Last updated on February 8th, 2024 at 02:21 pm

CFA After Engineering: The Ultimate Guide 2021

CFA or MBA after engineering can be a difficult proposition, both are known degrees but which one should you do? Or should you do both? Let’s find out.

CFA Journey For Engineers

Background or No Background: Does it Matter?

The plain answer is no, it really doesn’t! Why am I so confident in saying that? Because it really doesn’t, the industry couldn’t care less. The CFA institute doesn’t care and believe it or not I don’t care either as trainer. Remember what Elon musk once said about degrees :

” College is just for fun and not for learning”

The question to answer is, who had more fun and less learning? I can safely say, it has been the commerce students. There is absolutely no edge that a commerce student has in the CFA level 1 exam, compared to an engineer or a non-finance student. Teaching Enginners has been relatively easy not just for me, but even for the MBA professors.

What does CFA say about Engineers

Well nothing! CFA couldn’t care less what academic background you come from. Hell CFA doesn’t even care if you are a a graduate! Do you know why? Its only because, the academic baggage, that people boast about, really has no effect on investments. Investments are numbers, strategy, research, business, statistics and much more. So there is basically no one background, that can give an edge to a candidate. Don’t believe me? See the eligibility criteria, given by CFA institute.

So summing up, this is what it would look like for an engineer or non finance background student

- Pursuing Engineering ( 4 years): Basically you should be 11 months away from your CFA level 1 exam. So if your exam is May 2022, then you can safely register in august 2021. Another way of looking at the same thing, be a graduate before you register for the CFA level II Exam

- Completed Engineering: Well then nothing else matters. Jump in and register

- Engineering Drop out: Well first of all congratulations! You are one of the wiser one’s. But yes if you have

- 4000 Hrs or roughly 2 Years work experience( Any)

- 4000 Hrs or 2 years in combination( Drop out education and work experience): Education is considered ( 1000 Hrs per year)

- Internships are considered if they are paid

You see why I did the CFA program, because it values work over degrees!

Source: CFA Institute

You can also read this more in detail here:CFA Institute Eligibility Criteria

IIM: Who Gets There: Proof No 3

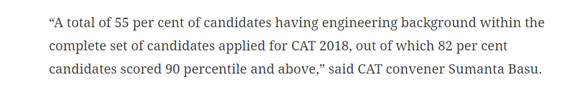

Now that I have shown you what CFA thinks about CFA, now lets look at unrelated stuff. IIM, the most likely place where engineers, who don’t like engineering end up. Engineering college population in India, is as big as commerce or slightly higher. Lets see their success rate in getting in, and plus why IIM’s prefer them? Read this news paper article cut.

Read the full article here:Why Engineers Crack CAT more than non engineers

55% of are from engineering background and 82% of them score more than 90% percent.

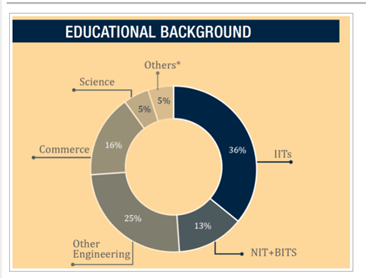

Lets also look at the academic background of the students, who actually get into such prestigious colleges:

The same ratio of more than 80% is also true in the real batch itself. Ask yourself this question. Why?

- Is the curriculum at IIM – A, easy?

- Don’t Finance companies come to IIM?

- Don’t the IIM Pass outs get a good package?

Simply put, logic. That’s my next point!

Logic Matters: Especially in Investments

Finance is nothing but logic!

- Financial statements: The company has a good idea, generates more profit, collects the money on time , has more cash flow and stock performs better.

- Research: You identify the company or stock, research whether the company can continue this performance in the future

- Quant: You use quants to find the current value of the money to be made in the future

- Economics: Does the economic policies support this company’s growth?

Voila! That’s finance in a nutshell. It’s not literature, its logic.

This is not just true in finance but many other areas of finance like prop trading, investment banking, credit, corporate finance and many more. Now you get the point?

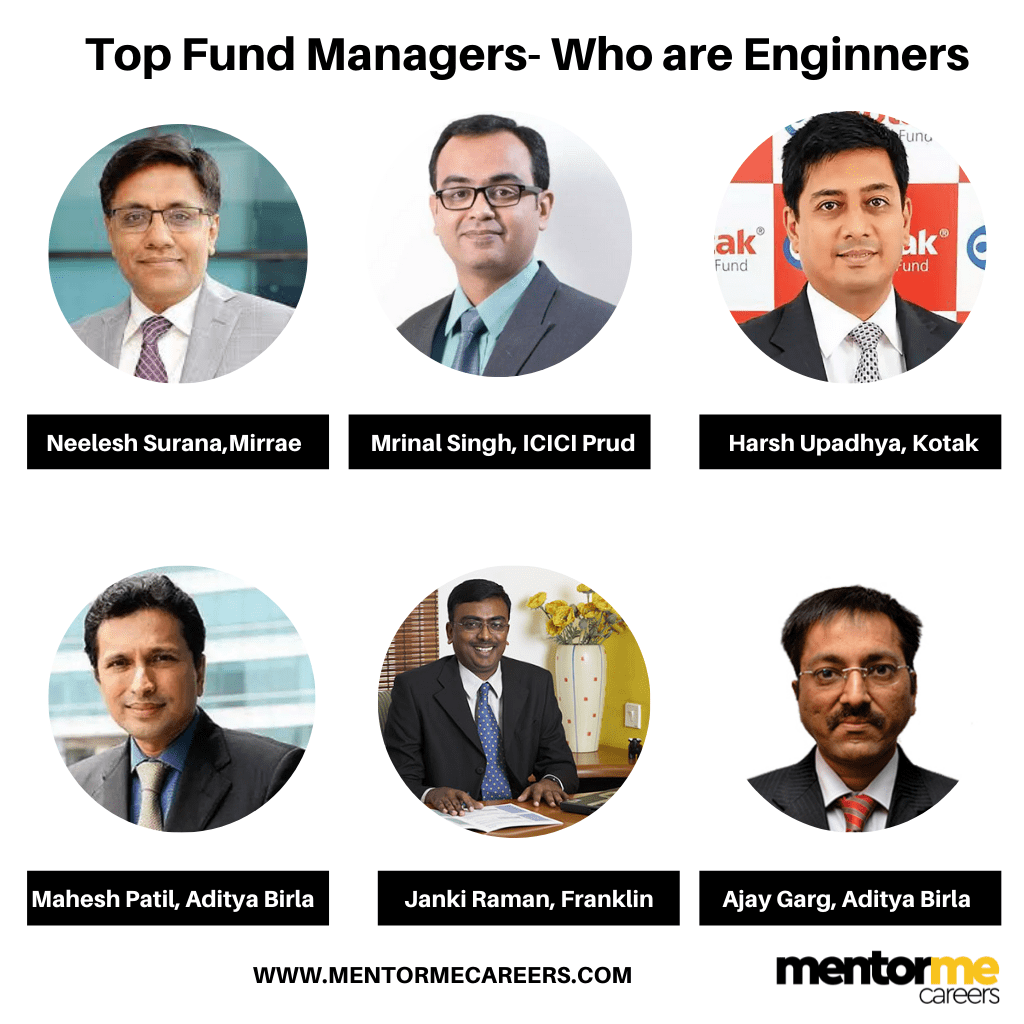

Living Proof: Fund Managers who are engineers

Now, here is your proof! If the above logic was not clear, then look at the following fund managers, with engineering as their background. Now if the industry wanted just commerce candidates, we wouldn’t have these people managing our money, won’t we? Again, reminding you undergraduate or post graduate or PHD has very little effect on investment finance careers. Even a chemical engineering student, can do CFA!

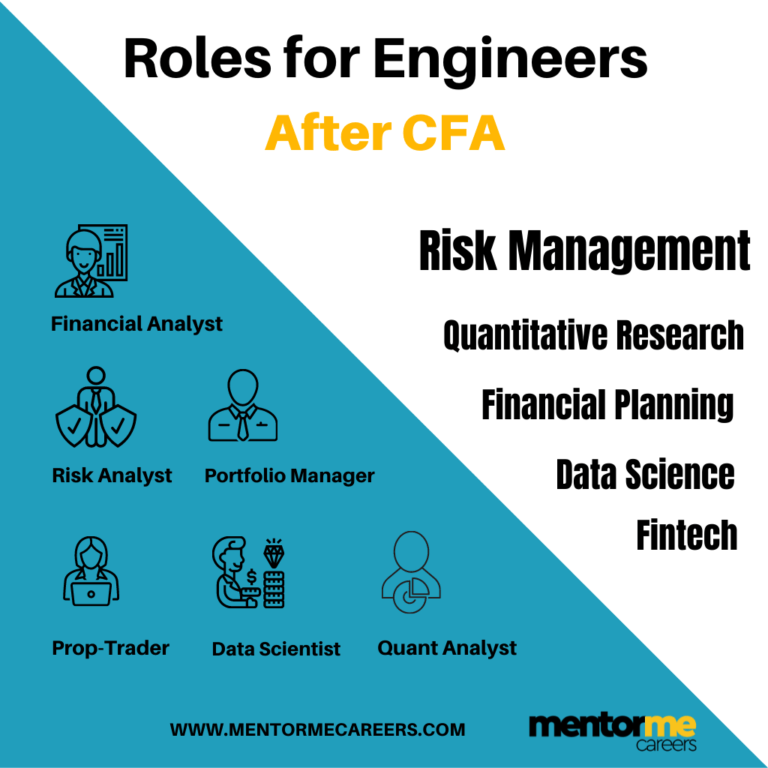

Roles after CFA For Engineers

There isn’t really anything special or different available for an engineering with the CFA Charter but yes there are some unique opportunities which only an engineer can qualify. If that makes sense? The keyword is technology, techno functional roles are exclusively available for engineers only. For example:

1.Data Scientist (Finance): Now this role needs finance as well as technical skills like python

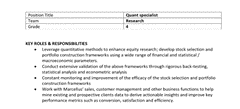

2.Quant Research Analyst: Research is becoming more a combination of finance and technlogoy. Below is an actual job description, for which we sent our own candidates from our CFA training program by mentor me

3.Quant Analyst Job description at: DSP Blackrock

I have categorised job roles apart from this in this simple infographic for your reference

7.Preparation Strategy: Books| Tuition| Study Plan

Well now if you are set with the decision, then here is a simple summary of things you need to know before embarking on this journey

- Books: Curriculum ( CFA Institute): Recommended- Reason is the depth of the content. I could have told you Schweizer notes, but at the end of the day it’s a derived content of the CFA curriculum. The curriculum prepares you not just for the exam, but beyond that for the job.

- Tuition: At Level I, I would strongly suggest a tuition provider. The reason for that is the experience sharing and mentoring. Don’t look for just any tuition provider but look for the one, which can give you a personal experience. A summary of your shortlisting criteria should be

Criteria for shortlisting tuition providers for CFA

- The qualification of the trainers: Are they Charter holders?

- Time Commitment of trainers: Can they give you personal time- very important. Mainly because, CFA preparation needs a lot of (Off classroom) support.

- Practice Schedule: Do they have a regular practice schedule or is it just the mocks.

- Pass Rates: Are their trainers committed to help you pass the exam or are they just visiting trainers

- Learning Experience: Check their demo class videos on youtube, is the learning experience good. Do they use technology? Is the voice and connectivity good?

List Of Training Providers :

- Edupristine: Large Institute| 120 Hrs Training| Pass rate : Unknown

- Fintree: Good for clearing the exam| Large student base| Not so good for engineers

- Mentor Me Careers: Small institute| 3 Permanent Faculty- Charter holders| 90% Pass rate

How to Prepare for CFA after engineering

Simply put CFA institute says, we need at least 300 Hrs learning to clear the exam. I say study till you get it and don’t count. My Strategy is simple, Start early and be regular

- Start at least 5 months before the exam day

- Give minimum1.5 to 2 Hrs for self-learning every day

- Practice at least 3000 questions excluding mocks

- Revise previous subjects using questions, not reading

- Create a small study group of likeminded individuals

- Get a mentor for that group- A CFA charter holder

- 1 month before the exam, just do mocks

- 1 week before the exam- just chill, watch movies, take a run, go to a spa but don’t study

Write to me at [email protected] or call at +91-9665795401, would be happy to guide.

Registration Process & When to apply?

The process of registration would require having the following things ready

- International Valid Passport: Make sure the expiry date is beyond the exam date. In case you don’t have the passport, apply at least 3 months before the registration date

- Registration link: Create your profile here

- Credit Card: Beg someone or borrow but registering using the credit is very convenient. You need a limit of at least $1200 , to be able to register.

- Wire Transfer (Alternative to Point B): In case you don’t have the credit card, then you can opt for this option

- TA B II Plus: Calculators at CFA level I is specific and you need to get this to practice. No other calculators allowed in the exam room. Will cost around INR 2500

When to apply?

- Apply 6 months before the exam date ( 5 Months Prep,1 month mock)

- decide 8 months before applying ( 2 months buffer for passport)

Extra Skills that Can Help

Some extra skills that can specifically help you to create a practical perspective of investment finance is financial modeling. This is a skill that you would anyways require while you approach employers, but doing it before CFA level 1 can give you the edge for the exam itself. I will keep this part short, check out my detailed article on what is financial modelling to understand more.

Nailing the Exam

This might find repetitive but a mentor can change the course of your exam results and journey. I was fortunate to have found mentors in my preparation, and that made the difference in my understanding of the concepts as well as clearing the exam. Make sure you have someone to talk to, before, during and after the exam to get the best out of your preparation. If you want to learn in this way, then feel free to contact us here

Communities to Join

I always like some common communities to join, which are productive to the preparation. I have listed some below

- Analyst Forum: A very serious forum for CFA preparation, it is segregated across levels. You can ask questions, discuss difficult topics and get views and updates.

- 300 Hrs: Very similar to analyst forum, but I like their summary of information that they provide

Disclaimer: Do not spend too much time on these forums and don’t take every advice given here. You might get more confused, than get clarity here. So be careful.

=Conclusion

My last bit! Taking the CFA exam is perfect if you have genuine interest in investment finance, the background doesn’t really matter. Whether you are a M Tech, BCA, Btech, PHD! All these can’t tell you the answer, what can really answer the question of : CFA after Engineering is:

Do you have the interest?