Last updated on February 10th, 2024 at 01:03 pm

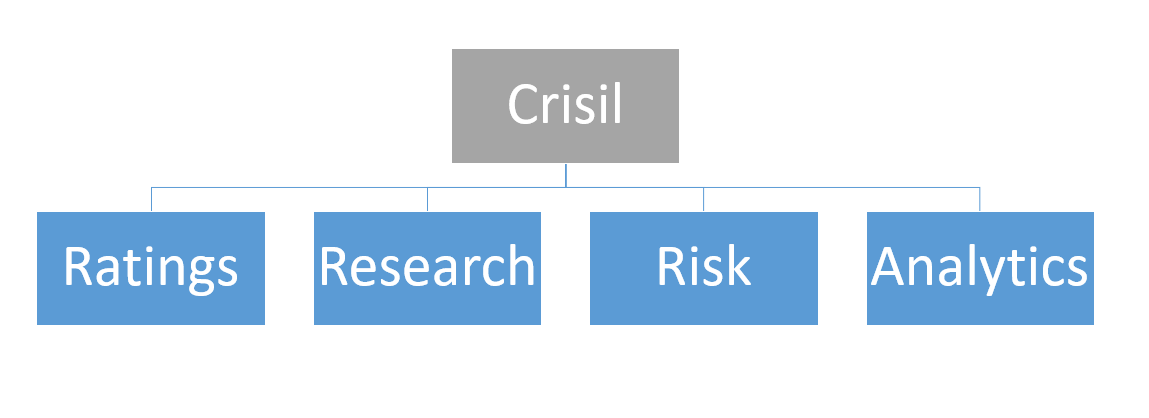

CRISIL is India’s leading ratings agency. It is also the foremost provider of high-end research to the world’s largest banks and leading corporations. With sustainable competitive advantage arising from their strong brand, unmatched credibility, market leadership across businesses, and large customer base, they deliver analysis, opinions, and solutions that make markets function better. CRISIL global analytical company providing ratings, research, and risk and policy advisory services. In this article we discuss in detail crisil interview questions.

About Crisil

Crisil is majorly involved in financial research some way or the other. This makes it imperative that the candidate is well versed with all financial topics; majorly the ones related to the analysis of financial statements, for the crisil interview questions.

For better clarity I will divide the answer into three sections :

Crisil Interview Question Types

Technical Crisil Interview Questions

As mentioned earlier knowledge of finance is vital. How does a particular transaction flow through the three statements; how do we value a stock; what is the kind of security that interests us most (fixed income, equity etc.); what are the hedging techniques; selection criteria for stocks; financial ratios; types of analysis: fundamental/technical. Questions on crisil interview questions will,majorly flow on these lines.

crisil interview questions like tell me something about yourself; about strengths/weaknesses; interests; career plans. The important thing to remember here is that you must have a sound reason for everything you speak. Every adjective that you use to describe yourself should be backed by instances.

Aptitude-Related Crisil Interview Questions

Guesstimate questions and riddles are commonly asked in the crisil interview questions.

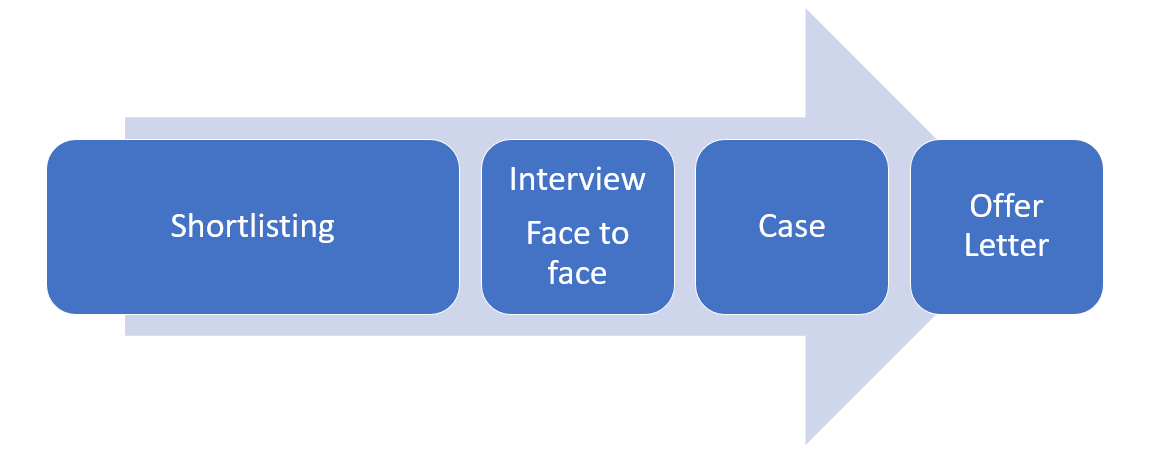

Now, you might have a lot of technical knowledge, but if you can’t apply it on time i.e.. during the interview, you will not be shortlisted. So it is crucial to prepare for every bit of the interview.

Detailed Technical Crisil Interview Questions

Here are some crisil interview questions questions you can face, and their probable answers:

Question 1. What are the credit factors would you look if you have to rate a company for credit worthiness?

Try to use the keywords as much as possible. Know everything that you speak, because the next crisil interview questions might be from what you just said.

Answer: Several factors such as financial statements, type and level of debt, lending and borrowing history, debt repayment ability, past credit repayment behaviour, etc. are taken into consideration before assigning a rating to a particular entity.

Question 2. Describe cash flow statement.?

Instead of using exactly a booking language, tell them something more. The concept always remains the same, but what makes you a selected candidate is how you explain and the examples you give while explaining.

Answer : A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

A company’s financial statements offer investors and analysts a portrait of all the transactions that go through the business, where every transaction contributes to its success. The cash flow statement is believed to be the most intuitive of all the financial statements because it follows the cash made by the business in three main ways: through operations, investment, and financing and so, the sum of these three segments is called net cash flow.

Question 3. Explain the best method to calculate return required for equity.

Again a very basic crisil interview questions which frequently turns up in the interview.

The required rate of return (RRR) is the minimum return an investor will accept for owning a company’s stock, as compensation for a given level of risk associated with holding the stock.

There are a couple of ways to calculate the required rate of return—either using the dividend discount model (DDM), or the capital asset pricing model (CAPM). The choice of model used to calculate the RRR depends on the situation for which it is being used.

- The dividend-discount model calculates the RRR for equity of a dividend-paying stock by utilizing the current stock price, the dividend payment per share, and the forecasted dividend growth rate. The formula is as follows:

RRR = (Expected dividend payment / Share Price) + Forecasted dividend growth rate

To calculate RRR using the dividend discount model:

- Take the expected dividend payment and divide it by the current stock price.

- Add the result to the forecasted dividend growth rate.

- The CAPM model of calculating RRR uses the beta of an asset. Beta is the risk coefficient of the holding. In other words, beta attempts to measure the riskiness of a stock or investment over time. Stocks with betas greater than 1 are considered riskier than the overall market (often represented by a benchmark equity index, such as the S&P 500 in the U.S., or the TSX Composite in Canada), whereas stocks with betas less than 1 are considered less risky than the overall market.

RRR = Risk-free rate of return + Beta X (Market rate of return – Risk-free rate of return)

To calculate RRR using the CAPM:

- Subtract the risk-free rate of return from the market rate of return.

- Multiply the above figure by the beta of the security.

- Add this result to the risk-free rate to determine the required rate of return.

Question 4. Explain Stochastic calculus.

Stochastic calculus is a branch of mathematics that operates on stochastic processes. It allows a consistent theory of integration to be defined for integrals of stochastic processes with respect to stochastic processes. This field was created and started by the Japanese mathematician Kiyoshi Itô during World War II.

Question 5 What is credit rating?

The most basic crisil interview questions of all. They might ask you this, just to get a hold of your intelligence. Are you able to connect the dots and link your answer to tell them that you have studied about their company well?

Answer: A credit rating is an evaluation of the credit risk of a prospective debtor, predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

CRISIL was a pioneer in India in this field. In 1987, CRISIL was incorporated by ICICI and UTI. These two institutions additionally acted as the promoters of CRISIL.

Since then it has given valuable and reliable ratings which can be trusted by all.

Question 5. Difference between cash flow and fund flow.

Answer : The cash flow will record a company’s inflow and outflow of actual cash (cash and cash equivalents). The fund flow records the movement of cash in and out of the company. Both help provide investors and the market with a snapshot of how the company is doing on a periodic basis.

Again a very basic crisil interview questions. Do remember to point out all the differences with the right keywords!

Preference Share Capital is the funds that a company has generated by issuing preference shares.

Equity Share Capital is the funds that a company has generated by issuing Equity shares.

- Dividend Rate-

The Dividend Rate in the case of Preference Share Capital is not changeable.

The Dividend Rate is changeable or fluctuating in the case of Equity Share Capital.

- Voting Rights-

Preference Shareholders do not have any voting rights in the selection of the management.

Equity Shareholders have voting rights in the selection of the management.

- Participation in Management-

Preference Shareholders do not have the right to participate in the management decisions.

Equity Shareholders holders have the right to participate in the management decisions.

- Claim to assets of the company-

Preference Shareholders have a right to claim over the company’s assets whenever they decide to wind up their operations.

Equity Shareholders do not have any right to claim their assets whenever they decide to wind up their operations.

- Preference in paying dividend-

Preference shareholders get the first preference when the company pays a dividend.

Equity shareholders get second preference when the company pays a dividend.

- Types of Shares-

The different types of Preference Shares are as follows:

Cumulative Preference Shares,Participating Preference Shares,Redeemable Preference Shares,Convertible Preference Shares

Non-Cumulative Preference Shares

Non-Participating Preference Shares

Non-Redeemable Preference Shares

Non-Convertible Preference Shares

The different types of Equity Shares are as follows:

Authorised Share Capital,Issued Share Capital,Subscribed Share Capital,Paid-up,Share Capital,Rights Share,Bonus Share,Sweat Equity, Share

Arrears of Dividend

- Preference Shareholders are eligible to get arrears of unpaid dividends from previous years. They can get it along with the dividend of the current year, except for non-cumulative preference shares.

- Equity Shareholders are not eligible to get arrears of unpaid dividends from previous years.

- Convertibility-

Preference Shares are eligible to get converted into Equity Shares.

Equity Shares can never be eligible to get converted into Preference Shares.

- Risk-

Preference Shareholders are at a lower risk compared to Equity Shareholders.

Equity Shareholders are at a higher risk compared to Preference Shareholders.

Question 7. Why do companies take Foreign Currency Loan?

A more logical crisil interview questions that is testing whether you understand the basic understanding of business dynamics.

Answer: Advantages of Foreign Currency Funding-

- Exposure to a variety of debt instruments.

- Suits to hedge your international trade.

- Cheaper cost of borrowing provided the proper provisioning is done.

- No extra hedging cost.

- You can hedge against your business income/expenses.

Question 8. What is terminal value?

Answer: Terminal value (TV) is the value of an asset, business, or project beyond the forecasted period when future cash flows can be estimated. Terminal value assumes a business will grow at a set growth rate forever after the forecast period. Terminal value often comprises a large percentage of the total assessed value.

Question 9. What is CRR?

Answer: The CRR (Cash Reserve Ratio) often comes up in the RBI monetary policies. It ensures consumers financial security.

Economies are usually volatile. They fluctuate depending on several internal and external factors. Banks and their ability to lend money are especially susceptible to these factors. Proper regulation and financial management can help avoid bumps in banking operations and maintain enough liquidity. The Reserve Bank of India (RBI) uses Cash Reserve Ratio (CRR) to eliminate such risks and regulate the money supply in the market. CRR impacts banks and financial institutions in how they offer loans and other credit products.

Question 10. How is the income statement linked to the balance sheet?

Answer: There is a connection between the balance sheet and income statement when double-entry accounting is used. In essence, increases in revenue and gains as reported on the income statement cause stockholders’ equity to increase on the balance sheet. Also, In addition, increases in expenses and losses as reported on the income statement cause stockholders’ equity to decrease on the income statement. In addition, the write-down of an asset on the balance sheet causes a loss to appear on the income statement.

So, these were the important questions in today’s list. Do share with us your interview experience so we can add more questions!

Conclusion Crisil Interview Questions

Crisil is a place which takes the best, not in terms of the fancy qualifications you hold. However, defenitely in terms of the quality of knowledge. Hence, if you want to crack the crisil interview questions, then you should focus on the basics of financial statements, valuation, genuine business knowledge and the correct attitude to learn.