers or companies.

C. Salary and Earning Potential

The average pay for a CFA charter holder in India is INR 4 Lacs P.A for freshers, according to ambition box.

D. Benefits of CFA Designation

Individuals with the CFA credential have the knowledge and abilities required to excel in the investment management sector. It also reveals to clients and employers that they have met strict professionalism and competency criteria.

E. Factors to Consider when Choosing CFA

Candidates should examine criteria such as their career objectives and interests, education and experience level, capacity to dedicate time and money to the program, and desire to adhere to ethical and professional standards before deciding whether to pursue the CFA certification.

F. CFA Updates

Emphasis on modern topics like ESG and real world case studies like it is in CFP. This shows a major shift in which skills are most important right now. Practical skills and knowledge is emphasized the most. Sustainability is the future in finance.

IV. CFP vs. CFA: Differences and Similarities

CFP vs CFA Qualification Comparison

| Criteria | CFP (Certified Financial Planner) | CFA (Chartered Financial Analyst) |

|---|---|---|

| Full Form | Certified Financial Planner | Chartered Financial Analyst |

| Governing Body | CFP Board (USA) / FPSB (Global) | CFA Institute |

| Cost | Approx. ₹60,000 – ₹100,000 (including study materials and exam fees) | Approx. ₹250,000 – ₹350,000 (including all 3 levels, materials, and exam fees) |

| Duration | Can be completed in 1-2 years | 3-4 years (for all 3 levels) |

| Prerequisites | High school diploma or equivalent; bachelor’s degree preferred | Bachelor’s degree or 4 years of relevant work experience |

| Exam Structure | Single-level exam, divided into multiple sections | Three levels (CFA Level I, II, and III) |

| Areas of Application | Financial planning, wealth management, retirement planning, estate planning | Investment banking, portfolio management, equity research, risk management |

| Type of Jobs | Financial Planner, Wealth Manager, Retirement Consultant | Investment Analyst, Portfolio Manager, Risk Manager, Equity Research Analyst |

| Skills Gained | Personal financial planning, investment management, tax planning, risk management | Advanced financial analysis, portfolio management, valuation, ethics in finance |

| Recognition | Globally recognized, but more popular in the US, Australia, and India | Globally recognized, especially in investment banking and asset management sectors |

| Salary Range | ₹6,00,000 to ₹15,00,000 per annum (varies by experience) | ₹8,00,000 to ₹25,00,000 per annum (varies by level and experience) |

| Ideal For | Professionals interested in personal financial planning, advising individual clients | Professionals aiming for roles in investment banking, portfolio management, asset management |

| Focus Area | Holistic financial planning for individuals and families | Financial markets, investments, and portfolio management |

A. Focus: CFP Vs CFA

The fundamental distinction between CFP and CFA is their focus. CFP is concerned with financial planning, whereas CFA is concerned with investment management.

B. Education and Requirements

The educational requirements and qualifications for CFP Vs CFA are also distinct. Candidates for CFP must finish a thorough education programme and pass a single test, whereas CFA candidates must complete a comprehensive education programme and pass three exams.

C. Career Paths

CFP Vs CFA both provide distinct professional possibilities. CFP professionals can work as financial planners, investment advisors, or wealth managers, whereas CFA charterholders can engage in a range of investment-related jobs such as investment analysts, portfolio managers, and financial advisors.

D. Salary and Earning Potential

In terms of pay and earning potential, CFA charter holders often earn more than CFP practitioners. However, it is vital to remember that earning potential might differ based on the individual’s experience, work type, and geographical location.

E. Benefits of Both Designations

Both the CFP Vs CFA credentials provide a variety of advantages, including exhibiting a high degree of expertise and competence, increasing employment opportunities and earning potential, and offering access to a network of like-minded individuals.

V. Choosing the Right Designation: CFP Vs CFA

A. Factors to Consider for choosing between CFP Vs CFA

Candidates should examine their career goals and interests, education and experience level, capacity to dedicate time and money to the program, and desire to adhere to ethical and professional standards while deciding between CFP and CFA.

B. Resources for Further Learning

Individuals interested in learning more about CFP and CFA can turn to professional organisations such as the Financial Planning Standards Board India and the CFA Society India, as well as online resources such as Investopedia and the CFA Institute website.

CFP vs CFA Quiz

1. What kind of financial role are you more interested in?

2. What kind of clients would you prefer to work with?

3. Which of these sounds more appealing?

4. How much time are you willing to dedicate to complete the qualification?

5. What type of financial decisions interest you the most?

6. What kind of recognition or career growth are you aiming for?

VI. Conclusion:CFP Vs CFA

Choosing between the CFP Vs CFA credentials is a crucial decision that should be taken after a thorough assessment of an individual’s career goals and interests. While both titles provide important benefits, they differ in focus, education and prerequisites, career pathways, and pay and earning potential. If you want to work in financial planning or investment management in India, the CFP and CFA qualifications are also good choices. The CFP credential focuses on comprehensive financial planning, whereas the CFA designation focuses on investment analysis and management.

Consider your professional ambitions, education and experience level, and willingness to dedicate time and resources to the programme when determining which designation to pursue. You should also consider the differences in career trajectories and income possibilities between the two titles.

Remember that gaining a professional designation such as CFP or CFA displays a high degree of expertise and competence in the field of finance and can lead to new employment prospects and increased earning potential. So, do your homework and select the classification that is most suited to your specific circumstances and goals.

We hope this blog has helped to clarify the distinctions between CFP and CFA and has offered some assistance to people contemplating seeking one of these credentials. You may achieve success in the exciting and gratifying sector of financial planning and investment management with dedication, hard effort, and a commitment to ethical and professional standards.

VII. FAQs: CFP Vs CFA

1.What is the difference between CFP Vs CFA?

The CFP designation is a professional designation for financial planners who offer complete financial planning services to individuals, families, and corporations. CFA is a professional qualification for investment professionals specializing in investment analysis, portfolio management, and other facets of investment management.

2.Which certification is better for career prospects in India?

Both credentials provide distinct advantages and can lead to lucrative professions in finance. The decision between the two is ultimately determined by your professional objectives and interests.

3.What are the education requirements for CFP Vs CFA in India?

In India, the academic requirements for both certificates differ based on the individual’s educational background and experience. Specific criteria should be checked with the individual certifying agencies.

4.Are there any government resources for financial planning and investment management in India?

Yes, the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) are two government entities that monitor and regulate India’s financial markets and institutions. Their websites include useful information on a variety of financial topics, such as financial planning and investment management.

5. What is a major shift happening in Finance?

Looking at the updates we know one now is finance is shifting towards more modern driven strategy which includes AI and Sustainability. Real world case studies and practical skills are equally important.